- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII · 12+ years in financial analysis

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- 50+ platforms tested · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- 40+ brokers tested · Active investor since 2013

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII · 12+ years in financial analysis

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- 50+ platforms tested · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- 40+ brokers tested · Active investor since 2013

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection (£120,000 per person)

Testing team:

Adam Woodhead, Thomas Drury (Chartered ACII), Dom Farnell — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Affiliate disclosure. Some links earn commission at no cost to you. This doesn't affect our ratings.

Contact: info@theinvestorscentre.co.uk

Quick Answer: Which is Better, Coinbase or OKX?

Coinbase remains the stronger choice for UK beginners and long-term investors who prioritise FCA oversight, asset protection, and a straightforward user experience. OKX is better suited to advanced traders looking for lower fees, derivatives access, and expanded Web3 functionality. Overall, for most UK investors in 2026, Coinbase’s focus on security and usability continues to outweigh OKX’s wider but higher-risk trading options.

Introduction

How Do OKX and Coinbase Compare at a Glance?

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

| Feature | Coinbase | OKX |

|---|---|---|

| Trustpilot Score | 4.0/5 (19k+ reviews) | ~3.2/5 (1.6k+ reviews) |

| Regulation | FCA registered UK | FCA compliant UK rules since 2024 |

| Assets | 300+ cryptocurrencies | 350+ cryptocurrencies |

| Spot Fees | ~0.4% taker / 0.25% maker | ~0.1% taker / 0.08% maker |

| Derivatives | No | Futures/Perpetuals/Options |

| Staking | Yes | Yes |

| Proof of Reserves | Yes | Yes - audited regularly |

| Fiat Support | GBP/USD/EUR | GBP/USD/EUR |

| Best For | Beginners / Safe investing | Advanced traders / Low fees |

Audience Fit and Use Cases

Who should choose Coinbase?

Coinbase is ideal for beginners, long-term holders, and cautious UK investors prioritising safety. With FCA registration, insured custodial funds, and an intuitive app, it provides trust and simplicity. For anyone entering crypto for the first time, Coinbase is the stronger choice.

Who should choose OKX?

OKX suits experienced traders seeking advanced features, derivatives, and low fees. It offers broader trading tools but lacks Coinbase’s regulatory depth and ease of use. For UK users willing to complete FCA-mandated risk checks, OKX provides variety but is less beginner-friendly.

Which Platform is Safest?

Coinbase is the safer platform, backed by FCA registration, insurance on custodial assets, and transparent public reporting as a listed company. OKX also applies strong protections and publishes proof of reserves but has a shorter UK track record. For most investors, Coinbase offers stronger reassurance.

Fees and Costs

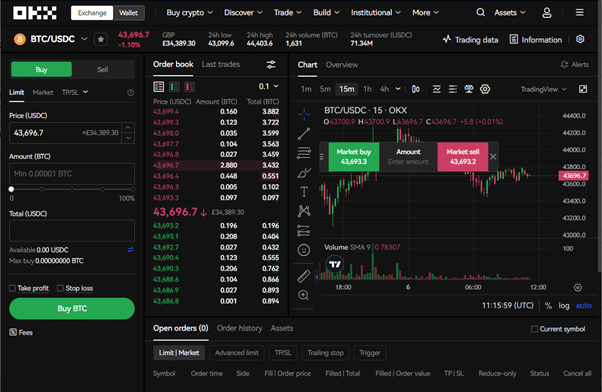

How do maker/taker spot fees compare?

OKX offers lower spot trading fees, around 0.1% taker and 0.08% maker, compared with Coinbase Advanced at 0.25% maker and 0.4% taker. OKX appeals to active traders, but for casual investors, Coinbase’s slightly higher fees are balanced by safety and simplicity.

Which platform is cheaper for futures, options, and margin?

Coinbase does not provide derivatives in the UK. OKX offers futures, perpetuals, and options at competitive fees under 0.05% for high-volume traders. For advanced strategies, OKX is cheaper and broader, but most UK retail investors will find Coinbase safer without leverage risks.

What deposit/withdrawal and FX conversion fees apply?

Coinbase charges spreads and FX fees on GBP-USD trades plus a small withdrawal cost. OKX also applies FX charges but has lower overall trading fees. For UK investors, Coinbase is more transparent with fiat payments, while OKX is cheaper but less straightforward.

| Fee Type | Coinbase | OKX |

|---|---|---|

| Spot Trading Fees | ~0.25% maker / ~0.40% taker | ~0.08% maker / ~0.10% taker |

| Futures / Derivatives | Not available | Futures / Perpetuals / Options <0.05% for high volume |

| Withdrawal Fees | Network fees apply | Network fees apply |

| Inactivity Fee | None | None |

| FX Conversion | Spread + variable fee | Variable fee (generally lower) |

| Deposit Methods | Bank transfer / Card / PayPal | Bank transfer / Card |

| Best For | Regulated beginners | Active low-fee traders |

Features and Asset Coverage

Which platform lists more coins and trading pairs?

OKX supports slightly more cryptocurrencies, with over 350 versus Coinbase’s 300. However, Coinbase focuses on regulated, established assets, while OKX lists riskier tokens. For UK investors, Coinbase’s curated approach is safer, whereas OKX suits traders chasing new, speculative opportunities.

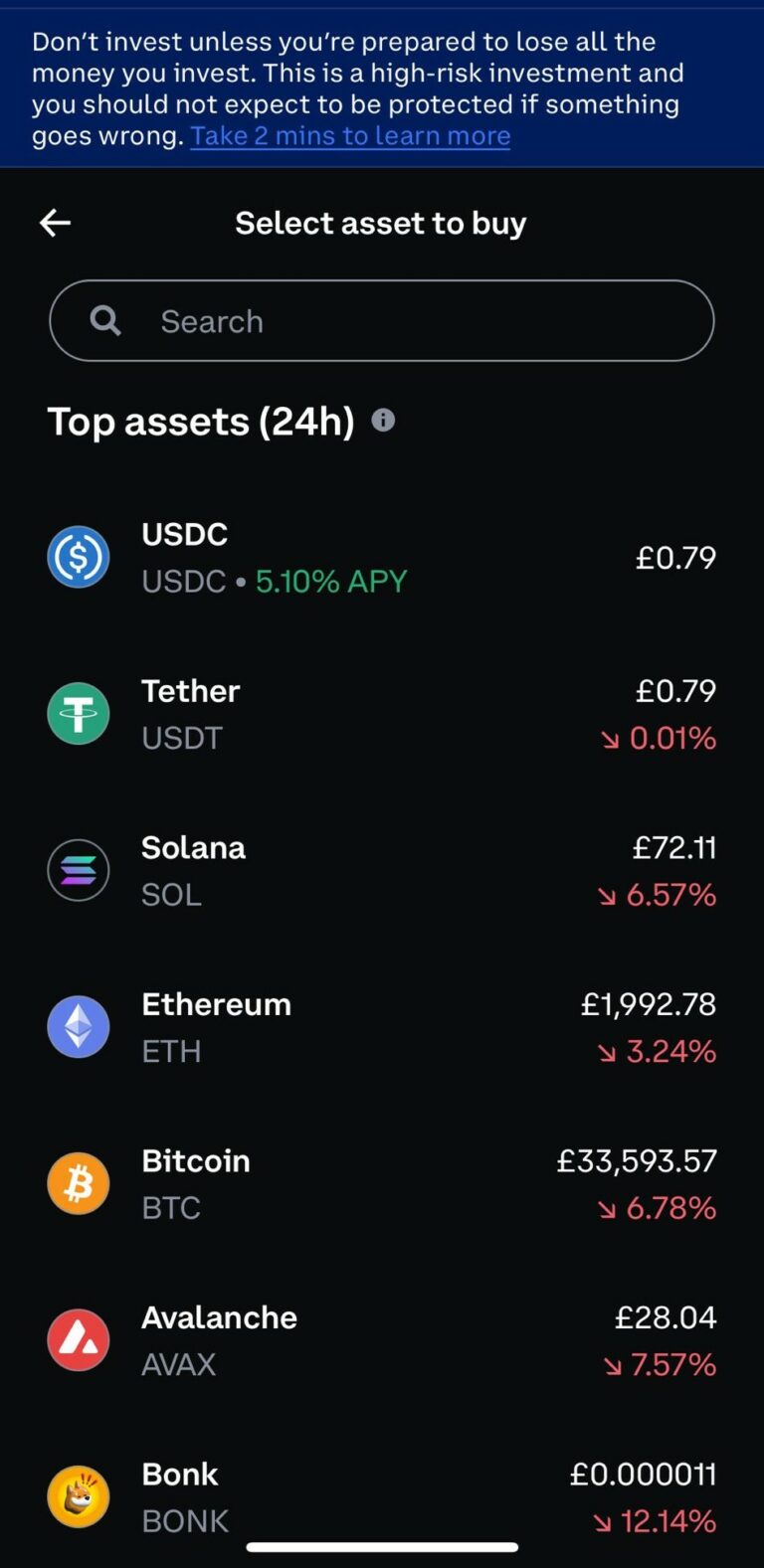

Do both support staking/earn products?

Yes. Coinbase offers staking for assets like ETH, SOL, and ADA with a simple interface. OKX provides broader staking and yield products across stablecoins and altcoins. For UK users, Coinbase prioritises transparency and regulation, while OKX offers higher potential returns with added complexity.

What derivatives are available?

Coinbase does not provide derivatives for UK investors. OKX offers futures, perpetuals, and options, appealing to professionals. While OKX is stronger for derivatives, Coinbase’s absence reinforces its role as a safer platform, avoiding products often linked to high risk.

Do they offer Web3 wallets, DeFi, or NFTs?

Coinbase has a dedicated Coinbase Wallet supporting DeFi, NFTs, and tokens. OKX integrates Web3 services into its platform, with NFT trading, DEX access, and launchpads. While OKX offers more integrated tools, Coinbase separates trading from DeFi for security and regulatory reasons.

Which Platform is More Intuitive to Use?

Which GBP/EUR/fiat payment methods are supported?

Coinbase supports UK bank transfers, debit cards, and PayPal deposits, giving investors multiple funding routes. OKX supports bank transfers and cards but fewer third-party options. For UK investors, Coinbase provides broader fiat payment choices with more transparency.

How fast are deposits and withdrawals?

Coinbase processes GBP transfers within one business day, with cards funding instantly. Withdrawals may take longer in peak demand but remain reliable. OKX transfers are efficient but vary by provider. For UK users, Coinbase offers faster and more consistent fiat transfers.

Are there limits or holds for new accounts?

Yes. Coinbase applies account limits based on verification, gradually increasing over time. OKX requires FCA-mandated questionnaires and cooling-off periods for new UK accounts. Both restrict new users, though Coinbase’s system is clearer and easier to navigate.

User Experience and Tools

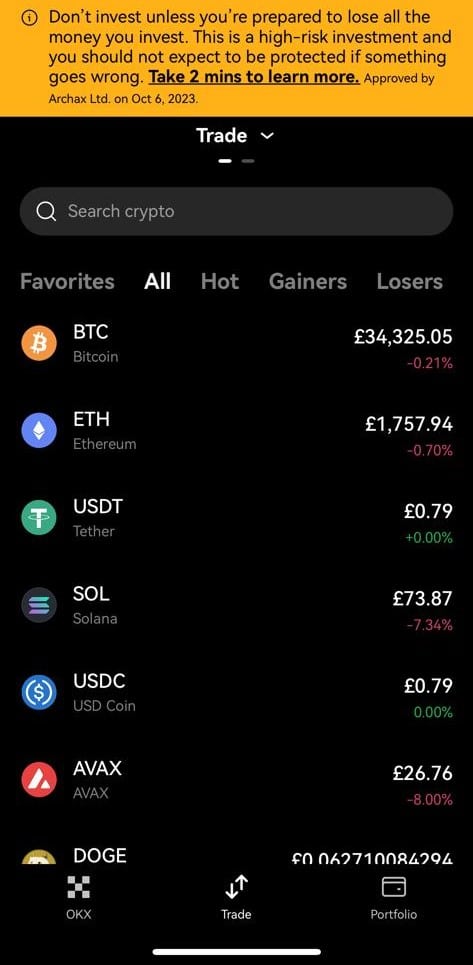

Which mobile app is easier for beginners?

Coinbase’s app is beginner-focused, with clean design and simple buy/sell buttons. OKX is feature-rich but complex for newcomers. For UK beginners, Coinbase’s interface provides clarity and ease, while OKX is suited for advanced traders who need powerful tools.

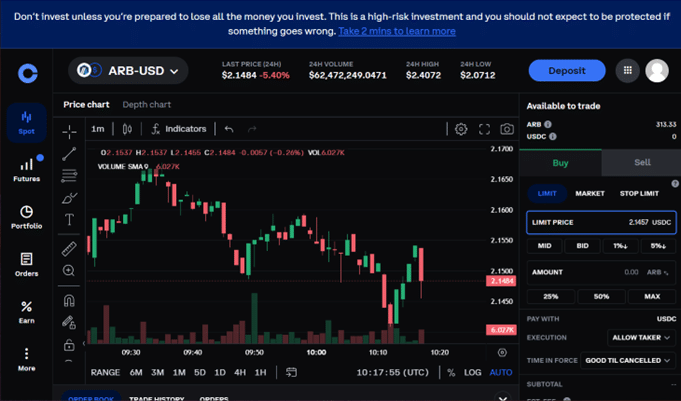

Which offers better charts, order types, and APIs?

OKX supports advanced charting, multiple order types, and API trading. Coinbase offers simpler tools, prioritising accessibility. Advanced UK traders benefit from OKX, but for most users, Coinbase’s clean design is preferable for long-term investing.

Are recurring buys, price alerts, and automation available?

Yes. Coinbase supports recurring buys and price alerts for passive investors, making dollar-cost averaging simple. OKX also offers advanced automation like trading bots and grid strategies. For UK beginners, Coinbase’s recurring features suffice, while OKX attracts active traders using automation.

Availability and Jurisdiction Considerations

Can you use OKX in the UK or US?

OKX is available in the UK with FCA compliance but not in the US. Coinbase is widely available in the UK, US, and EU. For global accessibility, Coinbase holds a clear advantage.

Is Coinbase available in your region with full features?

Yes. Coinbase operates in most regions, including the UK and US, offering spot trading, staking, and fiat funding. Some features vary by jurisdiction, but coverage remains broad. OKX’s reach is more restricted by regulation.

Are there regional restrictions on derivatives or staking?

Yes. Coinbase does not offer derivatives in the UK or US. OKX provides derivatives globally but faces restrictions under UK rules. Both limit features regionally, though Coinbase maintains clearer communication on compliance.

Customer Support, Education and Community

Which exchange has faster, more reliable support?

Coinbase provides 24/7 chat, email, and phone support, with mixed but generally stronger reviews than OKX. OKX support is multilingual but criticised for delays. UK investors typically find Coinbase’s customer service more reliable.

Which has better learning hubs and resources?

Coinbase Learn offers guides, quizzes, and rewards, making it beginner-focused. OKX Academy provides tutorials and market analysis but leans toward advanced traders. For UK newcomers, Coinbase education is stronger, helping them build confidence.

How do Trustpilot ratings and user sentiment compare?

Coinbase scores 4.0/5 on Trustpilot from 19,000+ reviews, reflecting trust and ease of use. OKX averages 3.2/5 from 1,600 reviews, with concerns about withdrawals and support. Sentiment shows Coinbase enjoys stronger trust among UK users.

Final Verdict

Coinbase remains the stronger crypto exchange for UK investors who prioritise regulation, security, and ease of use. OKX delivers lower fees and advanced trading tools aimed at professionals, but its added complexity and comparatively weaker trust perception limit its wider appeal. For beginners and long-term holders in 2026, Coinbase continues to offer a safer and more dependable choice.

Not Sure Which Platform to Choose?

Answer 5 quick questions and we’ll provide a personalised recommendation for the best options tailored to your specific needs and experience level.

Buy, sell, and grow crypto simply

- Invest from £2

- 300+ Tradable Coins

- Over 10 Million Users

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

FAQs

Is Coinbase better than OKX for beginners?

Yes. Coinbase is designed for simplicity, with FCA registration, insured funds, and clear learning tools. OKX is more complex and suited for advanced users. For UK beginners, Coinbase is the stronger choice.

Which has lower fees overall?

OKX is cheaper, with taker fees around 0.1% compared with Coinbase’s 0.4%. However, Coinbase’s higher fees fund regulation, insurance, and stronger protection. For UK investors, the extra cost often justifies the added security.

Which is safer for holding large balances?

Coinbase is safer, backed by FCA registration, insurance, and segregated client funds. OKX uses proof of reserves but lacks Coinbase’s global regulatory depth. For UK investors with significant holdings, Coinbase offers greater reassurance.

Does either platform offer proof of reserves?

Yes. Coinbase publishes detailed financial disclosures as a publicly listed company, alongside proof of reserves. OKX also provides regular third-party audits. Both are transparent, but Coinbase’s public reporting provides stronger reassurance for UK investors.

References

https://www.coindesk.com/policy/2025/02/03/coinbase-secures-spot-on-uk-crypto-register

https://uk.trustpilot.com/review/coinbase.com

https://uk.finance.yahoo.com/news/protocol-okx-slashes-native-token-171259692.html