eToro vs Robinhood UK - Which Is Better in 2026?

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: Which is Better, eToro or Robinhood?

Both eToro and Robinhood are accessible to UK users, but they serve different types of investors. eToro stands out with its wider range of global assets, FCA regulation, and distinctive social trading features, while Robinhood focuses on straightforward, commission-free stock dealing with a more limited overall offering.

For UK investors who value choice, regulatory protection, and advanced functionality, eToro is generally the more comprehensive platform, whereas Robinhood mainly suits those looking for simple, low-cost equity trades.

Top Rated

Top Rated

Regulated social trading with 30M+ users. Trade stocks, crypto, and ETFs in one sleek interface.

61% of retail CFD accounts lose money when trading CFDs with this provider.

Introduction

eToro and Robinhood are both well-known trading apps, but their appeal to UK investors differs significantly. eToro offers access to global markets, built-in social trading features, and the reassurance of FCA regulation.

Robinhood, which has only recently entered the UK market, focuses on commission-free trading through a polished mobile app but provides a more limited feature set. For most UK investors looking for flexibility, protection, and depth, eToro remains the more well-rounded option. See our full eToro review here.

How Do eToro and Robinhood Compare at a Glance?

| Feature | eToro | Robinhood |

|---|---|---|

| Trustpilot Score | 4.1/5 (25k+ reviews) | 1.2/5 (4k+ reviews) |

| Availability | UK + 140 countries | UK + US |

| Trading Fees | Spreads + $5 withdrawal | Commission-free |

| Assets | Stocks/ETFs/Crypto/Forex/Commodities | Stocks/ETFs/Crypto/ADRs |

| Social Trading | Yes | No |

| Regulation | FCA; CySEC; ASIC; SEC | FCA; SEC; FINRA |

| Withdrawal Fees | $5 fixed fee (non-US) | $100 ACAT transfer |

| Best For | Global investors & social traders | Cost-conscious beginners |

Platform Overviews – eToro vs Robinhood

What is eToro and how does it work?

eToro is a multi-asset trading platform available in over 140 countries. It offers stocks, ETFs, crypto, and forex, with FCA oversight in the UK. Its standout feature is social trading, where users can copy experienced investors. For UK traders, eToro balances innovation with strong regulatory protection.

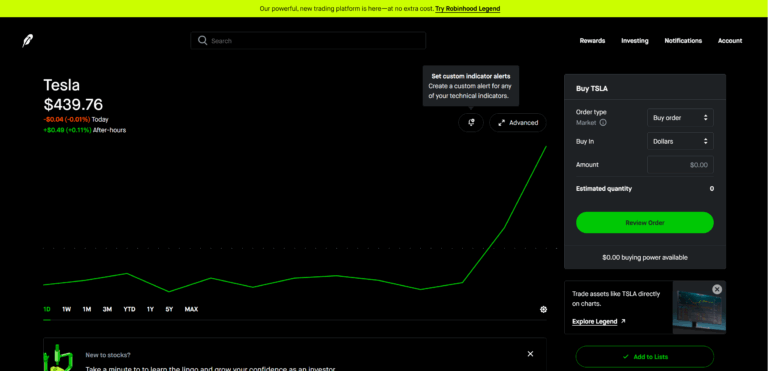

What is Robinhood and how does it work?

Robinhood is a US-born trading app offering commission-free trades in stocks, ETFs, and crypto. It expanded to the UK in 2024, targeting beginners with a simple interface. While cheap and easy to use, Robinhood lacks the broader asset range and community features that eToro provides.

Where is eToro vs Robinhood available in 2026?

eToro operates in the UK and more than 140 countries worldwide. Robinhood is available in the UK and US but has little global reach beyond these markets. For UK investors seeking global exposure and FCA-regulated stability, eToro remains the more established choice.

Who Is Each Broker Best Suited For?

Who Should Choose eToro?

eToro is ideal for UK investors wanting global exposure, copy trading, and FCA-regulated protection. It supports Stocks and Shares ISAs through Moneyfarm, plus diverse assets like forex and commodities. Beginners benefit from demo accounts, while experienced traders enjoy CFDs and advanced tools.

Who Should Choose Robinhood?

Robinhood suits beginners prioritising low costs and a clean, intuitive app. Its commission-free model is attractive for stock and ETF trades. UK investors focusing on US and UK equities may prefer Robinhood's simplicity, though its limited asset range and weaker support reduce appeal compared with eToro.

Fees and Costs

Which Broker Has Lower Fees in 2026?

Robinhood is cheaper for stock and ETF trades, offering commission-free pricing. eToro charges spreads and a $5 withdrawal fee, plus inactivity costs after 12 months. However, eToro's wider range of markets offsets fees. For pure cost efficiency, Robinhood wins, but eToro offers greater overall value.

How do trading fees compare?

Robinhood offers commission-free trading on stocks and ETFs, appealing to beginners. eToro charges spreads and a $5 withdrawal fee but provides access to more assets, including crypto, forex, and commodities. While Robinhood is cheaper for basic trades, eToro offers better overall value for diverse portfolios.

What about account, inactivity, and withdrawal fees?

eToro applies a $10 inactivity fee after 12 months and a $5 withdrawal fee. Robinhood has no inactivity fee but charges $100 for ACAT transfers. For active traders, costs remain modest on both platforms, though eToro's predictable structure suits UK investors long-term.

How do FX conversion fees compare?

Robinhood supports GBP accounts for UK users, reducing conversion costs for US trades. eToro applies variable GBP/USD conversion fees. While Robinhood is slightly cheaper for FX, eToro offsets this with its broader market access, including UK and European stocks.

Fees Comparison Table

| Fee Type | eToro | Robinhood |

|---|---|---|

| Trading Fees | Spreads on trades | Commission-free |

| Withdrawal Fee | $5 fixed | $100 ACAT transfer |

| Inactivity Fee | $10/month after 12 months | None |

| FX Conversion | Variable fee for GBP/USD | Lower for UK accounts |

| Other Costs | Overnight CFD fees | $5/month for Robinhood Gold |

Which Platform is Best for Beginners?

Both eToro and Robinhood suit beginners, but eToro offers more support. With demo accounts, social trading, and FCA regulation, eToro helps UK newcomers learn safely. Robinhood's clean design and commission-free trades are appealing, but its limited education and narrower assets make eToro the stronger choice overall.

Which platform has better learning tools and support?

eToro offers learning hubs, guides, and a vibrant social trading community. Robinhood provides only basic resources and has weaker support ratings. For UK beginners wanting more than just cheap access, eToro offers a more supportive environment to develop investing skills.

Which Platform is More Intuitive to Use?

Which app has a better design?

Robinhood is praised for its simplicity and smooth app design. eToro is also easy to use but offers additional functionality through social trading and global assets. For UK traders, Robinhood is simpler, but eToro combines usability with more features.

How do order types and execution compare?

eToro provides market, limit, and stop-loss orders, giving traders control. Robinhood supports only basic order types, prioritising simplicity. For UK investors who want flexibility in how trades are executed, eToro offers more robust options than Robinhood.

Which platform offers fractional shares?

Both platforms allow fractional investing, making expensive stocks affordable. This helps beginners diversify portfolios with small sums. UK users can use either platform for fractional shares, but eToro's wider asset choice makes this feature more powerful.

Account Types and Safety

Which Broker Is Safer and More Regulated?

eToro is FCA regulated in the UK with FSCS protection up to £85,000. It has a long track record globally across 140+ countries. Robinhood is also FCA regulated in the UK but is newer, with limited UK history. For proven reliability, eToro is stronger.

Does either platform offer tax-efficient accounts like ISAs or IRAs?

eToro offers UK investors ISAs through its Moneyfarm partnership, adding tax-efficient investing options. Robinhood supports IRAs in the US but does not offer ISAs in the UK. For tax planning, eToro is the clear winner.

How does investor protection compare (FSCS vs FDIC/SIPC)?

eToro provides FSCS protection up to £85,000 in the UK. Robinhood also operates under FCA oversight, but ISA support is absent. In the US, Robinhood provides SIPC cover. For UK investors, eToro offers stronger local protection.

Which Platform Has a Broader Asset Range?

Which Has a Better Asset Range?

eToro offers global stocks, ETFs, forex, commodities, and crypto, alongside ISA integration for UK investors. Robinhood covers mainly US and UK stocks, ETFs, and a smaller crypto list. For asset variety and international exposure, eToro clearly outperforms Robinhood in the UK.

Can you trade international stocks?

Yes. eToro offers access to UK, US, and global markets, making it ideal for diversified portfolios. Robinhood primarily focuses on US equities with limited UK exposure. For UK investors who want international reach, eToro is clearly the stronger choice.

Are ETFs and funds available?

Both platforms offer ETFs. eToro goes further by offering CFDs and managed portfolios tailored for UK users. Robinhood limits ETFs to US markets. For investors seeking variety and professional portfolio options, eToro is far more comprehensive than Robinhood.

Which has better crypto offerings?

eToro provides a broader range of cryptocurrencies, regulated under UK frameworks. Robinhood also supports crypto but with a smaller list of coins. For UK users interested in digital assets, eToro offers superior choice and stronger investor protections.

Asset Range Comparison Table

| Asset Type | eToro | Robinhood |

|---|---|---|

| UK Stocks | Yes | Yes (limited selection) |

| US Stocks | Yes | Yes |

| ETFs | Yes | Yes |

| Crypto | Yes | Yes (smaller range) |

| Forex | Yes | No |

| Commodities | Yes | No |

| Options | No | Yes |

Customer Support and Community

How responsive is eToro customer service?

eToro provides customer support through live chat and help centres. While response times can vary, FCA oversight ensures accountability. For UK investors, eToro offers more structured support than Robinhood, with additional help through its social trading network.

How responsive is Robinhood customer service?

Robinhood's customer service is weak, reflected in its Trustpilot score of 1.2/5. UK expansion has not fully solved these issues. For users prioritising strong service, eToro provides a more reliable option.

Does either platform offer social or community features?

eToro excels with its social trading community, allowing UK users to copy or learn from others. Robinhood does not provide social features, focusing purely on simplicity. For investors wanting guidance or collaboration, eToro is the stronger choice.

Final Verdict – Should You Choose eToro or Robinhood?

Both platforms are accessible to UK users, but they cater to different investor needs. Robinhood is best suited to beginners who want a straightforward way to place commission-free stock trades.

eToro, by contrast, offers a more comprehensive and secure experience, with access to global markets and built-in social trading features. For UK investors focused on long-term growth and learning, eToro stands out as the stronger overall choice.

FAQs

Is eToro better than Robinhood for beginners?

Yes. eToro offers demo accounts, social trading, and FCA protection, making it ideal for learning. Robinhood is beginner-friendly too, but lacks depth and education. For UK newcomers, eToro provides stronger support and resources.

Which is cheaper, eToro or Robinhood?

Robinhood is cheaper for basic stock and ETF trades with zero commissions. eToro has spreads and withdrawal fees but offers wider markets, including crypto, forex, and commodities. For pure cost savings, Robinhood wins, but eToro provides more overall value for UK investors.

Can UK investors use Robinhood?

Yes. Robinhood expanded into the UK in 2024, offering commission-free trades in US and some UK stocks, ETFs, and crypto. However, it has a narrower range than eToro, making it better suited to simple investing rather than diversified portfolios.

Does eToro offer ISAs in the UK?

Yes. eToro partners with Moneyfarm to offer Stocks and Shares ISAs to UK investors. This allows tax-efficient investing across global assets, making it more attractive than Robinhood, which does not offer ISA accounts.

References

61% of retail CFD accounts lose money when trading CFDs with this provider.