- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer: To Buy BYD Shares in the UK, You’ll Need To...

To buy BYD shares in the UK in 2026, choose an FCA-regulated broker like IG or eToro, open and verify your account, deposit GBP, search for BYD (ticker: BYDDF or 1211.HK), enter your investment amount, select your order type, and confirm the trade. You can then monitor your holdings through your broker’s platform.

Step 1 – Choose a Regulated Stock Broker

1. Choose a Regulated UK Broker

Selecting a regulated broker ensures safety, compliance, and secure trading. FCA-regulated platforms protect your funds, provide proper reporting, and maintain risk management protocols. Choose brokers with access to international stocks, competitive fees, and robust trading tools for seamless execution.

How do I know the broker is FCA-regulated?

Check the FCA register online for the broker’s license number and status. FCA-regulated brokers must comply with UK financial laws, hold segregated client funds, and provide investor protection schemes, ensuring your investments in BYD shares are legally secure and monitored.

Which brokers are best for BYD shares in the UK?

Top brokers include IG, eToro, CMC Markets, and Interactive Brokers. IG and CMC provide professional tools for international stocks, eToro offers fractional shares and copy trading, while Interactive Brokers gives global access and competitive pricing, all fully FCA-regulated for UK investors.

Quick Comparison Table

| Broker | Account Types | FCA Regulated | International Stocks | Fees | Key Feature |

|---|---|---|---|---|---|

| IG | ISA, SIPP, GIA | Yes | Yes | 0.45%-0.5% spread | Advanced research & platform tools |

| eToro | ISA, SIPP, GIA | Yes | Yes | 0% commission for stocks | CopyTrading & fractional shares |

| CMC Markets | ISA, SIPP, GIA | Yes | Yes | 0.45%-0.5% spread | Professional charts & low spreads |

| Interactive Brokers | ISA, SIPP, GIA | Yes | Yes | Low commission | Global market access & advanced tools |

2. Create and Verify Your Account

After selecting a broker, you must create an account and complete identity verification. This ensures compliance with FCA regulations and secure trading. Verification confirms your identity and residency, protecting against fraud while allowing you to invest safely in BYD shares.

What documents are required for UK verification?

UK brokers typically require a government-issued photo ID (passport or driver’s license) and proof of address (utility bill or bank statement). These documents verify your identity and residency to comply with anti-money laundering (AML) and FCA regulations.

How long does verification usually take?

Verification generally takes 1–3 business days, depending on document quality and broker processing speed. Some brokers provide instant or same-day approval if documents are clear and uploaded correctly.

3. Deposit Funds

Once verified, fund your account using supported payment methods. Ensure your deposit covers your intended BYD investment and potential fees. Brokers maintain secure transactions and allow you to start buying shares safely, ready to act on market opportunities.

What payment methods can I use to fund my account?

UK brokers accept bank transfers, debit/credit cards, and e-wallets (PayPal, Skrill, etc.). Bank transfers are common for larger deposits, while cards and e-wallets are faster for small amounts.

Are there fees for depositing GBP?

Most UK brokers allow free GBP deposits via bank transfer. Card or e-wallet deposits may incur small fees. Always check the broker’s deposit terms to avoid unexpected charges and maximize funds for buying BYD shares.

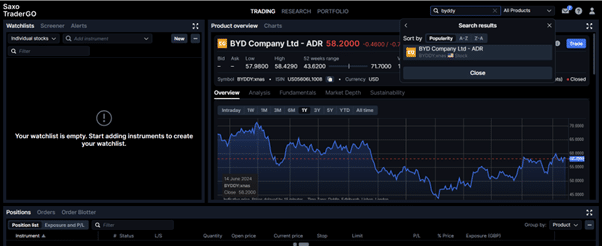

4. Search for BYD Shares

Locate BYD shares on your broker’s platform by entering the correct ticker symbol. Ensure you choose the appropriate listing for your investment, whether BYDDF (US OTC market) or 1211.HK (Hong Kong market), to access real-time prices and liquidity.

Which ticker symbols should I use (BYDDF or 1211.HK)?

BYDDF is traded on the US OTC market, priced in USD. 1211.HK is the Hong Kong listing, priced in HKD. Choose based on account access, currency preference, and trading hours, ensuring your broker supports the selected exchange.

Can I access BYD shares via ETFs or funds?

Yes, some global ETFs and mutual funds include BYD shares. This provides indirect exposure, diversification, and easier access for UK investors who prefer pooled investments over direct stock purchases.

Not Sure Which Platform to Choose?

Answer 5 quick questions and we’ll provide a personalised recommendation for the best options tailored to your specific needs and experience level.

5. Decide How Much to Invest

Assess your portfolio, risk tolerance, and investment goals. Decide how much capital to allocate to BYD shares, balancing exposure with diversification to avoid overconcentration in a single stock while maximizing potential gains.

How do I calculate my investment allocation?

Determine the percentage of your portfolio for BYD shares based on risk appetite and investment horizon. Use diversification principles and risk management rules to ensure your position size fits your financial plan.

Can I buy fractional shares?

Some brokers allow fractional BYD share purchases, enabling smaller investments without buying a full share. This helps manage capital efficiently and makes global stocks accessible even with limited funds.

| Decision Factor | Explanation | Practical Tips |

|---|---|---|

| Portfolio Allocation | Decide what percentage of your total investments to allocate to BYD shares | Start with 1-5% for high-risk growth stocks; adjust based on overall portfolio risk. |

| Risk Tolerance | Assess how much volatility you can handle | Use risk questionnaires or scenario analysis to estimate potential drawdowns you are comfortable with. |

| Investment Horizon | Determine if your goal is short-term gains or long-term growth | Long-term investors may tolerate more volatility; short-term traders should consider stop-loss strategies. |

| Diversification | Avoid overconcentration in a single stock | Combine BYD exposure with ETFs, other tech, or green energy stocks. |

| Fractional Shares | Allows smaller capital deployment by buying portions of a share | Check broker options for fractional trading to start with minimal investment. |

| Position Sizing | Set a specific dollar or percentage amount for each purchase | Use automated tools or spreadsheet calculations to keep each position within your risk limits. |

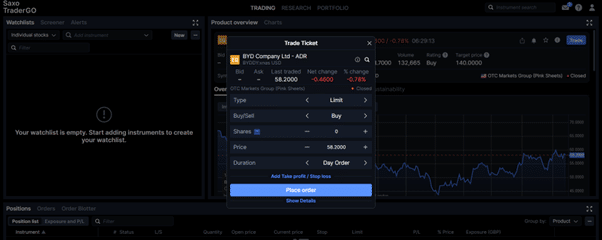

6. Place Your Order

Execute your BYD purchase by entering the number of shares or fractional amount. Select the order type, review details, and confirm to ensure your trade aligns with your intended entry price and risk management strategy.

How do I choose between market or limit orders?

Market orders execute immediately at current prices, ideal for quick entry. Limit orders set a target price, executed only when the stock reaches that level, offering control but potential delays if the price does not trigger.

How do I confirm my BYD purchase?

After placing the order, check trade confirmations on the platform. Verify quantity, price, and total cost. Many brokers send email receipts or dashboard updates to ensure transparency and accuracy.

7. Monitor and Manage Your Holdings

Track BYD shares post-purchase to manage risk and identify opportunities. Use portfolio dashboards, alerts, and news feeds to stay informed about price movements and market developments affecting your investment.

How do I track BYD share performance?

Use broker charts, price alerts, or financial apps to monitor real-time movements. Review historical performance, trends, and news to inform decisions on holding, adding, or selling shares.

How do I set stop-loss or alerts for risk management?

Set automated stop-loss levels to limit potential losses and price alerts to notify you of key movements. This ensures disciplined trading and protects capital in volatile market conditions.

What is BYD?

BYD is a Chinese multinational specializing in electric vehicles, batteries, and renewable energy solutions. It operates globally, producing EVs, battery storage systems, and solar technology. BYD has a diverse revenue stream, including consumer electronics, transport solutions, and green energy projects.

How Does BYD Operate?

BYD designs, manufactures, and sells electric vehicles, batteries, and solar systems. It has vertical integration, producing core components in-house. Sales channels include direct-to-consumer EV sales, fleet contracts, and international partnerships, providing a broad exposure to green technology markets.

Is BYD a Good Investment for UK Traders?

BYD offers growth potential through EV adoption and renewable energy expansion. UK traders should consider exposure via international shares or ETFs. Risks include currency fluctuations, Chinese market regulations, and competition. Allocate cautiously and balance BYD exposure within a diversified portfolio.

What Are the Risks of Buying BYD Shares?

Risks include market volatility, regulatory changes in China, currency risk (USD/HKD), competition in EV and battery sectors, and geopolitical tensions. Supply chain issues and company-specific operational risks may impact performance. Traders should assess their risk tolerance and diversify to mitigate exposure.

Final Thoughts - Is BYD Right for You?

BYD remains an attractive option for UK investors seeking long-term exposure to the EV and renewable energy sectors heading into 2026. Those willing to tolerate volatility, monitor international markets, and invest through regulated UK brokers or ETFs may benefit from the company’s continued global expansion. More conservative investors may prefer diversified funds rather than direct BYD exposure to manage risk effectively.

Top 5 Platforms

1

eToro

61% of retail CFD accounts lose money when trading CFD’s with this provider.

2

IG

68% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

3

Interactive Investor

Trading and investing involve risk. Capital at Risk

4

Hargreaves Lansdown

64% of retail investor accounts lose money when trading CFDs with this provider.

5

Interactive Brokers

When investing, your capital is at risk

FAQs

What are the tax implications of buying BYDDF shares in the UK?

Capital gains tax may apply to profits from selling BYDDF shares. Consult a tax advisor for specific advice.

Does BYD Company pay dividends?

BYD Company does not currently pay dividends, focusing on reinvesting profits for growth.

How does currency exchange affect my investment in BYDDF?

Investing in BYDDF involves currency risk as the shares are traded in a different currency. Exchange rate fluctuations can impact returns.

What are the costs associated with buying BYDDF shares?

Costs include broker fees, currency conversion fees, and any applicable taxes. Compare brokers to find the best rates.

Can I buy BYDDF shares through an ISA or SIPP?

Yes, you can purchase BYDDF shares through an Individual Savings Account (ISA) or Self-Invested Personal Pension (SIPP) in the UK, offering tax advantages.

References

- BYD Company Official Website: BYD Official Website

- Yahoo Finance – BYDDF Stock: Yahoo Finance – BYDDF

- Financial Conduct Authority (FCA): FCA Official Website