How to Buy Ethereum In The UK 2026

Explore our curated list of reputable exchanges for buying ETH, each rigorously tested with real funds. All brokers are accessible to traders in the United Kingdom.

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

To Buy Ethereum in the UK, you'll need to:

- Choose a cryptocurrency exchange that supports Ethereum (ETH), like eToro or Bitpanda.

- Register and verify your account following KYC procedures.

- Deposit funds using GBP through bank transfer or card.

- Search for Ethereum (ETH) and place a buy order.

- Secure your ETH in a wallet.

How to Buy Ethereum in the UK (Step-by-Step)

1. Choose a UK-Approved Exchange

To buy Ethereum safely, start by choosing a platform that supports UK users and complies with FCA regulations. Look for exchanges that accept GBP, have strong security features, transparent fees, and offer Ethereum (ETH) as a supported cryptocurrency.

How do I know the exchange is reputable?

Check if the exchange is registered with the FCA or widely used by UK traders. Read user reviews, confirm security features like 2FA, and ensure the platform has transparent fee structures and solid customer support.

Which platforms are popular in the UK?

Top UK exchanges include eToro, Coinbase, and Uphold. These platforms support GBP deposits, offer Ethereum trading, and are trusted by UK users for their ease of use, compliance, and security.

Quick Comparison Table

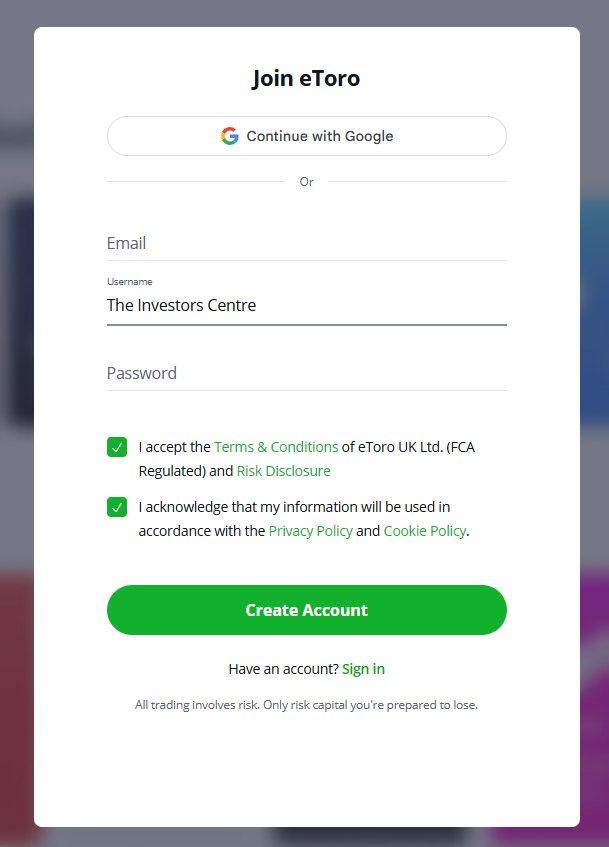

2. Create and Verify Your Account

Sign up using your email and create a strong password. Most UK exchanges require identity verification to comply with regulations. This process ensures secure access, protects your funds, and unlocks full trading functionality on the platform.

What documents are required in the UK?

You'll usually need a government-issued ID (like a passport or driver's licence) and proof of address (such as a utility bill or bank statement). Make sure your documents are recent, clear, and match the details on your account.

How long does verification usually take?

Verification is typically completed within minutes using automated checks. If your documents need manual review, it may take a few hours. Most platforms will notify you by email once your account is fully verified and ready to fund.

3. Deposit Funds

Once your account is verified, deposit GBP to fund your crypto wallet. Most UK exchanges accept several payment methods and process deposits quickly. Choose the method that best suits your speed, budget, and convenience.

What payment methods can I use?

You can typically deposit GBP via bank transfer, debit card, credit card, or PayPal (on supported platforms). Bank transfers often have lower fees, while cards and PayPal provide faster processing times.

Are there fees for depositing GBP?

Bank transfers are usually free. Debit or credit card payments may incur a 1–3% fee depending on the platform. Always check the fee schedule before depositing to avoid surprises.

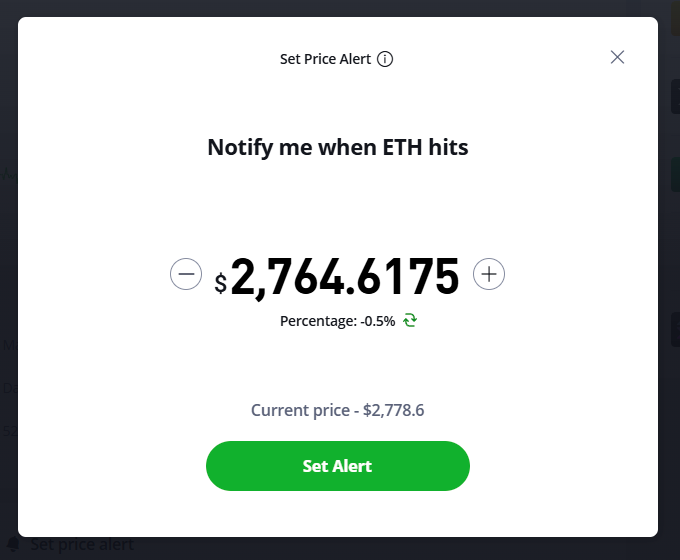

4. Buy Ethereum (ETH)

After funding your account, search for Ethereum (ETH), enter the amount you want to buy, and place your order. You can purchase a fraction of ETH, and most orders execute instantly on major UK platforms.

How do I place a buy order for ETH?

After funding your account, search for Ethereum (ETH), enter the amount you want to buy, and place your order. You can purchase a fraction of ETH, and most orders execute instantly on major UK platforms.

How can I review and confirm my purchase?

After buying, check your portfolio or transaction history. Most platforms provide a receipt, price per coin, total amount purchased, and time of execution. Always verify the details before completing the transaction.

5. Store Ethereum Safely

Once you've bought Ethereum, you can store it on the exchange or transfer it to a personal wallet. For better security, especially for long-term holding, using a private wallet gives you full control of your ETH.

Should I use a hot or cold wallet?

Hot wallets are convenient for frequent access but connected to the internet. Cold wallets (like hardware devices) store ETH offline, making them more secure. For long-term storage, a cold wallet is strongly recommended.

How do I withdraw ETH to a personal wallet?

Go to your exchange's withdrawal section, enter your wallet address, choose the amount, and confirm the transaction. Double-check the wallet address to avoid loss—Ethereum transactions are irreversible.

What's New for Buying Ethereum in 2026?

- Ethereum's transition to proof-of-stake continues to reduce network fees

- More FCA-registered UK exchanges now support direct GBP deposits

- Enhanced security measures and biometric authentication on major platforms

- Growing institutional adoption provides more liquidity for UK retail investors

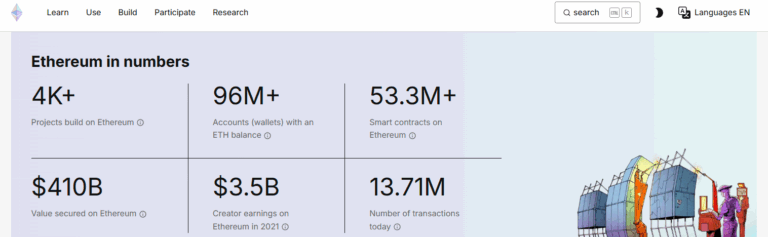

What is Ethereum?

Ethereum is a decentralised blockchain platform that enables smart contracts—self-executing programs with no downtime or censorship. It powers decentralised apps (dApps) across finance, gaming, and tech. ETH, Ethereum's native token, is used for transaction fees and as a store of value.

How Does Ethereum Work?

Ethereum runs on a decentralised blockchain and now uses a proof-of-stake (PoS) system. Validators stake ETH to confirm transactions, reducing energy use. Smart contracts run on Ethereum, enabling decentralised apps (dApps). ETH is used to pay gas fees for using the network.

Is Ethereum a Good Investment?

Ethereum is backed by a strong developer ecosystem, real-world use cases, and continuous upgrades. Its transition to proof-of-stake and widespread dApp usage give it long-term potential. However, like all crypto, it's speculative—only invest what you're prepared to lose.

What Are the Risks of Trading Ethereum?

Ethereum is highly volatile and sensitive to market sentiment. Network congestion can cause high gas fees. Smart contract bugs, phishing scams, or poor storage practices can lead to losses. Always trade securely and understand the risks before investing.

Is Ethereum Right for You?

Ethereum offers innovation, real-world use cases, and long-term growth potential—but it comes with volatility and complexity. If you're comfortable with digital technology, understand the risks, and want exposure to a leading blockchain, Ethereum may be a good fit for your portfolio.

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

FAQs

How do smart contracts work on Ethereum?

Smart contracts are self-executing programs that run automatically when preset conditions are met, removing the need for intermediaries.

How is Ethereum different from Bitcoin?

Bitcoin is a digital currency focused on payments and value storage. Ethereum enables smart contracts and Apps, making it more versatile for applications.

What is Ether?

Ether (ETH) is Ethereum's native currency, used to pay for transactions, execute smart contracts, and interact with dApps on the network.

Can Ethereum scale?

Yes. Layer 2 solutions, such as rollups and sidechains, enhance Ethereum's speed and capacity by processing transactions off-chain while utilising its security layer.

References

- Ethereum Official Website – What is Ethereum?

- Financial Conduct Authority (FCA) – Cryptoasset Consumer Warnings

- CoinMarketCap – Ethereum Price and Market Data

- Investopedia – Ethereum Explained

- HMRC – Cryptoassets: Tax for Individuals (UK)

- ✓ Crypto, stocks, ETFs & metals

- ✓ Fractional investing from €1

- ✓ Automated savings plans available

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more