How We Test

Every platform we review is tested with real money, real accounts, and real trades. We don't rely on manufacturer specs, demo accounts, or marketing materials. We deposit our own capital and find out what actually happens.

Last updated: 13 February 2026Why We Test This Way

Most comparison sites write reviews based on information from the platform's own website — fee tables, feature lists, marketing copy. Some use demo accounts. A few rely entirely on AI-generated summaries.

The problem is that none of this tells you what it's actually like to use the platform. Demo accounts don't show you real spreads during volatile markets. Marketing pages don't mention that customer support takes three days to respond. Fee tables don't warn you about the charges buried in the small print.

So we do it differently. We open genuine funded accounts, deposit real money, execute real trades, contact customer support with real questions, and withdraw funds to see how long it actually takes. Then we write about what we find.

What We Test

Our testing covers three main categories, each with its own specific criteria and methodology. The same team handles all testing collaboratively, but we apply different standards depending on what type of platform we're reviewing.

Investing

Stock trading platforms, ISA providers, pension platforms, ETF brokers

Trading

CFD brokers, forex platforms, spread betting providers, derivatives

Crypto

Cryptocurrency exchanges, crypto wallets, DeFi platforms

Our Testing Process

Every platform goes through the same core process, from initial research through to ongoing monitoring. Here's how it works:

Initial Research & Verification

Before we open an account, we verify the platform's regulatory status. For UK platforms, this means checking FCA registration, FSCS protection status, and any regulatory warnings. We review the platform's ownership structure, company history, and any past regulatory actions.

If a platform isn't properly regulated for UK users, we don't proceed to testing — and we don't feature it on the site.

Account Opening

We go through the full sign-up process as a genuine new customer. This includes identity verification, document uploads, and any waiting periods. We time how long the process takes and note any friction points, unclear instructions, or excessive requirements.

This tells us what your first experience with the platform will actually be like.

Funding & Deposits

We deposit real money using multiple payment methods where available — bank transfer, debit card, and e-wallets. We record processing times, any fees charged, and minimum deposit requirements. We also check if the deposited amounts match what appears in the account.

Platform Testing

This is the core of our review. We spend significant time using the platform as a real customer would — placing trades, testing features, navigating the interface on both desktop and mobile. We assess everything from charting tools and order types to search functionality and account settings.

For trading platforms, we execute trades during different market conditions to test execution quality, spreads, and slippage. For investment platforms, we test the full journey from research to purchase to portfolio management.

Fee Verification

We compare the fees we're actually charged against what's advertised. This includes trading fees, spreads, overnight financing, currency conversion, inactivity fees, and withdrawal charges. We look for hidden costs that aren't prominently disclosed.

We've found that advertised fees and actual fees don't always match — especially for spreads during volatile periods.

Customer Support Testing

We contact customer support through every available channel — live chat, email, phone, and social media. We ask genuine questions and time how long it takes to get a useful response. We test support at different times of day, including evenings and weekends.

A platform can have great features, but if you can't get help when something goes wrong, that matters.

Withdrawal Testing

We request withdrawals and track the entire process — from request to funds arriving in our bank account. We note any verification requirements, delays, or fees. This is often where problems with less reputable platforms become apparent.

Ongoing Monitoring

Testing doesn't end when the review is published. We maintain funded accounts on major platforms and monitor for changes — fee updates, new features, changes to terms, or shifts in service quality. When we notice significant changes, we update our reviews.

Testing in Action

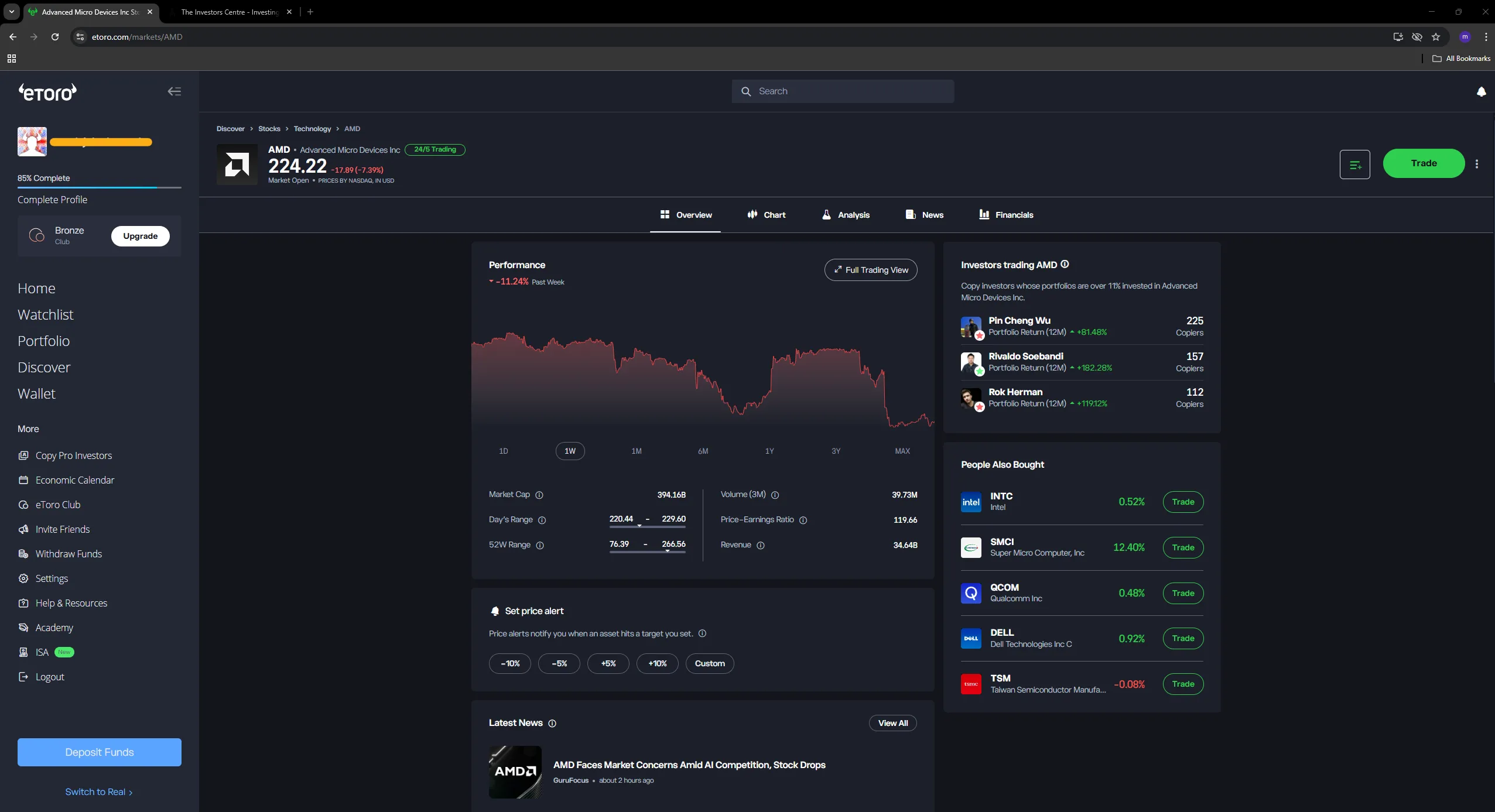

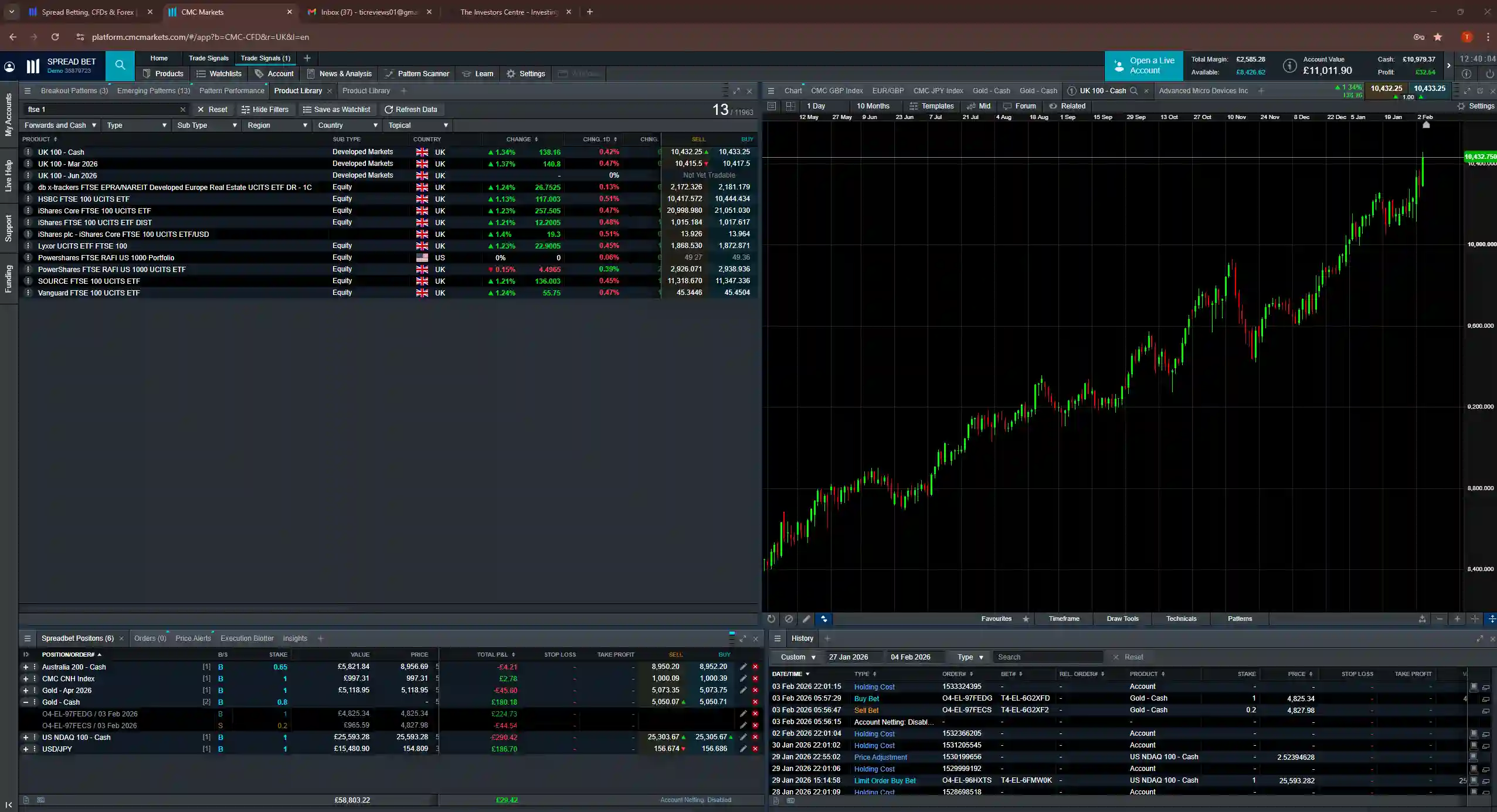

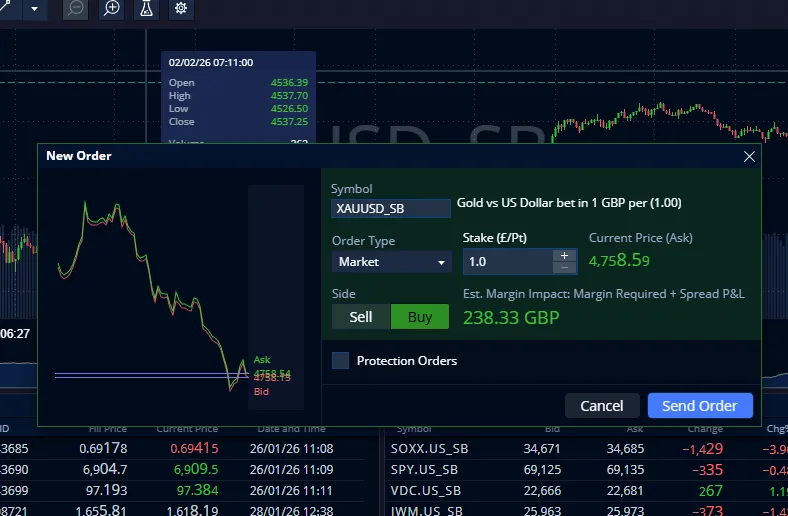

Here are screenshots from our actual testing accounts, showing the platforms as we experience them during our review process.

What We Assess

Our testing covers multiple categories, weighted according to what matters most for each platform type. Here's what we look at:

Fees & Costs

The true cost of using the platform, including charges that aren't prominently advertised.

- Trading commissions and spreads (measured, not just quoted)

- Currency conversion fees

- Overnight financing / swap rates

- Deposit and withdrawal charges

- Inactivity fees and account maintenance

- Hidden costs in the terms and conditions

Platform & Usability

How well the platform works in practice, not just how it looks in screenshots.

- Desktop and web platform functionality

- Mobile app quality and feature parity

- Order types and execution options

- Charting tools and technical analysis

- Search and navigation

- Account management and settings

Regulation & Security

Whether your money and data are properly protected.

- FCA regulation status and registration

- FSCS protection (up to £85,000)

- Negative balance protection

- Two-factor authentication

- Segregation of client funds

- Company financial stability

Product Range

What you can actually trade or invest in on the platform.

- Available markets and asset classes

- Number of instruments

- ISA and SIPP availability (for investment platforms)

- Fractional shares

- Research and educational resources

- Additional features (copy trading, auto-invest, etc.)

Customer Support

What happens when you need help.

- Available contact channels

- Response times (actually measured)

- Quality and accuracy of responses

- Operating hours

- Help centre and self-service resources

Account Experience

The end-to-end experience from sign-up to withdrawal.

- Account opening speed and requirements

- Deposit methods and processing times

- Withdrawal speed and reliability

- Verification process

- Account statements and tax reporting

Our Scoring System

We score each platform out of 5 based on weighted criteria. The weighting varies depending on platform type — fees matter more for frequent traders, while regulation and security are weighted heavily across all categories.

| Category | What We Measure | Typical Weighting |

|---|---|---|

| Fees & Costs | Actual costs measured during testing, fee transparency | 20-25% |

| Platform & Usability | Functionality, reliability, ease of use across devices | 20-25% |

| Regulation & Security | FCA status, fund protection, security features | 20% |

| Product Range | Available instruments, account types, features | 15-20% |

| Customer Support | Response quality and speed across channels | 10-15% |

| Account Experience | Onboarding, deposits, withdrawals, reporting | 10% |

Final scores aren't just an average — we apply editorial judgment based on our testing experience. A platform with excellent fees but serious withdrawal problems won't score highly overall, even if the numbers suggest it should.

What Our Scores Mean

High Scores (4.0 - 5.0)

- 5.0: Exceptional across all categories

- 4.5: Excellent, minor areas for improvement

- 4.0: Very good, recommended for most users

Lower Scores (Below 4.0)

- 3.5: Good, but notable weaknesses

- 3.0: Average, consider alternatives

- Below 3.0: Significant concerns, use with caution

Platform-Specific Testing

While our core methodology is consistent, we apply additional criteria depending on the type of platform:

Trading Platforms (CFDs, Forex, Spread Betting)

For trading platforms, execution quality is critical. We measure actual spreads during different market conditions — not just the "typical" spreads quoted on the website. We test execution speed, check for slippage on market orders, and verify that stop losses are honoured. We also assess margin requirements, leverage options, and overnight financing rates.

Our Senior Trading Analyst has personally executed trades across 35+ trading platforms, bringing institutional-level scrutiny to margin rates, execution latency, and regulatory capital requirements.

Investment Platforms (Stocks, ISAs, Pensions)

For investment platforms, we focus on the long-term user experience. This includes ISA and SIPP functionality, dividend handling, corporate action processing, and the quality of research tools. We test how well platforms handle different order types, fractional shares, and recurring investments.

We also assess the true cost of investing over time, including FX fees for international stocks and the impact of platform fees on portfolio growth.

Cryptocurrency Exchanges

For crypto platforms, security is paramount. We assess custody arrangements, withdrawal processes, and security features like cold storage percentages and insurance coverage. We test deposit and withdrawal speeds for both fiat and crypto, and verify that the coins and tokens listed are actually available to UK users.

We also evaluate staking options, earn products, and the platform's approach to regulatory compliance in the UK's evolving crypto landscape.

How We Keep Reviews Current

Publishing a review isn't the end of our testing process. Financial platforms change constantly — fees are updated, features are added or removed, and service quality can shift over time.

We maintain live, funded accounts on major platforms so we can monitor ongoing performance. When platforms announce significant changes, we re-test the affected areas and update our reviews accordingly.

Every review displays a "last updated" date so you know how recent our information is. We aim to comprehensively re-test all featured platforms at least annually, with more frequent updates when:

- Fee structures change

- New features are launched or removed

- Regulatory status changes

- We receive significant reader feedback

- Industry news suggests service quality has changed

If you notice something in a review that's out of date, please let us know. Reader feedback is valuable in helping us keep our content accurate.

Our Independence

We earn revenue through affiliate commissions when readers sign up to platforms through our links. This is how we fund our testing and content production.

However, commercial relationships never influence our scores or rankings. Our testing methodology is applied identically whether a platform pays us commission or not. We've rejected partnerships with over 20 unregulated platforms that failed our vetting process — the potential revenue wasn't worth compromising our readers' safety.

For full details, see our Editorial Policy.