Best Day Trading Platforms in the UK

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom, a Co-Founder at TIC, is an avid investor and experienced blogger who specialises in financial markets and wealth management. He strives to help people make smart investment decisions through clear and engaging content.

Twitter ProfileAuthor Bio

How We Test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Please bear in mind that trading involves the risk of capital loss. 51% to 84% of retail investor accounts lose money when trading CFDs with the providers below. You should consider whether you can afford to take the high risk of losing your money.

Quick Answer: What is the best platform for day trading in the UK?

Here are the top 10 best Day Trading Platforms in the UK:

- IG – By far the Best Platform for Trading

- SpreadEX – Best Choice for Intermediate Traders

- XTB – Unique Trading Platform features

- eToro– Most easy to use platform

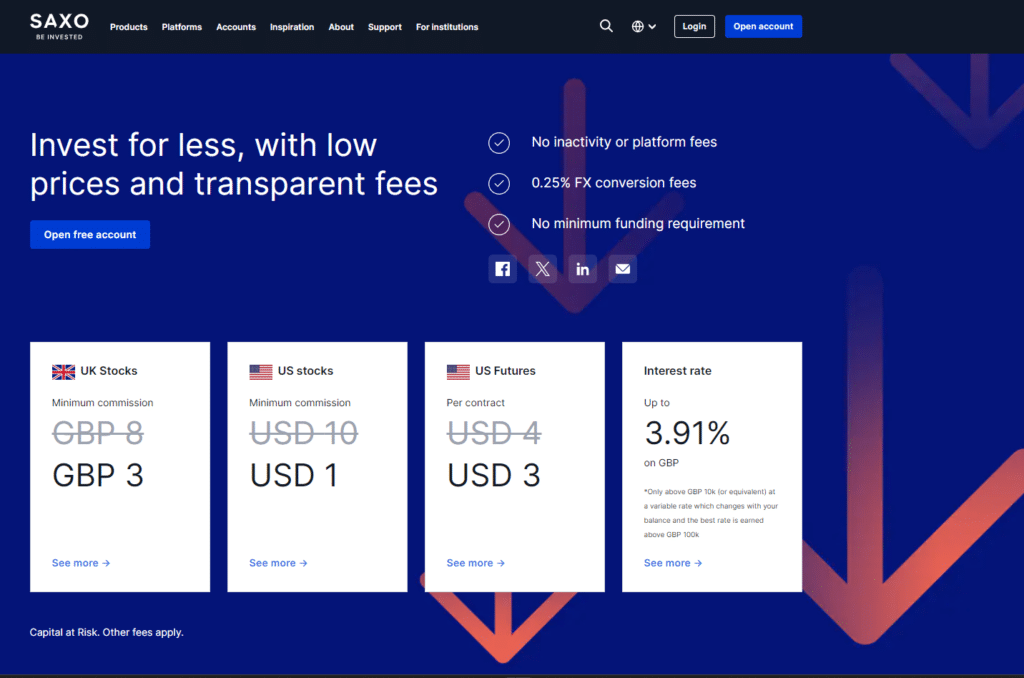

- Saxo – Outstanding advanced technical anlaysis features

- Interactive Brokers – Great for Experienced Traders

- Plus500 – Great for CFD Service Analytic tools

- Pepperstone – Best for a range of platforms

- Admiral Markets – All round strong trading platform

- CMC Markets – Access to great trading assets

Featured Broker

eToro - Best for Beginners

- Copy Trading

- Competitive Fees

- Diverse Asset Range

- Regulated & Trusted

- 30 Million+ Users

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

What Does This Page Cover?

- How do these Day Trading Brokers Compare?

- 10 Best Day Trading Platforms

- Step-by-Step Guide to Becoming a Day Trader

- Top Markets for Day Trading in the UK Explained

- Effective Day Trading Strategies

- Essential Day Trading Terminology

- Weighing the Pros and Cons of Day Trading

- Understanding Day Trading Costs

- FAQ

- References

How do these Day Trading Brokers Compare?

Fee Score | 4.1 | 4.1 | 4 | 4 | 4.1 | 4 | 3.9 | 4.1 | 3.9 | 3.8 |

Platform Score | 4.9 | 4.8 | 4.3 | 5 | 4.8 | 4.8 | 4.9 | 3.5 | 4.2 | 4.6 |

Account Opening Score | 4.5 | 4.8 | 4.4 | 5 | 4.9 | 4.2 | 5 | 3.5 | 4.2 | 4.4 |

EURUSD Spread | 0.6 | Varies | 1 | 1 | Varies on Account | 0.1-0.2 | 0.8 | 0.1 | Varies | 0.7 |

Withdrawl/ Deposit Fee | No | No | No | $5 | No | No | No | No | No | No |

Minimum Deposit | $0 | $0 | $0 | $0 | $0 | $0 | $100 | $0 | $0 | $0 |

MT4 Available | Yes | No | No | No | No | No | No | Yes | Yes | No |

FCA Regulated | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

FSCS Protection of £85K to UK Clients | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Supported Assets | Forex Stocks (including fractional shares) ETFs Options Cryptocurrencies Futures Indices Commodities | Forex Stocks (CFDs) ETFs (CFDs) Indices (CFDs) Commodities (CFDs) | Forex Stocks (CFDs) ETFs (CFDs) Indices (CFDs) Commodities (CFDs) | Stocks ETFs Cryptocurrencies Indices (CFDs) Commodities (CFDs) | CFDs on Forex, Stocks & ETFs, Indices, Index Options, Commodities & Bonds + Investing Asssets, Thematic Investing | Forex (Spot Currencies), Stocks, ETFs, Options, Futures/FOPs, CFDs, Metals, Bonds, Mutual Funds | Forex Stocks (CFDs) ETFs (CFDs) Cryptocurrency CFDs Indices (CFDs) Options on indices CFDs Commodities (CFDs) | Forex Stocks (CFDs and DMA) ETFs (CFDs and DMA) Cryptocurrencies (CFDs) Commodities (CFDs) Indices (CFDs) | Forex Stocks (CFDs) ETFs (CFDs) Commodities (CFDs) | Forex Stocks (including fractional shares) ETFs Options Futures Spread bets Commodities |

10 Best Day Trading Platforms

Pros

Cons

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- Extensive Market Access: IG provides day traders with broad exposure to various financial markets, including stocks, forex, commodities, and indices, enabling a diversified trading strategy.

- Advanced Trading Tools: Equipped with powerful charting software, technical analysis tools, and real-time data, IG ensures traders can make informed decisions quickly.

- Highly Rated Trading Platform: The platform's intuitive design and reliability earn it high marks among day traders for both usability and performance.

- Comprehensive Educational Resources: IG offers an extensive range of learning materials, from webinars to tutorials, supporting traders at all levels of expertise.

- Platform Variety: While IG's main platform is highly acclaimed, some traders may seek greater variety or the option to use alternative platforms like MetaTrader for day trading.

- Customer Support Response Times: During peak times, there may be delays in support response, which could be improved to offer more immediate assistance.

- Fee Transparency: Clearer communication regarding fees and charges would benefit traders, ensuring there are no surprises when it comes to trading costs.

Fees

Spread: Varies depending on asset and account type. Starts from 0.6 pips for forex.

Commissions: Share dealing: £3 per trade, £10 minimum charge. CFD trading: £0.10 per share. Options: £10 per contract.

Other fees: Inactivity fee (£12 after 12 months), withdrawal fees (variable).

Day Trading Tools

L2 Dealer – view market depth and liquidity

ProRealTime charting platform

Advanced order types (including OCO and trailing stops)

Trading API

Sentiment indicators

SpreadEX - Best Choice for Intermediate Traders

Pros

Cons

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Tax-Free Profits: In many jurisdictions, including the UK, profits from spread betting are exempt from capital gains tax and stamp duty. This can significantly increase your net returns compared to other trading methods.

- Leverage: Spread betting allows traders to control a large position with a relatively small amount of capital. This leverage can amplify profits on successful trades.

- Access to a Wide Range of Markets: Spread betting platforms often provide access to a vast array of markets, including indices, stocks, forex, commodities, and more. This variety allows day traders to diversify their trading strategies and find opportunities in different sectors.

- No Commission: Many spread betting brokers do not charge commissions on trades, as they make money through the spread. This can reduce trading costs, which is particularly beneficial for day traders who execute multiple trades daily.

- Leveraged: The platform does not offer Individual Savings Accounts (ISAs) or non-leveraged accounts. It is specifically designed for trading activities rather than long-term investment purposes.

- Restricted International Access: Certain services provided by the platform are exclusively available to residents of the UK and Ireland, limiting accessibility for international users.

- Trading Platform: The platform is not compatible with MetaTrader 4 (MT4) or MetaTrader 5 (MT5). However, it does offer integration with TradingView, providing users with advanced charting and analysis tools.

Fees

Spread: Varies depending on asset and account type.

Commissions: No commissions.

Day Trading Tools

Web-based platform with basic technical analysis tools

Limited order types (market, limit, stop-loss)

Economic calendar and news feed

XTB - Unique Trading Platform features

Pros

Cons

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Extensive Market Access: XTB provides a broad spectrum of trading instruments, including forex, CFDs on stocks, commodities, indices, and cryptocurrencies, meeting the varied interests of day traders.

- Competitive Forex Spreads: With its notably low spreads in forex trading, XTB stands out for enabling cost-effective strategy execution, which is crucial for maximizing day trading returns.

- Advanced Trading Technology: The proprietary xStation 5 platform, known for its intuitive design, advanced charting, and fast execution speeds, significantly enhances the trading experience.

- Robust Regulatory Environment: Regulated by several top-tier authorities, XTB assures traders of a secure and reliable trading environment, fostering trust and confidence.

- Limited MetaTrader Support: Although XTB's xStation 5 platform is highly acclaimed, the limited availability of MetaTrader platforms could be a drawback for traders accustomed to those tools.

- Inactivity Fees: An important consideration for less active traders is the potential inactivity fees, adding a layer of cost for those not trading regularly.

Fees

Spread: Varies depending on asset and account type. Starts from 0.6 pips for forex.

Commissions: Share CFDs: £0.02 per share.

Other fees: Inactivity fee (£10 after 12 months), withdrawal fees (variable).

Day Trading Tools

xStation 5 platform (advanced platform)

Web-based platform (basic platform)

Advanced order types (including OCO and trailing stops)

Algorithmic trading capabilities

Economic calendar and news feed

TIC Score 4/5

Pros

Cons

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Vast Trading Instruments: Saxo Bank's extensive offering across major, minor, and exotic forex pairs provides unparalleled trading opportunities, setting it apart in the forex community.

- Competitive Pricing: The platform's competitive spreads ensure that trading costs are kept to a minimum, benefiting traders focused on cost efficiency.

- Advanced Platforms: With proprietary platforms like SaxoTraderGO and SaxoTraderPRO, Saxo Bank offers robust analysis tools and a user-friendly experience, appealing to traders of all skill levels.

- Rich Educational Content: The platform is lauded for its comprehensive market research and educational materials, aiding traders in making well-informed trading decisions.

- Complex Fee Structure: Despite offering competitive rates, the platform's pricing model can be intricate, with varying spreads and commissions that may confuse some traders.

- Limited MetaTrader Support: The absence of MetaTrader platform options might be a drawback for traders who prefer this widely used trading environment.

- Complicated for Beginners: As the platform is tailored for investors with experience, it can be overwhelming for beginners.

Fees

FX: Spreads as low as 0.4 Pips

CFDs: Spreads as low as 0.85 on UK 100

Other fees: Commissions from $1 on US Stocks, check their website here for further information: Saxo Fees

Day Trading Tools

SaxoTraderGO (advanced platform)

SaxoTrader platform (basic platform)

Advanced order types (including OCO and trailing stops)

Algorithmic trading capabilities

Market data and news feed

eToro - Most easy to use platform

Pros

Cons

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 51% of retail CFD accounts lose money when trading CFD’s with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- Innovative Social Trading: eToro has transformed the trading experience with its social trading network, making financial markets more accessible by allowing users to follow and copy the trades of top performers on the platform.

- Copy Trading Excellence: The platform’s copy trading feature offers an opportunity for novice traders to mirror the trading strategies of more experienced individuals, democratizing access to trading knowledge and strategies.

- User-Friendly Design: eToro is designed to be intuitive and easy to navigate, making it suitable for traders at all levels of experience.

- User-Friendly Interface: The platform is designed with user experience in mind, offering an intuitive and easy-to-navigate interface suitable for both beginners and experienced traders.

- Withdrawal and Conversion Fees: The platform imposes a fixed withdrawal fee and conversion fees for non-USD transactions, which could lead to additional costs for international traders.

- Limited Advanced Tools: Advanced traders might find eToro’s analytical tools lacking for in-depth technical analysis when compared to more specialized trading platforms.

- Inactivity Fee: eToro charges an inactivity fee for accounts that remain dormant for a specific period, impacting traders who are not consistently active.

Fees

Spread: Varies depending on asset and account type. Starts from 0.1 pips for forex.

Commissions: No commissions on stocks and ETFs. 1% fee on buying/selling cryptocurrencies.

Other fees: Withdrawal fee ($5).

Day Trading Tools

Web-based platform with basic technical analysis tools

Smart Portfolio – automated investment portfolios

Sentiment indicators

Pros

Cons

The inclusion of Interactive Brokers’ (IBKR) name, logo or weblinks is present pursuant to an advertising

arrangement only. IBKR is not a contributor, reviewer, provider or sponsor of content published on this site, and

is not responsible for the accuracy of any products or services discussed.

- Cost-Effective Trading: Interactive Brokers is known for its highly competitive pricing, offering low spreads, including an attractive EURUSD spread starting from 0.1 pips, making it a top choice for cost-conscious day traders.

- No Hidden Fees: Interactive Brokers eliminates fees for deposits and typically for withdrawals, ensuring traders can manage their funds efficiently without worrying about extra charges reducing their profits.

- Extensive Global Access: With access to over 150 global markets and a wide range of financial instruments, Interactive Brokers offers day traders the flexibility to explore and capitalize on diverse trading opportunities worldwide.

- Powerful Trading Tools: Interactive Brokers provides advanced trading platforms with a vast array of tools, including real-time data, sophisticated charting options, and comprehensive reporting features, crucial for effective day trading.

- Platform Complexity: The advanced features and comprehensive tools offered by Interactive Brokers can be overwhelming for beginners, potentially requiring a steep learning curve to fully utilize the platform's capabilities.

- Inactivity Fees: Interactive Brokers charges an inactivity fee if certain trading volume or balance requirements are not met, which can be a drawback for less active traders.

- High Minimum for Interest Payments: Interest on cash balances is only paid on accounts with a net asset value of $100,000 or more, which might not be accessible for all traders.

- No MetaTrader Integration: Unlike some competitors, Interactive Brokers does not support MetaTrader platforms (MT4/MT5), which could be a limitation for traders accustomed to these popular tools.

Fees

- Spread: Varies depending on the asset. EURUSD spread starts from 0.1-0.2 pips.

- Commissions: Commissions vary by product; forex trades are often commission-free, with other fees depending on the asset class.

- Other fees: Inactivity fee ($10 per month if trading volume or account balance criteria are not met), withdrawal fees (typically free for the first withdrawal each month, with possible fees for additional withdrawals).

Day Trading Tools

- IBKR Trader Workstation (TWS): A highly customizable trading platform offering advanced trading tools, real-time data, and sophisticated charting features.

- IBKR Mobile: A robust mobile trading app providing on-the-go access to global markets and advanced trading capabilities.

- IBKR GlobalAnalyst: A tool for identifying global investment opportunities based on data-driven analysis.

- Algorithmic Trading: Advanced trading algorithms and order types available to automate and optimize trading strategies.

- Market Data and News: Access to comprehensive market data, news feeds, and research from leading providers.

TIC Score 4.5/5

Pros

Cons

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Competitive Pricing: Plus500 offers a compelling fee structure with a EURUSD spread of just 0.8, making it an economical option for day traders who value cost-effective trading environments.

- No Transfer Fees: The platform eliminates fees on deposits and withdrawals, facilitating smoother financial transactions and effective fund management for traders.

- Versatile Funding Options: With support for various deposit methods, including bank transfers and e-wallets like PayPal and Wise, Plus500 provides traders with the flexibility to manage their accounts conveniently.

- Efficient Account Setup: The process to open an account with Plus500 is streamlined and user-friendly, welcoming newcomers to start trading without hassle.

- No MetaTrader Access: The absence of MetaTrader 4 and 5 might deter traders preferring these platforms for their advanced tools and automated trading solutions.

- Inactivity Fee: A monthly inactivity fee of $10 after a set period can add to the costs for less active traders, highlighting the importance of consistent trading activity to avoid extra charges.

Fees

Spread: Varies depending on asset and account type. Starts from 0.8 pips for forex.

Commissions: No commissions.

Other fees: Overnight financing fee, There is a charge on all trades on instruments denominated in a currency different from the currency of your account, and the percentage is up to 0.7%

Day Trading Tools

Web-based platform with basic technical analysis tools

Guaranteed stop-loss orders

Trailing stop-loss orders

Economic calendar and news feed

TIC Score 4/5

Pros

Cons

81.7% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Market-Leading Spreads: Boasting one of the lowest spreads in the industry, notably a 0.1 EURUSD spread, Pepperstone ensures its traders can enjoy minimized trading costs.

- No Transaction Fees: The elimination of deposit and withdrawal fees underscores Pepperstone's approach to straightforward fund management, sparing traders from worrying about hidden costs.

- Diverse Payment Options: Pepperstone accommodates a variety of payment methods, including bank transfers and e-wallets like PayPal, adding layers of convenience and flexibility for traders.

- Streamlined Account Opening: Recognized for its hassle-free account setup process, Pepperstone demonstrates its dedication to making trading accessible to newcomers and experienced traders alike.

- Platform Improvements: While its platform is highly functional, there's room for enhancement in usability and feature expansion to better cater to user needs.

- Limited Proprietary Platform Features: Traders seeking cutting-edge tools and unique functionalities might find the proprietary platform offerings a bit behind the curve in innovation.

- Enhanced Educational Resources: There's a noticeable opportunity for Pepperstone to expand its educational and research materials, providing deeper market insights and more robust learning tools for traders.

Fees

Spread: Varies depending on asset and account type. Starts from 0.0 pips for forex.

Commissions: £8 per lot for DMA stocks, £0.50 per share for CFDs.

Other fees: Inactivity fee (£10 after 12 months), withdrawal fees (variable)

Day Trading Tools

cTrader platform (known for advanced features)

MT4 and MT5 platforms

Smart Trader tools (auto trading, algo trading)

Tick charts and advanced analysis tools

VPS hosting

Pros

Cons

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Competitive Spreads: Admiral Markets are celebrated for its tight spreads, particularly on major markets, enhancing trading efficiency and aiding in cost reduction for day traders.

- Diverse Trading Instruments: Offering access to a vast array of markets including stocks, forex, commodities, and indices, Admiral allows day traders to diversify their strategies across multiple asset classes.

- Robust Trading Platforms: The availability of both its proprietary WebTrader and MetaTrader 4 ensures flexibility and provides advanced tools suitable for all trading styles, from manual to automated day trading.

- Platform Learning Curve: While offering sophisticated tools, newcomers may initially find the platform's comprehensive features a bit daunting until they acclimate to the system.

- Inactivity Fee: An inactivity fee applies to traders who do not maintain regular trading activity, potentially adding an extra cost for those not consistently active in the markets.

- Limited Account Types: Compared to some competitors, the selection of account types at City Index might seem more constrained, possibly not meeting all day traders' specific needs or preferences.

Fees

- Spreads: Variable spreads starting as low as 0 pips on certain forex pairs.

- Commissions: No commission fees for trading stocks and ETFs, though some CFD trading comes with commissions.

- Overnight Fees: Swap rates apply if positions are held overnight (depending on the instrument and leverage).

- Inactivity Fee: Accounts that remain inactive for over 12 months are charged a fee. Overall, the platform is considered cost-effective, particularly for those trading stocks and ETFs.

Day Trading Tools

AdvancedTrader platform (powerful platform)

Web-based platform (basic platform)

Guaranteed stop-loss orders

Trailing stop-loss orders

Economic calendar and news feed

TIC Score 4/5

CMC Markets -Access to great trading assets

CMC Markets excels in providing day traders with an expansive selection of trading opportunities, complemented by competitive pricing and advanced analytical tools.

Pros

Cons

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- Wide Range of Markets: Day traders have access to an extensive array of instruments, including forex, stocks, commodities, indices, and cryptocurrencies, facilitating a diversified trading approach.

- Competitive Pricing: Known for its tight spreads across various markets, CMC Markets offers an efficient trading environment that can contribute to cost savings and improved trading outcomes.

- Advanced Analytical Tools: The platform boasts sophisticated charting capabilities and a comprehensive set of analytical tools, catering to the needs of traders requiring depth in market analysis.

- Rich Educational Resources: A robust collection of educational materials supports traders at every level, enhancing their ability to develop and refine their trading strategies.

- Regulatory Assurance: Being regulated by top-tier authorities, CMC Markets provides a secure and trustworthy environment, ensuring peace of mind for its users.

- Platform Complexity: The advanced features and functionalities of CMC Markets may present a learning curve for new traders, necessitating time to become proficient in navigating the platform.

- Inactivity Fees: An important consideration for day traders is the inactivity fee, which could impact those who do not engage in frequent trading activities.

- Additional Fees for Premium Tools: Access to certain premium market data and advanced analytical tools may incur additional fees, adding to the cost for traders who rely on these resources.

CMC Markets’ commitment to offering a broad range of trading instruments, combined with its focus on competitive pricing and comprehensive analytical tools, solidifies its position as a preferred choice for day traders. While the platform’s complexity and potential additional fees warrant consideration, its overall offering remains attractive for those seeking a dynamic and enriched trading experience.

Fees

Spread: Varies depending on asset and account type. Starts from 0.6 pips for forex.

Commissions: Share dealing: £3 per trade, £10 minimum charge. CFD trading: £0.10 per share. Options: £10 per contract.

Other fees: Inactivity fee (£12 after 12 months), withdrawal fees (variable).

Day Trading Tools

NextGen platform (advanced platform)

Web-based platform (basic platform)

Advanced order types (including OCO and trailing stops)

Market data and news feed

Step-by-Step Guide to Becoming a Day Trader

1. Understanding Market Dynamics

The first step in your day trading journey is to gain a solid understanding of market dynamics. This includes familiarizing yourself with how different markets operate, the factors that influence price movements, and the timing of market fluctuations. Start by focusing on one or two markets, such as the stock market or forex, and learn as much as you can about them. Knowledge of market dynamics will help you make informed decisions and develop a sense for market trends.

2. Selecting Your Day Trading Strategies

Day trading involves various strategies, each with its unique approach and risk level. Some popular strategies include scalping, momentum trading, and swing trading. Experiment with different strategies in a demo account to find the one that suits your risk tolerance and trading style best. Remember, a strategy that works for one trader might not work for another, so it’s essential to choose a strategy that aligns with your personal goals and preferences.

3. Leveraging Technical & Fundamental Analysis

To make informed trading decisions, you need to leverage both technical and fundamental analysis. Technical analysis involves studying price charts and using indicators to predict future movements. In contrast, fundamental analysis looks at economic indicators, company earnings, and news events to gauge the market’s direction. Combining these analyses can provide a more comprehensive view of the market, helping you to identify high-probability trading opportunities.

4. Identifying the Best Trading Platform for You

The trading platform you choose plays a critical role in your day trading success. Look for a platform that is user-friendly, offers fast execution speeds, and provides access to the markets you’re interested in trading. Many platforms also offer tools for analysis, which can be invaluable. Consider platforms like Plus500, eToro, or Saxo Bank, which are known for their robust features and reliability. Most importantly, ensure the platform is regulated by a reputable authority to guarantee your funds’ safety.

5. Adhering to Day Trading Rules

Finally, successful day trading requires discipline and a strict adherence to trading rules. Develop a full day trading legal plan that outlines your strategy, risk management rules, and profit targets. Stick to this plan religiously and avoid letting emotions drive your trading decisions. Additionally, stay informed about regulatory requirements and ensure you comply with any rules and restrictions that apply to day trading in the UK.

By following these steps and committing to continuous learning and improvement, you can navigate the day trading landscape more effectively and increase your chances of success. Remember, day trading is not a guaranteed path to wealth, and it comes with significant risks. However, with dedication, discipline, and a strategic approach, it can be a rewarding endeavor.

Top Markets for Day Trading in the UK Explained

1. Exploring the Stock Market for Day Trading

The stock market is a popular choice for day traders due to its vast array of trading opportunities. It encompasses a wide range of sectors and allows traders to speculate on the price movements of individual companies. The key to success in stock market day trading lies in understanding company fundamentals, market trends, and how external factors like economic indicators and political events might affect stock prices. Volatility in the stock market, while presenting higher risk, also opens the door to significant profit opportunities for those who can adeptly navigate these fluctuations.

2. Navigating the Forex Market for Day Traders

The Forex market, known for its high liquidity and 24-hour trading cycle, is ideal for day traders looking for flexibility. It involves trading currency pairs, such as GBP/USD or EUR/GBP, and benefits from the ability to trade on leverage, which can amplify both gains and losses. Successful forex trading demands a good grasp of currency fundamentals, global economic indicators, and geopolitical events that can influence currency values. The forex market’s global nature means it offers continuous trading opportunities, allowing traders to react swiftly to international news and economic developments.

3. Capitalising on Opportunities in the Derivatives Market

Derivatives markets, including options and futures, provide day traders with the potential to profit from price movements without owning the underlying asset. These markets are attractive for their leverage potential and the variety of strategies traders can employ, such as hedging against price movements in other investments. Derivatives trading requires an understanding of complex products and the risks involved, including the potential for rapid losses. However, for knowledgeable traders, the derivatives market offers substantial opportunities for profit, especially in short-term trading scenarios where volatility can be leveraged to the trader’s advantage.

Each of these markets has its own set of characteristics, risks, and rewards. Day traders should carefully consider their individual trading style, risk tolerance, and the amount of time they can dedicate to monitoring the markets when deciding which market best suits their objectives. Diversifying across different markets can also help spread risk, but traders must ensure they have the necessary knowledge and tools to manage their trades effectively across multiple platforms. With the right approach and continuous learning, day traders can find success in these dynamic trading environments.

Effective Day Trading Strategies

1. Mastering News Trading

News trading involves capitalizing on market movements that follow news releases, economic data, and corporate announcements.

Key Points:

Stay updated with financial news calendars.

Understand the impact of high-impact news on market volatility.

Practice quick decision-making to take advantage of short-term price movements.

2. Understanding Swing Trading

Swing trading is about capturing gains in a stock or any financial instrument over a few days to several weeks.

Key Points:

Identify stocks with volatility and liquidity.

Use technical analysis to find entry and exit points.

Be patient; swing trading doesn’t require daily trades.

3. Implementing Momentum (Trend) Trading

Momentum traders focus on stocks moving significantly in one direction on high volume.

Key Points:

Look for strong market trends and ride them until they show signs of reversal.

Utilize momentum indicators like MACD, RSI, and Stochastic Oscillator.

Pay attention to news that might affect the momentum of your chosen market.

4. Analysing Money Flow for Day Trading

Money flow analysis involves assessing the buying and selling pressure on a stock to predict future price movements.

Key Points:

Use tools like the Money Flow Index (MFI) to gauge the strength of money flowing in or out of a stock.

Combine money flow analysis with other indicators for a comprehensive view.

Look for divergences between price and money flow to identify potential reversal points.

5. Applying Mean Reversion Strategies

Mean reversion is based on the theory that prices and returns eventually move back towards the mean or average.

Key Points:

Identify assets that have deviated significantly from their historical average.

Use statistical measures like the Bollinger Bands to find overbought or oversold conditions.

Be cautious of false signals and ensure proper risk management to protect your trades.

By mastering these strategies and incorporating them into your trading plan, you can enhance your day trading approach. Remember, the key to successful trading lies not only in the strategy itself but also in disciplined risk management, continuous learning, and adapting to changing market conditions.

Essential Day Trading Terminology

Before embarking on the day trading journey, it’s imperative to familiarise oneself with the lingo. Terms like “bid” and “ask” represent the prices available for selling and buying assets, respectively. “Spread” refers to the difference between these two prices, a critical factor in the profitability of day trades. “Leverage” allows traders to amplify their trading capacity, potentially increasing gains but also escalating risks. Understanding these terms lays the groundwork for navigating the markets more effectively.

Weighing the Pros and Cons of Day Trading

Benefits of Day Trading in the UK

Day trading offers the tantalizing prospect of substantial profits over a short period, appealing to those with a keen sense of market trends and the ability to act swiftly on them. It provides unparalleled flexibility, enabling traders to operate on their own terms, without the commitment required by more traditional investment strategies. Moreover, the UK’s sophisticated financial infrastructure and regulatory environment offer a secure and efficient framework for day trading activities.

Challenges of Day Trading in the UK

However, the path of a day trader is fraught with challenges. The volatile nature of markets can turn investments sour in a matter of minutes, highlighting the high-risk nature of this strategy. The psychological strain of constant decision-making under pressure can be daunting, requiring a mindset that not all investors possess. Furthermore, the competitive landscape means that staying ahead requires continuous learning and adaptation.

Understanding Day Trading Costs

The financial implications of day trading extend beyond potential profits and losses from trades. Commission fees, although relatively lower in recent years, can accumulate quickly with the high volume of transactions typical of day trading. Spread costs also take a toll on profitability, especially in less liquid markets. Additionally, the possibility of overnight financing fees for positions held open beyond the trading day underscores the importance of meticulous financial planning and strategy.

In conclusion, day trading in the UK presents a dynamic and potentially rewarding opportunity for those equipped with the knowledge, skills, and temperament to navigate its complexities. As with any financial endeavor, success in day trading is contingent upon a comprehensive understanding of its mechanisms, a realistic appraisal of its challenges, and a diligent approach to managing its costs.

Frequently Asked Questions

A trading platform enhances your day trading strategy by offering advanced trading tools, real-time market data, and analytical capabilities, enabling you to make informed decisions and execute trades more efficiently.

When choosing a trading account for day trading or custody fees, consider factors such as low trading fees, access to a wide range of financial instruments, and the availability of advanced trading tools to support your trading strategy.

Trading fees can significantly impact your day trading profits, as frequent trades can accumulate high costs. Selecting a free trading platform with low trading fees is crucial to maximizing your returns.

Access to foreign exchange markets is important for a day trading platform as it offers day traders the opportunity to trade currency pairs, capitalise on market volatility, and diversify their trading strategies across global markets.

References:

1 – Day Trading: The Basics And How To Get Started – Investopedia

2 – 7 Best Indicators for Day Trading – City Index

3 – Stock Market Trading Hours – CMC Markets

4 – Restricting Contract For Difference Products Sold To Retail Clients – FCA

5 – Top Financial Markets To Trade In 2024 – Admirals

6 – 14 Day Trading Strategies for Beginners – Go Banking Rates

7 – Glossary of trading terms – IG

8 – Brokerage Fees and Investment Commissions Explained – Nerd Wallet

Featured Blogs

80% of retail CFD accounts lose money.

Our Top Day Trading Platforms in the UK

{etoroCFDrisk}% to 81.7% of retail CFD accounts lose money.