Is FOREX.com Good for Day Trading?

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: How Good is FOREX.com for Day Trading?

FOREX.com offers competitive spreads, fast trade execution, and access to 2,000+ markets including forex, and CFDs on indices, commodities, and shares. The platform's advanced tools, charting, and alert systems make it a suitable option for active traders looking for reliable intraday performance in the UK.

Author's Comments

Having tested FOREX.com extensively, I found the platform highly responsive and reliable. Execution speed remains consistent during volatile sessions, spreads are competitive, and the charting tools provide excellent support for intraday strategies. Beginners benefit from demo accounts, while experienced traders gain efficiency through advanced features.

FOREX.com Overview

FOREX.com is a globally recognised forex and CFD broker and part of the NASDAQ-listed StoneX Group. Founded in 2001, it is FCA-regulated and trusted by over 1 million traders worldwide. The broker offers powerful platforms, competitive pricing, and extensive market coverage — giving traders access to global opportunities across multiple asset classes.

- Minimum Deposit: £100

- Regulation: FCA (UK)

- Trading Platforms: WebTrader, TradingView, MT4, MT5

- Market Access: 80+ Forex pairs, CFDs on Indices, Shares, Commodities, and Metals

- Spread betting available for UK clients

- Extended Trading Hours: 24-hour forex trading, Sunday to Friday, with global market access across major time zones.

How Does FOREX.com Support Day Traders?

FOREX.com supports active trading with multiple platforms, powerful charting tools, and robust trade management features. Traders can access advanced analytics, alerts, and custom watchlists, which ensure that market opportunities are actionable immediately. Both web and mobile platforms are optimised for intraday decision-making.

What trading platforms does FOREX.com offer for day trading?

FOREX.com offers a browser-based web platform, a mobile app, TradingView integration, and enhanced MT4 platforms. Each provides charting, indicators, news feeds, and trade execution suitable for fast-paced trading. The variety ensures traders can choose the platform that matches their intraday strategy and workflow.

How do these platforms cater to the needs of day traders?

Day traders require speed, precision, and market access. FOREX.com platforms provide ultra-fast execution, multiple chart types, technical indicators, price alerts, and customisable watchlists. These features allow traders to react immediately to market movements and manage positions efficiently, whether scalping, swing trading, or monitoring multiple instruments.

Specific Features Designed for Active Trading

| Feature | Web Platform | Mobile App | TradingView | MT4 Enhanced |

|---|---|---|---|---|

| Real-time Market Data | Yes | Yes | Yes | Yes |

| Advanced Charting | Yes | Yes | Yes | Yes |

| Technical Indicators | 80+ | 50+ | 100+ | 70+ |

| Alerts & Notifications | Yes | Yes | Yes | Yes |

| Trade Execution Speed | Fast | Fast | Fast | Very Fast |

| Integrated News Feeds | Reuters | Reuters | TradingView | Reuters |

| Custom Watchlists | Yes | Yes | Yes | Yes |

| Demo Account Available | Yes | Yes | Yes | Yes |

What Are the Costs Associated with Day Trading on FOREX.com?

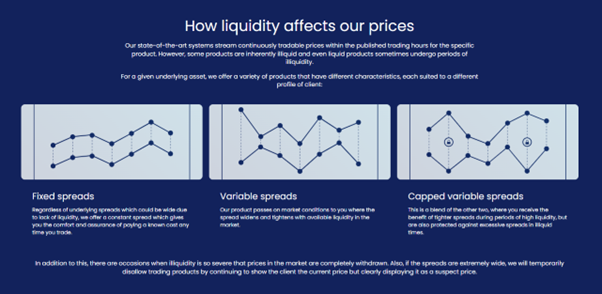

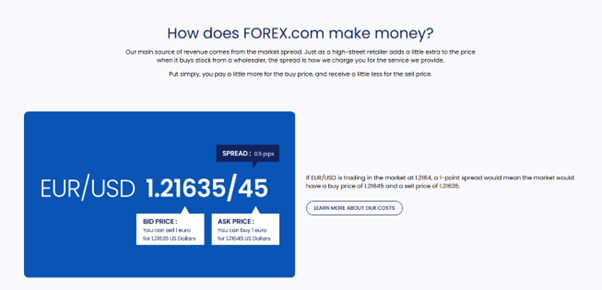

Day trading on FOREX.com involves spreads, commissions, and occasional overnight financing fees. Forex spreads can start as low as 0.7 pips for EUR/USD. Costs are transparent, with volume discounts for frequent traders. Being aware of overnight charges is crucial for managing intraday and multi-day positions.

What are the spreads and commissions for day trading?

FOREX.com offers tight spreads on major forex pairs, from 0.7 pips on EUR/USD. CFD trading has variable spreads depending on the instrument, with no hidden commissions on most markets. Commissions may apply for specific shares or international indices, but pricing remains competitive for intraday strategies.

Are there any hidden fees or costs to be aware of?

FOREX.com is transparent, but traders should consider overnight financing, currency conversion fees, and margin interest. There are no inactivity fees for active accounts. Monitoring these costs is essential for day traders who frequently enter and exit positions to protect profit margins.

What are the overall costs?

| Market Type | Spreads | Commissions | Overnight Fees |

|---|---|---|---|

| Forex Major Pairs | From 0.7 pips | None | Yes |

| CFDs (Indices/Commodities) | 0.3%-0.5% avg | Varies | Yes |

| Shares | Varies | From 0.08% | Yes |

| Precious Metals | Fixed | None | Yes |

What Tools and Resources Does FOREX.com Provide for Day Traders?

FOREX.com supports active trading with a full suite of tools, including advanced charting, alerts, watchlists, and integrated news feeds. Risk management tools such as stop-loss, take-profit, and margin calculators help manage exposure. Educational resources and demo accounts support skill development for intraday traders.

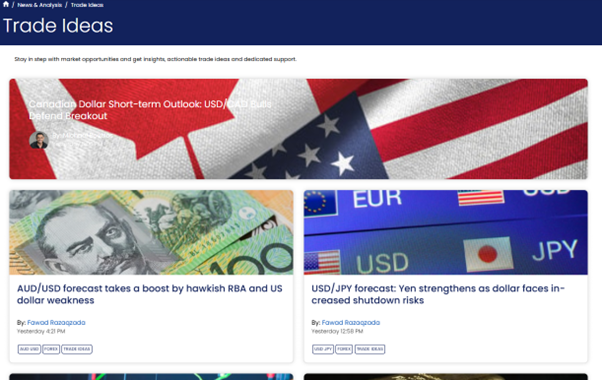

What charting tools are available for technical analysis?

FOREX.com platforms offer over 80 indicators, drawing tools, trendlines, and pattern recognition. TradingView integration adds dynamic charting and community-driven trade ideas. Multi-timeframe analysis and customisable charts allow traders to quickly identify entry and exit points during volatile market conditions.

Are there any risk management tools offered?

Yes, stop-loss, take-profit, margin calculators, and position-sizing tools are all available. Alerts notify traders of price movements or margin levels. These tools help manage risk, prevent large losses, and maintain disciplined trading, particularly important for high-frequency or scalping strategies.

Does FOREX.com provide educational resources for day traders?

FOREX.com offers webinars, tutorials, and a Trading Academy covering forex, CFDs, and risk management. Market analysis, video lessons, and platform guides ensure traders can develop strategies and practice intraday trading using demo accounts before committing real capital.

What Are the Pros and Cons of Using FOREX.com for Day Trading?

Pros

- Tight spreads on major pairs

- Fast, reliable execution

- Advanced charting and indicators

- Multiple platforms including MT4, TradingView

- Transparent fee structure with volume discounts

Cons

- Overnight financing fees apply

- Some advanced features may overwhelm beginners

- CFD trading carries high risk due to leverage

- Limited access to certain international stocks for CFD trading

- Learning curve for new traders

How Does FOREX.com Compare to Other Brokers for Day Trading?

FOREX.com excels in execution speed, tight spreads, and advanced charting tools. Integration with TradingView and MT4 provides flexibility for intraday strategies. Compared with competitors like IG, CMC Markets, and Pepperstone, it offers strong risk management tools, although some brokers may have lower commissions for certain instruments.

What features make FOREX.com stand out for day trading?

Key features include millisecond-level execution, customisable alerts, advanced technical indicators, and multi-platform access. The ability to connect to TradingView for extended charting and community insights, combined with responsive mobile and desktop apps, gives day traders significant operational advantages.

How does it compare in terms of costs, execution speed, and tools?

Costs are competitive, with forex spreads starting at 0.7 pips and CFD spreads from 0.3%-0.5%. Execution speed is consistently fast, minimising slippage. Tools include over 80 technical indicators, risk management calculators, integrated news feeds, and multi-chart layouts for efficient intraday trading.

Are there other brokers that might be more suitable for day trading?

Brokers like Pepperstone may offer slightly lower forex spreads, while IG provides extensive research and analytics. eToro is more beginner-focused with social trading features. Choice depends on your trading style, instrument preference, and whether you prioritise costs, tools, or global market access.

Final Verdict: Is FOREX.com Suitable for Day Trading?

FOREX.com is suitable for UK day traders seeking tight spreads, fast execution, and advanced technical tools. Its FCA regulation, segregated accounts, and robust platforms provide a secure and professional environment. Beginners may benefit from demo accounts, while active traders gain an edge with advanced features.

Who would benefit most from using FOREX.com for day trading?

Active forex and CFD traders requiring low-latency execution, advanced charting, and integrated risk management will benefit. Traders who manage multiple positions, use technical strategies, or monitor intraday volatility gain the most, particularly those prioritising regulatory oversight and capital protection.

FAQs

What is the minimum deposit required to start day trading on FOREX.com?

The minimum deposit is £50 for standard accounts, allowing new UK traders to start with modest capital while accessing full platform features and risk management tools.

Does FOREX.com offer leverage for day trading?

Yes, UK traders can access up to 30:1 leverage on major forex pairs under ESMA rules. Leverage for indices and commodities is lower, and traders must understand the increased risk when using high leverage.

Can I trade on FOREX.com using mobile devices?

Yes, FOREX.com offers fully-featured mobile apps for iOS and Android, supporting trade execution, charting, alerts, and portfolio monitoring, allowing day trading anywhere with secure account access.

Are there any restrictions on trading hours for day traders?

Forex trading is available 24/5. CFDs have market-specific hours, including indices and commodities. Traders should verify hours per instrument and consider extended hours or liquidity constraints when planning intraday trades.

How can I open a demo account to practice day trading on FOREX.com?

UK users can open a risk-free demo account in minutes via the FOREX.com website. It provides virtual funds, access to full platform tools, and realistic market conditions to practice strategies before committing real capital.

References

- ✓ Raw spreads from 0.0 pips on commission account

- ✓ Trade on MT4, MT5 & FOREX.com's own platform

- ✓ TradingView integration for advanced charting

- ✓ Powerful API access for algorithmic traders

76% of retail investor accounts lose money when trading CFDs with this provider