How to Mine Bitcoin in the UK | 2026 Beginner's Guide

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: How Do I Mine Bitcoin in the UK?

Bitcoin mining in the UK remains possible in 2026 with the right hardware, software, and energy setup. While elevated electricity costs pose a challenge, choosing efficient ASIC miners and joining a mining pool can help make it viable for individuals looking to participate in the Bitcoin network from home.

What Do You Need to Start Mining Bitcoin?

In 2026, ASIC miners like the Antminer S21 or WhatsMiner M60 offer the best efficiency. These devices are purpose-built for Bitcoin mining and far outperform GPUs. UK miners should prioritise energy-efficient models to manage electricity costs and maintain long-term profitability.

What Hardware Do You Need to Start Mining Bitcoin?

ASIC miners like the Antminer S21 or WhatsMiner M60 offer the best efficiency. These devices are purpose-built for Bitcoin mining and far outperform GPUs. UK miners should prioritise energy-efficient models to manage electricity costs and maintain long-term profitability.

Hardware Comparison Table

| Model | Hashrate (TH/s) | Power Use (W) | Efficiency (J/TH) | Est. Price (GBP) | Best For |

|---|---|---|---|---|---|

| Antminer S21 | 200 | 3550 | 17.8 | £2,500–£3,000 | Home mining setups |

| WhatsMiner M60S | 170 | 3420 | 20.1 | £2,200–£2,800 | Quiet, efficient ops |

| AvalonMiner 1246 | 90 | 3420 | 38 | £1,500–£1,800 | Budget-conscious rigs |

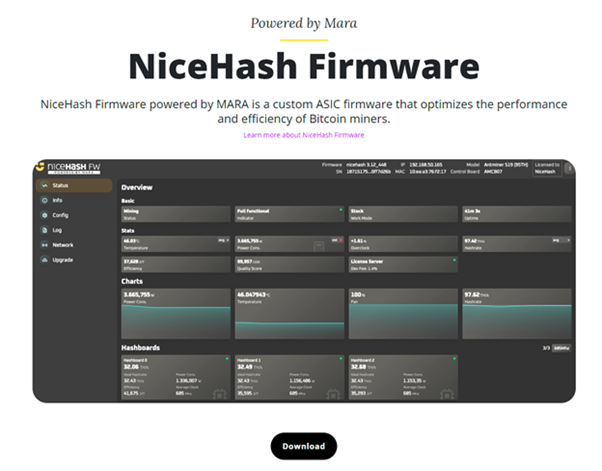

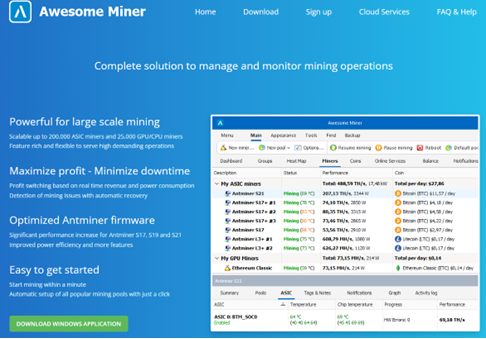

Which Mining Software Should You Use in the UK?

Top mining software includes CGMiner, EasyMiner, and BFGMiner. These tools are compatible with major ASICs and pools. Choose software that supports your hardware, offers real-time monitoring, and runs smoothly on your operating system. Ease of setup matters if you're new to mining.

Software Comparison Table

| Software | Open Source? | UI Difficulty | ASIC Support | Platform | Best For |

|---|---|---|---|---|---|

| CGMiner | Yes | Advanced | Yes | Linux, Windows | Tech-savvy miners |

| NiceHash | No | Very Easy | Yes | Windows | Beginners |

| BFGMiner | Yes | Moderate | Yes | Linux, MacOS | Custom setups |

Where Should You Store Your Mined Bitcoin?

You'll need a secure Bitcoin wallet to receive mining rewards. Cold wallets like Ledger or Trezor offer the highest protection. Hot wallets such as Electrum or BlueWallet are convenient but less secure. Always back up your keys and avoid storing coins on exchanges.

How Do You Start Mining Bitcoin in the UK?

Step 1 – Choose & Set Up Your Mining Hardware

The Antminer S21 and WhatsMiner M60 are top choices in 2026. They offer high hashrates with lower energy consumption. Choose an ASIC with efficient cooling, solid manufacturer support, and a good ROI calculator to evaluate profitability based on your energy costs.

What setup or cooling is needed at home?

ASIC miners generate significant heat and noise. Use a dedicated, ventilated space with proper airflow. Inline duct fans and external exhaust vents help prevent overheating. Avoid bedrooms or shared spaces—mining rigs are loud and run 24/7.

Step 2 – Install & Configure Mining Software

What are the easiest tools for beginners?

NiceHash and EasyMiner are beginner-friendly with intuitive interfaces and auto-configuration. They detect your hardware and optimise mining settings. These platforms simplify pool setup and provide built-in profitability calculators, making them ideal for first-time miners in the UK.

Which OS and settings should I use?

Windows is widely supported, but Linux-based systems offer better stability and resource efficiency. Use minimal background processes and disable sleep mode. Configure your software to auto-restart and optimise fan speeds for temperature control and performance tracking.

Step 3 – Create or Secure a Bitcoin Wallet

For mining, a cold wallet offers better security. Devices like Ledger or Trezor store your private keys offline, protecting you from hacks. Hot wallets are more convenient but less secure—use them only for small balances or frequent transactions.

What's the safest UK-friendly wallet?

Ledger Nano X and Trezor Model T are the most secure and widely trusted hardware wallets. Both work with UK platforms and support multiple cryptocurrencies. For hot wallet users, Electrum or BlueWallet offer strong encryption and simple interfaces.

Step 4 – Join a Mining Pool or Go Solo

ViaBTC, F2Pool, and Slush Pool remain popular in 2026, offering stable payouts, low fees, and real-time stats. Poolin and Antpool are also reliable. Choose a pool with UK server locations or low latency to maximise performance.

Mining Pool Comparison Table

| Pool | Payout Type | Fees | UK Access | Notable Features |

|---|---|---|---|---|

| F2Pool | PPS+ | 2.5% | Yes | Consistent payouts |

| ViaBTC | PPS/PPLNS | 2% | Yes | Cloud options available |

| Slush Pool | Score-based | 2% | Yes | Historical stats, API |

| Luxor | FPPS | 1.5% | Yes | Firmware & analytics tools |

Is solo mining viable in the UK?

Solo mining is rarely profitable in the UK due to high electricity costs and increased network difficulty. Joining a pool provides consistent payouts and reduces the chance of long dry spells without rewards—especially important for home-based or small-scale miners.

Step 5 – Start Mining & Monitor Performance

Use your mining pool's dashboard for real-time earnings, hashrate, and payout data. Tools like Minerstat, Hive OS, or NiceHash offer more detailed tracking, helping you monitor efficiency, profitability, and downtime across devices from a central interface or mobile app.

Which tools help optimise energy use?

Energy-efficient settings and undervolting options are available in firmware like Braiins OS or ASICtuner. Smart plugs, thermal sensors, and automatic fan control help manage usage. Mining calculators like WhatToMine can estimate profitability based on your hardware and local electricity rates.

What Does Bitcoin Mining Cost in the UK?

How much electricity does it use?

A single ASIC miner uses around 3,000 watts, running 24/7. That's roughly 2,100 kWh per month—costing £600+ at average UK rates. Cooling systems and other equipment can raise energy usage further, making electricity the biggest cost factor in mining profitability.

Can you make a profit at UK energy prices?

It's difficult, but possible with ultra-efficient ASICs and low fixed-rate electricity tariffs. Using surplus energy or operating during off-peak hours improves margins. Still, most UK miners see better results by joining pools and treating mining as a long-term, supplemental income stream.

Profitability Comparison Table

| Electricity Rate (p/kWh) | Daily Cost (ASIC 3kW) | Daily BTC Mined | Net Daily Profit | Monthly Net |

|---|---|---|---|---|

| 15p | £10.80 | £12.00 | £1.20 | ~£36 |

| 25p | £18.00 | £12.00 | -£6.00 | -£180 |

What hidden costs should you expect?

Expect extra costs for import taxes, shipping, voltage adapters, cooling systems, and maintenance. ASIC hardware also depreciates quickly. If mining at home, factor in increased electricity bills, network upgrades, and possible wear on home wiring or ventilation systems.

Is Bitcoin Mining Legal in the UK?

Bitcoin mining remains legal in the UK in 2026, provided you comply with energy regulations and local laws. There are no direct restrictions on mining, but you must use compliant equipment and avoid activities that disrupt the national grid or safety codes.

Do you need to register as a business?

If you mine regularly with the intent to earn profit, HMRC may classify your activity as a business. In that case, you'll need to register, keep financial records, and report earnings. Hobbyist miners may not require registration but must still declare income.

Are there mining bans or restrictions?

There are no UK-wide bans on mining, but local councils may enforce zoning or environmental regulations. Excessive noise, heat, or energy draw from home setups could raise issues. Always check with your local authority if running multiple rigs or using industrial power.

Do You Need to Pay Tax on Mined Bitcoin?

HMRC treats mining income as taxable, either as trading income or miscellaneous income depending on scale and intent. If mined coins are later sold, Capital Gains Tax (CGT) may apply. Keeping detailed records of costs, earnings, and withdrawals is essential.

Tax Treatment Table

| Activity Type | Taxed as Income? | CGT on Sale? | Business Registration Needed? |

|---|---|---|---|

| Hobbyist Mining | Yes | Yes | No |

| Commercial Mining | Yes | Yes | Yes |

| Cloud Mining | Possibly | Yes | Possibly |

When do you report earnings?

You must report earnings during the tax year they're received or converted to fiat. Declare them via your Self Assessment tax return. For consistent or large-scale mining, register as a sole trader and submit profit-and-loss statements annually.

Is it treated differently than buying crypto?

Yes. Buying crypto through an exchange is typically only subject to Capital Gains Tax when sold. Mining, on the other hand, is classed as income at the point it's earned, and CGT may still apply when those mined coins are later disposed of.

Final Thoughts

Bitcoin mining is legal in the UK in 2026, though high energy prices and tax obligations can squeeze profitability. It's best suited to hobbyists with access to cheap electricity and a solid technical understanding. For most UK-based beginners, alternatives like buying Bitcoin directly, cloud mining, or staking other cryptocurrencies may offer a simpler and lower-risk path into the market.

FAQs

Is it legal to mine Bitcoin in the UK in 2026?

Yes, Bitcoin mining is legal in the UK. However, any income or profits from mining are subject to HMRC tax rules, so make sure to keep accurate records and report your earnings.

Can I mine Bitcoin from home in the UK?

Yes, but it depends on your setup. Home mining requires specialised ASIC hardware, a stable power supply, and proper ventilation. Be prepared for noise, heat, and high electricity usage.

How much does it cost to start Bitcoin mining in the UK?

Startup costs vary, but expect to spend £2,500–£4,500+ for an ASIC miner, plus potential import fees, setup costs, and ongoing electricity bills of £20–£25 per day, depending on usage.

What is the best Bitcoin mining software for beginners?

NiceHash and EasyMiner are great options for beginners. They're easy to set up, have user-friendly dashboards, and handle most of the technical heavy lifting for you.

What is a mining pool, and should I join one?

A mining pool is a group of miners who combine their hash power to increase the chances of earning rewards. In 2026, solo mining is rarely profitable—joining a pool is usually the better option.

References

- HMRC – Cryptoassets: Tax for Individuals

- WhatToMine – Crypto Mining Profitability Calculator

- ASIC Miner Value – ASIC Profitability Rankings

- Bitmain – Antminer Product Page

- MicroBT – Whatsminer Series

- NiceHash – Beginner-Friendly Mining Platform

- Hive OS – Operating System for Mining Rigs

- CryptoCompare – Energy Consumption Index

- Slush Pool – Mining Pool Overview and Stats

- How to Mine Bitcoin in the UK (2025) – Profit, Setup & Regulations

- ✓ Buy crypto from just £1

- ✓ Zero deposit and withdrawal fees

- ✓ Built-in staking and savings tools

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

Don’t invest unless you’re prepared to lose all the money you invest.