Is Capital.com Safe? - A Full Review of Its Security Features

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection (£120,000 per person)

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Affiliate disclosure. Broker buttons and "Get Started" links are affiliate links. We may earn a commission if you open an account — at no extra cost to you. This never affects our ratings, rankings, or recommendations, which are based solely on our independent testing methodology.

Contact: info@theinvestorscentre.co.uk

Quick Answer: How Safe is Capital.com?

Capital.com is a safe and secure platform regulated by top authorities like the FCA, ASIC, and CySEC. It uses SSL encryption and two-factor authentication (2FA) to protect your data. Client funds are kept in segregated accounts, and UK users benefit from the Financial Services Compensation Scheme (FSCS).

Capital.com Overview

Capital.com is a multi-asset CFD and spread betting broker offering forex, indices, commodities, and share CFDs. Regulated by the FCA (UK), CySEC, and ASIC, it’s trusted by traders worldwide. The broker offers an intuitive platform, competitive pricing, and commission-free trading — giving traders access to global markets with tight spreads.

- Minimum Deposit: £20

- Regulation: FCA (UK), CySEC, ASIC

- Trading Platforms: Web Platform, Mobile App, TradingView, MT4

-

Market Access:

- 5000+ markets

- CFDs on Forex, Indices, Shares, Commodities

- Spread betting available for UK clients

- Commission-Free Trading: 0% commission on all CFD trades (*other fees may apply), with costs built into competitive spreads

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 60% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Is Capital.com Regulated and What Does That Mean for You?

Yes, Capital.com is regulated by FCA, ASIC, SCB, SCA and CySEC, which impose strict standards that brokers must follow. Regulation provides legal frameworks for fund protection and operational transparency, and ensures the platform complies with strict rules to avoid fraud, offering peace of mind to traders.

Why Does Regulation Matter for Trader Protection?

Regulation plays a key role in safeguarding traders. It ensures brokers like Capital.com operate under strict rules around transparency, fair treatment, capital adequacy, and segregation of client funds. If a broker faces insolvency, regulations like the Investor Compensation Fund ensure that traders are compensated for their losses, although compensation schemes vary by availability per region.

How Secure Is Capital.com for Traders?

Capital.com implements several security measures to ensure the safety of user funds and data. With SSL encryption, two-factor authentication (2FA), and segregated accounts for client funds, the platform prioritizes data protection and provides a secure trading environment for all users.

For more on this see our page is capital.com good for day trading?

Does Capital.com Use SSL Encryption to Protect Your Data?

Yes, SSL encryption is used by Capital.com to secure user data during transactions. This encryption ensures that all sensitive information, such as personal details and financial data, is protected from hackers and third-party access during trading on the platform.

Does Capital.com Offer Two-Factor Authentication (2FA)?

Yes, two-factor authentication (2FA) is available to add an extra layer of protection to your account. With 2FA, even if someone gains access to your password, they won’t be able to access your account without a second verification code, which adds another level of security.

Capital.com Withdrawal Process: What to Expect

One of the most common concerns traders have is whether they can actually get their money out. We tested Capital.com’s withdrawal process with real funds to give you a clear picture of what to expect.

How Long Do Capital.com Withdrawals Take?

Capital.com processes withdrawal requests within 24 hours on business days. However, the time it takes to reach your account depends on your withdrawal method:

- Bank Transfer: 2-5 business days after processing

- Debit/Credit Card: 2-5 business days (refunds to the original card used for deposit)

- Apple Pay/Google Pay: 1-3 business days

In our testing, a bank transfer withdrawal was initiated on a Tuesday morning and funds arrived in our UK bank account by Thursday afternoon – well within the stated timeframes.

Are There Withdrawal Fees?

Capital.com does not charge withdrawal fees. However, your bank may apply incoming transfer fees, and currency conversion charges may apply if withdrawing to an account in a different currency than your trading account.

Withdrawal Limits

There is no maximum withdrawal limit at Capital.com. You can withdraw your entire balance at any time, subject to any open positions being closed or having sufficient margin.

Important: You must withdraw to the same payment method you used to deposit, up to the deposited amount. Any profits above your deposit can be withdrawn via bank transfer.

What Do Real Users Say About Capital.com?

Beyond our own testing, we analysed thousands of user reviews across Trustpilot, Reddit, and trading forums to understand what actual traders experience with Capital.com.

Trustpilot Reviews Summary

Capital.com holds a 4.6 out of 5 rating on Trustpilot based on over 13,700 reviews. The most common praise focuses on:

- User-friendly platform interface

- Fast withdrawal processing

- Responsive customer support

- Educational resources for beginners

The most frequent complaints relate to spread widening during volatile market conditions and the verification process taking longer than expected for some users.

Reddit User Experiences

Discussions on r/UKPersonalFinance and r/trading generally reflect positive experiences with Capital.com. Users frequently mention the platform’s intuitive design and the fact that it’s FCA-regulated as reasons they chose it over alternatives.

Common concerns raised include:

- Spreads being wider than some competitors during high-volatility periods

- Limited product range compared to multi-asset brokers

- Some users preferring MetaTrader 4/5 over Capital.com’s proprietary platform

Is Capital.com a Scam? Addressing the Concern

No, Capital.com is not a scam. It is a legitimate, FCA-regulated broker with a verifiable track record.

If you’re concerned about legitimacy, you can verify Capital.com’s FCA registration directly on the FCA Register (Firm Reference Number: 793714).

How Does Capital.com Protect My Funds?

Capital.com takes fund protection seriously by using segregated accounts at top-tier banks to keep client funds separate from company funds. This ensures that even in the unlikely event of insolvency, your funds remain secure and protected. UK clients are covered by the Financial Services Compensation Scheme (FSCS).

Are Client Funds Segregated at Capital.com?

Yes, Capital.com uses segregated accounts to separate client funds from its own operating capital. This provides an extra layer of security, ensuring that your funds are protected and cannot be used for the company’s operations or liabilities.

Is Capital.com Part of the Investor Compensation Fund?

Yes, Capital.com is part of the Financial Services Compensation Scheme (FSCS) for UK-based users, which protects up to £85,000 in the event of the broker’s insolvency. This fund ensures that users can recover their funds in the unlikely event that Capital.com becomes insolvent.

Is Capital.com Safe for Beginners?

Yes, Capital.com is an excellent and safe choice for beginner traders. The platform is designed to be user-friendly, with clear features and tutorials. It also offers security features like SSL encryption and 2FA. Additionally, demo accounts allow new traders to practice without risk.

Does Capital.com Offer a Demo Account for Practice?

Yes, Capital.com offers a free demo account, which allows beginners to practice trading with virtual funds. This enables new traders to learn how to navigate the platform and understand trading strategies without the risk of losing real money.

How Easy and Secure Is the Platform for New Traders?

Capital.com provides an intuitive platform with a user-friendly interface and simple navigation, making it easy for beginners to get started. It also offers security features like two-factor authentication (2FA) and SSL encryption to ensure that your data and funds are protected while learning the ropes of trading.

How Does Capital.com Compare to Other Brokers in Terms of Safety?

Capital.com ranks highly in terms of safety compared to competitors like eToro and Trading 212. It offers strong regulation, segregated accounts, and advanced encryption. While other brokers also have safety measures, Capital.com’s comprehensive security features make it a trusted option.

For a full regulatory and cost comparison, see our XTB vs Capital.com guide. You can also compare security features in our Capital.com vs Trading 212 breakdown.

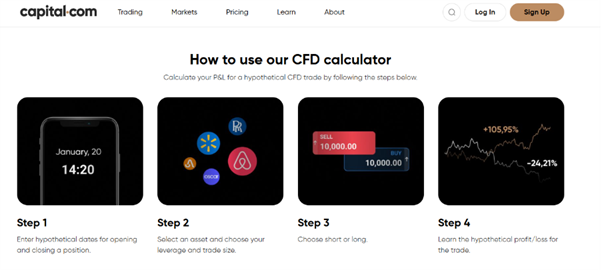

What Are the Potential Risks of Using Capital.com?

While Capital.com is a secure platform, there are inherent risks, especially with CFD trading and leverage. These can amplify both gains and losses, and overnight fees apply when holding leveraged positions. Traders should be aware of market volatility and the potential for losing more than their initial deposit when using leverage.

How Do CFDs and Spread Betting Affect Safety?

CFDs and spread betting carry significant risk due to their leveraged nature. While they can offer potential rewards, they also expose traders to amplified losses. Understanding these risks and managing positions carefully is critical to maintaining safety when using these products. Spread betting is available only for UK clients.

Is Capital.com a Safe Platform for You?

Capital.com is a safe platform, offering strong regulation, segregated accounts, and security features like SSL encryption and two-factor authentication (2FA). However, potential risks from CFD trading and leverage exist, and it’s important to assess your risk tolerance before trading.

For a complete overview of features and fees, see our Capital.com review.

Trade with Capital.com

Access 5,000+ CFD Markets

- ✓ 0% Commission (Other fees apply)

- ✓ 0.014s Avg. Execution Speed

- ✓ Seamless TradingView Integration

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 60% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

FAQs

Is Capital.com safe?

Yes, Capital.com is a safe and legitimate trading platform. It is regulated by the FCA (UK), ASIC (Australia), and CySEC (Cyprus), which are among the strictest financial regulators globally. The platform uses SSL encryption, two-factor authentication, and holds client funds in segregated accounts at top-tier banks. UK users also benefit from FSCS protection.

Is Capital.com regulated in the UK?

Yes, Capital.com is regulated by the FCA (Financial Conduct Authority) under Firm Reference Number 793714. This ensures the platform operates under strict standards of transparency and security for UK users. You can verify this directly on the FCA Register.

Does Capital.com offer negative balance protection?

Yes, Capital.com offers negative balance protection to prevent traders from losing more than their deposited funds. This means your balance cannot go below zero when using the platform, even during extreme market volatility.

How secure is my data on Capital.com?

Your data on Capital.com is protected with 256-bit SSL encryption, ensuring secure transactions and safeguarding your personal and financial information from unauthorised access.

Can I trust Capital.com with my funds?

Yes, Capital.com is a trustworthy platform with segregated accounts that protect your funds. Your money is kept separate from the company’s operating capital at top-tier banks. It is also covered by the FSCS for eligible claims.

Is Capital.com safe for beginner traders?

Yes, Capital.com is safe for beginners. The platform offers a user-friendly interface, free demo account for practice, and comprehensive educational resources. The same regulatory protections and security measures apply to all users regardless of experience level.

Can I trust Capital.com with large deposits?

Capital.com is FCA-regulated and holds client funds in segregated accounts at top-tier banks. While deposits above the FSCS limit (£120,000 for cash) carry some theoretical risk if multiple banks failed simultaneously, this is extremely unlikely. Many professional traders use Capital.com for significant portfolios.

Has Capital.com ever had security breaches?

There are no publicly reported security breaches at Capital.com. The platform uses 256-bit SSL encryption, two-factor authentication, and employs industry-standard security protocols to protect user data and funds.

What happens to my money if Capital.com goes bankrupt?

If Capital.com were to fail, your funds in segregated accounts would be returned to you as they are legally separate from the company’s assets. Additionally, FSCS protection would cover eligible claims up to £85,000 for investments or £120,000 for deposits held in segregated bank accounts.

Is Capital.com safe to link my bank account?

Yes. Capital.com uses secure, encrypted connections for all payment processing. When you link a bank account or card, the connection is protected by the same security standards used by major banks. Capital.com is also PCI DSS compliant for card payments.

Is Capital.com a scam?

No, Capital.com is not a scam. It is a legitimate, FCA-regulated broker with over 690,000 users worldwide. Concerns typically arise from CFD trading losses (60% of retail accounts lose money, which is the product risk), strict verification requirements (a regulatory obligation), or spread widening during volatile markets. You can verify Capital.com’s legitimacy on the FCA Register using FRN 793714.

How long do Capital.com withdrawals take?

Capital.com processes withdrawal requests within 24 hours on business days. Bank transfers typically arrive within 2-5 business days, while card refunds take 2-5 business days. Apple Pay and Google Pay withdrawals usually complete within 1-3 business days.

Are there withdrawal fees at Capital.com?

No, Capital.com does not charge withdrawal fees. However, your bank may apply incoming transfer fees, and currency conversion charges may apply if withdrawing to an account in a different currency than your trading account.

References

- Trading Price Advantage | FOREX.com

- StoneX Financial Ltd FCA Register

- FOREX.com Reviews | Read Customer Service Reviews of www.forex.com