IG vs Capital.com – Which UK Broker Is Better in 2026?

A head-to-head comparison of IG and Capital.com — two FCA-regulated UK brokers tested with real money. Market depth, spreads, platforms, and costs compared.

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Should You Choose IG or Capital.com?

IG and Capital.com are two of the most popular FCA-regulated brokers for UK traders. Having tested both with real money over the past two years, I can tell you they serve different types of traders. IG offers unmatched market depth with 17,000+ instruments and options trading. Capital.com delivers native TradingView integration and no inactivity fees.

Choose IG if you want maximum market range, ISA/SIPP accounts, or options trading. Choose Capital.com if you prioritise TradingView integration, lower minimum deposits, or want to avoid inactivity fees. Both are FCA-regulated with identical EUR/USD spreads from 0.6 pips.

| Feature | IG | Capital.com |

|---|---|---|

| Founded | 1974 | 2016 |

| FCA Regulated | Yes (FRN: 195355) | Yes (FRN: 793714) |

| Min Deposit | £0 (cards), £250 suggested | £20 |

| EUR/USD Spread | From 0.6 pips | From 0.6 pips |

| Platforms | Web, Mobile, MT4, ProRealTime | Web, Mobile, MT4, TradingView |

| Spread Betting | Yes | Yes |

| ISA/SIPP | Yes | No |

| Crypto Access | Via Uphold partnership | Professional clients only (UK) |

| TIC Score | 4.6/5 | 4.35/5 |

Which Broker Has Lower Fees and Spreads?

Both brokers match on core forex spreads at 0.6 pips for EUR/USD. The differences emerge in secondary costs. IG charges a £12 monthly inactivity fee after 24 months of no trades. Capital.com charges nothing for inactivity. Share CFD commission also differs: IG charges from £3 per trade whilst Capital.com uses spread-only pricing.

| Cost Type | IG | Capital.com | Winner |

|---|---|---|---|

| EUR/USD Spread | From 0.6 pips | From 0.6 pips | Tie |

| GBP/USD Spread | From 0.9 pips | 1.3 pips | IG |

| UK 100 Spread | 1 point | 1 point | Tie |

| Share CFD Commission | From £3/trade | Spread only | Capital.com |

| FX Conversion | 0.5% | 0.7% | IG |

| Overnight Funding | Varies by instrument | 4% + benchmark | IG |

| Inactivity Fee | £12/month after 24 months | None | Capital.com |

| Withdrawal Fee | None | None | Tie |

My personal experience with IG's costs

Trading GBP/USD during London sessions, I paid roughly 0.9 pip spreads consistently. The share CFD commission adds up for frequent traders. I appreciated the lack of deposit fees but got caught with the inactivity charge when I took a break.

My personal experience with Capital.com's costs

The spread-only model made cost calculation simpler. Forex spreads matched IG on majors. The 0.7% FX conversion fee bit into profits when trading USD-denominated instruments from my GBP account. No surprise inactivity fees after my three-month hiatus.

Which Platform Is Easier to Use?

Capital.com wins for modern interface design and TradingView integration. IG wins for platform variety and depth of features. Both mobile apps performed reliably during my testing. Execution speed was comparable at under 0.05 seconds for both.

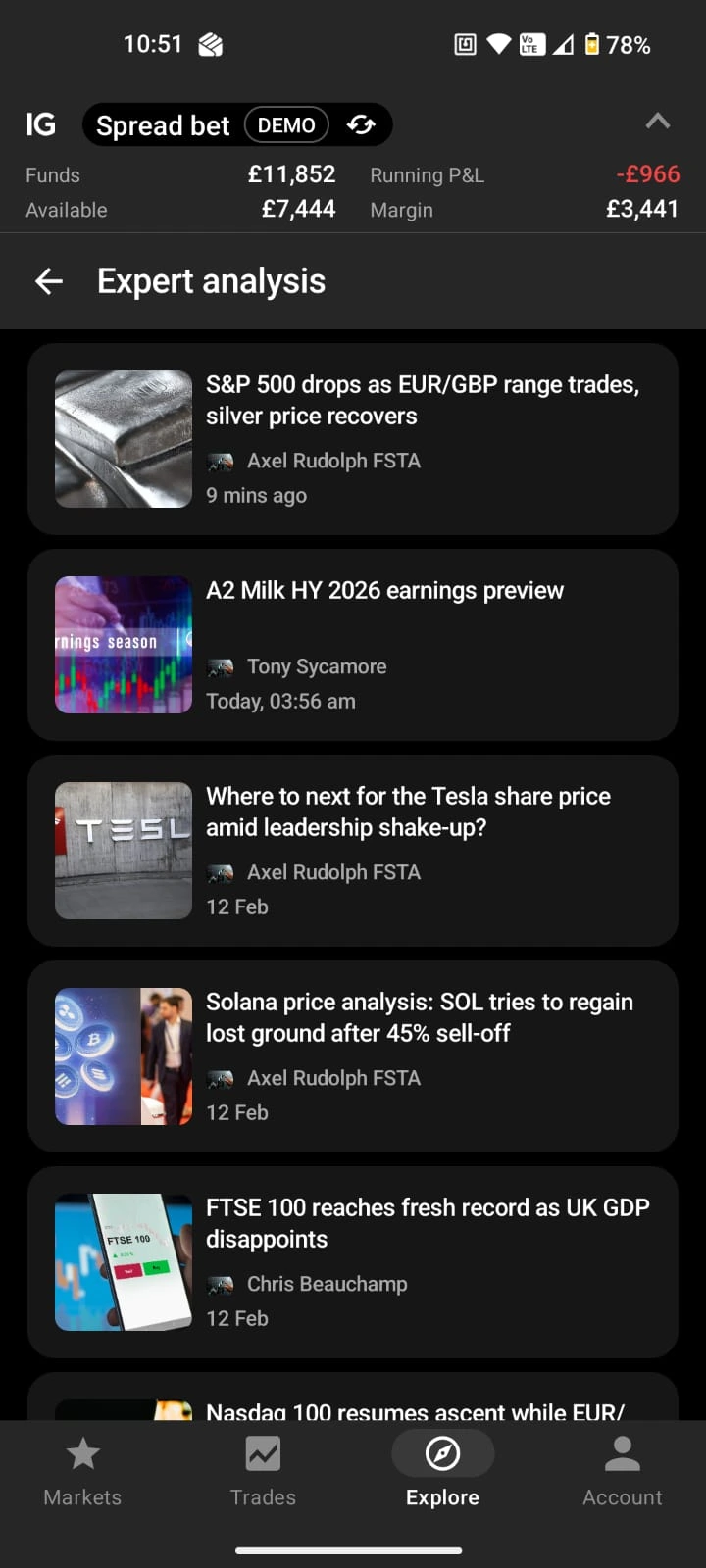

My personal experience with IG's platform

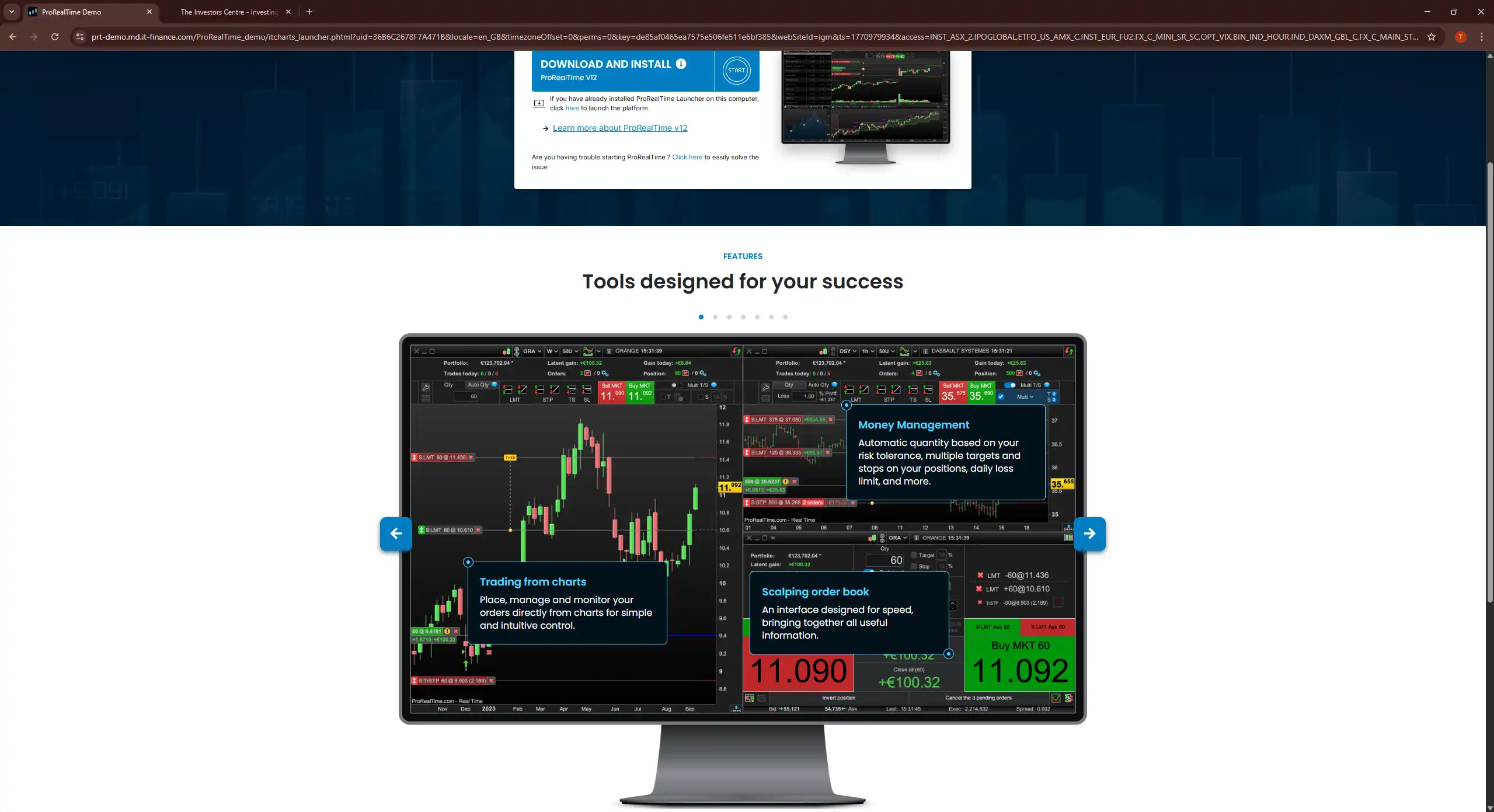

IG's web platform feels comprehensive but overwhelming initially. ProRealTime charting is excellent for technical analysis. The mobile app mirrors web functionality well. I needed two weeks to feel comfortable navigating all features.

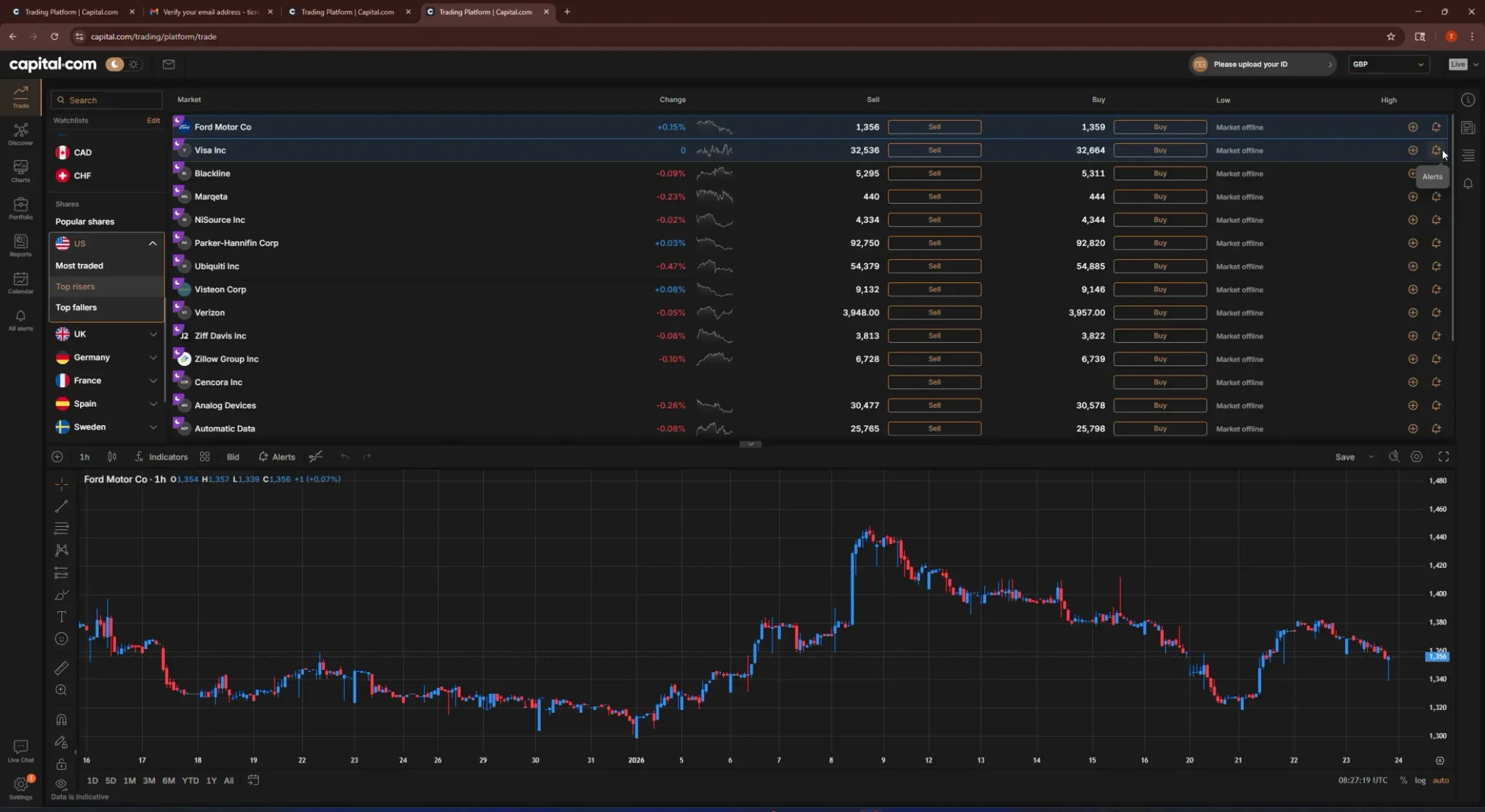

My personal experience with Capital.com's platform

Capital.com's interface is cleaner and more intuitive. The native TradingView integration means I can trade directly from charts I already know. Their 0.014-second average execution speed impressed during volatile sessions. Setup took one afternoon.

Which Broker Has Better TradingView Integration?

Capital.com wins decisively. Capital.com offers native TradingView integration, allowing you to trade directly from TradingView's charts with full indicator access. IG does not support TradingView. IG offers ProRealTime as an alternative, which is powerful but requires a separate learning curve. For technical traders already using TradingView, Capital.com is the obvious choice.

Which Broker Is Safer for UK Traders?

Both brokers maintain top-tier safety standards. IG edges ahead due to 50+ years of operation and public listing on the London Stock Exchange. Capital.com is multi-regulated across FCA, CySEC, ASIC, SCB, and SCA jurisdictions. Both offer FSCS protection up to £85,000 and segregated client accounts.

| Safety Feature | IG | Capital.com | Winner |

|---|---|---|---|

| FCA Regulated | Yes (FRN: 195355) | Yes (FRN: 793714) | Tie |

| FSCS Protection | Up to £85,000 | Up to £85,000 | Tie |

| Segregated Accounts | Yes | Yes | Tie |

| Negative Balance Protection | Yes | Yes | Tie |

| Years Operating | 50+ years | 8+ years | IG |

| Publicly Listed | Yes (LSE: IGG) | No | IG |

Learn more about Capital.com's safety credentials.

Which Broker Is Better for Beginners?

Capital.com wins for beginners. The £20 minimum deposit lowers the barrier to entry significantly compared to IG's suggested £250. Capital.com's Investmate app provides bite-sized lessons under three minutes. The platform's cleaner interface creates a gentler learning curve. IG's Academy offers excellent content but the platform complexity can overwhelm newcomers.

Which Broker Is Better for Day Trading?

IG wins for day trading breadth. Access to 17,000+ instruments means more opportunities across sessions. ProRealTime's advanced charting suits technical strategies. Capital.com's 0.014-second execution speed matches IG's performance. For pure forex day trading, both perform equally. For multi-asset day trading, IG's range wins. See my detailed analysis of Capital.com for day trading.

Which Broker Is Better for Spread Betting?

Both brokers deliver strong spread betting platforms. IG offers 4,700+ spread betting markets whilst Capital.com provides 4,700+ markets. Both platforms allow tax-free trading where profits are exempt from capital gains tax and stamp duty. Tax treatment depends on individual circumstances. IG's longer track record in spread betting gives slight edge for this specific product.

Which Broker Is Better for Investing?

IG wins for long-term investing. IG offers ISA and SIPP accounts that Capital.com lacks entirely. These tax wrappers let you shelter gains from capital gains tax. IG's share dealing service provides access to 12,000+ stocks on major exchanges. Capital.com focuses purely on CFD and spread betting products with no share ownership. For buy-and-hold investors wanting actual stock ownership, IG is the only viable choice.

What Can You Trade on Each Platform?

IG wins comprehensively on market range. The 17,000+ instruments dwarf Capital.com's 5,000+. IG offers options and futures that Capital.com lacks entirely. Capital.com counters with 130+ forex pairs versus IG's 80+. For cryptocurrency access, UK retail traders face restrictions on both platforms.

| Asset Class | IG | Capital.com | Winner |

|---|---|---|---|

| Forex Pairs | 80+ | 130+ | Capital.com |

| Share CFDs | 16,000+ | 4,000+ | IG |

| Indices | 80+ | 20+ | IG |

| Commodities | 35+ | 25+ | IG |

| Crypto (UK Retail) | Via Uphold | Pro clients only | IG |

| ETFs | Yes | Yes | Tie |

| Options | Yes | No | IG |

| Futures | Yes | No | IG |

What Are the Pros and Cons of Each Broker?

IG – Pros

Over 50 years of industry experience with proven stability and a public listing on the London Stock Exchange for added transparency. An extensive market range including options and futures gives traders access to 17,000+ instruments across virtually every asset class. ISA and SIPP accounts are available for tax-efficient long-term investing — something Capital.com cannot offer.

IG – Cons

The £12 monthly inactivity fee after 24 months catches traders who take extended breaks. No native TradingView integration means technical traders must adapt to ProRealTime or MT4 instead. The platform can feel complex for beginners with its depth of features, and the suggested minimum deposit of £250 is higher than competitors.

Capital.com – Pros

Native TradingView integration allows chart-based trading directly from TradingView without platform switching. No inactivity fees regardless of trading frequency protects dormant accounts. The £20 minimum deposit lowers the barrier to entry, and the 0.014-second average execution speed delivers reliable fills during volatile sessions.

Capital.com – Cons

A younger company with less track record at 8 years versus IG's 50+. No ISA or SIPP accounts means Capital.com cannot serve long-term investors needing tax wrappers. Crypto is restricted to professional UK clients only, and the smaller market range at 5,000+ versus 17,000+ limits access to niche instruments, options, and futures.

Compare Capital.com against other platforms: Capital.com vs Trading 212 and XTB vs Capital.com.

Full Feature Comparison Table

Here's the complete side-by-side breakdown across every key metric.

| Feature | IG | Capital.com | Winner |

|---|---|---|---|

| Regulation | FCA, ASIC, multiple | FCA, CySEC, ASIC, SCB, SCA | Tie |

| Years Operating | 50+ | 8+ | IG |

| Min Deposit | £250 suggested | £20 | Capital.com |

| EUR/USD Spread | From 0.6 pips | From 0.6 pips | Tie |

| Platform Choice | 4 options | 3 options | IG |

| TradingView | No | Yes | Capital.com |

| Spread Betting | Yes | Yes | Tie |

| ISA/SIPP | Yes | No | IG |

| Education | Excellent | Excellent | Tie |

| Inactivity Fee | £12/month (24mo) | None | Capital.com |

| Market Range | 17,000+ | 5,000+ | IG |

| Trustpilot Rating | 4.2/5 | 4.6/5 | Capital.com |

Final Verdict – Which Broker Should You Choose?

IG wins for experienced traders wanting maximum market access, options trading, or tax-wrapper accounts. Capital.com wins for cost-conscious traders, TradingView users, and beginners starting with smaller deposits. Neither is objectively better — the right choice depends entirely on your trading priorities.

| If you want… | Choose |

|---|---|

| Maximum market range | IG |

| TradingView integration | Capital.com |

| ISA or SIPP | IG |

| Lower minimum deposit | Capital.com |

| No inactivity fees | Capital.com |

| Options/futures trading | IG |

| Tax-free spread betting | Either |

| Best mobile app design | Capital.com |

| Longest track record | IG |

FAQs

Is IG or Capital.com cheaper for forex trading?

They match on major pairs with EUR/USD from 0.6 pips on both platforms. Capital.com wins overall due to no inactivity fees and spread-only pricing on share CFDs.

Which broker has better customer support?

Capital.com scores higher with 24/7 English support and 5-minute average chat response. IG support quality varies by contact method and time of day.

Can I use TradingView with IG or Capital.com?

Only Capital.com offers native TradingView integration. IG does not support TradingView but offers ProRealTime as an advanced charting alternative.

Which broker is better for UK beginners?

Capital.com suits beginners better with its £20 minimum deposit, simpler interface, and Investmate educational app delivering lessons under three minutes.

Are both brokers regulated by the FCA?

Yes. IG holds FCA registration FRN 195355. Capital.com holds FCA registration FRN 793714. Both provide FSCS protection up to £85,000.

Which broker has lower spreads?

Spreads match on major forex pairs at 0.6 pips for EUR/USD. IG offers tighter GBP/USD spreads at 0.9 pips versus Capital.com's 1.3 pips.