- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII · 12+ years in financial analysis

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- 50+ platforms tested · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- 40+ brokers tested · Active investor since 2013

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII · 12+ years in financial analysis

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- 50+ platforms tested · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- 40+ brokers tested · Active investor since 2013

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection (£120,000 per person)

Testing team:

Adam Woodhead, Thomas Drury (Chartered ACII), Dom Farnell — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Affiliate disclosure. Some links earn commission at no cost to you. This doesn't affect our ratings.

Contact: info@theinvestorscentre.co.uk

Crypto trading gives you direct exposure to digital assets like Bitcoin and Ethereum without going through traditional finance. Here’s our 2026 list of trusted, FCA-registered crypto exchanges — tested with real funds and available to UK traders.

Quick Answer: What's the Best Crypto Exchange in the UK?

For many UK users, Bitpanda is a strong all-around crypto platform. It offers an intuitive interface, robust security, FCA registration, and access to crypto alongside stocks and ETFs. While fees may not be the lowest, Bitpanda stands out for simplicity and reliability, making it well suited to beginners and long-term investors.

What are the best UK crypto exchanges Ranked?

| Rank | Exchange | Trustpilot Score | Beginner Score | Fees | GBP Deposit Methods |

|---|---|---|---|---|---|

| 1 | Bitpanda | 3.9 | 4.9 | Up to ~1.49% | Bank transfer, debit card, Skrill, Neteller, PayPal |

| 2 | eToro | 4.2 | 4.7 | ~1% + market spread | Bank transfer, debit card, Neteller, Skrill, eToro Money |

| 3 | Coinbase | 3.9 | 4.5 | ~1% + 0.5% spread fee | Bank transfer, debit card, PayPal |

| 4 | IG | 3.9 | 4.5 | 1.49% flat fee | Bank transfer, debit card |

| 5 | Uphold | 4.5 | 4 | 0.8–1.5% spread (varies by asset) | Bank transfer, debit card, Apple Pay, Google Pay |

| 6 | MoonPay | 4.1 | 2.6 | ~1.5% (varies by payment method) | Debit/credit card, Apple Pay |

Here are the Top 6 Best Crypto Platforms in the UK:

- Bitpanda – Low Fees, High Liquidity, Wide Functionality

- eToro – Social Trading, Easy to Use, Rated Highest for Beginners

- Coinbase – Beginner-Friendly, Secure, Most Crypto

- IG – Low Fees, Trusted Platform, Multi-Asset

- Uphold – Multi-Asset, Low Minimums, Fewer Features

- MoonPay – Streamlined, Transparent, and Secure

Pros & Cons

- Choose from more than 600 cryptocurrencies, plus crypto index products

- Security standards backed by ISO 27001 certification

- Deposit and withdraw funds without paying fees

- User-friendly design tailored for beginners and experienced traders

- Hot wallet setup—not designed for long-term cold storage

- Platform custody means it isn’t fully non-custodial

- Less Web3 and DeFi functionality compared with some competitor wallets

What are the Fees?

The wallet itself is free. Deposits and withdrawals—whether in crypto or fiat—carry no extra charges. With a minimum starting point of just £1, users only face a transparent spread on trades. Blockchain network fees apply solely when moving crypto outside of Bitpanda.

What Cryptocurrencies are Available?

Bitpanda lists over 600 digital currencies, from more well known assets like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) to a wide variety of altcoins. Crypto indices are also available, offering pre-bundled selections of assets that track different parts of the crypto ecosystem.

How Safe is the Broker?

Security is built in at every level, with ISO 27001 certification, advanced encryption, cold wallet integration, and multi-factor authentication. Regular third-party audits verify that safeguards remain robust and up to date.

Who Is It Best For?

Bitpanda is designed for UK investors seeking wide crypto access with minimal fees. It’s a great option for beginners investing small sums, as well as for seasoned traders who want to expand and diversify their holdings.

DON’T INVEST UNLESS YOU’RE PREPARED TO LOSE ALL THE MONEY YOU INVEST. THIS IS A HIGH-RISK INVESTMENT AND YOU SHOULD NOT EXPECT TO BE PROTECTED IF SOMETHING GOES WRONG.

eToro - Social Trading, Easy to Use, Rated Highest

Pros & Cons

- User-friendly interface

- Social trading features (CopyTrader™)

- FCA regulated

- Wide asset range (crypto, stocks, ETFs)

- 1% trading fee

- Limited advanced trading tools

- Small currency conversion fee for GBP deposits

What are the Fees?

eToro charges a 1% trading fee on crypto transactions, plus a 0.5% GBP deposit fee. There’s also a $5 withdrawal fee and a $10 inactivity fee if the account is idle for 12 months. No hidden fees are applied beyond these.

What Cryptocurrencies are Available?

eToro offers access to over 120 cryptocurrencies, including major coins like Bitcoin, Ethereum, and Solana. While not as extensive as some other exchanges, it covers all the major assets most UK investors are likely to trade.

How Safe is the Exchange?

eToro is considered highly secure. It uses cold storage for the majority of crypto assets and two-factor authentication (2FA) to protect user accounts. It’s also regulated by the FCA, adding an extra layer of trust for UK investors.

Who Is It Best For?

eToro is best for beginners and casual investors who want an easy way to buy crypto and learn from others. Its social trading feature allows users to copy experienced investors, making it perfect for those new to the crypto market.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Coinbase- Beginner-Friendly, Secure, Trusted Brand

Pros & Cons

- Beginner-friendly interface

- Strong security measures

- FCA-registered

- Supports over 390 cryptocurrencies

- Higher fees compared to competitors

- Limited advanced trading features unless using Coinbase Advanced

- Slower customer support response times

What are the Fees?

Coinbase charges around 1% per trade, plus a spread fee of 0.5%. Debit card deposits incur a 3.99% fee. Advanced traders using Coinbase Advanced enjoy lower maker-taker fees starting at 0.5% and decreasing with higher volumes.

What Cryptocurrencies are Available?

Coinbase offers over 390 cryptocurrencies, including Bitcoin, Ethereum, Cardano, and many altcoins. It’s one of the widest selections available among FCA-registered platforms, catering to both casual buyers and those exploring newer tokens.

How Safe is the Exchange?

Coinbase is highly secure, storing 98% of customer assets in cold storage. It enforces two-factor authentication and has a strong reputation for protecting user funds. Its compliance with UK regulations adds an extra layer of investor protection.

Who Is It Best For?

Coinbase is best for beginners who prioritize ease of use and security. Its simple platform design and clear buying process make it perfect for those new to cryptocurrency who want a safe place to start without technical complexity.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

IG – Best for Low-Fee Multi-Asset Trading

Pros & Cons

- Just 1.49% all-in trading cost—no hidden deposit or withdrawal fees

- Real crypto ownership across 55+ coins, not CFDs or derivatives

- FTSE 250 company with 50+ years of trading history and FCA registration

- Unified platform lets you manage crypto, shares, and forex in one place

- No external wallet transfers—coins must stay on the IG platform

- No staking rewards available

What are the Fees?

IG charges a flat 1.49% spread per trade with no additional costs. Deposits via debit card or bank transfer are free, and withdrawals to your UK bank account carry no charges. With a £1 minimum purchase, the fee structure remains transparent—you’ll see the exact cost before confirming each trade. No blockchain network fees apply since external transfers aren’t supported.

What Cryptocurrencies are Available?

IG offers 55+ digital assets, covering major coins like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), alongside DeFi tokens such as Chainlink (LINK) and Aave (AAVE), Layer 1 projects including Cardano (ADA) and Polkadot (DOT), and even meme coins like Dogecoin (DOGE) and Pepe (PEPE). Stablecoins USDT and USDC are also available.

How Safe is the Broker?

IG uses institutional-grade custody with cold storage keeping most assets offline in secure vaults. Security measures include two-factor authentication (2FA), end-to-end encryption, and fund segregation from IG’s corporate money. FCA registration under Money Laundering Regulations ensures AML compliance, though crypto balances aren’t covered by the £120,000 FSCS protection scheme.

Who Is It Best For?

IG suits UK investors who want straightforward crypto access with competitive fees and the convenience of managing multiple asset classes in one account. It’s ideal for buy-and-hold investors already using IG for shares or forex, as well as beginners who value simplicity over advanced features like staking or self-custody.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Uphold - Multi-Asset, Low Minimums, Fewer Features

Pros & Cons

- Multi-asset trading (crypto, stocks, metals)

- Easy account setup

- FCA-registered

- Transparent reserve reporting

- Higher spreads on low-volume assets

- Limited advanced trading features

- Debit card deposit fees are high

What are the Fees?

Uphold charges a 1% trading fee plus a spread, which varies by asset. Debit card deposits have a 3.99% fee in the UK. There are no withdrawal fees to UK bank accounts via Faster Payments.

What Cryptocurrencies are Available?

Uphold supports over 60 cryptocurrencies, including popular coins like Bitcoin, Ethereum, and XRP. While the selection is smaller than competitors like Coinbase, it covers most of what casual investors are looking for.

How Safe is the Exchange?

Uphold maintains a 100% reserve model, ensuring user funds are fully backed. It uses two-factor authentication and undergoes third-party audits, providing a strong layer of transparency and security for UK users.

Who Is It Best For?

Uphold is best for casual investors who want to diversify across crypto, equities, and commodities within a single platform. It's particularly useful for beginners who prefer simplicity over complex trading tools.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

MoonPay – Streamlined, Transparent, and Secure

Pros & Cons

- Fast and easy crypto purchases

- Transparent pricing

- High security standards

- Higher fees for instant buys

- Limited cryptocurrency selection

- No trading or advanced features

What are the Fees?

MoonPay typically charges around 4.5% for card purchases. Crypto-to-crypto conversions have variable but generally lower fees. Network fees apply separately depending on the blockchain and transaction type.

What Cryptocurrencies are Available?

MoonPay offers around 80 cryptocurrencies, covering major assets like Bitcoin, Ethereum, and Litecoin. It's enough for typical buyers but lacks the broader altcoin range seen on larger exchanges.

How Safe is the Exchange?

MoonPay is considered secure, using bank-grade encryption and two-factor authentication to protect user transactions and data. While not a full exchange, its simple buying process minimizes exposure to platform risks.

Who Is It Best For?

MoonPay is best for investors who want a fast, no-frills way to purchase crypto directly with a card. It's a good fit for beginners looking for a straightforward buying experience without the need for trading features.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

What's New for UK Crypto Exchanges in 2026?

The FCA’s tighter rules around crypto marketing are now fully in force, meaning only compliant platforms can advertise to UK users. That’s good news — it’s easier to spot legitimate exchanges. eToro and Coinbase remain the top choices for beginners, while Bitpanda has grown its UK presence with competitive fees and a huge asset range.

OKX still offers strong advanced features but remains unregulated here, so it’s best suited to experienced traders who understand the risks. If you’re starting out, stick with FCA-registered platforms for added peace of mind.

The latest UK cryptocurrency statistics show crypto ownership peaked at 12% in 2024 before settling at 8% — signalling a maturing market.

What is a Crypto Exchange?

A crypto exchange is a platform that allows users to buy, sell, and trade cryptocurrencies. It acts as a marketplace where buyers and sellers meet, facilitating the exchange of digital assets using order books or direct purchase methods.

What Are the Different Types of Cryptocurrency Exchanges?

Cryptocurrency exchanges fall into three main types: custodial, non-custodial, and decentralized (DEXs). Each type offers a different balance of control, security, and ease of use, catering to different investor preferences and experience levels.

What Is a Custodial Exchange?

A custodial exchange manages and stores your crypto assets on your behalf. It offers convenience and liquidity but requires you to trust the platform’s security measures to protect your funds.

Examples: Coinbase and Binance

What Is a Non-Custodial Exchange?

Non-custodial exchanges let users trade crypto directly from their wallets, without handing over control to a third party. They offer greater security and privacy but can be less user-friendly and have lower liquidity.

Examples: ShapeShift and Changelly

What Is a Decentralized Exchange (DEX)?

A decentralized exchange (DEX) operates without intermediaries, using smart contracts to enable peer-to-peer trading. DEXs promote privacy and censorship resistance but often have lower liquidity and can be complex for beginners.

Examples: Uniswap and SushiSwap

What are the Pros and Cons of Each?

| Exchange Type | Advantages | Disadvantages |

|---|---|---|

| Custodial Exchanges | Easy to use High liquidity | Higher security risks Less personal control |

| Non-Custodial Exchanges | Enhanced security Full control of assets | Less intuitive Slower transactions |

| Decentralised Exchanges (DEXs) | Strong decentralisation Minimal censorship risk | Lower liquidity Challenging for new users |

Should I use a custodial, non-custodial, or decentralised exchange?

Custodial exchanges are often the easiest place to start, especially for beginners, though they do require a degree of trust in the platform to keep your funds secure. In contrast, non-custodial exchanges hand full control of your assets back to you — but that control comes with extra responsibility and a steeper learning curve.

Decentralised exchanges (DEXs) take things a step further by removing intermediaries altogether, offering greater privacy and independence. However, they can be daunting for newcomers and carry higher risks if you’re not familiar with self-custody. The best choice ultimately depends on your comfort level with security, convenience, and control.

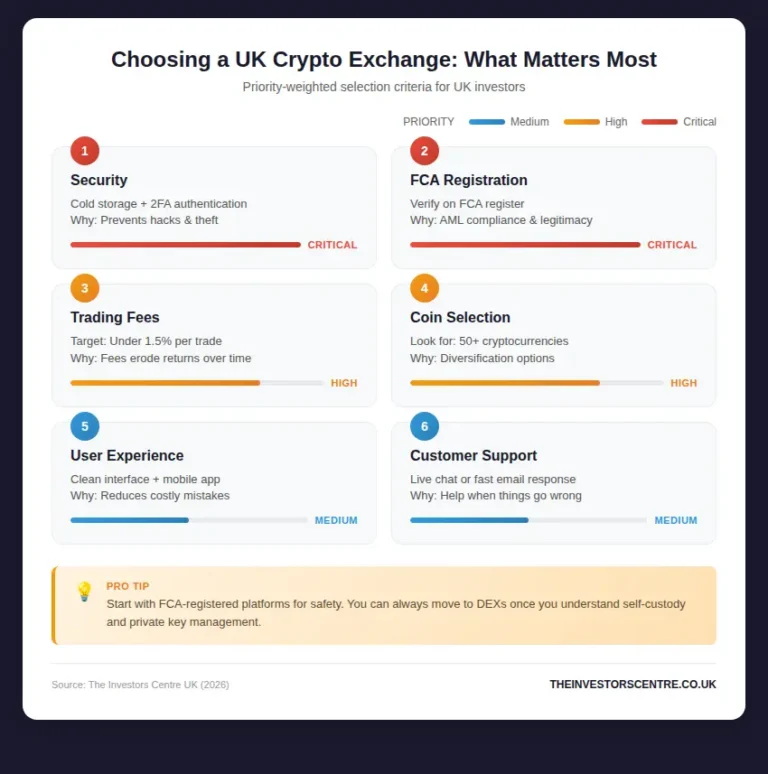

What Factors Should You Consider When Choosing the Right Platform?

Choosing the right crypto platform depends on several factors, including security, regulation, fees, user experience, market variety, and customer support. Balancing these elements ensures a safer, smoother investing experience that matches your trading goals and comfort level with risk.

How Important Is Security?

Security is crucial. Without strong protections like two-factor authentication and cold storage, your crypto assets are vulnerable to hacks and theft. Always choose platforms with robust security protocols and a proven track record of safeguarding customer funds.

Why Does Regulation Matter?

What Fees Should You Look Out For?

How Does User Experience Affect Your Choice?

Why Is Market Variety Important?

A broad selection of cryptocurrencies allows you to diversify your portfolio and access emerging opportunities. Platforms with more trading pairs give you the flexibility to invest beyond major coins like Bitcoin and Ethereum.

How Critical Is Good Customer Support?

Reliable customer support matters when things go wrong. Whether it’s account access issues or transaction delays, fast and helpful service can prevent small problems from becoming major headaches. Look for 24/7 live chat or strong support reputations.

What Else Should UK Investors Keep in Mind?

UK investors should consider how crypto is regulated, the tax obligations they face, and how to stay compliant with HMRC. Understanding these areas helps protect your investments and ensures you meet all legal responsibilities when trading or holding crypto assets.

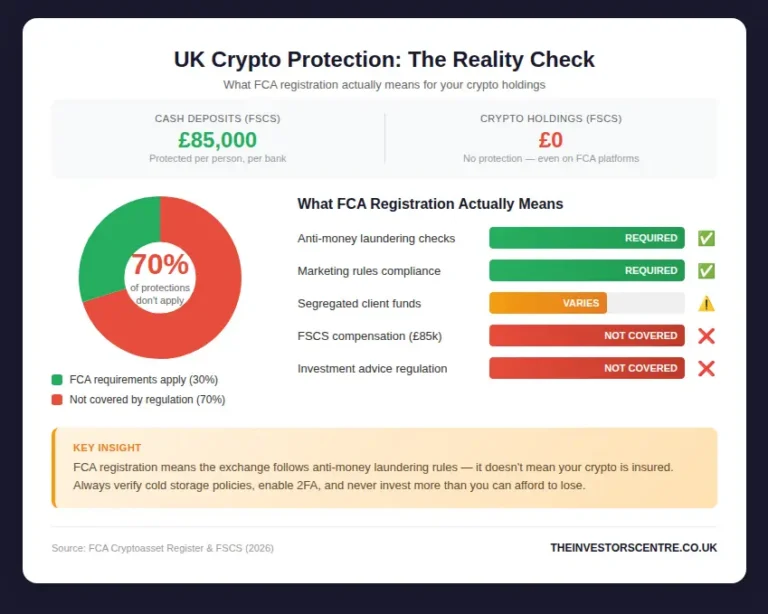

How Are Cryptocurrencies Regulated?

In the UK, cryptocurrencies are regulated mainly for anti-money laundering purposes. The Financial Conduct Authority (FCA) oversees registered crypto firms, but crypto investments are not covered by the Financial Services Compensation Scheme, so investor protections are limited.

Do You Need to Pay Tax on Crypto in the UK?

Yes, crypto transactions are taxable in the UK. HMRC treats cryptocurrency as property, meaning you may owe Capital Gains Tax (CGT) when selling or exchanging crypto. Some activities, like mining or staking, can also trigger Income Tax.

What Taxes Apply When You Receive Cryptoassets?

Receiving crypto through mining, staking, or as payment is usually treated as income by HMRC. This means you may need to pay Income Tax and National Insurance contributions based on the fair market value at the time you receive it.

What Happens Tax-Wise When You Sell Crypto?

When you sell, swap, or spend crypto, you may be liable for Capital Gains Tax if your gains exceed the annual allowance. It’s important to track all transactions carefully to calculate gains accurately and report them to HMRC.

How Can You Avoid Getting Fined by HMRC?

To avoid penalties, keep detailed records of all crypto transactions, including dates, amounts, and GBP values. File accurate tax returns on time, and consider consulting a tax advisor if your crypto activity is significant or complex.

Conclusion: Which Exchange Should I Choose?

Think about what matters most to you — security, fees, ease of use, regulation, market range, and customer support. Each platform has its own strengths: eToro stands out for its beginner-friendly design, while Coinbase appeals to users who want a wider selection of coins. The best choice depends on how you trade and how much control you want over your assets.

If you’re just starting out, take your time to research and compare the top UK exchanges. Check trusted sources like the FCA register and reputable crypto news sites to make sure you’re getting accurate, up-to-date information. The right exchange won’t just make trading easier — it’ll give you more confidence in your investment journey.

Top 5 Exchanges

1

Bitpanda

Don’t invest unless you’re prepared to lose all the money you invest.

2

eToro

Investing in crypto carries a high level of risk.

3

Coinbase

Investing in crypto carries a high level of risk.

4

IG

Don’t invest unless you’re prepared to lose all the money you invest.

5

Uphold

Investing in crypto carries a high level of risk.

FAQs

How can I find a crypto exchange with a wide range of crypto assets?

To find a crypto exchange in the UK offering a wide range of crypto assets, consider platforms like Binance or MEXC. These exchanges are known for their extensive selection of cryptocurrencies, catering to both novice and experienced traders looking for diversity in their investments.

Are there any decentralised exchanges operating in the UK?

Yes, there are decentralised exchanges (DEXs) available to UK users, offering an alternative to centralised platforms by enabling direct peer-to-peer transactions without the need google pay for an intermediary. Popular DEXs include Uniswap and SushiSwap, which support a variety of crypto assets but often you cannot fund your account via bank transfers!

What should I look for in crypto trading platforms regulated in the UK?

When searching for crypto trading platforms regulated in the UK, prioritize those that comply with local financial regulations, offer robust security measures, provide transparent fee structures, and support a wide range of cryptocurrencies. Regulated platforms like eToro and Coinbase ensure a safer trading environment for UK investors.

How do I ensure my digital assets are safe with crypto exchanges?

To ensure your digital assets are safe with crypto exchanges, choose platforms that implement strong security protocols such as two-factor authentication (2FA), cold storage for the majority of funds, and regular security audits. Additionally, consider exchanges that offer insurance policies or are part of the Financial Services Compensation Scheme (FSCS) for added protection.

How do you buy cryptocurrency?

To buy cryptocurrency, you need to create an account with a cryptocurrency exchange where you can trade traditional currency, like dollars or euros, for digital coins.

What’s the difference between a crypto exchange and a crypto broker?

A crypto exchange lets you trade digital assets directly with other users, often with more control and lower fees. A crypto broker acts as a middleman, offering an easier way to buy or sell crypto but usually with higher fees and less control. In the UK, brokers like eToro and Bitpanda are FCA-registered, not fully regulated.

References

- Cryptocurrency Exchanges: What They Are and How to Choose

- Crypto Exchanges: What Investors Need To Know

- Bitcoin: Crypto fans can now invest in exchange-traded funds – but what are they? – BBC News

- UK sets out plans to regulate crypto and protect consumers – GOV.UK

- Registered Cryptoasset Firms

- Trustpilot Reviews