Quick Answer – ETF or ETN: Which Is Better for Crypto Investors?

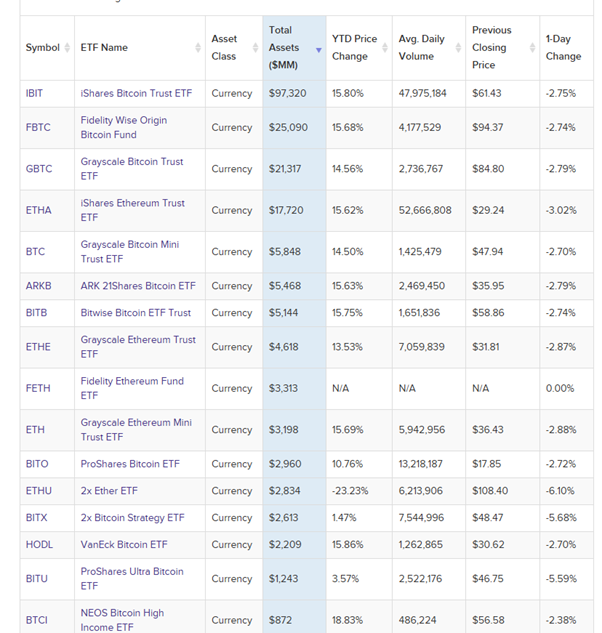

Crypto ETFs provide regulated, asset-backed exposure and are generally safer for long-term investors. ETNs, however, offer more flexibility and sometimes higher potential returns — but with additional credit risk tied to the issuer. In 2025, ETFs dominate regulated UK and EU crypto markets.

As a new instrument available in the UK for retail traders, most top investment platforms are yet to provide access to their clients. However, you can buy crypto from brokers and the FCA registered crypto exchanges.

Summary Table – ETF vs ETN Overview (2026)

What Are Crypto ETFs?

Crypto ETFs are regulated investment funds that track the price of cryptocurrencies like Bitcoin or Ethereum. They hold either the actual asset or futures contracts, allowing investors exposure without handling wallets or private keys. Accessible via issuers like WisdomTree and BlackRock, crypto ETFs are gaining traction across Europe, though FCA rules currently limit retail access in the UK.

What Are Crypto ETNs?

Crypto ETNs (Exchange-Traded Notes) are debt-based securities issued by financial institutions that mirror crypto price movements without owning the underlying coins. They introduce counterparty risk, meaning investors rely on the issuer’s solvency. Commonly listed on European exchanges such as Xetra and SIX, ETNs offer broader crypto exposure and leverage options but carry higher inherent risk.

ETF vs ETN Structural Differences

How Do They Perform Compared to Holding Crypto Directly?

Both ETFs and ETNs let investors gain exposure to crypto without managing private keys or crypto wallets. They remove custody risks, simplify taxes, and provide easier liquidity. However, they trade exposure—not ownership—so investors miss potential benefits like staking rewards or blockchain governance participation.

What Are the Pros and Cons of Each?

ETFs provide regulated, asset-backed exposure with lower fees, while ETNs offer greater flexibility and access to niche or leveraged crypto products. The key difference lies in risk—ETFs protect against issuer default, while ETNs carry credit risk tied to the note issuer.

ETFs vs ETNs (Pros & Cons)

Which Offers Better Risk-Adjusted Returns?

Crypto ETFs typically offer safer, more stable long-term exposure suited for diversified portfolios, while ETNs attract investors seeking leveraged returns or access to less mainstream tokens. Institutional sentiment strongly favours ETFs, which combine transparency, regulation, and efficient tracking with reduced default risk.

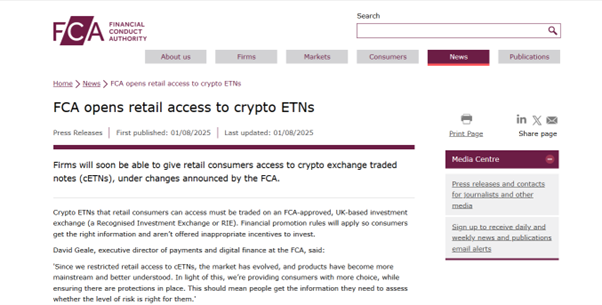

Are Crypto ETFs Now Available to UK Investors from 2025?

Yes – the FCA officially lifted its ban on crypto-linked ETFs and ETNs in 2025, allowing UK retail investors to access regulated crypto investment products for the first time. Funds tracking Bitcoin and Ethereum from issuers like BlackRock, WisdomTree, and 21Shares are now available through FCA-authorised brokers.

This reform enhances transparency, investor protection, and accessibility — removing the need for wallets or unregulated exchanges. It also aligns the UK with Europe’s regulated crypto markets, legitimising digital assets as mainstream investment vehicles.

What Does the FCA’s Decision Mean for Retail Investors?

For everyday investors, the rule change opens the door to secure, regulated crypto exposure without managing private keys or offshore platforms. It simplifies diversification into Bitcoin and Ethereum via familiar broker accounts while ensuring strong consumer safeguards under UK financial regulations.

Key Facts: FCA’s 2025 Crypto ETF Access

What's New for Crypto ETFs & ETNs in 2026?

• Following FCA approval in March 2025, UK retail investors now have established access to crypto ETPs

• More issuers have entered the UK market with competitive fee structures

• Trading volumes have matured since initial launch, providing better liquidity

• Additional cryptocurrencies may be eligible for ETP inclusion beyond Bitcoin and Ethereum

Should You Choose a Crypto ETF or ETN in 2026?

Crypto ETFs are ideal for investors who value simplicity, regulation, and long-term exposure to Bitcoin or Ethereum. ETNs suit those comfortable with higher risk and seeking broader or leveraged crypto access. Your choice ultimately depends on risk appetite and EU market access.

FAQs

Yes. ETFs are backed by underlying assets and managed under fund regulation, while ETNs depend on the issuer’s creditworthiness.

Some ETFs hold physical crypto (e.g., spot Bitcoin), while others use futures contracts to track prices. ETNs typically mirror price movements without holding assets.

Major European exchanges include Xetra (Germany), SIX (Switzerland), and Nasdaq Nordic, where issuers like 21Shares and CoinShares list ETNs.

Yes. Because ETNs are debt instruments, a market decline or issuer insolvency can amplify losses beyond typical market volatility.