- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

High fees eat into your crypto gains fast. Here are the lowest-cost exchanges available to UK traders in 2026 — ranked by real trading costs and value.

Bitpanda

Low Fee Score: 4.9/5

Don’t invest unless you’re prepared to lose all the money you invest.

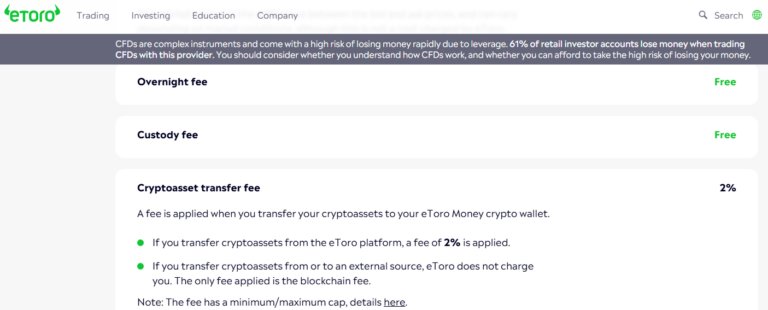

eToro

Low Fee Score: 4.8/5

Investing in crypto carries a high level of risk.

Quick Answer: What’s the Cheapest Crypto Exchange in the UK?

How do the Cheapest Crypto Exchanges Rank?

| Rank | Exchange | Trading Fees (Maker/Taker) | Deposit Fees | Withdrawal Fees | Supported Cryptos |

|---|---|---|---|---|---|

| #1 | Bitpanda | Spread-based fees (varies by crypto) | Free for bank transfer | Varies by crypto | 600+ |

| #2 | eToro | 1% spread (no direct fees) | Free for bank transfer | $5 per withdrawal | 70+ |

| #3 | Coinbase | Maker: 0.00%–0.40% / Taker: 0.05%–0.60% | Varies by payment method | SWIFT transfers incur £1 fee | 150+ |

| #4 | IG | 1.49% flat spread | Free for bank transfer and debit card | Free to UK bank account | 55+ |

| #5 | Uphold | No commission; spread from ~0.8%–1.2% | Free for bank transfer | No fees for crypto withdrawals | 250+ |

Top 5 Low Fee Crypto Exchanges Reviewed

Pros & Cons

- Large selection of 600+ cryptocurrencies.

- Low-fee deposits via bank transfer.

- User-friendly interface with beginner and advanced options.

- Spread-based fees can vary per crypto.

- Limited advanced trading charts for professionals.

- Customer support response times can be slow.

-

What are the Fees?

-

What Cryptocurrencies Are Available?

-

How Safe is the Platform?

Bitpanda uses spread-based fees that differ by cryptocurrency. Bank transfers are free, while other methods vary. Overall, the platform is affordable for diverse trading, especially for investors holding multiple altcoins.

Bitpanda supports 600+ cryptocurrencies, including Bitcoin, Ethereum, and emerging altcoins. It allows fractional investing, staking, and portfolio diversification, appealing to UK traders seeking wide market coverage.

Bitpanda implements 2FA, cold storage for most funds, and conducts regular security audits. Client funds are segregated, providing robust protection for investors in the UK.

DON’T INVEST UNLESS YOU’RE PREPARED TO LOSE ALL THE MONEY YOU INVEST. THIS IS A HIGH-RISK INVESTMENT AND YOU SHOULD NOT EXPECT TO BE PROTECTED IF SOMETHING GOES WRONG.

Pros & Cons

- Combines crypto with stocks, ETFs, and commodities.

- Social trading features for beginners and advanced users.

- FCA-regulated and strong security measures.

- Spread-based fees are slightly higher.

- Limited range of advanced crypto tools.

- Withdrawal fees may apply for small amounts.

-

What are the Fees?

-

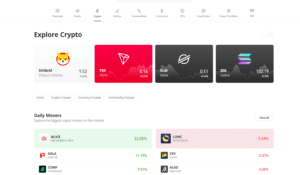

What Cryptocurrencies Are Available?

-

How Safe is the Platform?

eToro uses a 1% spread with no direct trading fees. Deposits are free via bank transfer, while withdrawals cost $5. The platform is cost-effective for diversified traders combining crypto with traditional assets.

eToro supports 70+ cryptocurrencies, including major coins and popular altcoins. Traders can diversify with CFDs or direct crypto ownership, making it suitable for both beginners and more experienced investors.

eToro is FCA-regulated, uses segregated client accounts, two-factor authentication, and robust cybersecurity measures. UK users benefit from strong legal protection, ensuring funds and personal data remain secure.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Pros & Cons

- Intuitive, beginner-friendly platform.

- FCA-regulated and secure with 2FA.

- Supports 150+ cryptocurrencies with easy fiat deposits.

- Higher fees compared to advanced platforms.

- Limited advanced trading tools.

- Withdrawal fees may apply for certain payment methods.

-

What are the Fees?

-

What Cryptocurrencies Are Available?

-

How Safe is the Platform?

Standard Coinbase trading fees are 0.50%, though Coinbase Pro offers lower rates for active users. Bank transfers are free; card payments include fees. Beginners benefit from simplicity despite slightly higher costs compared to professional platforms.

Coinbase supports 150+ cryptocurrencies, including Bitcoin, Ethereum, and stablecoins. The platform updates its list regularly, making it suitable for both beginners exploring major coins and users gradually expanding into altcoins.

Coinbase is FCA-regulated, stores 98% of funds in cold storage, and offers two-factor authentication. UK clients benefit from strong regulatory oversight and FSCS coverage on GBP deposits, ensuring user security and confidence.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Pros & Cons

- FTSE 250 company with 50+ years of established trading history

- Flat 1.49% fee structure—saves £33+ versus Coinbase on £1,000 trades

- Real crypto ownership across 55+ coins with institutional-grade custody

- Unified platform lets you trade crypto alongside shares and forex

- No external wallet transfers—coins cannot be moved to Ledger or Trezor

- Zero staking rewards means no passive income opportunities

- £25k daily withdrawal limit to your UK bank account

-

What are the Fees?

-

What Cryptocurrencies Are Available?

-

How Safe is the Platform?

IG charges a flat 1.49% spread per trade with complete transparency—no commission, no deposit fees, no withdrawal charges. Bank transfers and debit card deposits are free, and withdrawals to your UK bank account cost nothing. With a £1 minimum purchase, you see the exact cost upfront before confirming each trade. No network fees apply since external transfers aren’t supported.

The platform supports 55+ digital assets, including major coins like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), DeFi tokens such as Chainlink (LINK) and Aave (AAVE), Layer 1 projects including Cardano (ADA) and Polkadot (DOT), and meme coins like Dogecoin (DOGE) and Pepe (PEPE). Stablecoins USDT and USDC are also available. Beyond crypto, IG also allows access to shares, forex, and indices—all tradable within one account.

IG operates with FCA registration under Money Laundering Regulations in the UK, bringing regulatory credibility. Security includes institutional-grade custody with cold storage keeping most assets offline, two-factor authentication (2FA), end-to-end encryption, and fund segregation from IG’s corporate money. As a publicly-traded FTSE 250 company, IG maintains transparency and accountability, though crypto balances aren’t covered by the £120,000 FSCS protection scheme.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Pros & Cons

- Easy-to-use platform with quick onboarding

- FCA-registered for added regulatory oversight in the UK

- Supports 250+ cryptocurrencies, plus metals, equities, and FX trading

- Transparent pricing with spreads rather than hidden fees

- Spreads are typically higher than some advanced exchanges

- Limited advanced trading and charting tools

- Withdrawal fees may apply depending on method and currency

-

What are the Fees?

-

What Cryptocurrencies Are Available?

-

How Safe is the Platform?

Uphold charges no commission but applies spreads, usually ranging from 0.8% to 1.2% on major cryptocurrencies. Deposits by bank transfer are free, and most crypto withdrawals are fee-free. However, network fees and certain fiat withdrawal charges may apply depending on the payment method.

The platform supports 250+ digital assets, including popular coins like BTC, ETH, and XRP, alongside a wide variety of altcoins. Beyond crypto, Uphold also allows access to metals (like gold and silver), fiat currencies, and US equities—all tradable within one account.

Uphold operates with FCA registration in the UK, bringing added credibility. Security includes multi-factor authentication, encryption, and cold storage measures. Its “transparency page” also provides real-time proof of reserves, so users can verify that their funds are fully backed.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

What Fees Will You Pay When Using a Crypto Exchange in the UK?

UK crypto exchanges charge trading fees, spreads, and sometimes deposit/withdrawal costs. Fees vary by platform, payment method, and trade volume. Understanding these costs upfront ensures you maximize profits and select an exchange that balances low fees with security and features.

What Are Trading Fees and How Do They Work?

Trading fees are charged per buy or sell order, often as a percentage of the trade (maker/taker). Lower fees reward high-volume traders, while spreads may apply. Some platforms offer tiered rates or discounted fees for using their native tokens.

What Deposit and Withdrawal Fees Should You Expect?

Deposits via bank transfer are usually free; cards may include 1–2% fees. Withdrawals can incur fixed fees or percentage-based costs. Cryptocurrency withdrawal fees vary by token and blockchain network congestion, so always check before executing a transaction.

How Does Capital Gains Tax (CGT) Affect Crypto Traders in the UK?

UK residents must pay CGT on profits from crypto sales exceeding the annual allowance (£6,000 in 2025). Losses can offset gains. Taxes apply to exchanges, wallets, and swaps, so maintaining accurate records is essential for compliance and tax efficiency.

How Can You Reduce Your Crypto Trading Fees?

You can lower fees by selecting exchanges with low spreads, using bank transfers instead of cards, participating in loyalty or referral programs, trading higher volumes for discounts, and leveraging native tokens that provide discounted trading on some platforms.

Are There Fee Discounts for High-Volume Trading?

Yes. Many exchanges offer tiered fee structures, rewarding traders with lower fees as 30-day trading volume increases. High-volume traders can benefit from substantial cost reductions, especially on professional platforms with maker/taker models.

Can You Lower Fees by Using Native Tokens or Loyalty Programs?

Exchanges like Binance or KuCoin allow trading with native tokens, providing up to 25–50% fee discounts. Loyalty programs, referral bonuses, or staking can also reduce costs, making crypto trading cheaper for frequent users or long-term investors.

Is It Cheaper to Use Bank Transfers Instead of Cards?

Yes. Bank transfers are generally free or low-cost, while card payments often include 1–2% fees. Using SEPA, Faster Payments, or ACH options helps reduce deposit costs, especially for larger transactions, saving traders significant money over time.

What Other Factors Should You Consider When Choosing a Crypto Exchange?

Beyond fees, consider security measures, regulatory compliance, customer support, cryptocurrency selection, platform usability, and research tools. A reliable exchange balances affordability with strong protection, legal oversight, and quality features to ensure safe and effective trading.

Why Is Exchange Security So Important?

Security protects funds and personal data from hacks or theft. Look for cold storage, two-factor authentication, encryption, and regular audits. A secure exchange minimizes risk and ensures peace of mind for UK traders, especially when dealing with large balances or volatile assets.

How Does Regulation Protect You as a UK Investor?

FCA-regulated exchanges must follow strict financial rules, segregate client funds, and comply with anti-money laundering laws. This reduces risk of fraud and ensures recourse in disputes. Regulation also provides FSCS protections for GBP deposits, enhancing investor confidence.

How Good Is the Exchange’s Customer Support?

Responsive customer support is critical for resolving account issues, transaction problems, or security concerns. Look for multiple channels (live chat, email, phone) and fast response times. Strong support ensures smooth trading and reduces stress for new and experienced users alike.

What’s Changed in 2026?

Coinbase Advanced remains the go-to for low maker/taker fees—tiered pricing rewards active traders. Bitpanda expanded its UK presence with 600+ assets and zero deposit fees on bank transfers. IG launched spot crypto trading in 2025, offering real ownership of 55+ coins at a flat 1.49% fee—undercutting Coinbase Simple and Revolut significantly. eToro now offers ISAs through Moneyfarm, making it a stronger all-in-one option for tax-efficient investing. Kraken continues to attract experienced traders with its advanced features and competitive staking rewards. FCA crypto marketing rules are fully enforced, so it’s easier to spot legitimate platforms—but always compare fees before committing.

Final Verdict: Which Low-Fee Crypto Exchange Should You Use in the UK?

Choosing the right exchange depends on fees, security, usability, and available cryptocurrencies. Coinbase Advanced remains the go-to for low maker/taker fees — tiered pricing rewards active traders. eToro is ideal for mixing crypto with traditional assets safely.

Top 5 Exchanges

1

Bitpanda

Don’t invest unless you’re prepared to lose all the money you invest.

2

eToro

Investing in crypto carries a high level of risk.

3

Coinbase

Investing in crypto carries a high level of risk.

4

IG

Don’t invest unless you’re prepared to lose all the money you invest.

5

Uphold

Investing in crypto carries a high level of risk.

FAQs

What is the cheapest crypto exchange for UK users?

Coinbase Advanced and OKX are among the lowest-cost platforms, especially for high-volume traders using bank transfers. Exact costs depend on trading volume and funding methods.

Are crypto exchanges in the UK regulated?

Some, like Coinbase and eToro, are FCA-registered for AML compliance. However, crypto itself isn’t regulated as a financial product in the UK.

How do crypto exchanges make money if they offer low trading fees?

They earn from trading and withdrawal fees, spreads, FX conversions, and premium services like staking or token utilities.

What is the difference between spot trading and crypto CFDs?

Spot trading involves buying real crypto. CFDs are leveraged derivatives that let you trade price movements without owning the asset.

Can I deposit GBP directly into a crypto exchange?

Yes, via Faster Payments or debit card. Bank transfers are usually free; card deposits may incur higher fees.

References

- Financial Conduct Authority (FCA) – Cryptoasset Firm Register

- Coinbase Advanced – Fee Schedule

- OKX – Fees and VIP Trading Tiers

- eToro UK Ltd – Crypto Trading Fees

- Coinbase – UK Deposit and Withdrawal Fees

- HMRC – Cryptoassets Manual (CGT Guidance)