eToro Copy Trading Review UK 2025 – Is It Safe & Worth It?

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII · 12+ years in financial analysis

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- 50+ platforms tested · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- 40+ brokers tested · Active investor since 2013

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII · 12+ years in financial analysis

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- 50+ platforms tested · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- 40+ brokers tested · Active investor since 2013

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

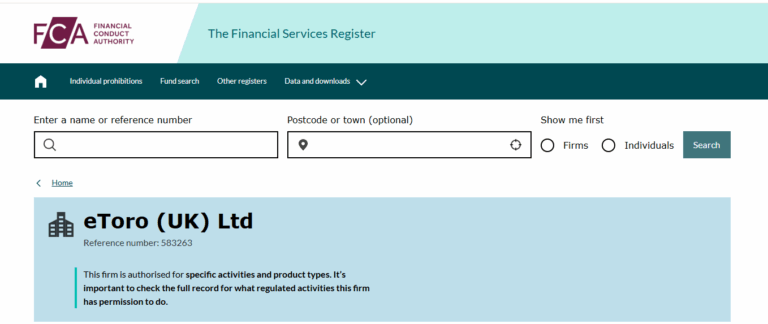

FCA Register verification · FSCS protection (£120,000 per person)

Testing team:

Adam Woodhead, Thomas Drury (Chartered ACII), Dom Farnell — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Affiliate disclosure. Some links earn commission at no cost to you. This doesn't affect our ratings.

Contact: info@theinvestorscentre.co.uk

Quick Answer: Is eToro Copy Trading Worth It?

eToro copy trading is worth considering for UK users seeking a hands-off investing experience. It allows you to mirror top-performing traders automatically. It’s beginner-friendly, FCA-regulated, and best for those wanting exposure without managing trades directly. Risk varies by strategy and trader selection.

Authors Comments:

eToro’s Copy Trading remains one of the most intuitive and transparent tools for UK investors. Its regulated framework, user-friendly design, and vast community of traders make it ideal for beginners seeking passive exposure—provided users apply sound risk management and selective trader research. – Thomas Drury

Quick Verdict

| Category | Verdict |

|---|---|

| Overall Rating | 4.9 / 5 |

| Best For | Beginner and passive UK investors |

| Regulation | FCA Regulated |

| Ease of Use | Excellent – intuitive interface |

| Minimum Deposit | $50 |

| Verdict Summary | Highly recommended for those seeking a safe, social, and low-effort investing experience. |

Get Up To $500

Worth In Free Assets

- New users only

- Choose from 6 select stocks & ETFs

- Not valid for ISA accounts

Terms apply. This bonus does not include ISA deposits.

Your capital is at risk.

What Is eToro Copy Trading?

eToro’s copy trading lets you choose verified investors to follow. Once selected, your account automatically replicates their trades in real time, proportionally based on your allocated amount. You maintain full control and can stop copying or withdraw funds at any time.

What makes eToro different from other platforms?

Unlike traditional platforms, eToro combines regulated investing with social trading tools. You can view trader stats, risk scores, and historical performance before copying. It’s fully integrated—no third-party tools required. UK users benefit from FCA oversight and an intuitive, mobile-friendly interface.

Is copy trading suitable for beginners?

Yes. Copy trading is ideal for beginners who want market exposure without learning complex strategies. eToro simplifies investing through risk ratings, performance data, and a user-friendly dashboard. Still, results depend on who you copy, so research is key to success.

How to Use eToro Copy Trading (Step-by-Step)

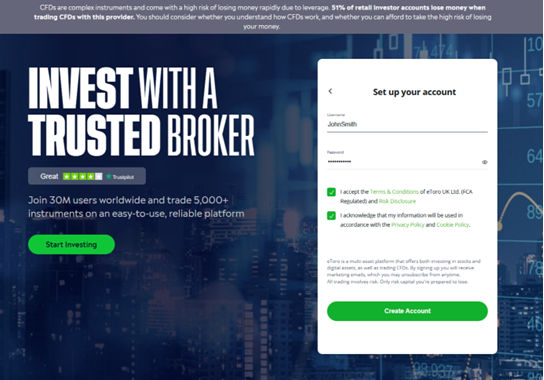

Step 1 – Open a Free eToro Account

To verify your eToro account in the UK, you’ll need a valid photo ID (passport or driver’s licence) and a recent proof of address, such as a bank statement or utility bill. eToro uses these to meet FCA anti-money laundering regulations.

Can you try copy trading on demo mode?

Yes, eToro offers a £100,000 virtual demo account. You can explore copy trading risk-free, test investor performance, and understand how strategies behave in real time—without using real money. This is ideal for UK beginners before committing real capital.

Step 2 – Browse and Select Top Investors

Traders on eToro are ranked using a combination of performance, risk score, average returns, number of copiers, and activity level. These are presented transparently in a dedicated dashboard, making it easy for UK users to compare and filter top-performing investors.

What metrics should I evaluate?

Key copy trading metrics include 12-month return, average monthly risk score (0–10), drawdown, portfolio allocation, and how long they’ve been active. Also check number of open trades, recent performance trends, and whether they’re diversified across markets or highly concentrated.

Step 3 – Set Your Copy Amount and Risk Controls

The minimum amount to copy a trader on eToro is $200 (around £150). This ensures diversification across trades. You can set stop-loss limits to control risk and pause copying anytime. The amount is fully allocated to mirror the trader’s live positions.

Can I stop copying at any time?

Yes, you can stop copying instantly. When you do, eToro automatically closes all open copied trades and returns your funds to your available balance. You keep full control and can exit at any time—ideal for active risk management or changing strategies.

Step 4 – Monitor and Adjust Your Portfolio

eToro allows you to copy up to 100 traders simultaneously, helping you diversify across strategies, assets, and risk profiles. You can allocate different amounts to each trader and manage your portfolio from one dashboard for better control and balance.

What happens during market volatility?

During volatility, copied trades execute in real time, just like manual ones. High-risk traders may see sharp swings. eToro’s risk score helps you avoid overly aggressive profiles. You can pause or adjust your copying settings to reduce exposure during unstable periods.

How Are Top Traders on eToro Selected?

eToro’s Popular Investor Program rewards experienced traders who are copied by others. These traders earn monthly payments and tiered perks based on assets under copy (AUC). To qualify, they must maintain consistent performance, responsible risk scores, and meet community and activity standards.

How transparent are their trading stats?

eToro provides full transparency. You can view each trader’s historical returns, monthly performance, asset allocation, number of copiers, average risk score, and open trades. This helps UK users make informed decisions and assess trading consistency before committing real funds.

Can anyone become a Popular Investor?

Yes, any eToro user can apply to become a Popular Investor, but they must meet strict criteria. This includes maintaining a low-to-moderate risk score, positive trading history, and community engagement. The program is designed to reward skilled, disciplined, and trustworthy traders.

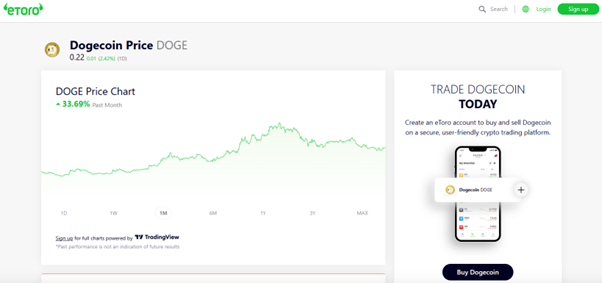

eToro Copy Trading Fees Explained

There are no hidden copy trading fees on eToro. You don’t pay management or performance charges. However, standard trading costs like spreads, overnight fees, and currency conversion may still apply depending on the assets your copied trader holds.

How does eToro make money from copy trading?

eToro earns revenue from spreads, overnight financing, and currency conversion—not directly from copy trading. The platform also benefits from higher user engagement and trade volume when users copy top investors, keeping more users active on the platform longer.

Are spreads and overnight fees applied?

Yes, standard trading costs apply. You’ll pay the same spreads and overnight fees as if you placed the trades manually. These fees are automatically deducted from your copied positions and vary by asset type, especially on leveraged or volatile instruments.

Pros and Cons of eToro Copy Trading

| Pros | Cons |

|---|---|

| Simple for beginners | Past performance doesn’t guarantee results |

| No management fees | Limited control once copying starts |

| Access to real-time trader data | Some traders take high-risk strategies |

| Built-in demo and risk controls | Weekend support is limited |

Is eToro Safe and Regulated in the UK?

Yes, eToro is fully FCA-regulated under eToro (UK) Ltd, giving UK users strong investor protections. This means it follows strict rules on financial conduct, customer verification, and anti-money laundering compliance—providing a high level of operational trust and transparency.

How is client money protected?

Yes. eToro’s copy trading is backed by real-time execution, full performance transparency, and built-in risk scores. The platform doesn’t guarantee profits, but offers tools to minimise risk, such as stop-loss settings and manual control to stop copying anytime.

Final Thoughts

eToro copy trading is ideal for UK beginners and passive investors who want exposure to financial markets without trading manually. It’s FCA-regulated, simple to use, and offers transparency. Active traders or those seeking full control may prefer direct trading strategies instead.

eToro is a multi-asset platform which offers both investing in stocks and

cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money

rapidly due to leverage. 61% of retail investor accounts lose money when

trading CFDs with this provider. You should consider whether you

understand how CFDs work, and whether you can afford to take the high risk

of losing your money.

This communication is intended for information and educational purposes

only and should not be considered investment advice or investment

recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your

investments may go up or down. Your capital is at risk.

Donʼt invest unless youʼre prepared to lose all the money you invest. This is a

high-risk investment and you should not expect to be protected if something

goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and

assumes no liability as to the accuracy or completeness of the content of this

publication, which has been prepared by our partner utilizing publicly

available non-entity specific information about eToro.

Get Up To $500

Worth In Free Assets

- New users only

- Choose from 6 select stocks & ETFs

- Not valid for ISA accounts

Terms apply. This bonus does not include ISA deposits.

Your capital is at risk.

FAQs

Is eToro copy trading legal in the UK?

Yes. eToro copy trading is fully legal and FCA-regulated in the UK. It complies with financial promotion and consumer protection laws, offering a secure, transparent way to access the markets through regulated social investing.

Can you make money copy trading?

Yes, many users profit through copy trading, but returns are not guaranteed. Your performance depends entirely on the traders you copy. Smart selection, diversification, and active monitoring can improve results—but always understand the risk of loss, especially during market volatility.

What happens if a trader you copy loses money?

If a copied trader loses money, your portfolio reflects the same percentage loss. The system automatically mirrors their trades. However, you can pause or stop copying at any time to limit further downside and protect remaining capital.

Can you withdraw funds while copy trading?

Yes, you can withdraw available funds at any time. If the funds are tied up in open copied trades, you’ll need to stop copying or reduce your copy allocation first. Withdrawals are typically processed within 1–2 business days.