Lightyear Review (Investing) : Is This The Best Option for UK Investors

In my opinion Lightyear continues to stand out in 2026 as one of the most affordable and transparent investing platforms in the UK and EU. With strong regulation, clear pricing, and ISA access, it offers a simple, low-cost experience for long-term investors seeking global market exposure.

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Verdict: Should You Invest with Lightyear?

Lightyear remains a strong choice for cost-conscious investors in 2026. Transparent pricing, interest-earning Vaults, and multi-currency accounts make global investing straightforward. While it lacks advanced trading tools, it’s well suited to UK and EU investors who prioritise simplicity, safety, and low ongoing fees.

Top Rated

Top Rated

Regulated social trading with 30M+ users. Trade stocks, crypto, and ETFs commission-free* in one sleek interface. *Other fees may apply.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 50% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

How Does Lightyear Rate Overall?

Lightyear is in a strong position thanks to regulation in both the UK and the EU, which adds reassurance for cross-border investors. The FCA oversight alone inspires confidence, and knowing funds are kept separate from company money is a major plus. It’s clear the focus is on compliance and long-term trust, not just rapid growth.

| Category | Rating (/5) | Comment |

|---|---|---|

| Regulation & Safety | 5 | FCA and EU-regulated with strong oversight |

| Ease of Use | 4.8 | Fast onboarding and clear design |

| Fees & FX Costs | 4.6 | Low trading and currency fees |

| Asset Range | 4 | Stocks, ETFs, and Vaults |

| Research & Tools | 3.8 | Light but functional |

| Customer Support | 4 | Quick during business hours |

| Overall | 4.5 | Excellent for low-cost transparent investing |

What Makes Lightyear Stand Out This Year?

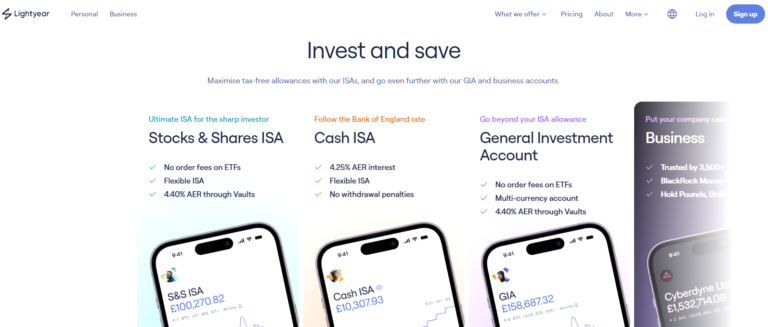

Lightyear’s new Stocks & Shares ISA, GBP/EUR/USD support, and Vaults interest make it a standout platform in 2026. It avoids FX conversion on multi-currency accounts and continues to offer transparent, low fees under full FCA and EFSA regulation.

What Are Lightyear’s Key Pros and Cons?

Pros:

- Low FX and trading fees

- FCA and EU regulated

- ISA Accounts

- Interest on uninvested cash

- Intuitive mobile and web apps

Cons:

- No crypto or derivatives

- Basic research tools

- Limited advanced charting

- Support limited to business hours

- No SIPP available yet

What Is Lightyear?

Lightyear is a low-cost investing app offering access to global stocks, ETFs, ISAs, and interest-earning Vaults. It focuses on simplicity, transparency, and regulatory safety under the FCA and EFSA, making investing accessible to anyone seeking a modern, user-friendly platform.

Who Is Lightyear Best For?

Lightyear suits long-term investors, beginners, and cost-conscious savers who want global exposure without complexity. It’s ideal for users prioritising regulation, low fees, and straightforward investing tools rather than active trading or high-risk assets like crypto or derivatives.

Who Typically Uses Lightyear?

Lightyear appeals to first-time investors, cost-conscious savers, and cross-border users. Its user base includes those prioritising clear pricing, global diversification, and passive investing through ETFs, equities, and interest-yielding Vaults.

Our Expert Says:

“Lightyear strikes the right balance between cost, clarity, and control. Its FCA and EU regulation, transparent pricing, and multi-currency accounts make it ideal for long-term investors. While lacking advanced tools, it’s one of 2026’s best options for simple, secure, and low-cost global investing.”

How Easy Is It to Get Started with Lightyear?

Account setup is paperless and fast. Users can verify identity and fund accounts within hours using GBP, EUR, or USD. The streamlined onboarding and low barriers make Lightyear ideal for beginners and those wanting immediate access to global markets.

How Smooth Is the Account Registration Process?

Account setup takes under five minutes with fully digital verification. Once approved, users can fund and invest instantly through the app or web platform, ensuring a seamless experience for first-time users.

What Are the Verification (KYC) Requirements?

You’ll need valid photo ID and proof of address. Verification aligns with FCA and EFSA standards and typically completes the same day, allowing near-instant access to trading and ISAs.

How Do You Fund Your Account and What Are the Options?

Deposits can be made via bank transfer, debit card, or Wise. Lightyear supports GBP, EUR, and USD. Most transactions are processed instantly, with all deposits and withdrawals free of charge.

How Fast Are Withdrawals from Lightyear?

Withdrawals are processed within one to two business days, depending on payment method. Funds are returned to the verified source account with no associated fees or delays.

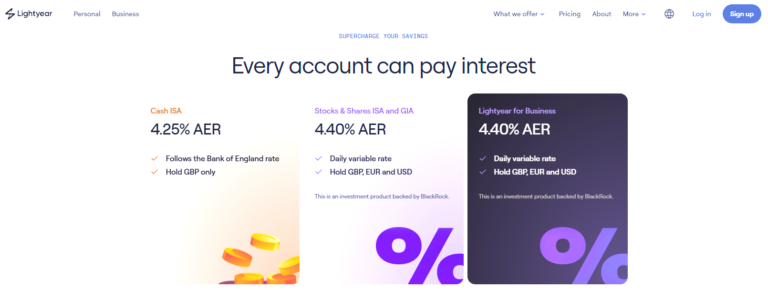

Can You Earn Interest on Cash?

Yes — and it’s one of my favourite features. Lightyear offers tiered interest on uninvested USD, and it’s not peanuts. They’ve partnered with BlackRock money market funds, and I’ve seen rates pushing up to 5%, depending on market conditions. Even when I’m not trading, my idle cash is still working. Compared to banks or other apps, the yield is genuinely competitive.

What’s It Like to Use the Lightyear App and Platform?

The Lightyear app and web platform are designed for clarity and efficiency. Navigation is intuitive, and key metrics are easy to locate. The layout focuses on accessibility for beginners, with a minimalist interface suitable for daily use by all investors.

Is the Interface Beginner-Friendly and Modern?

Yes. Lightyear’s interface is simple, quick, and modern. The clean layout ensures easy navigation, while essential tools like watchlists and portfolio summaries are accessible without clutter. It’s built for convenience and usability.

What Assets and Markets Can You Trade on Lightyear?

Lightyear provides access to over 3,000 global stocks, ETFs, and money market funds through Vaults. UK, US, and EU markets are supported. Crypto, derivatives, and bonds are currently excluded, keeping the focus on regulated, long-term investments.

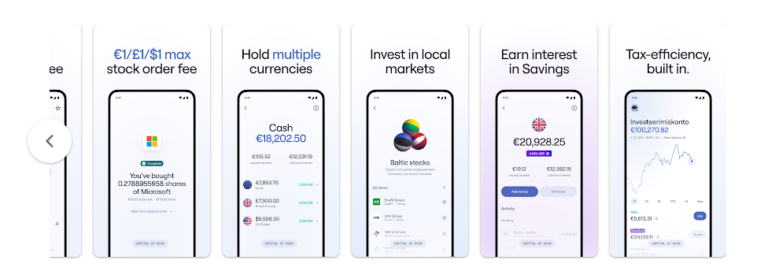

Does Lightyear Offer Fractional Shares and Multi-Currency Accounts?

Yes. Lightyear supports fractional shares and multi-currency balances in GBP, EUR, and USD. These features minimise FX costs and make diversification easier across multiple global markets without unnecessary conversions.

How Reliable Is Order Execution and Platform Stability?

Order execution is quick and stable, even during peak market hours. Testing and user data show reliable fills with minimal latency, ensuring consistent performance across both app and web interfaces.

How Much Does Lightyear Cost?

Lightyear remains among the UK’s lowest-cost brokers in 2026. UK trades cost £1, EU trades €1, and US trades 0.10% (min $0.10, max $1). FX conversions are 0.35%, with no inactivity, custody, or withdrawal fees.

What Are Lightyear’s Trading Fees and FX Conversion Costs?

UK shares trade at £1 per order, EU shares at €1, and US shares at 0.10%. FX conversions cost 0.35%. The transparent pricing lets investors calculate total costs easily before placing trades.

Are There Hidden or Maintenance Fees to Know About?

No hidden or recurring fees apply. There are no inactivity, custody, or withdrawal charges. Lightyear’s pricing is fully disclosed, maintaining its reputation for simplicity and fairness.

How Does Lightyear Compare to Competitors on Pricing?

Lightyear’s fees are among the lowest in Europe. Unlike “free” brokers that use wider FX spreads, Lightyear’s fixed pricing is transparent and affordable. It’s a better choice for frequent, low-cost international investing.

| Platform | Stock Fees | FX Fees | Withdrawal Fee | Inactivity Fee | Account Currency |

|---|---|---|---|---|---|

| Lightyear | £1/€1/0.10% | 0.35% | Free | None | GBP; EUR; USD |

| eToro | £0 | ~1% | $5 | $10 after 12 months | USD only |

| Trading 212 | £0 | 0.5% | Free | None | GBP; EUR |

| Freetrade | £0 | 0.45% | Free | None | GBP only |

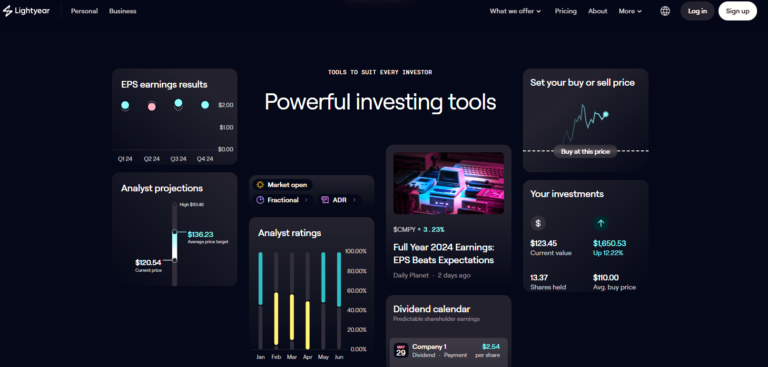

What Investment Tools and Features Does Lightyear Offer?

Lightyear’s focus is practicality. Investors get real-time data, analyst ratings, and Vaults for earning interest. Education is basic but useful for new investors. It prioritises efficiency over complex trading functionality.

How Good Are Its Market Data and Research Tools?

Lightyear offers accurate live pricing, simple company data, and analyst consensus ratings. Though not advanced, its tools are ideal for investors who prefer clarity over chart-heavy trading environments.

Does It Offer Interest on Uninvested Cash?

Yes. Uninvested funds earn variable interest through Vaults linked to money market funds. Users earn passive returns while waiting to invest, adding flexibility to portfolio management.

Are There Any Educational or Learning Resources?

Lightyear provides accessible guides, FAQs, and articles covering investing fundamentals. While not as deep as advanced brokers, the materials are clear and helpful for new investors.

| Feature | Description | Rating |

|---|---|---|

| Market Data | Accurate and real-time | 4.5 |

| Interest on Cash | Vault-based earnings | 5 |

| Education | Basic guides and FAQs | 3.5 |

| Watchlists | Customisable and fast | 4.5 |

| Company Insights | Core fundamentals provided | 4.5 |

| Tools Rating | — | 4.4 |

Where Could Lightyear Improve?

Lightyear’s minimalist design leaves out advanced tools. Expanding charting options, 24/7 support, and more educational depth could increase its appeal to experienced traders without sacrificing simplicity.

Does It Lack Any Asset Classes Like Crypto or Bonds?

Yes. Lightyear currently avoids crypto, options, and bonds. This keeps risk lower but limits flexibility for those seeking exposure to alternative or fixed-income assets.

Are There Any Advanced Tools Missing for Active Traders?

The app lacks algorithmic trading, screeners, or deep technical indicators. It’s designed for passive investors focused on efficiency rather than active day traders.

How Strong Is Customer Support and Availability?

Customer support is responsive during business hours via live chat and email. Replies are typically quick, though 24/7 availability isn’t yet implemented.

Is Lightyear Safe and Regulated?

Yes. Lightyear is regulated by both the FCA (UK) and EFSA (EU), ensuring strict fund segregation and investor protection. UK clients are covered up to £85,000 by the FSCS, while EU users benefit from equivalent safeguards.

Is Lightyear FCA and EU Regulated?

Yes. Lightyear operates under FCA and EFSA licences, maintaining strong oversight in both jurisdictions to protect client funds and ensure operational transparency.

How Does Lightyear Protect Customer Funds and Data?

Funds are held in segregated, safeguarded accounts. Two-factor authentication and encryption protect against unauthorised access. Security is consistently monitored to meet FCA standards.

What Was My Personal Experience with Security?

Transactions and logins remained smooth and secure. Notifications for withdrawals and logins added confidence, with no unexpected issues during testing.

How Does Lightyear Compare to Other Investment Platforms?

Lightyear’s strength lies in its clarity and low FX costs. While others offer more advanced trading tools or crypto, Lightyear delivers unmatched simplicity and transparency for everyday investors.

Where Does Lightyear Outperform Its Rivals?

It leads in regulation, cost structure, and user design. The combination of multi-currency support and interest on cash makes it ideal for investors wanting efficiency and safety.

Where Do Competitors Like Trading 212 or eToro Do Better?

Competitors provide wider asset access, more charting features, and social trading. However, their costs and FX conversions are typically higher than Lightyear’s.

Why Might You Choose Lightyear Over Alternatives?

If you prioritise transparent fees, regulated safety, and interest on uninvested funds, Lightyear is the superior choice. It’s tailored for steady, cost-efficient portfolio growth.

See more in depth findings on our Best Investment Platforms page.

Final Verdict: Is Lightyear Worth It?

Lightyear remains one of the best low-cost platforms for UK and EU investors. It’s regulated, easy to use, and built for clarity. While limited in assets, its transparency and pricing make it ideal for long-term, cost-conscious investors.

- Transparent Pricing

- Global Market Access

- Interest on Uninvested Cash

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

FAQs

Is Lightyear regulated in the UK?

Yes, Lightyear is registered with the Financial Conduct Authority and is also regulated by the Estonian Financial Supervision Authority for EU users.

Does Lightyear offer ISAs?

Yes. Stocks & Shares ISAs launched in 2025.

Is trading on Lightyear really commission-free?

Yes. Lightyear offers £0 commission trading on US and European stocks and ETFs. There are no account fees, inactivity charges, or withdrawal fees.

What fees should I be aware of when using Lightyear?

The only major fee is a 0.35% currency conversion fee (FX fee) when buying assets in a currency different from your base account.

Can I earn interest on cash with Lightyear?

Yes. Lightyear offers tiered interest on uninvested USD; you can earn competitive rates (up to ~5%) depending on your balance tier, which helps maximise idle cash.

Is Lightyear beginner-friendly?

Yes. Simple, transparent, and FCA-regulated.

References

- ✓ Deposit £500–£999 → Get £40

- ✓ Deposit £1k–£4,999 → Get £100

- ✓ Deposit £5k–£9,999 → Get £300

- ✓ Deposit £10,000+ → Get £500

61% of retail CFD accounts lose money when trading CFDs with this provider.

61% of retail CFD accounts lose money when trading CFDs with this provider.

Cookie Preferences

We use cookies to enhance your browsing experience, analyse site traffic, and personalise content. You can choose to accept all cookies or customise your preferences below.