Does IG Have an ISA in 2026?

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: Does IG Offer an ISA?

Yes — IG offers a Stocks and Shares ISA that lets you invest up to £20,000 per tax year with tax-free gains. It's FCA-regulated, competitively priced, and gives you access to UK and US shares, ETFs, and investment trusts. If you're an active trader looking for a straightforward ISA with low dealing fees, IG is worth considering.

IG ISA – Quick Overview

| Feature | Details | Verdict |

|---|---|---|

| ISA Type | Stocks and Shares ISA | ✓ |

| Annual Allowance | £20,000 | ✓ |

| Custody Fee | 0.25% (capped at £24/quarter) | ✓ |

| Commission | £3 per trade | ✓ |

| Investments Available | UK & US shares, ETFs, investment trusts | ✓ |

| Minimum Deposit | None | ✓ |

What Type of ISA Does IG Offer?

IG provides a Stocks and Shares ISA — not a Cash ISA or Lifetime ISA. This means your money is invested in the stock market rather than sitting in a savings account. It’s designed for people who want to grow their wealth over time through shares and funds, with the benefit of tax-free returns. If you’re relatively new to investing, I cover how the broader IG platform handles the learning curve for beginners in a separate guide.

What Can You Invest in with IG's ISA?

You can invest in UK shares, US shares, ETFs, and investment trusts. The range covers most major markets and gives you flexibility to build a diversified portfolio. However, IG doesn't offer funds or OEICs within the ISA, so it's best suited for those who prefer picking individual stocks or ETFs.

Is IG's ISA Flexible?

Yes. IG offers a flexible ISA, which means you can withdraw money and replace it within the same tax year without affecting your annual allowance. This is useful if you need temporary access to your funds but still want to maximise your tax-free investing.

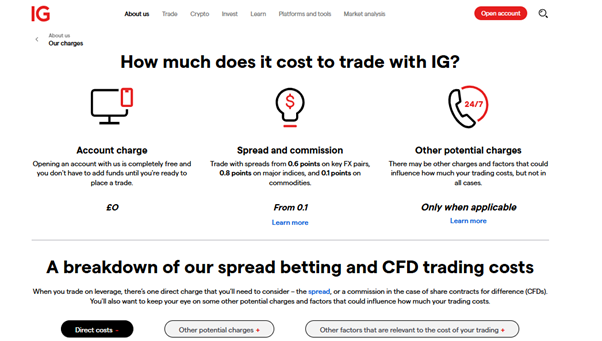

How Much Does IG's ISA Cost?

IG keeps its ISA pricing simple and transparent. There are two main costs to consider: an annual custody fee for holding your investments, and a commission each time you buy or sell. Both are competitive compared to traditional brokers.

What Are the Custody Fees?

IG charges a 0.25% annual custody fee on the value of your ISA holdings. This is capped at £24 per quarter, which means you'll never pay more than £96 per year regardless of how large your portfolio grows. For bigger portfolios, this cap makes IG more cost-effective than percentage-based competitors.

How Much Are Trading Commissions?

Each trade costs £3 for UK and US shares. That’s significantly cheaper than many traditional brokers like Hargreaves Lansdown. If you trade frequently, those savings add up quickly — and if you’re interested in more active strategies, I look at how IG’s fee structure holds up for higher-frequency day trading as well. IG also offers a Smart Portfolio option with no dealing fees if you prefer a managed approach.

IG ISA Fees vs Competitors

| Provider | Custody Fee | UK Share Dealing | US Share Dealing | Fee Cap |

|---|---|---|---|---|

| IG | 0.25% | £3 | £3 | £24/quarter |

| Hargreaves Lansdown | 0.45% | £11.95 | £11.95 | £45/year (shares) |

| AJ Bell | 0.25% | £5 | £5 | £3.50/month |

| Interactive Investor | £4.99/month | £3.99 | £3.99 | Flat fee |

How Does IG's ISA Compare to Competitors?

IG sits in the middle ground between premium brokers and budget platforms. It’s cheaper than Hargreaves Lansdown for active traders, but not quite as low-cost as some commission-free apps. The balance of price, platform quality, and reliability makes it a solid all-rounder. For a broader look at how IG compares on features beyond ISAs, my eToro vs IG comparison covers the key differences.

Is IG Cheaper Than Hargreaves Lansdown?

Yes, by a fair margin. IG charges £3 per trade versus £11.95 at Hargreaves Lansdown. The custody fee is also lower at 0.25% compared to 0.45%. If you're making regular trades, IG could save you hundreds of pounds per year in fees alone.

Who Offers Better Value for Beginners?

For beginners making occasional trades, IG remains competitive. However, if you're investing small amounts monthly, platforms like InvestEngine or Trading 212 offer commission-free ISAs that might work out cheaper. It depends on how often you trade and how hands-on you want to be.

What Are the Benefits of IG's ISA?

The main draw is tax-free investing wrapped in a reliable, well-established platform. IG has been around for decades and is fully FCA-regulated, which provides peace of mind that newer fintech apps can’t always match. I go into more detail on IG’s regulation and fund protection in my dedicated safety review.

How Does Tax-Free Investing Work?

Any gains you make inside an ISA are free from capital gains tax, and dividends aren't subject to dividend tax. You can invest up to £20,000 each tax year, and there's no limit to how much your ISA can grow over time. It's one of the most tax-efficient ways to invest in the UK.

Can You Transfer an Existing ISA to IG?

Yes. IG accepts ISA transfers from other providers. The process typically takes two to four weeks depending on your current provider. You can transfer in cash or, in some cases, move existing holdings across without selling them first.

Where Does IG's ISA Fall Short?

IG’s ISA isn’t perfect for everyone. There are a few limitations worth knowing before you commit, particularly around the types of investments available and how costs stack up for certain investing styles. If you’re more interested in leveraged trading than long-term investing, IG’s spread betting service might be a better fit.

Is the Investment Range Limited?

Compared to some competitors, yes. IG doesn't offer funds or OEICs in its ISA — only shares, ETFs, and investment trusts. If you want access to a wide range of managed funds, platforms like Hargreaves Lansdown or AJ Bell offer more choice.

Are There Cheaper Alternatives?

For buy-and-hold investors, commission-free platforms like Trading 212 or InvestEngine may work out cheaper. And for very large portfolios, flat-fee brokers like Interactive Investor can offer better value than percentage-based custody fees, even with IG's cap.

Who Is IG's ISA Best Suited For?

IG’s ISA works well for active traders who want access to UK and US shares at a reasonable cost. It suits mid-sized portfolios where the custody fee cap provides good value, and those who prefer a trusted, established platform over newer app-based alternatives. It’s less ideal for passive investors focused on funds, or those seeking the absolute lowest fees. Note that crypto assets can’t be held inside an ISA — if you’re interested in digital currencies, IG offers that through a separate crypto trading account.

What Are the Biggest Advantages and Drawbacks of IG’s ISA?

Pros and Cons of Using IG’s Stocks and Shares ISA

Pros

- Low £3 dealing fee undercuts most traditional ISA providers significantly

- Custody fee capped at £24 per quarter, great value for larger portfolios

- Flexible ISA allows withdrawals and re-deposits within the same tax year

- FCA-regulated with FSCS protection and a 50-year track record of stability

Cons

- No funds or OEICs available — limited to shares, ETFs, and investment trusts

- Not the cheapest option for buy-and-hold investors making very few trades

- No Lifetime ISA or Junior ISA available through IG

- Platform can feel complex if you only want simple, passive investing

Final Verdict – Should You Open an ISA with IG?

IG offers a solid Stocks and Shares ISA with competitive fees, a flexible structure, and access to a decent range of investments. It’s not the cheapest option for passive investors, and the lack of funds may be a dealbreaker for some. But for active share traders who value platform reliability, IG strikes a good balance between cost and quality.

If you’re already using IG for trading or spread betting, adding an ISA keeps everything in one place. For a full breakdown of the platform, see my complete IG review.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

FAQs

Does IG offer a Lifetime ISA?

No. IG only offers a Stocks and Shares ISA. If you’re looking for a Lifetime ISA to save for your first home or retirement, you’ll need to look at other providers like AJ Bell or Hargreaves Lansdown.

What is the minimum deposit for IG’s ISA?

There’s no minimum deposit required to open an ISA with IG. You can start with whatever amount suits you and add more over time, up to the £20,000 annual allowance.

Can I hold funds in IG’s ISA?

No. IG’s ISA is limited to shares, ETFs, and investment trusts. If you want to invest in mutual funds or OEICs, you’ll need to choose a different provider.

Is IG’s ISA any good for beginners?

It can be. The platform is well-designed and the fees are reasonable. However, beginners focused on simple, low-cost investing might find commission-free alternatives easier to start with.

Can I transfer my existing ISA to IG?

Yes. IG accepts ISA transfers from other providers. The process typically takes two to four weeks. You can transfer in cash or, in some cases, move existing holdings across without selling them first.

What is the annual ISA allowance for 2025/26?

The annual ISA allowance is £20,000 for the 2025/26 tax year. This is the total you can invest across all ISA types combined, not per ISA account.

Does IG’s ISA charge an inactivity fee?

No. IG does not charge an inactivity fee on its Stocks and Shares ISA. The only ongoing cost is the 0.25% annual custody fee, capped at £24 per quarter.

Can I buy US shares in IG’s ISA?

Yes. IG’s ISA gives you access to both UK and US shares, along with ETFs and investment trusts. US share trades cost £3 per deal, the same as UK shares.

Is IG’s ISA flexible?

Yes. IG offers a flexible ISA, meaning you can withdraw and reinvest within the same tax year without it counting against your annual allowance. This is useful if you need temporary access to your funds.

Is my money protected in IG’s ISA?

Yes. IG is FCA-regulated and your investments are held in segregated accounts. You’re also covered by the FSCS up to £85,000 if IG were to become insolvent. This does not protect against investment losses.

References

- ✓ 17,000+ markets including shares & forex

- ✓ ProRealTime & MT4 platform access

- ✓ Weekend & out-of-hours trading

68% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

68% of retail CFD accounts lose money.