- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

We tested 12 FCA-regulated CFD brokers between October 2025 and January 2026, funding each with real deposits and executing 50+ trades per platform. Six made this list. The rest fell short on spreads, execution, or platform reliability – we’ve excluded them rather than pad out the rankings.

This guide covers what we found: verified spreads, execution speeds, fee structures, and the limitations each broker doesn’t advertise. Whether you’re trading forex, indices, or commodities, the comparison tables and broker breakdowns below should help you choose without wading through marketing copy.

Quick Answer – What is the Best CFD Trading Platform in the UK?

Pepperstone is our top pick for CFD trading in the UK. It combines raw spreads from 0.0 pips on the Razor account, execution speeds averaging 30ms, and a fee structure with no inactivity charges or deposit fees. For forex and index CFDs specifically, no other FCA-regulated broker matched its combination of cost and reliability during our testing period.

That said, the best platform depends on what you’re trading and how:

- Best for low-cost forex CFDs: Pepperstone

- Best all-round for spread betting + CFDs: Spreadex

- Best for advanced tools and market range: IG

- Best for index CFDs and pattern recognition: CMC Markets

- Best for mobile trading: XTB

- Best for beginners: Capital.com

Pepperstone

CFD Platform Score: 4.9/5

72% of retail CFD accounts lose money.

Spreadex

CFD Platform Score: 4.7/5

65% of retail CFD accounts lose money.

How Did We Test These CFD Platforms?

Each broker was tested with a live funded account – minimum £500 deposit per platform. We executed trades across forex, indices, and commodities during different market conditions: London open, New York overlap, and around high-impact data releases where spreads typically widen.

Our testing covered five areas:

- Spread accuracy – Recorded GBP/USD and EUR/USD spreads at multiple points throughout the trading day, comparing advertised minimums against actual averages.

- Execution quality – 50+ trades per platform, measuring fill speed, slippage frequency, and requote rates.

- Platform stability – Charting responsiveness, mobile app reliability, and order execution under load.

- Withdrawal speed – Time from withdrawal request to funds arriving in a UK bank account.

- Fee transparency – Overnight financing rates, inactivity charges, and currency conversion costs.

This review was led by Thomas Drury (Chartered ACII) and Dom Farnell. The Investors Centre has published trading platform research since 2023, covering brokers across the UK, Australia, and Canada. Our methodology prioritises first-hand testing over manufacturer specifications.

Where data couldn’t be independently verified, we’ve noted it. Platforms that performed inconsistently or failed basic reliability checks during testing were excluded from the final seven.

How do the Best UK CFD Brokers Rank?

The table below shows real-world performance metrics gathered during our testing period, alongside publicly available trust indicators. Trustpilot scores and app ratings reflect public sentiment as of January 2026.

| Rank | Broker | Min Deposit | FCA Reference | Best For | Our Verdict |

|---|---|---|---|---|---|

| 1 | Pepperstone | £0 | 684312 | Low-cost forex CFDs | Tightest spreads, fastest execution, no inactivity fee |

| 2 | Spreadex | £0 | 190941 | Spread betting + CFDs | Best all-rounder for UK traders wanting both products |

| 3 | IG | £0 | 195355 | Advanced tools and market range | 17,000+ markets, premium research, steeper learning curve |

| 4 | CMC Markets | £0 | 173730 | Index CFDs and pattern recognition | Excellent charting, £10/month inactivity fee after 12 months |

| 5 | XTB | £0 | 522157 | Mobile trading | Polished xStation app, no spread betting for UK clients |

| 6 | Capital.com | £20 | 793714 | Beginners | Clean interface, AI insights, no crypto CFDs for UK retail |

FCA reference numbers link directly to the FCA Register. FSCS protection covers eligible claimants up to £120,000.

What Did Our Testing Reveal?

Between October 2025 and January 2026, we deposited £500 into each platform and executed 50+ trades per broker across forex, indices, and commodities. The table below summarises our findings across five key areas.

| Broker | Spread Accuracy | Execution Quality | Platform Stability | Withdrawal Speed | Fee Transparency |

|---|---|---|---|---|---|

| Pepperstone | Excellent | Excellent | Excellent | Same day | Excellent |

| Spreadex | Good | Good | Excellent | Same day | Good |

| IG | Good | Excellent | Excellent | Same day | Excellent |

| CMC Markets | Good | Good | Excellent | 1-2 days | Excellent |

| XTB | Good | Good | Good | Same day | Good |

| Capital.com | Good | Average | Good | 1-2 days | Good |

Ratings explanation: Excellent = consistent, no issues observed; Good = minor inconsistencies that did not materially affect trading; Average = noticeable issues that required attention. Platforms that scored below Average in any category were excluded from this list.

The Top 6 CFD Brokers in the UK Reviewed

Pepperstone – Best for Low-Cost Forex CFDs

Pepperstone’s Razor account offers raw spreads from 0.0 pips plus a £2.25 per-side commission on GBP accounts. For active forex traders, this typically works out cheaper than spread-only pricing. We’ve used Pepperstone as our primary forex testing account since 2023, mostly trading GBP/USD and EUR/USD during London sessions.

Pros & Cons

- Raw spreads from 0.0 pips + £2.25 commission on Razor account

- Five platform choices: MT4, MT5, cTrader, TradingView, proprietary

- No inactivity fee, deposit fee, or withdrawal fee

- Smart Trader Tools plugin included free on MT4

- 1,350 markets is limited versus IG (17,000+) or CMC (10,000+)

- No bonds, futures, or options CFDs

- Weekend support slower than weekday responses

-

What Does Pepperstone Cost?

-

What’s Trading on Pepperstone Like?

-

Who Should (and Shouldn’t) Use Pepperstone?

Razor Account: Raw spreads + £2.25 commission per side per standard lot. Pepperstone publishes average spreads of 0.17 pips on EUR/USD and 0.42 pips on GBP/USD during peak hours. In our experience, spreads during London sessions sit close to these figures.

Standard Account: Spreads from 1.0 pip with no commission. Less competitive for frequent traders.

No hidden fees: No deposit charges, no withdrawal fees, no inactivity penalty. This is increasingly rare—most brokers now charge for dormant accounts.

Five platforms connect to Pepperstone’s liquidity: MT4, MT5, cTrader, TradingView, and their proprietary platform. We primarily use MT4 for forex testing—it’s familiar and the Smart Trader Tools plugin adds useful functionality. cTrader offers more advanced order types and depth-of-market visibility for traders who want that level of detail.

The 1,350+ market range is modest compared to IG or CMC. You won’t find bonds, futures, or options CFDs here. We’ve also found weekend support slower than weekday responses when we’ve had queries—not a dealbreaker, but worth knowing.

Good for: Forex-focused traders who prioritise low costs over market breadth. Scalpers and day traders who want raw spreads. Anyone running EAs on MT4/MT5. Traders who want platform choice without paying extra.

Not for: Traders wanting a wide range of markets beyond forex and major indices. Anyone prioritising spread betting as their main product—Pepperstone offers it, but it’s not their core strength. Complete beginners may find cTrader’s depth-of-market features intimidating initially.

| Metric | Value |

|---|---|

| FCA Reference | 684312 |

| Trustpilot Score | 4.2/5 |

| iOS App Rating | 4.7/5 |

| Execution Speed | 30ms avg (Pepperstone reported) |

| GBP/USD Spread | From 0.0 pips (Razor) |

| Tradeable Assets | 1350+ |

72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Spreadex – Best for Spread Betting and CFDs Combined

Spreadex offers both spread betting and CFDs on a single platform with fixed spreads. The fixed-spread model means costs remain consistent regardless of market volatility—something we’ve appreciated when trading UK 100 around BOE announcements.

Pros & Cons

- Fixed spreads don’t widen during news events or volatility

- Both spread betting and CFDs on one platform

- Strong UK small-cap and AIM stock coverage

- Operating since 1999 with no deposit or withdrawal fees

- No MetaTrader support

- Mobile app less polished than XTB or Capital.com

- Execution speed not publicly disclosed

- Limited educational resources

-

What Does Spreadex Cost?

-

What’s Trading on Spreadex Like?

-

Who Should (and Shouldn’t) Use Spreadex?

Fixed spreads across all instruments: 0.9 pips on GBP/USD, 0.6 pips on EUR/USD, 1 point on UK 100. No commission. What you see quoted is your trading cost.

The trade-off: fixed spreads may be slightly wider than variable spreads during quiet market periods, but won’t widen during news events. If you trade around economic releases, this predictability has real value.

No deposit fees. No withdrawal fees. Spreadex has operated since 1999, originally as a sports betting firm.

Spreadex uses a proprietary platform with TradingView integration for charting. No MetaTrader support—if you rely on EAs or custom MT4 indicators, this isn’t the broker for you.

The desktop platform handles our index and UK equity trades fine, though the mobile app feels a step behind XTB and Capital.com in terms of polish. Where Spreadex stands out is UK small-cap coverage—we’ve found AIM stocks here that weren’t available on IG or CMC.

Educational resources are limited compared to XTB or IG. Execution speed isn’t publicly disclosed.

Good for: UK traders who want spread betting and CFDs in one place. News traders who value predictable costs during volatility. Anyone trading UK small-caps and AIM stocks. Traders who prefer fixed spreads over variable.

Not for: Traders who rely on MetaTrader for EAs or custom indicators. Mobile-first traders who want a polished app experience. Beginners who need extensive educational content to get started.

| Metric | Value |

|---|---|

| FCA Reference | 190941 |

| Trustpilot Score | 4.4/5 |

| iOS App Rating | 4.5/5 |

| Execution Speed | Not publicly disclosed |

| GBP/USD Spread | 0.9 pips (fixed) |

| Tradeable Assets | 10000+ |

65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

IG – Best for Market Range and Research

IG offers 17,000+ markets—more than any other UK retail broker. The company has operated since 1974 and is listed on the FTSE 250. We maintain an IG account primarily for accessing niche markets—emerging market forex pairs and smaller indices that other brokers don’t cover.

Pros & Cons

- 17,000+ markets—widest range of any UK retail broker

- Reuters news and quality in-house research included

- ProRealTime charting free with 4+ monthly trades

- FTSE 250 listed company operating since 1974

- Forex spreads wider than Pepperstone on major pairs

- £12/month inactivity fee after 24 months

- Platform complexity can overwhelm beginners

- Trustpilot score (3.9) lower than competitors

-

What Does IG Cost?

-

What’s Trading on IG Like?

-

Who Should (and Shouldn’t) Use IG?

Spread betting/CFDs: GBP/USD from 0.9 pips, EUR/USD from 0.6 pips, UK 100 from 1 point. No commission on standard accounts.

Share CFDs: 0.10% commission on UK shares (£10 minimum).

Inactivity fee: £12/month after 24 consecutive months with no trades. This is more generous than CMC’s 12-month trigger, but still catches occasional traders.

ProRealTime: Free if you place 4+ trades monthly, otherwise £40/month.

IG’s proprietary platform includes Reuters news, in-house analyst commentary, and economic calendars. The research quality stands out—we’ve found IG’s morning briefings more useful than most broker commentary, which tends toward generic filler.

ProRealTime advanced charting is genuinely powerful. DMA (Direct Market Access) is available for professional-tier clients who want exchange-level execution.

The downside: platform complexity can overwhelm beginners. There’s a lot to navigate, and 17,000 markets means endless menus. Trustpilot score (3.9) is lower than several competitors, which appears to reflect mixed customer service experiences.

Good for: Traders who want comprehensive market access and research tools in one platform. Those who need niche markets (EM forex, exotic indices, options). Professional traders who want DMA. Anyone who values quality research and analysis.

Not for: Cost-focused forex traders—Pepperstone is roughly 50% cheaper on major pairs. Occasional traders who may trigger the 24-month inactivity fee. Complete beginners who might find 17,000 markets overwhelming rather than useful.

| Metric | Value |

|---|---|

| FCA Reference | 195355 |

| Trustpilot Score | 3.9/5 |

| iOS App Rating | 4.7/5 |

| Execution Speed | Not publicly disclosed |

| GBP/USD Spread | 0.9 pips avg |

| Tradeable Assets | 17000+ |

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

CMC Markets – Best for Technical Analysis

CMC Markets reports a median execution speed of 0.004 seconds (4ms)—the fastest disclosed figure among UK brokers. Their Next Generation platform includes pattern recognition scanning and 115+ technical indicators. We use CMC primarily for index CFDs on the UK 100 and Germany 40, where the charting tools add genuine value.

Pros & Cons

- 4ms median execution—fastest disclosed among UK brokers

- Pattern recognition scanner monitors charts automatically

- 115+ technical indicators and client sentiment data

- FX Active account offers raw spreads for high-volume traders

- £10/month inactivity fee after just 12 months

- Platform learning curve takes time to navigate

- Pattern tools require technical analysis knowledge

- MT4 version has fewer markets than proprietary platform

-

What Does CMC Markets Cost?

-

What’s Trading on CMC Markets Like?

-

Who Should (and Shouldn’t) Use CMC Markets?

Standard: GBP/USD from 0.7 pips, EUR/USD from 0.6 pips, UK 100 from 1 point. No commission.

FX Active: Raw spreads from 0.0 pips plus commission for high-volume forex traders.

Inactivity fee: £10/month after 12 months without trading—stricter than IG’s 24-month grace period. CMC refunds up to 3 months of fees upon reactivation, which softens the blow slightly.

The Next Generation platform includes a pattern recognition scanner that monitors watchlists for chart formations (triangles, head-and-shoulders, double tops). Not every pattern plays out, but it flags setups we’d otherwise miss when scanning multiple indices. Client sentiment data shows how CMC’s user base is positioned.

The platform has a learning curve—it took us a few sessions to configure the workspace efficiently. MT4 is available but offers fewer markets than the proprietary platform.

Execution at 4ms median is noticeably fast. Pattern recognition tools require understanding of technical analysis to interpret properly—they’re powerful but not beginner-friendly.

Good for: Technical traders who value charting tools and fast execution. Pattern traders who want automated scanning. Anyone who trades actively enough to avoid the 12-month inactivity fee. Index and forex traders who prioritise platform depth.

Not for: Casual traders who won’t hit the 12-month activity threshold—you’ll leak £120/year in fees. Beginners who don’t yet understand chart patterns. Traders who prefer a simple, stripped-back interface.

| Metric | Value |

|---|---|

| FCA Reference | 173730 |

| Trustpilot Score | 4.1/5 |

| iOS App Rating | 4.6/5 |

| Execution Speed | 4ms median (CMC reported) |

| GBP/USD Spread | 0.7 pips avg |

| Tradeable Assets | 10000+ |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64% of retail CFD accounts lose money. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

XTB – Best Mobile Trading App

XTB’s xStation 5 mobile app consistently receives strong reviews for design and functionality. Having tested most broker apps while travelling, we’d agree—it’s noticeably more polished than the competition. We’ve used XTB mainly for commodity CFDs on gold and oil when away from our main setup.

Pros & Cons

- xStation 5 mobile app is best-in-class for design and usability

- Zero commission on forex, indices, and commodities

- Commission-free stocks and ETFs up to €100K monthly volume

- Comprehensive educational content (videos, webinars, courses)

- Execution at 85ms is slower than CMC (4ms) or Capital.com (24ms)

- No spread betting for UK clients

- No MetaTrader option

- Trustpilot score (3.7) lowest among featured brokers

-

What Does XTB Cost?

-

What’s Trading on XTB Like?

-

Who Should (and Shouldn’t) Use XTB?

Zero commission on forex, indices, and commodities—costs included in spreads. GBP/USD from 0.9 pips, EUR/USD from 0.8 pips.

Stocks and ETFs: Commission-free up to €100,000 monthly volume, then 0.2% (€10 minimum). Useful if you want CFDs and real stocks in one place.

Inactivity fee: €10/month after 12 months without trading.

xStation 5 is available on desktop, web, and mobile. Chart annotations sync across devices—useful when starting analysis on desktop and checking positions later on mobile. The educational content (video courses, webinars) is more comprehensive than most competitors.

No MetaTrader option. Execution speed at 85ms is slower than CMC (4ms) or Capital.com (24ms)—we noticed this when placing orders on both platforms during the same session, though it’s unlikely to matter for swing traders holding positions for hours or days.

No spread betting for UK clients. Trustpilot score (3.7) is the lowest among our featured brokers.

Good for: Mobile-first traders who want a polished app experience. Beginners who value educational resources. Swing traders and position traders who don’t need millisecond execution. Anyone wanting stocks and CFDs on one platform.

Not for: Scalpers or high-frequency traders who need fast execution. UK traders who want spread betting for tax efficiency. Anyone who relies on MetaTrader for existing EAs or indicators.

| Metric | Value |

|---|---|

| FCA Reference | 522157 |

| Trustpilot Score | *Removed Due to Fake Review Listings* |

| iOS App Rating | 4.7/5 |

| Execution Speed | 85ms avg (XTB reported) |

| GBP/USD Spread | 0.9 pips avg |

| Tradeable Assets | 5800+ |

71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Capital.com – Best for Beginners

Capital.com’s platform is designed for accessibility. The minimum deposit is £20— which is still one of lowest among major UK brokers. We’ve used Capital.com to introduce colleagues to CFD trading, mostly on forex pairs and the UK 100, and the learning curve is noticeably gentler than other platforms.

Pros & Cons

- £20 minimum deposit—lowest among major UK brokers

- No commission, deposit fees, withdrawal fees, or inactivity fee

- 24ms execution speed—second fastest tested

- AI assistant provides behavioural trading feedback

- 3,000 markets is limited versus IG or CMC

- No spread betting for UK clients

- No MetaTrader on UK platform

- Experienced traders may outgrow the simplified interface

-

What Does Capital.com Cost?

-

What’s Trading on Capital.com Like?

-

Who Should (and Shouldn’t) Use Capital.com?

GBP/USD from 0.8 pips, EUR/USD from 0.6 pips, UK 100 from 1 point. No commission. No deposit fees. No withdrawal fees. No inactivity fee.

Capital.com states that 91% of withdrawals are processed within 5 minutes. Our withdrawals have been processed same-day without issues.

The no-fee structure removes a layer of complexity that often confuses new traders.

The AI-powered assistant analyses trading behaviour and offers feedback on patterns like cutting winners early or overleveraging. It’s not groundbreaking, but useful for beginners building discipline.

TradingView integration is available for charting. No MetaTrader on the UK platform. The interface prioritises simplicity—experienced traders may find it limiting, but that’s not the target audience.

Execution at 24ms is faster than Pepperstone (30ms) and far ahead of XTB (85ms). Market range (3,000+) is smaller than IG or CMC. No cryptocurrency CFDs for UK retail clients—this applies to all FCA-regulated brokers since January 2021, not just Capital.com.

Good for: First-time CFD traders who want a straightforward platform. Cost-conscious traders starting with small capital. Anyone who values speed and simplicity over advanced features. Traders who want zero account fees.

Not for: Experienced traders who’ll outgrow the simplified interface within months. Anyone needing spread betting for tax-free gains. Traders wanting access to 10,000+ markets—Capital.com’s 3,000 will feel limiting.

| Metric | Value |

|---|---|

| FCA Reference | 793714 |

| Trustpilot Score | 4.6/5 |

| iOS App Rating | 4.7/5 |

| Execution Speed | 24ms (Capital.com reported) |

| GBP/USD Spread | 0.8 pips avg |

| Tradeable Assets | 3000+ |

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 60% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

What Is CFD Trading and How Does It Work?

A Contract for Difference (CFD) is a derivative that lets you speculate on price movements without owning the underlying asset. When you open a CFD position, you’re entering an agreement with your broker to exchange the difference in price between when you open and close the trade.

If you buy (go long) a CFD on the FTSE 100 at 7,500 and close at 7,550, you profit from the 50-point rise. If it falls to 7,450, you lose the equivalent of 50 points. The same logic applies in reverse if you sell (go short)—you profit when prices fall and lose when they rise.

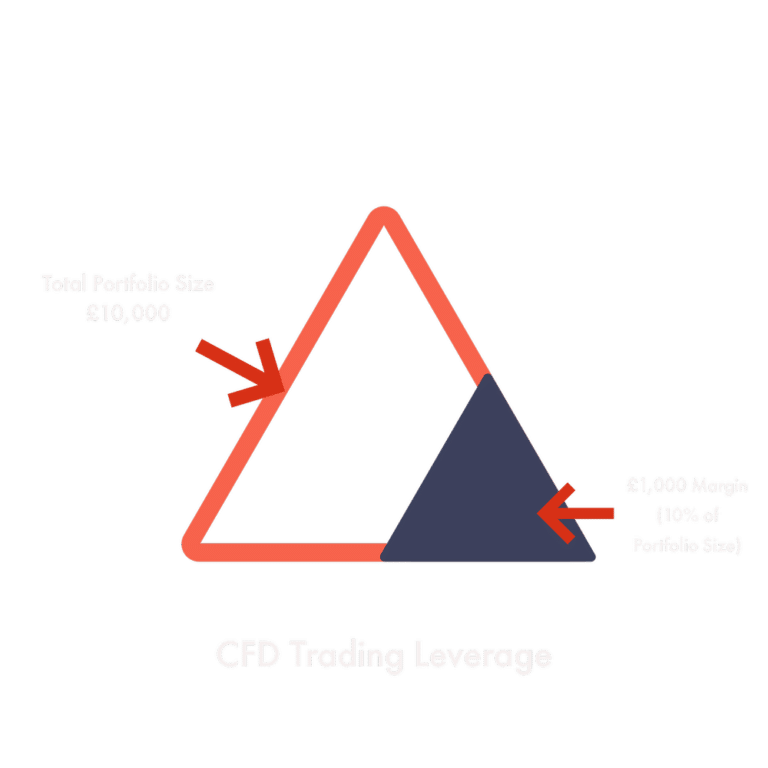

How Does Leverage Work in CFD Trading?

Leverage allows you to control a larger position with a smaller deposit. Under FCA rules, UK retail clients can access leverage up to 30:1 on major forex pairs, 20:1 on minor forex and major indices, 10:1 on commodities, and 5:1 on shares.

For example, with 10:1 leverage on the UK 100, a £1,000 deposit controls a £10,000 position. This amplifies both gains and losses—a 5% move in your favour doubles your money, but a 5% move against you wipes out your deposit.

The FCA introduced these leverage caps in 2019 following ESMA’s EU-wide restrictions. Prior to this, retail traders could access leverage of 200:1 or higher, which contributed to significant retail losses.

What's the Difference Between CFDs and Spread Betting?

Both CFDs and spread betting allow leveraged speculation on price movements, but they differ in tax treatment and structure:

CFDs are priced in the underlying asset’s currency. You trade a number of contracts, and profits are subject to Capital Gains Tax (though losses can offset gains elsewhere).

Spread betting is priced in pounds per point. Profits are currently tax-free for most UK retail traders as HMRC classifies it as gambling rather than investment. However, losses cannot be offset against other gains.

In our experience testing both products, the practical trading experience is similar. The choice typically comes down to tax status and whether you want to offset potential losses.

What Should You Know Before Choosing a CFD Platform?

What Features Matter Most in a CFD Platform?

Execution quality is critical. Delays, slippage, or frequent requotes can materially affect results, particularly for active traders.

Platform stability also matters. Outages during high-volatility periods can prevent exits or adjustments when they matter most.

Costs extend beyond spreads. Financing charges, commissions, and execution slippage all contribute to real trading expenses over time.

What Are STP, ECN and B-Book Brokers?

Broker models affect how trades are handled.

STP and ECN brokers route orders to external liquidity providers, reducing conflicts of interest. Pricing is typically variable and execution depends on market depth.

B-Book brokers internalise trades. This can offer fixed spreads but may introduce conflicts if risk management is weak.

How Does Overnight Financing Work?

Holding CFDs overnight usually incurs a financing charge, based on the underlying interest rate plus the broker’s markup.

These costs accumulate quietly. For longer-term trades, overnight financing can significantly impact profitability and should always be factored into trade planning.

For extended holding periods, CFDs are often less cost-effective than alternatives such as futures or ETFs.

What Are the Risks of CFD Trading?

CFD trading is high risk due to leverage, which amplifies both gains and losses. Even small adverse price movements can quickly erode capital if position sizes are too large.

Poor risk management, overtrading, and emotional decision-making further increase losses. Without a clear strategy and disciplined controls, many retail traders experience a gradual but consistent decline in their account balance.

What Protections Exist for Retail CFD Traders?

UK retail traders benefit from FCA-mandated protections designed to limit extreme losses. These include negative balance protection, leverage caps, automatic margin close-outs, and standardised risk warnings.

While these measures reduce the chance of catastrophic losses, they do not prevent ongoing losses caused by poor risk management, overtrading, or trading without a sustainable edge.

What About Professional CFD Trading?

Professional CFD traders operate with fewer regulatory restrictions but greater responsibility. This status is intended for experienced traders who understand leverage, margin, and risk at an advanced level. We cover this in more detail on our professional CFD trading page, where we rate Pepperstone as our top choice based on execution quality and overall trading conditions.

Are CFD Profits Taxable in the UK?

CFD profits are subject to Capital Gains Tax (CGT) in the UK. Spread betting profits are currently tax-free. This distinction matters for profitable traders.

How Is CFD Trading Taxed?

Profits from CFD trading count as capital gains. For the 2025/26 tax year:

- Annual CGT allowance: £3,000 (reduced from £6,000 in 2024/25)

- Basic rate taxpayers: 10% on gains above the allowance

- Higher/additional rate taxpayers: 20% on gains above the allowance

Losses from CFD trading can be offset against other capital gains in the same tax year, or carried forward to offset future gains. This loss offset is a key difference from spread betting, where losses have no tax utility.

Is Spread Betting Tax-Free?

For most retail traders, yes. HMRC classifies spread betting as gambling, so profits are not subject to CGT or Income Tax. However, there’s an important caveat: if spread betting constitutes your primary source of income, HMRC may reclassify it as taxable trading activity.

The threshold for this reclassification isn’t precisely defined—it depends on factors like frequency, sophistication, and whether you have other income sources. Most recreational spread bettors won’t encounter this issue.

Final Verdict – Which Is the Best CFD Broker for You?

After extensive testing across 12 platforms using real funds, Pepperstone stands out as the best overall CFD broker for most UK traders. Competitive Razor pricing, reliable execution, no inactivity fees, and excellent platform support make it particularly strong for forex and active trading.

Other brokers suit more specific needs. Spreadex works well for fixed spreads and news trading, IG for market breadth and research, CMC Markets for technical tools, XTB for mobile trading, and Capital.com for beginners. The right choice ultimately depends on how you trade, what you trade, and how often—use the comparison tables above to find the best fit.

Top 5 Brokers

1

Pepperstone

72% of retail CFD accounts lose money.

2

SpreadEX

65% of retail investor accounts lose money when trading CFDs with this provider.

3

IG

68% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

4

CMC Markets

64% of retail CFD accounts lose money.

5

XTB

71% of Retail CFD Accounts Lose Money

FAQs

Are CFDs Legal in the UK?

Yes, CFD trading is legal and regulated in the UK. All CFD brokers serving UK retail clients must be authorised by the Financial Conduct Authority (FCA). The FCA imposes leverage limits, requires negative balance protection, and mandates that client funds are held in segregated accounts. Cryptocurrency CFDs are banned for UK retail clients as of January 2021.

How Much Money Do You Need to Start CFD Trading?

Most UK CFD brokers have no minimum deposit requirement—Pepperstone, IG, CMC Markets, and XTB all allow you to start with any amount. Capital.com has the lowest stated minimum at £20. However, trading with very small amounts limits position sizing and makes risk management difficult. A practical starting point for learning is £200-£500.

Can You Lose More Than Your Deposit Trading CFDs?

No, not as a UK retail client. FCA regulations require brokers to provide negative balance protection, meaning your maximum loss is limited to your account balance. If a market gaps beyond your stop-loss, the broker absorbs the excess loss. This protection doesn’t apply to professional clients who opt out of retail safeguards.

What Is the Difference Between CFDs and Spread Betting?

Both allow leveraged speculation on price movements, but they differ in tax treatment. CFD profits are subject to Capital Gains Tax (10-20%), while spread betting profits are currently tax-free for most UK traders. However, CFD losses can offset other capital gains, whereas spread betting losses cannot. Several UK brokers offer both products.

How Are CFD Brokers Regulated in the UK?

CFD brokers must be authorised by the Financial Conduct Authority (FCA) to serve UK retail clients. FCA regulation requires segregated client funds, negative balance protection, leverage limits (maximum 30:1 on major forex), standardised risk warnings, and FSCS protection up to £120,000 if the firm fails. You can verify any broker’s status on the FCA Register at register.fca.org.uk.

Do CFD Brokers Trade Against You?

Some do, some don’t—and it’s more nuanced than it sounds. Market makers (B-Book brokers) may take the opposite side of your trade internally, creating a theoretical conflict of interest. However, reputable brokers hedge their exposure and compete on execution quality. STP and ECN brokers pass orders to external liquidity providers, removing this conflict. In practice, regulatory oversight and reputation matter more than the execution model.

What Happens If a CFD Broker Goes Bust?

UK retail clients are protected by the Financial Services Compensation Scheme (FSCS) up to £120,000 per person, per firm. Additionally, FCA rules require brokers to hold client funds in segregated accounts, separate from company operating funds. This means your money should be identifiable and recoverable even in insolvency. Funds beyond £120,000 are at risk if segregated assets don’t cover all client claims.

References

- Financial Conduct Authority (FCA) – Contract for differences | FCA

- Financial Conduct Authority – FCA Register. Available at: register.fca.org.uk

- HM Revenue & Customs – Capital Gains Tax rates and allowances. Available at: gov.uk/capital-gains-tax

- Financial Services Compensation Scheme – Protection limits. Available at: fscs.org.uk

- XTB CFD Trading – Trade CFDs on global currency pairs

- IG Group – CFD Trading Platform Overview & Educational Resources

- CMC Markets – CMC Markets: CFDs, Spread Betting & Forex Trading

- Pepperstone – Open a share CFD or spread bet account

- UK Government – Capital Gains Tax on Investments