- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: Is Hargreaves Lansdown Worth It in 2026?

Yes, Hargreaves Lansdown continues to be a reliable option for investors in 2026, combining in-depth research tools, high-quality customer support, and a wide range of investment choices. Its long-standing reputation and well-established platform make it particularly well suited to long-term investing and informed financial decision-making.

Author’s Comment

Based on my continued use of Hargreaves Lansdown, the platform still stands out for its dependability, depth of research, and consistently strong customer support—factors that help justify its higher-than-average fees. While it isn’t the lowest-cost provider, for UK investors focused on long-term goals who prioritise trust, stability, and clear direction, HL remains a premium choice in 2026.

— Thomas Drury

Overall Verdict

| Category | Rating (out of 5) | Author Notes |

|---|---|---|

| Account Setup | 4.5 | Fast; seamless; and beginner-friendly with clear onboarding. |

| Platform Usability | 4 | Clean design and intuitive tools for web and mobile. |

| Mobile App | 4 | Reliable; secure; and user-focused — minor charting limitations. |

| Investment Options | 5 | Wide range of funds; shares; ETFs; and tax-efficient accounts. |

| Research & Tools | 4.5 | Excellent insights and data; few advanced trader features. |

| Fees & Value | 3 | Transparent but higher than discount competitors. |

| Customer Support | 5 | UK-based; fast response; and knowledgeable assistance. |

| Security & Regulation | 5 | FCA-regulated; FSCS-protected; with strong cybersecurity. |

| Education & Learning | 4 | Great guides and webinars; ideal for beginner investors. |

| Overall Experience | 4 | Reliable; trusted; and well-suited for long-term investors. |

Hargreaves Lansdown- Overview

- Minimum Deposit: £100 (for stocks and shares ISA, or self-invested pensions)

- Access a wide range of investments, including stocks, funds, ETFs, and bonds

- FCA regulated with over 1.5 million customers

- User-friendly mobile and web platform with real-time data and research tools

- Ideal for investors seeking a well-established, reliable platform with strong customer support

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

Is Hargreaves Lansdown Worth Using in 2026?

Hargreaves Lansdown remains one of the UK’s leading investment platforms in 2026. It offers FCA regulation, extensive research tools, tax-efficient accounts, and a user-friendly interface. Beginners and experienced investors alike benefit from diversified investment options, strong mobile apps, and responsive customer support.

What are the key highlights for investors?

HL provides Stocks & Shares ISAs, SIPPs, and General Investment Accounts with access to thousands of stocks, funds, ETFs, and bonds. Its research tools, model portfolios, and mobile app functionality help investors make informed decisions efficiently.

Who benefits most from this platform?

HL suits beginners needing guidance through education tools and structured portfolios, as well as long-term investors seeking tax-efficient accounts. Active traders may find fees higher than discount brokers, but the combination of security, reliability, and comprehensive support benefits most UK investors.

Quick comparison of HL vs other top UK brokers

| Broker | Account Types | FCA Regulated | Key Feature | Fees |

|---|---|---|---|---|

| Hargreaves Lansdown | ISA, SIPP, General Investment Account | Yes | Research tools & all-in-one platform | Moderate |

| AJ Bell | ISA, SIPP, General Investment Account | Yes | Simple interface & competitive pricing | Low |

| Fidelity | ISA, SIPP, General Investment Account | Yes | Strong research & fund range | Moderate |

What Services Does Hargreaves Lansdown Offer to UK Investors?

HL offers a comprehensive suite of services for UK investors, including tax-efficient accounts, a broad range of investments, and research tools. It supports beginners and experienced investors alike, providing options for self-directed investing, retirement planning, and portfolio diversification.

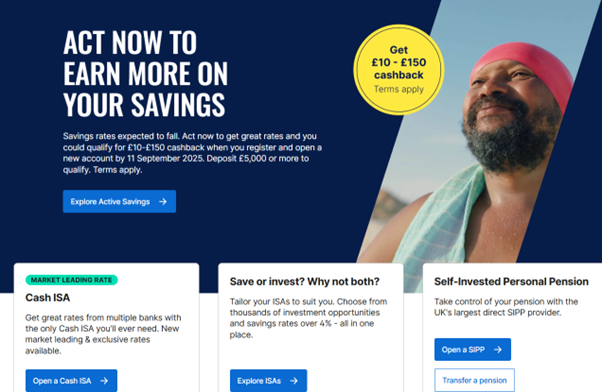

What account types are available (ISA, SIPP, General Investment Account)?

HL provides Stocks & Shares ISAs, SIPPs, and General Investment Accounts, allowing tax-efficient investing and flexible portfolio management. Investors can start with lump sums or regular contributions, making it suitable for both first-time investors and experienced traders seeking structured retirement planning.

What investment options can I access (stocks, funds, ETFs, bonds)?

Investors can trade thousands of UK and international stocks, mutual funds, ETFs, corporate and government bonds, and investment trusts. HL also offers model portfolios and ethical investment options, enabling diversified investment across sectors and risk profiles.

How does it compare to other UK brokers?

| Feature | Description | Hargreaves Lansdown | AJ Bell | Fidelity |

|---|---|---|---|---|

| Account Types | Tax-efficient investment accounts | ISA, SIPP, GIA | ISA, SIPP, GIA | ISA, SIPP, GIA |

| Investments | Stocks, funds, ETFs, bonds | Yes | Yes | Yes |

| Platform | Usability and tools | User-friendly web & mobile | Simple web platform | Strong research tools |

| Regulation | FCA regulation | Yes | Yes | Yes |

| Fees | Trading & platform costs | Moderate | Low | Moderate |

What Are the Pros and Cons of Using Hargreaves Lansdown?

| Pros | Cons |

|---|---|

| Comprehensive research tools | Higher trading and platform fees |

| Tax-efficient accounts (ISA, SIPP) | Limited advanced trading tools |

| User-friendly web & mobile platform | Occasional delays for large transactions |

| Educational resources and model portfolios | Not ideal for high-frequency traders |

| FCA-regulated and secure | Some competitors offer lower fees |

From my experience, HL has been a reliable platform. Their customer service has been responsive, and I am confident knowing that my investments are managed within a well-regulated and established framework.

What’s It Really Like to Use Hargreaves Lansdown in 2026?

Opening an HL account is fast and user-friendly. Investors can register online within minutes, verify ID digitally, and fund accounts with as little as £100. A clear setup process explains each account type and guides beginners step-by-step, making onboarding smooth for first-time investors.

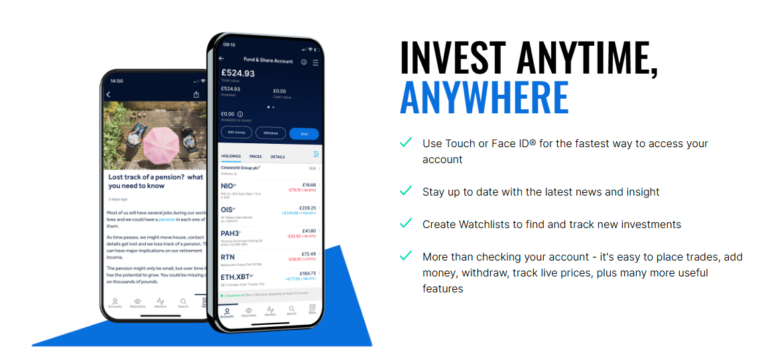

What’s the trading experience like on web and mobile?

Both desktop and mobile platforms are reliable, responsive, and designed for long-term investors. Real-time pricing, portfolio tracking, and watchlists ensure a streamlined experience. The app’s intuitive layout, biometric login, and alerts make investing easy anywhere, though advanced charting tools remain limited compared to active trading platforms.

What are the real costs of investing with Hargreaves Lansdown?

HL’s fees are transparent but above budget brokers. Expect a 0.45% platform charge and £11.95 per UK share trade. Investors with £20,000 in mixed assets pay about £95 yearly. No inactivity or withdrawal fees apply, though foreign currency conversions attract modest percentage-based charges.

| Feature | Hargreaves Lansdown | AJ Bell | Fidelity |

|---|---|---|---|

| Account Opening | Fully digital, ~15 mins | Online, easy | Online, simple |

| Minimum Deposit | £100 (ISA/SIPP) | £25 | £25 |

| Annual Platform Fee | 0.45% | 0.25% | 0.35% |

| UK Share Trade | £11.95 | £9.95 | £10.00 |

| Mobile App Rating | 4.7 / 5 | 4.5 / 5 | 4.6 / 5 |

| Best For | Long-term UK investors | Cost-conscious traders | Fund-focused investors |

Is My Money Safe with Hargreaves Lansdown?

HL is FCA-regulated, segregates client funds from corporate accounts, and provides investor compensation protections. It maintains strong cybersecurity, secure trading platforms, and insurance coverage, making it a safe option for UK investors seeking reliable fund protection and regulatory oversight.

Does HL have a good reputation and FCA regulation?

HL is one of the UK’s most trusted investment platforms, fully FCA-regulated. It has a strong long-term reputation for transparency, customer service, and compliance, reassuring investors that funds are handled responsibly and under strict regulatory oversight.

What security measures protect my funds?

HL segregates client money from company accounts, uses advanced encryption and authentication for online accounts, and monitors transactions to prevent fraud. Regular audits ensure compliance, while the platform provides tools to protect login credentials and personal information.

How does client fund insurance work?

HL clients are protected under the FSCS, which covers up to £85,000 per investor if the company fails. Segregated accounts ensure that client funds are separate from HL’s operational accounts, minimizing risk and enhancing security.

What Can You Invest in with Hargreaves Lansdown?

Hargreaves Lansdown provides access to thousands of investment products, including stocks, ETFs, funds, bonds, investment trusts, and more. The platform supports tax-efficient ISAs and SIPPs, allowing both beginners and advanced traders to build diversified portfolios according to risk tolerance and financial goals.

Which investment products does HL offer?

HL offers UK and international shares, ETFs, mutual funds, bonds, investment trusts, and structured products. Investors can also access model portfolios and ready-made strategies. Tax-efficient wrappers such as ISAs and SIPPs enhance long-term growth while simplifying reporting and tax management.

Investment types, minimum investment, fees, and tax benefits

| Investment Type | Minimum Investment | Typical Fees | Tax Benefits | Best For |

|---|---|---|---|---|

| UK & International Shares | £1 | 0.45%-0.5% platform fee | Capital Gains Tax (if ISA/SIPP) | Advanced Traders |

| ETFs | £1 | 0.45%-0.5% platform fee | Tax-free in ISA/SIPP | Beginners & Advanced |

| Mutual Funds | £25-£100 | 0.45%-0.5% platform fee | Tax-free in ISA/SIPP | Beginners |

| Bonds | £100+ | 0.45%-0.5% platform fee | Tax-free in ISA/SIPP | Advanced Traders |

| Investment Trusts | £100+ | 0.45%-0.5% platform fee | Tax-free in ISA/SIPP | Advanced Traders |

| Model Portfolios | £100+ | 0.45%-0.5% platform fee | Tax-free in ISA/SIPP | Beginners |

How Much Does Hargreaves Lansdown Cost to Use?

HL is known for higher-than-average platform fees compared to discount brokers, but its all-in-one service, research, and customer support justify the cost. Standard fees apply per account type, plus fund charges; however, there are no hidden fees for trading or account management beyond the published rates.

What are the standard trading and account fees?

HL charges a 0.45%-0.5% annual platform fee on funds, £11.95 per online UK share trade (discounted for frequent trading), and SIPP/ISA administration fees. Fund-specific OCFs (0.1%-1%) apply. Fees are transparent and posted clearly on their website.

Fee breakdown for ISA, SIPP, funds, and trades

| Investment Type | Minimum Investment | Typical Fees | Tax Benefits | Best For |

|---|---|---|---|---|

| UK & International Shares | £1 | 0.45%-0.5% platform fee | Capital Gains Tax (if ISA/SIPP) | Advanced Traders |

| ETFs | £1 | 0.45%-0.5% platform fee | Tax-free in ISA/SIPP | Beginners & Advanced |

| Mutual Funds | £25-£100 | 0.45%-0.5% platform fee | Tax-free in ISA/SIPP | Beginners |

| Bonds | £100+ | 0.45%-0.5% platform fee | Tax-free in ISA/SIPP | Advanced Traders |

| Investment Trusts | £100+ | 0.45%-0.5% platform fee | Tax-free in ISA/SIPP | Advanced Traders |

| Model Portfolios | £100+ | 0.45%-0.5% platform fee | Tax-free in ISA/SIPP | Beginners |

What Is the User Experience Like on Hargreaves Lansdown?

Hargreaves Lansdown offers a polished, intuitive experience across web, desktop, and mobile. Account opening is quick, and investors can manage trades, monitor portfolios, and access research easily. Mobile and desktop platforms are reliable, and customer support is professional, providing guidance for both beginners and advanced traders.

How user-friendly is the web and desktop platform?

The HL web and desktop platforms are clean, responsive, and logically organized. Tools for watchlists, alerts, and research are easily accessible. Advanced charting features are present but not overwhelming, allowing both beginners and seasoned investors to navigate with minimal friction.

How effective is the mobile app?

The HL mobile app mirrors desktop functionality, offering trade execution, portfolio monitoring, and research on the go. It supports push notifications, watchlists, and secure login. While not as feature-rich as desktop, it is reliable, stable, and sufficient for everyday trading.

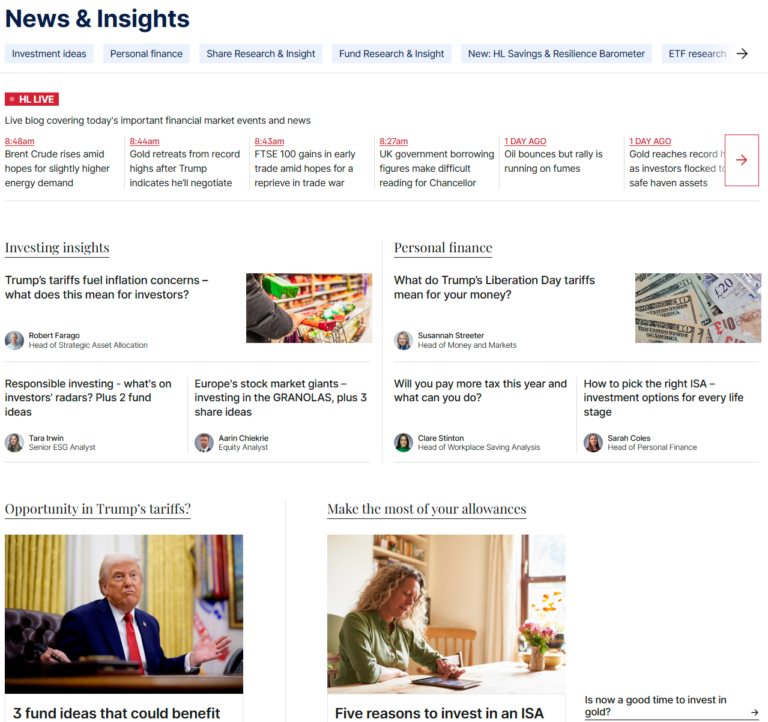

Does Hargreaves Lansdown Provide Research and Learning Resources?

HL excels in research and learning. Investors get access to market commentary, analyst reports, price alerts, model portfolios, and detailed fund analysis. Educational content includes guides, webinars, and videos for beginners, while advanced investors benefit from data tools, portfolio analysis, and planning resources.

What research tools and market analysis are available?

HL offers in-depth fund and share research, real-time pricing, analyst ratings, performance charts, and sector insights. Alerts, screeners, and comparison tools help investors make informed decisions. Professional-grade tools are accessible without extra cost, giving UK traders a competitive edge.

What educational resources are offered for beginners?

HL provides beginner-friendly guides, videos, and webinars covering investing basics, ISAs, SIPPs, and market principles. Step-by-step tutorials and demo accounts support confidence building. Educational content helps newcomers understand risk, diversification, and long-term growth strategies.

Is Hargreaves Lansdown Right for Me in 2026?

Build Your Portfolio with Ease

- Wide Investment Options

- Award-Winning Platform

- Comprehensive Research Tools

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

FAQs

Is Hargreaves Lansdown good for beginners?

Yes, it’s one of the most beginner-friendly full-service platforms in the UK. The interface is easy to use, and Hargreaves Lansdown offers excellent educational content and customer support.

What fees does Hargreaves Lansdown charge?

Hargreaves Lansdown charges a 0.45% platform fee on funds, up to £11.95 per trade for shares, and up to 1% in FX fees. There are no inactivity or exit fees.

Can I open an ISA or SIPP with Hargreaves Lansdown?

Absolutely. Hargreaves Lansdown offers Stocks and Shares ISAs, Lifetime ISAs, Junior ISAs, and Self-Invested Personal Pensions (SIPPs), all with competitive investment options.

Does Hargreaves Lansdown offer fractional shares?

No, Hargreaves Lansdown currently does not support fractional shares. You must buy whole shares, which may limit access to high-priced stocks for smaller investors.

How long does it take to open an account with HL?

The sign-up process is usually quick—many accounts are approved within 24 hours, especially if all ID checks are completed online.

References

- Hargreaves Lansdown – Charges and Fees Overview

- Security and FSCS Protection – How safe is your investment?

- Hargreaves Lansdown – Expert outlook for 2025 and investment ideas

- Hargreaves Lansdown – Stocks And Shares ISA

- Hargreaves Lansdown Learning Hub – learn how to invest for Beginners

- FCA Registration Confirmation – Hargreaves Lansdown Savings Limited – FCA Register

- FSCS Protection Details – What we cover | Check your money is protected | FSCS