Admiral Markets Review for UK Traders 2026

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: Is AvaTrade Still a Good Trading Platform in 2026?

AvaTrade remains a well-rounded global broker, offering a strong range of trading tools, broad market access, and robust international regulation. However, as it no longer accepts new UK clients, domestic traders are better served by FCA-regulated alternatives such as Spreadex, which provides more accessible onboarding, tailored UK support, and a simpler overall experience for local residents.

Authors Comments

"I've traded with AvaTrade for several years, and while it's still reliable globally, it's no longer a practical choice for UK traders. The platform's stability and tools are impressive, but losing direct UK onboarding makes Spreadex the more suitable, compliant option going forward." – Thomas Drury

Quick Summary

| Category | Verdict |

|---|---|

| Overall Rating | 3.8 / 5 |

| Best For | International traders seeking a multi-asset platform |

| Regulation | Globally regulated but not FCA authorised for UK onboarding |

| Ease of Use | Smooth on desktop and mobile; interface shows its age |

| Trading Tools | Strong range with AutoChartist and MetaTrader integration |

| Fees | Average – competitive spreads but notable inactivity charges |

| UK Access | No new UK accounts; existing users still supported |

| Verdict Summary | AvaTrade performs well internationally but UK traders should consider Spreadex as a regulated local alternative. |

Top Rated

Top Rated

Award-winning CFD trading platform. Access over 5,000 global markets with tight spreads.

62% of retail investor accounts lose money when trading CFDs with this provider.

What Exactly Is AvaTrade and How Does It Work?

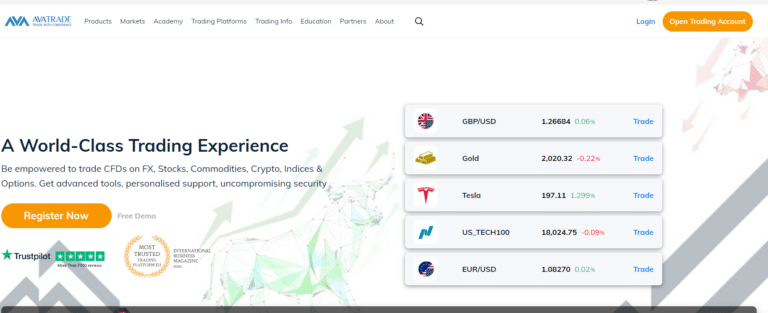

AvaTrade is a long-standing global trading platform offering forex, CFDs, commodities, indices, and crypto trading to users in over 150 countries. It's known for its user-friendly setup and solid trading tools, but it no longer accepts new clients from the UK due to regulatory restrictions.

How Easy Is It to Open an Account?

Account setup with AvaTrade is quick and straightforward. Verification typically takes less than 24 hours with standard ID and proof of address checks. However, UK residents will see limited access or redirection since new registrations from the UK are no longer being accepted.

How Does the Demo Account Perform for Practice Trading?

The demo account is generous, realistic, and ideal for testing strategies without risk. It mirrors live market conditions across AvaTrade's platforms, including MetaTrader 4 and AvaTradeGO. It's a great way to explore features, though UK users may need to access it via international domains.

| Category | Score (Out of 5) | Comments |

|---|---|---|

| Ease of Account Opening | 4.5 | Simple and straightforward process, but verification took slightly longer than expected (2 business days). |

| Minimum Deposit | 4.5 | $100 minimum deposit felt reasonable, with flexible funding options like PayPal and credit cards. |

| Demo Account | 5 | Excellent for testing strategies; realistic market conditions and easy to switch to live trading. |

| User Interface | 4.5 | AvaTradeGO was intuitive for beginners, while MetaTrader offered depth for advanced traders. A slight learning curve with MT4. |

| Platform Options | 5 | Multiple platforms (MetaTrader, AvaTradeGO, etc.) cater to different needs and skill levels. |

What's the User Interface Like on Desktop and Mobile?

AvaTrade's interface is clean and well-organized, with a layout that suits both MetaTrader users and beginners on AvaTradeGO. Charts load fast, and navigation feels smooth on mobile. That said, the design hasn't evolved much recently compared to newer, UK-based platforms like Spreadex.

What Did I Actually Like About AvaTrade?

Despite its age, AvaTrade still delivers a dependable trading experience with a strong range of markets, useful analytics, and solid platform stability. It's particularly appealing for those who value structure and a traditional brokerage layout over flashy new features or risky, unregulated alternatives

What Trading Options Stand Out?

AvaTrade offers a broad mix of forex, CFDs, commodities, indices, ETFs, and cryptocurrencies. Traders can speculate on global markets without switching platforms, and spreads are competitive across major pairs. The variety suits diversified traders who want multi-asset access under one account.

Which Tools Made the Biggest Difference?

AutoChartist and MetaTrader integrations are where AvaTrade shines. These tools help identify trading opportunities automatically, with visual chart patterns and risk calculators that save time. The built-in analytics and economic calendar make it easy to track trends and plan trades without third-party software.

How Does AvaTrade Handle Copy Trading?

AvaTrade supports copy trading through third-party services like DupliTrade and ZuluTrade. These platforms let users mirror the strategies of experienced traders. It's useful for beginners or time-poor investors, though performance varies and it's not as seamless as built-in systems on competitors.

| Category | Score (Out of 5) | Comments |

|---|---|---|

| Diverse Trading Options | 5 | Over 1,260 instruments available, including forex, CFDs, futures, and cryptocurrencies. Suitable for varied trading goals. |

| AvaProtect | 5 | A standout feature for risk management; it saved me during high-volatility trades. Innovative and easy to use. |

| Copy Trading | 4.5 | AvaSocial and ZuluTrade offered excellent opportunities to learn from experienced traders, though filtering options could be more robust. |

| Mobile Experience | 4.5 | AvaTradeGO was user-friendly and convenient, though advanced charting tools were somewhat limited. |

What's the Mobile Trading Experience Like?

The AvaTradeGO app is stable, intuitive, and mirrors the web platform closely. It's easy to check charts, execute trades, and manage risk on the go. Push notifications work well, but the interface feels dated compared to newer UK alternatives such as Spreadex.

Where Does AvaTrade Fall Short (Especially for UK Users)?

While AvaTrade remains a respected global broker, it's no longer ideal for UK traders. Its regulatory shift, platform limitations, and inactivity fees make it harder to recommend, especially when UK-regulated options like Spreadex provide smoother onboarding and stronger local protection.

Why Are UK Traders No Longer Supported?

AvaTrade stopped onboarding UK clients after regulatory realignments following tighter FCA requirements. The firm now focuses on international operations through its global subsidiaries, leaving existing UK users supported but preventing new registrations. UK traders seeking regulated access should consider Spreadex or other FCA-authorised platforms.

| Category | Score (Out of 5) | Comments |

|---|---|---|

| Educational Resources | 5 | AvaAcademy provided structured courses for all levels. Topics like candlestick patterns were practical and impactful. |

| Webinars and Videos | 4.5 | High-quality webinars and market outlook videos were insightful, but there's room for more in-depth analysis. |

| Practical Application | 5 | Easy to apply what I learned directly into my trades. Specific strategies like Bollinger Bands gave me measurable success. |

Are AvaTrade's Fees Competitive?

AvaTrade's spreads are reasonable for major forex pairs and CFDs, but not the lowest. The lack of commission-free structures can add up for frequent traders. Combined with inactivity fees, it's clear that AvaTrade prioritises global retail users over cost-sensitive or high-volume UK traders.

What's Frustrating About Its Proprietary Platforms?

AvaTrade's proprietary platforms, while functional, feel dated compared to competitors. Charting tools and order execution are smooth, but the layout lacks the flexibility and modern design of MetaTrader or UK-based trading apps. The user experience can feel rigid, especially on smaller mobile screens.

Is the Inactivity Fee Still a Problem?

Yes. AvaTrade still charges an inactivity fee after three months of no trading activity, which can quickly eat into smaller accounts. It's a long-standing frustration for casual traders and one area where other brokers — like Spreadex — offer more lenient policies.

| Category | Score (Out of 5) | Comments |

|---|---|---|

| Regulation and Trust Score | 5 | AvaTrade is regulated in four Tier-1 jurisdictions (e.g., ASIC, JFSA) and has a strong Trust Score of 94/99. |

| Transparency | 5 | Clear communication about fund segregation, regulatory compliance, and safety protocols reassured me. |

| Cybersecurity | 4.5 | Strong cybersecurity measures and WebTrust compliance; no major breaches reported, but more proactive updates would be welcome. |

Is AvaTrade Safe and Trustworthy in 2025?

AvaTrade continues to operate securely and transparently, with years of regulatory oversight and no major data breaches. Globally, it remains a legitimate broker with proper licensing and client fund segregation — though UK users must remember it's no longer FCA regulated locally.

How Is AvaTrade Regulated Around the World?

AvaTrade is licensed by top-tier regulators including the Central Bank of Ireland, ASIC (Australia), and FSCA (South Africa). These licences ensure oversight, capital adequacy, and client fund segregation. However, without FCA authorisation, UK users lose access to domestic investor protection schemes.

What Security Measures Protect Traders?

AvaTrade safeguards client data with SSL encryption, secure login systems, and strict identity verification. Funds are held in segregated bank accounts, separate from company operations. While it offers strong technical protection, the absence of UK regulatory coverage slightly weakens its trust factor for British investors.

If You're in the UK, What's the Best Alternative to AvaTrade?

Since AvaTrade no longer accepts new UK clients, Spreadex stands out as the best local alternative. It's FCA-regulated, built for UK traders, and offers both spread betting and CFD trading in one intuitive platform — all with competitive spreads and reliable service.

Why Do We Recommend Spreadex for UK Traders?

Spreadex combines tight spreads, tax-free spread betting, and FCA oversight, giving UK traders both flexibility and peace of mind. Its platform is easy to use, customer support is UK-based, and it offers fast onboarding with low minimum deposits — ideal for both new and active traders.

How Does Spreadex Compare to AvaTrade?

| Category | Spreadex Verdict | AvaTrade Verdict |

|---|---|---|

| Regulation | Fully FCA regulated and UK headquartered | Globally regulated but no longer FCA authorised |

| Account Type | Spread betting and CFD accounts | CFD and forex accounts only |

| Ease of Use | Modern, simple platform for all levels | User-friendly but dated interface |

| Fees & Spreads | Tight spreads; no inactivity fee | Competitive spreads; inactivity fee applies |

| Tools & Features | Integrated charts, risk tools, and mobile trading | MetaTrader, AutoChartist, and third-party integrations |

| Support | UK-based customer service team | Global support; no local UK contact |

| Tax Benefits | Spread betting profits tax-free for UK residents | No tax advantage; CFD-only trading |

| Best For | UK traders seeking regulated, low-cost access | International traders outside the UK |

Final Verdict: Is AvaTrade Worth It in 2026?

AvaTrade continues to offer solid trading tools and dependable execution on a global scale, but its relevance for UK traders has diminished. With new UK registrations no longer supported, Spreadex stands out as the more practical alternative—FCA-regulated, easy to use, and designed specifically with the UK trading market in mind.FAQs

Can UK residents open an account with AvaTrade?

Unfortunately, AvaTrade is not currently onboarding new clients from the UK. However, traders from other regions can explore the platform's offerings, including forex, CFDs, and more.

What is the minimum deposit required to start trading with AvaTrade?

AvaTrade requires a minimum deposit of $100 to open an account, making it accessible for beginners. Multiple funding options, such as PayPal, credit cards, and bank transfers, are available.

Does AvaTrade offer risk management tools like stop-loss features?

Yes, AvaTrade provides excellent risk management tools, including AvaProtect. This feature allows traders to protect specific trades against losses for a small fee, ensuring peace of mind during volatile market conditions.

Is AvaTrade suitable for beginners?

Absolutely. AvaTrade offers beginner-friendly tools like a demo account, extensive educational resources through AvaAcademy, and copy trading via AvaSocial, making it a great choice for those new to trading.

How long do AvaTrade withdrawals take?

Withdrawals typically take 1-2 business days to process, depending on the chosen withdrawal method. Ensure your account is fully verified to avoid delays in processing your request.

References

- ✓ 0% Commission (other fees apply)

- ✓ 5,000 Markets — FX, Stocks

- ✓ Free to open · £20 minimum deposit

62% of retail investor accounts lose money when trading CFDs with this provider.