Is Uphold Safe? – 2026 Trust Update

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: Is Uphold Safe?

Uphold is generally considered safe for most users in 2026. It operates as a regulated, custodial platform with strong encryption, two-factor authentication, and proof-of-reserves transparency. However, users rely on Uphold to safeguard assets, making it best suited for convenience rather than full self-custody.

Author's Comment

"We found Uphold to be a reliable option for everyday crypto and fiat transfers. It's well-regulated and easy to use, but you're still trusting a third party with custody. For most retail users, that's an acceptable trade-off for simplicity and speed." – Thomas Drury

Quick Summary

| Category | Verdict |

|---|---|

| Overall Rating | 4.3 / 5 |

| Best For | Users seeking a regulated, easy-to-use crypto platform |

| Regulation | Registered and licensed in multiple jurisdictions |

| Security | Strong encryption, 2FA, and proof-of-reserves transparency |

| Custody Type | Custodial – Uphold holds user assets |

| Verdict Summary | Safe for most users, but not ideal for those wanting full self-custody. |

Most Coins

Most Coins

Bitpanda rates highly for ease of use and crypto asset variety, offering the UK's largest selection of tradeable coins. It's well-suited to beginners and long-term crypto holders, with a simple UI and robust security making it a solid choice for digital assets.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. This marketing communication does not constitute investment advice, a solicitation, or an offer to buy or sell any cryptoassets. In no way are performance or results guaranteed. You should keep yourself informed and understand the risks involved in buying and holding cryptoassets.

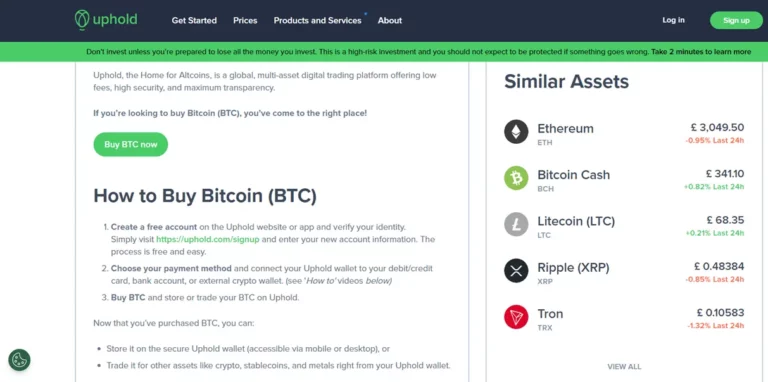

What Exactly Is Uphold and How Does It Work?

Uphold is a digital money platform that lets users buy, sell, and hold crypto, precious metals, and traditional currencies in one place. It's known for its easy interface, instant conversions, and transparent pricing—ideal for people who want a simple, all-in-one financial app.

What Are the Key Facts You Should Know About Uphold?

Launched in 2015, Uphold now serves over 10 million users across 180 countries. It supports 250+ digital and fiat assets, including gold and silver. The company is regulated in the U.S. and U.K., publishes proof-of-reserves data, and emphasizes transparency in pricing and transaction security.

| Feature | Details |

|---|---|

| Founded | 2015 |

| Headquarters | London, UK |

| Regulatory Status | FCA Registered (UK) |

| Assets Supported | Crypto, Stocks, Metals, FX |

| User Base | 10M+ Users Worldwide |

How Does Uphold Protect Your Money and Personal Data?

Uphold combines strong encryption, strict identity checks, and independent auditing to keep user funds safe. It separates company and customer assets, stores most crypto in cold wallets, and provides regular transparency reports. Its layered security approach protects both account access and stored information.

What Security Measures Does the Platform Use?

Uphold uses AES-256 encryption, multi-signature cold storage, and regular third-party security audits. Transactions pass through encrypted SSL connections, and platform infrastructure is monitored 24/7. These measures reduce hacking risks and align Uphold with industry standards for financial-grade cybersecurity.

How Are User Accounts Protected on Uphold?

Every account includes two-factor authentication, KYC identity verification, and anti-fraud monitoring. Suspicious activity triggers alerts, and withdrawals may require extra confirmation. These layers ensure that even if login details are compromised, unauthorized access and fund transfers are difficult.

Is Uphold Regulated and Transparent About Its Operations?

Yes. Uphold is registered with FinCEN in the U.S. and FCA in the U.K. It publicly displays proof-of-reserves showing 100% asset backing. Regular audits confirm solvency, and users can view real-time holdings versus liabilities—rare transparency among crypto platforms.

| Security Feature | Details |

|---|---|

| Encryption | End-to-end encryption for data security |

| Cold Storage | Majority of crypto assets held offline |

| Two-Factor Auth | Required for account access and withdrawals |

| Regulatory Compliance | FCA Registered, follows AML & KYC rules |

| Proof of Reserves | Ensures all user funds are backed 1:1 |

What Are the Main Risks or Downsides of Using Uphold?

While Uphold is generally safe, it's not perfect. Fees can be higher than some competitors, and customer support isn't always fast. Because it's a custodial platform, users don't control their private keys, which adds a level of trust dependency on Uphold's security practices.

Are There Any Hidden Fees or Costs to Watch Out For?

Uphold doesn't charge trading commissions, but its spreads can vary depending on market conditions. Conversion rates between currencies or crypto can also include small markups. There are no deposit fees, but network withdrawal fees and inactivity charges may apply in some cases.

Does Uphold Have Good Customer Support When Things Go Wrong?

Customer support is mainly email-based, with no live chat or phone option for most users. Response times can range from a few hours to several days. The help centre is detailed, but resolving urgent issues may feel slow compared to larger exchanges.

Is Keeping Crypto in Uphold's Custodial Wallet Risky?

Since Uphold controls users' private keys, there's always some counterparty risk. Funds are safe as long as Uphold's systems remain secure, but it's not the same as holding assets in a private wallet. Serious investors often move long-term holdings to self-custody wallets.

| Risk | Details |

|---|---|

| High Fees | Spread fees higher than some competitors |

| Custodial Wallet | Users don't control private keys for their assets |

| Support Issues | Limited customer support options |

| Regulatory Risks | Compliance rules may change, affecting users |

Is Uphold a Good Choice for Beginners in 2025?

Yes, Uphold suits beginners thanks to its clean layout, instant conversions, and wide asset selection. The learning curve is low, and onboarding is fast. However, first-time users should still learn the basics of crypto security before depositing large amounts.

How Secure Is Uphold for First-Time Investors?

Uphold offers strong protections—KYC verification, encryption, and two-factor authentication are standard. For beginners, these safeguards make it one of the more approachable and trusted options. As with any custodial platform, though, personal vigilance is key to staying fully protected.

Why Do So Many Beginners Start with Uphold?

New users often choose Uphold for its simplicity. It supports instant crypto purchases with cards or bank accounts, and balances can be held in both fiat and digital assets. The design feels familiar, making the first crypto experience less intimidating and more intuitive.

| Feature | Why It's Beginner-Friendly |

|---|---|

| User Interface | Simple, easy-to-use platform |

| Security Features | 2FA, encryption, and FCA oversight |

| Asset Variety | Trade crypto, stocks, and metals in one place |

| Fiat Support | Allows GBP deposits via bank transfer or card |

How Can You Make Your Uphold Account More Secure?

Even though Uphold offers strong security features, users should take additional steps to safeguard their accounts and assets.

- Enable Two-Factor Authentication (2FA): This adds an extra layer of security for logging in and making transactions.

- Use a Strong, Unique Password: Avoid using the same password across multiple platforms to reduce the risk of hacking.

- Store Large Holdings in a Hardware Wallet: If you plan to hold crypto long-term, transfer assets to a hardware wallet for enhanced security.

- Monitor Transactions Regularly: Keep an eye on account activity to detect any suspicious withdrawals or unauthorized logins.

What Are the Best Practices for Staying Safe on Uphold?

| Security Tip | How It Helps |

|---|---|

| Enable 2FA | Protects account from unauthorized logins |

| Strong Password | Reduces the risk of hacking attempts |

| Use Hardware Wallet | Keeps crypto safe from exchange risks |

| Monitor Activity | Detects fraud or suspicious withdrawals |

Should You Trust Uphold with Your Money in 2025?

Yes — Uphold is trusted by many UK users in 2026 thanks to regulation in multiple jurisdictions, proof-of-reserves transparency, and strong security practices like encryption and two-factor authentication. However, it remains a custodial platform, so you trade convenience for control. For long-term holders who want full self-custody, a private wallet may be safer. Always evaluate risks and regulatory updates before depositing funds.

Final Recommendation:

Uphold remains a trustworthy option for most users, especially those who value convenience and regulation. It's secure and user-friendly but not risk-free. For everyday use, it's excellent; for long-term crypto storage, self-custody is the safer move. A balanced choice overall.

FAQs

Is Uphold regulated in the UK?

Yes, Uphold is FCA-registered, ensuring compliance with UK financial regulations.

Does Uphold offer insurance on user funds?

No, while it follows security best practices, user funds are not insured against hacks or insolvency.

Can I store my crypto on Uphold long-term?

It's possible, but using a private wallet is safer for long-term storage.

Are my transactions private on Uphold?

Uphold follows AML and KYC laws, so transactions may be reported to regulators.

How does Uphold compare to Coinbase for security?

Both offer strong security, but Coinbase has a longer track record and stronger regulatory compliance.

References

Don’t invest unless you’re prepared to lose all the money you invest.