Does eToro Pay Interest on Your Uninvested Cash?

This information was correct as the time of writing. Actual rates are subject to change. For current rates always check with eToro.

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer – Does eToro Offer Interest on Your Cash?

Yes. eToro pays 4.05% annual interest on eligible uninvested USD balances. The rate is credited monthly, automatically, and requires no lock-in. The feature is available to retail users in supported regions under FCA and ESMA regulation.

This information was correct at the time of writing. Actual rates are subject to change. For current rates always check with eToro.

What Is eToro's USD Balance Interest Program?

eToro's interest feature rewards users for maintaining idle USD cash balances. Interest accrues daily and is credited automatically each month. This initiative allows investors to benefit from their uninvested funds while waiting for market opportunities — an efficient way to stay both liquid and productive.

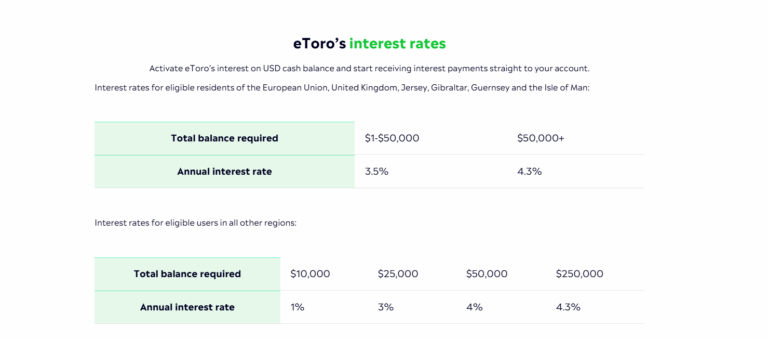

Who Can Access It in the UK and EU?

Eligible eToro account holders in the UK, EU, Jersey, Gibraltar, Guernsey, and the Isle of Man can use the feature. The minimum balance required is just $1, and there's no restriction on withdrawing or using your funds.

Who Qualifies for Interest Payments in the UK and EU?

UK and EU retail clients are eligible when holding uninvested USD in their accounts. The feature excludes CFD margin balances, open trades, and funds in non-USD currencies. There's no minimum requirement — any positive USD balance qualifies for daily interest accrual.

Summary of eToro Interest on Cash

| Account Type | Interest Rate | Base Currency | Payment Frequency |

|---|---|---|---|

| Standard Retail | 4.05% | USD | Monthly |

| Club Members (Silver+) | 4.05% | USD | Monthly |

| Institutional Accounts | N/A | USD | Not applicable |

What Are the Current UK/EU Rates?

UK and EU users can earn up to 4.05% APY on their USD balance. The rate depends on your total balance, with higher amounts unlocking the maximum rate. Interest is paid monthly and calculated daily for accuracy.

How to Activate Your Interest on Cash

- Log in to your eToro account

- Open the Club Dashboard

- Toggle "Interest on USD Cash Balance"

- Start earning monthly interest on your eligible USD funds immediately.

Does eToro Pay Interest on GBP?

No. eToro currently pays 4.05% interest on uninvested USD balances only. GBP and EUR balances held by UK or EU users do not earn interest. To benefit, UK clients can hold cash in USD — interest is calculated daily and paid monthly to eligible balances.

How to Access eToro's Interest on Cash as a UK Customer?

To earn interest, UK users must hold uninvested USD in their eToro account. Funds can be converted from GBP at market FX rates within the platform. Once held in USD, interest accrues automatically, credited monthly without any additional action required.

Who Is This Feature Best For?

This feature benefits anyone holding USD in their account — from active traders wanting extra yield on idle cash to passive investors seeking low-effort returns.

| Type | Suitable? | Reason |

|---|---|---|

| Active Traders | Yes | Earn on idle USD |

| Passive Holders | Yes | Steady; no lock-in |

| Beginners | Yes | Easy setup |

What Are the Pros and Cons of eToro's Interest on Cash?

Pros:

- Competitive 4.05% rate on USD

- Automatic, no activation required

- Daily accrual and monthly payout

- FCA and ESMA regulated protection

Cons:

- USD only; GBP/EUR excluded

- No compounding beyond monthly

- Ineligible on CFD balances

How Does eToro's Interest Compare to Other Platforms?

eToro's 4.05% USD rate is competitive across major platforms. It trails Lightyear's GBP rate but exceeds average savings rates on most exchanges. The automatic accrual and lack of lock-ins make it an attractive option for investors seeking simplicity and stable returns.

eToro vs Competitor Interest Rates (2026)

| Platform | Interest Rate | Currency | Availability |

|---|---|---|---|

| eToro | 4.05% | USD | Automatic for retail users |

| Lightyear | Up to 5.00% | GBP/EUR/USD | Standard for all users |

| Trading 212 | Up to 5.10% | GBP/EUR/USD | Automatic with balance |

| Freetrade | 4.70% | GBP | Plus members only |

| Revolut | 3.75% | GBP/EUR | Premium tiers only |

Table summary: 2026 uninvested cash interest rates across top UK and EU brokers.

Final Verdict – Is It Worth Activating?

For UK and EU traders holding idle USD balances on eToro, this feature offers an easy, low-effort way to earn up to 4.05% APY. With no lock-in and monthly payouts, it's a smart choice for maximising uninvested funds.

FAQs

Can I earn interest on currencies other than USD?

No — the interest feature currently applies only to your available USD cash balance on eToro.

How often is interest paid into my account?

Interest is calculated daily and paid into your eToro balance once per month.

Do I need to lock my funds to earn interest?

No — your funds remain accessible at all times, with no lock-in period.

How do I track my earnings?

Interest appears in your account's "Available Cash" ledger each month.

References

- ✓ Deposit £500–£999 → Get £40

- ✓ Deposit £1k–£4,999 → Get £100

- ✓ Deposit £5k–£9,999 → Get £300

- ✓ Deposit £10,000+ → Get £500

61% of retail CFD accounts lose money when trading CFDs with this provider.