Is eToro Good for Crypto in 2026?

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection (£120,000 per person)

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Affiliate disclosure. Broker buttons and "Get Started" links are affiliate links. We may earn a commission if you open an account — at no extra cost to you. This never affects our ratings, rankings, or recommendations, which are based solely on our independent testing methodology.

Contact: info@theinvestorscentre.co.uk

Thinking about buying crypto on eToro? Here’s what UK investors need to know in 2026 — including fees, coin availability, and how it stacks up against dedicated exchanges.

Quick Answer: Should you use eToro for cryptocurrency investing?

Yes, eToro is a beginner-friendly, regulated platform for investors looking to trade in crypto. While fees are higher than some exchanges, its ease of use and copy trading make it ideal for new investors. Best for learning and safe trading!

- Minimum Deposit: $50 (via UK bank transfer)

- Copy top-performing traders across a wide range of assets

- FCA regulated and compliant with UK crypto marketing rules

- User-friendly platform with social trading and mobile app support

- Perfect for beginners and casual investors looking to follow expert strategies with ease

Donʼt invest unless youʼre prepared to lose all the money you invest. This is a

high-risk investment and you should not expect to be protected if something

goes wrong. Take 2 mins to learn more.

Get Up To $500

Worth In Free Assets

- New users only

- Choose from 6 select stocks & ETFs

- Not valid for ISA accounts

Terms apply. This bonus does not include ISA deposits.

Your capital is at risk.

Why did I start using eToro to buy Crypto?

When I first became interested in buying cryptocurrencies, I was immediately overwhelmed by the number of exchanges available. Some platforms felt too complicated, while others seemed less than ideal when it came to security and regulation. That is when I decided to consider eToro.

I liked that it was a regulated platform, meaning my funds were safer than on some of those anonymous exchanges. Plus, eToro has a social trading feature that lets me see what experienced traders are doing and even replicate them if I choose, which was a huge plus when I was still learning. If you’re new to the platform and wondering what is eToro?, it’s worth exploring how it works, its key features, and what sets it apart from other trading platforms.

What was my experience with eToro’s Interface?

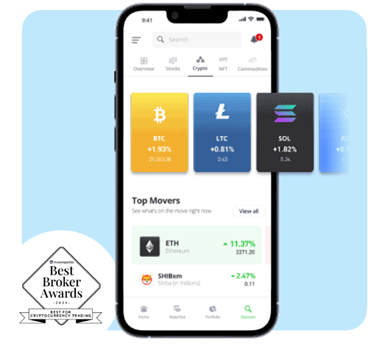

One of the first things that stood out about eToro was how easy it is to use. I’ve tried other well-known platforms, and while they offer more advanced features, they can be intimidating—especially if you’re new to cryptocurrency, like I was. eToro, on the other hand, makes the process super simple. If you’re just starting out, you might be wondering is eToro good for beginners?—its user-friendly design and social trading features make it a popular choice for those new to investing.

The main cost you’ll deal with is the spread. This varies depending on the asset, and in fast-moving markets, it can fluctuate quickly. When I first traded forex on eToro, I didn’t pay enough attention to spreads, and it ended up eating into my profits. Lesson learned: Always check the spread before you place a trade.

Here’s what I love about the platform’s usability:

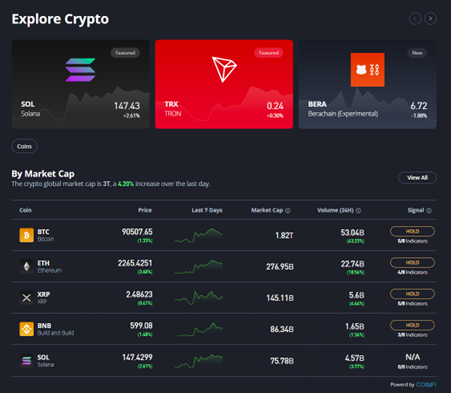

- Clean, intuitive dashboard: The layout is well-organised, and finding different cryptocurrencies is effortless.

- Price alerts and charts: I can set alerts for when a coin reaches a specific price so I don’t have to check the market (and my phone) constantly.

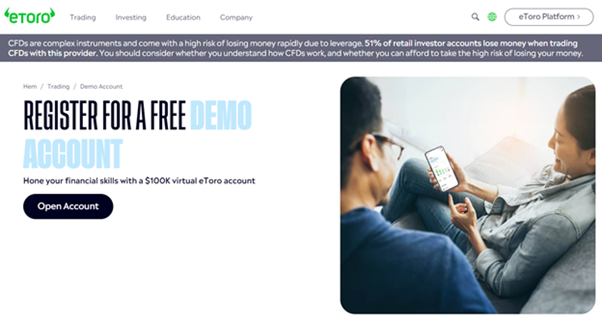

- Demo account: Before I risked spending my money, I had the chance to play around with the demo account, which is a great way to get comfortable with the platform and mechanics.

Does eToro provide a secure trading experience?

Security was one of my biggest concerns when I started investing in crypto. The industry is filled with stories of exchanges being hacked or disappearing overnight and taking users’ funds with them. That is why I chose eToro—it’s one of the few cryptocurrency platforms that are fully regulated. If you’re wondering is eToro safe?, it’s worth looking into its regulatory protections, security measures, and how it safeguards users’ funds.

- Regulated in multiple jurisdictions: eToro is registered with financial authorities like the FCA (UK), ASIC (Australia), and CySEC (Cyprus).

- SSL encryption & Two-Factor Authentication (2FA): My account and funds feel secure because of these extra layers of protection.

- Built-in wallet: eToro has a crypto wallet (the eToro Money Wallet), handy if you want to store your assets within the platform.

For me, security is non-negotiable, and eToro ticks that box.

How Much Does it Cost to Trade on eToro?

Let’s talk fees and costs. They can make or break a trading experience. eToro has a spread-based fee system; this means they don’t charge a commission per trade, but instead, they make money from the difference between the buying and selling price (the spread).

- Bitcoin spread fee: Around 1%, which is fair and competitive.

- No deposit fees: I liked that I could fund my account without any hidden deposit charges.

- Withdrawal fee: There’s a $5 withdrawal fee.

- Currency conversion fee: Since eToro operates in US Dollars, any deposit in another currency (like GBP or EUR) gets hit with a small conversion fee.

Is it the cheapest platform out there? No. But for a regulated and beginner-friendly experience, I think the fees are fair.

Why Is eToro a Good Platform for Crypto and Trading? - The Positives

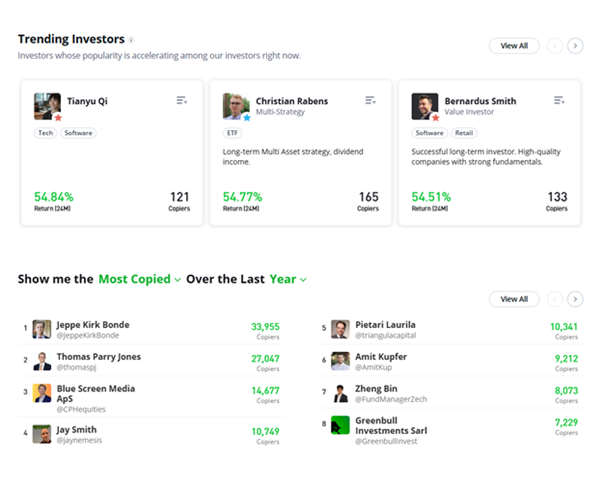

One of the biggest reasons I keep using eToro—despite trying multiple other platforms—is its social and copy trading features. These tools make eToro more than just a standard crypto exchange; they turn it into an interactive learning environment that helps both beginners and experienced traders succeed.

- CopyTrader: I could follow successful traders and automatically copy their trades. When I was starting out, this was a game-changer because I could learn from experts in real time. Instead of guessing which cryptocurrencies to buy, I mirrored the trades of professionals with proven track records. Over time, I started analysing their moves and adapting their strategies to my style.

- Social Feed: eToro includes a social media-like feed where traders discuss market trends, strategies, and investment insights. I often check it to see what’s trending in the crypto world—whether it’s Bitcoin news, upcoming altcoins, or technical analysis from experienced traders. This kind of real-time community insight is something I haven’t found on most other exchanges.

- CopyPortfolio: This is eToro’s portfolio management tool, where they bundle multiple cryptocurrencies into a single investment option. Instead of manually choosing individual coins, I can invest in a diversified crypto portfolio managed by eToro experts. It’s an excellent hands-off approach for long-term investors who want exposure to different assets without actively trading.

- Community Engagement: Unlike most crypto exchanges, eToro fosters a sense of community. I can engage with other traders, ask questions, and even share my own strategies. Crypto trading can feel isolating, but eToro makes it a collaborative experience where users learn and grow together.

- Demo Account: eToro offers a fully functional demo account where users can practice trading with virtual funds. This was incredibly useful when I was learning how to navigate the platform, test strategies, and get comfortable with crypto trading—without the risk of losing real money.

- eToro Academy: eToro provides educational resources through its Academy, which includes tutorials, webinars, and trading guides. These materials helped me understand crypto fundamentals, market trends, and risk management techniques, making it easier to make informed investment decisions.

No other crypto exchange I’ve used offers this level of social integration and educational support, which is why I’ still keep my eToro account active. The ability to learn from real traders, copy strategies, practice risk-free, and engage with a knowledgeable community makes eToro an outstanding platform for both beginners and experienced investors.

What could they eToro do Differently? - The Downsides

While I think eToro is excellent, it is not perfect. Here are a few things that could be better:

- Higher fees compared to Binance & Kraken – If you’re looking for the absolute lowest fees, eToro might not be your best bet. For a full breakdown of costs, check out my eToro Fees Explained guide to understand the different charges you might encounter.

- Limited control over your crypto – Unlike some decentralized exchanges, eToro holds your assets unless you transfer them to an external wallet.

- Withdrawal times – While deposits are fast, withdrawals can take a few business days—something to keep in mind if you need quick access to your funds.

How does eToro compare?

| Feature | eToro | Coinbase | Binance |

|---|---|---|---|

| Ease of Use | Very beginner-friendly | Simple but higher fees | Complex for beginners |

| Fees | Medium | High | Low |

| Security | Highly regulated | Highly regulated | Less regulated in some regions |

| Social Trading | Yes | No | No |

| Wallet Options | eToro Wallet | Coinbase Wallet | Binance Trust Wallet |

| Withdrawal Speed | Slower | Medium | Fast |

My Final Verdict: Is eToro a good choice to trade Crypto?

So, after using eToro for crypto trading, do I think it’s worth it? Yes—but with some caveats.

The platform is beginner-friendly and is recommended for someone who wants a safe, regulated user experience. If you are looking for this, then eToro is a fantastic option. The social trading features are a game-changer, and the security measures provide peace of mind at the end of the day.

However, if you are a more experienced trader and looking for complete control over your crypto assets, you might prefer other exchanges like Binance or Kraken instead.

I enjoy using eToro because of its simplicity, social aspects, and security. If you are considering taking a step towards crypto, then I’d recommend opening an account and trying out the demo mode first—it is a great way to test the waters before investing real money. If you’re ready to get started, check out my How to Buy Bitcoin on eToro guide for a step-by-step walkthrough.

What’s Changed in 2026?

eToro still FCA-registered with around 100 cryptos available. 1% spread fee unchanged. eToro Money Wallet active. Copy trading and CopyPortfolios remain key features. No staking for UK users. $5 withdrawal fee still applies.

eToro is a multi-asset platform which offers both investing in stocks and

cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money

rapidly due to leverage. 61% of retail investor accounts lose money when

trading CFDs with this provider. You should consider whether you

understand how CFDs work, and whether you can afford to take the high risk

of losing your money.

This communication is intended for information and educational purposes

only and should not be considered investment advice or investment

recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your

investments may go up or down. Your capital is at risk.

Donʼt invest unless youʼre prepared to lose all the money you invest. This is a

high-risk investment and you should not expect to be protected if something

goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and

assumes no liability as to the accuracy or completeness of the content of this

publication, which has been prepared by our partner utilizing publicly

available non-entity specific information about eToro.

Get Up To $500

Worth In Free Assets

- New users only

- Choose from 6 select stocks & ETFs

- Not valid for ISA accounts

Terms apply. This bonus does not include ISA deposits.

Your capital is at risk.

FAQs

Is eToro a good platform for beginners in cryptocurrency?

Yes! eToro’s user-friendly interface, demo account, and social trading features make it a great choice for beginners looking to learn and invest in crypto.

What are eToro’s fees for crypto trading?

eToro charges a spread fee of around 1% for Bitcoin and other cryptos. There’s no deposit fee, but a $5 withdrawal fee and a currency conversion fee if depositing in non-USD.

Can I withdraw my crypto from eToro?

Yes, but you need to transfer it to the eToro Money Wallet first. From there, you can send it to an external crypto wallet. Keep in mind that fees may apply.

What’s the difference between a spread and a commission?

A spread is the difference between the buy and sell price of an asset, while a commission is a fixed trading fee. eToro doesn’t charge commissions on real stocks, but spreads apply to most trades.

Are there any hidden fees on eToro?

No, eToro is fairly transparent about its fees. However, you should always check for:

- Spreads on CFDs, forex, and crypto.

- Overnight fees on leveraged trades.

- Currency conversion charges for non-USD deposits.

References

- eToro Official Fees Page – eToro Fees – What they are & how they are calculated

- eToro Terms & Conditions – Terms and Conditions

- eToro Inactivity Fees – What happens if I do not log into my eToro investment account?

- Financial Conduct Authority (FCA) – Understanding Trading Fees