- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer: To Buy META (facebook)Shares, You’ll Need to…

Open an account with an FCA-regulated UK broker.

Deposit GBP into your account.

Search for Meta Platforms (NASDAQ: META).

Place a buy order.

Manage your investment and review regularly.

UK New Clients

UK New Clients

61% of retail CFD accounts lose money when trading CFD’s with this provider.

Introduction

Meta Platforms, Inc. (NASDAQ: META), the parent company of Facebook, Instagram, and WhatsApp, is one of the world’s largest technology companies. UK investors can access its shares via FCA-regulated brokers. This guide explains how to buy META shares step-by-step, plus the risks and alternatives.

How to Buy META Shares in the UK (Step-by-Step)

Step 1. Choose a UK-Regulated Broker or Trading Platform

To invest in META, you should use a broker regulated by the Financial Conduct Authority (FCA). FCA oversight ensures your money is protected. Popular FCA-regulated brokers offering META shares include eToro, IG, and XTB. Compare fees, tools, and ease of use.

How do I know the broker is FCA-regulated?

Check the FCA’s public register online. Regulated brokers list their license number on their websites. This verification ensures they comply with UK investor protection rules and segregate client funds, giving you added safety when trading U.S. shares like META.

Which are the best investing platforms in the UK to Buy Stocks?

eToro, IG, and XTB are among the best Investment Platforms in the UK for buying U.S. shares. eToro is known for commission-free trading, IG for advanced tools, and XTB for competitive spreads. The best choice depends on your investment style.

Not Sure Which Platform to Choose?

Answer 5 quick questions and we’ll provide a personalised recommendation for the best options tailored to your specific needs and experience level.

Step 2. Create and Verify Your Brokerage Account

Once you’ve chosen a broker, register online with your name, address, and contact details. You must verify your identity with ID documents and proof of address, in line with UK regulations. After approval, you’ll gain access to the trading platform.

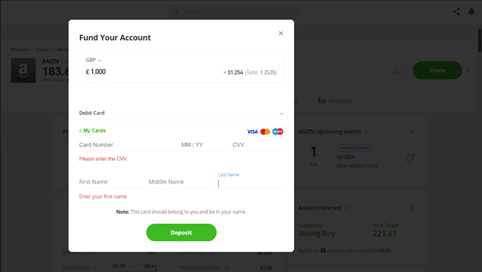

Step 3. Deposit Funds Into Your Account

To buy META shares, you need to add money to your brokerage account. Deposit options include bank transfer, debit card, or e-wallets such as PayPal (availability varies by broker). Deposits in GBP are converted into USD automatically, since META is listed on the NASDAQ exchange.

What payment methods can I use?

eToro, IG, and XTB support bank transfers for larger deposits and debit cards for instant funding. Some also accept PayPal for added convenience. Choose the option that suits your budget and speed requirements, keeping in mind that processing times differ between payment methods.

Are there fees for depositing GBP?

Yes, some brokers charge small fees for deposits or apply foreign exchange (FX) fees when converting GBP to USD. For example, FX charges often range from 0.5% to 1.5%. Review your broker’s fee schedule before funding your account to avoid unnecessary costs when buying META.

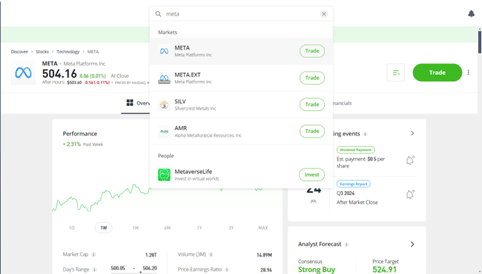

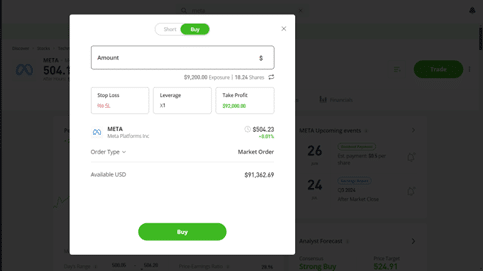

Step 4. Buy META Shares (NASDAQ: META)

Once your account is funded, you can place an order for META shares. Log into your broker’s platform, search for “Meta Platforms” or ticker “META,” and select the stock. Then choose the order type, enter the amount you want to invest, and confirm the purchase.

Order types

A market order buys META instantly at the current price. A limit order executes only when META reaches your chosen price. Brokers like eToro, IG, and XTB also offer stop-loss and take-profit orders, which help UK investors manage risk by automating selling points.

How do I place a buy order for META?

Log into eToro, IG, or XTB and use the search bar to find “Meta Platforms” or ticker “META.” Select the stock, enter how many shares or the cash amount you want to invest, and choose your order type. Review the order details carefully before clicking confirm.

How can I review and confirm my purchase?

After placing your order, go to the “Portfolio” or “Orders” tab. Here you’ll see how many META shares you own, your average purchase price, and current market value. Your broker will also provide trade confirmations and transaction history, useful for both tracking and tax purposes.

Step 5. Store or Manage Your META Investment

After buying META, decide how you’ll manage the investment. Long-term investors may hold shares for years, while active traders monitor prices daily. Regularly review your portfolio, consider your risk tolerance, and stay updated on Meta’s performance. Good management helps protect and grow your investment.

Should I have an exit strategy?

Yes. An exit strategy prevents emotional decision-making and sets clear targets for selling. You might sell when META reaches a price goal, or use stop-loss orders to limit downside risk. Regular portfolio reviews also help you decide whether META still fits your investment goals.

Can I reinvest dividends or set up recurring investments?

Meta does not currently pay dividends, but recurring investments are possible. eToro, IG, and XTB allow you to schedule automatic purchases of META shares. This method, known as pound-cost averaging, helps spread risk by investing consistently over time rather than all at once.

What is Meta Platforms, Inc. (NASDAQ: META)?

Overview of Meta Platforms, Inc. (NASDAQ: META)

Meta Platforms is a U.S.-listed technology company behind Facebook, Instagram, WhatsApp, and Oculus. Traded under ticker META on the NASDAQ, it is valued among the world’s largest U.S. stocks. Meta invests heavily in AI, social networking, and metaverse technologies.

Is META Stock a Good Investment in 2025?

Meta stock has grown thanks to its dominance in social media and digital advertising. Its future depends on innovation in AI and virtual reality. While META may offer long-term growth, its performance is tied to global ad spending and tech market volatility.

What Are the Risks of Buying META Shares?

Risks include reliance on ad revenue, privacy regulation, large spending on the metaverse, and competition from TikTok and other platforms. Like most NASDAQ-listed tech stocks, META is volatile. UK investors should diversify their holdings to avoid heavy exposure to one company.

Pros and Cons of Investing in Meta Shares

Pros & Cons of Investing in Meta Shares

Before investing, consider the key advantages and risks of owning Meta (META) stock.

- Strong Revenue Growth – Meta generated $116.6 billion in 2023, a 16% YoY increase.

- Market Leader in Social Media – Owns Facebook, Instagram,

- WhatsApp with nearly 4 billion users.

Expanding into AI & Metaverse – Investing over $36 billion in VR, AI, and advertising technology. - Profitable Business Model – High-profit margins due to advertising dominance.

- Stock Buybacks – Meta has repurchased billions in shares, increasing shareholder value.

- Regulatory Risks – Ongoing EU and US antitrust investigations into Meta’s ad business.

- High Competition – Faces strong rivals like TikTok, Google, and Apple in digital advertising.

- Stock Price Volatility – META dropped 75% in 2022 before recovering in 2023.

- No Dividends – Unlike Apple or Microsoft, Meta reinvests profits instead of paying shareholders.

- Metaverse Uncertainty – Heavy investment in VR & AI, but profitability remains uncertain.

Can I Buy META Through a Fund?

Final Thoughts: Is Buying META Shares Right for You?

UK New Clients

UK New Clients

61% of retail CFD accounts lose money when trading CFD’s with this provider.

FAQs

What are the tax considerations for buying Meta Platforms shares in the UK?

Capital gains tax may apply to profits from selling shares. Consult with a tax advisor for specific advice.

Does Meta Platforms pay dividends?

As of now, Meta Platforms does not pay dividends, reinvesting profits into growth initiatives.

How does currency exchange affect investing in Meta Platforms shares?

Investments in US stocks involve currency exchange risk. Fluctuations in the GBP/USD exchange rate can impact returns.

What is the minimum investment required to buy Meta Platforms shares?

This depends on the broker. Some platforms offer fractional shares, allowing investments as low as £1.

Can I buy Meta Platforms shares through a UK ISA or SIPP?

Yes, many brokers allow you to hold US stocks like Meta Platforms in ISAs and SIPPs, providing tax advantages.

References

- eToro Official Website – www.etoro.com

- IG Trading Platform – www.ig.com/uk

- Yahoo Finance: META Stock Data – finance.yahoo.com/quote/META

- Nasdaq: META Stock Overview – www.nasdaq.com/market-activity/stocks/meta