IG Review 2026 | UK Fees, Features & Expert Take

IG is one of the most established brokers in the UK — but does it still hold up in 2026? Here’s our honest take on fees, platform quality, and what UK traders should know.

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: Would I Recommend IG After Using It Myself?

Yes — IG remains one of the most reliable brokers for UK traders in 2026. Its platform is polished, regulation is top-tier, and execution is quick. Fees aren't the lowest, but the overall experience feels professional, stable, and worth the slightly higher cost.

What Stood Out Most During My Review?

IG's depth of markets and platform reliability impressed me most. Whether trading forex, indices, or shares, order execution felt seamless. The platform's learning tools and clear layout make it approachable for beginners while offering enough advanced tools to satisfy experienced traders.

Quick Summary – How IG Performs Across Key Categories

| Category | Score (out of 5) | Comment |

|---|---|---|

| Regulation & Safety | 5.0 | FCA-regulated and highly trusted |

| Platform & Tools | 4.5 | Clean, powerful, and intuitive |

| Fees & Spreads | 4.0 | Slightly above average but transparent |

| Education & Research | 4.5 | Excellent resources for all levels |

| Customer Support | 4.0 | Responsive but not 24/7 |

| Crypto Access | 4.0 | Direct ownership, low fees, limited coins |

| Overall Experience | 4.6 | Consistently strong and reliable |

What's It Like Getting Started with IG?

Getting started with IG feels smooth and efficient. The sign-up flow is modern, verification is quick, and there's no unnecessary friction. Within minutes, you can access the demo or live platform. It's professional yet welcoming — exactly what you'd expect from a leading broker.

Is Opening an Account Straightforward or a Headache?

Opening an account is simple. IG's online form takes about five minutes, and ID verification is automated. Most users are approved the same day. It's much easier than traditional brokers, with clear steps and no confusing paperwork. Straightforward, fast, and transparent from start to finish.

What Are the Deposit Options and How Fast Do They Clear?

Deposits are straightforward through debit card, bank transfer, or PayPal. Card and PayPal deposits usually appear instantly, while bank transfers take one to three days. IG doesn’t charge deposit fees, and the funding section clearly shows available methods and expected processing times. If you’re planning to use the spread betting account specifically, I’ve covered the full setup in my look at whether IG is good for spread betting.

How Smooth Is the Withdrawal Process When You Need Your Cash?

Withdrawals are efficient and reliable. IG processes most requests within one business day, and funds typically reach your bank within three. There are no withdrawal fees for UK clients. The process feels transparent, with clear confirmation emails and easy tracking from your account.

Overview Table – IG Account Setup

| Feature | Details | Verdict |

|---|---|---|

| Account Opening Time | Under 24 hours | Quick and easy |

| Verification Process | Automated ID check | Smooth and fast |

| Deposit Methods | Card, Bank, PayPal | Flexible options |

| Deposit Speed | Instant–3 days | Dependable |

| Withdrawal Processing | 1 business day | Efficient |

| User Interface Experience | Clean, intuitive | Excellent |

| Overall Setup Rating | 4/5 | Seamless onboarding experience |

Can You Actually Learn to Trade Better with IG?

Yes — IG offers one of the most complete learning environments of any UK broker. The resources are structured, engaging, and practical. Whether you're testing strategies or studying fundamentals, the educational support genuinely helps traders progress with confidence.

Is the Demo Account Useful or Just a Gimmick?

The demo account is genuinely valuable. It mirrors live-market conditions with real pricing and full platform access. You can practise strategies without risk and switch easily between demo and live trading. It's one of the best free tools for skill-building before committing capital.

What’s My Take on the Quality of IG’s Educational Content?

IG’s educational material stands out for clarity and structure. It avoids filler and provides actionable lessons. The mix of written guides, live webinars, and interactive modules means there’s something for every learning style. It’s practical, reliable, and clearly created by industry professionals. If you’re considering short-term strategies, my guide on whether IG is good for day trading explores how these tools translate into real execution.

Summary Table – IG's Learning Tools and Resources

| Learning Feature | Description | Verdict |

|---|---|---|

| Demo Account | Full-featured, real-time simulation | Excellent for practice |

| IG Academy | Structured lessons with interactive content | High-quality education |

| Webinars & Seminars | Regular live sessions with experts | Insightful and engaging |

| Trading Guides & Articles | Covers strategies, risk, and psychology | Useful and practical |

| Learning Accessibility | Web, mobile, and app-based | Convenient and flexible |

| Overall Learning Rating | 4/5 | Genuine value for improving traders |

Can You Buy Real Crypto Through IG?

Yes — and this is one of the bigger additions to IG's lineup in recent years. Rather than just offering crypto through CFDs or spread bets (which the FCA banned for retail clients back in 2021), IG now lets you buy and own actual coins directly. It launched the service in 2025, and it's been a welcome change for anyone who wanted crypto exposure without leaving IG's ecosystem.

The setup is straightforward. IG handles the platform and trading interface, while a third-party custodian manages the actual coin storage and execution behind the scenes. You hold beneficial ownership — meaning the coins are yours, they're just held securely on your behalf. Think of it like how a nominee account works for shares.

What Does IG's Crypto Actually Cost?

A flat 1.49% per trade. No commission on top, no deposit fees, no withdrawal fees. On a £1,000 Bitcoin purchase, you'd pay £14.90 — compared to roughly £48.70 on Coinbase's standard platform or £24.90 through Revolut. The minimum buy is just £1, so you don't need to commit serious capital to get started.

What Coins Are Available and What's Missing?

55+ cryptocurrencies covering the coins most UK investors actually care about — Bitcoin, Ethereum, Solana, XRP, Cardano, plus DeFi tokens like Chainlink and Aave, and even meme coins like Dogecoin and Pepe. It's not Kraken's 350+ range, but for mainstream portfolios it's more than enough.

The gaps worth knowing about: no wallet withdrawals (coins stay on IG's platform), no staking rewards, and no FSCS protection on crypto balances. That last point is true for every UK crypto platform, not just IG — but it's still worth flagging. For a full breakdown of how the fees stack up against Coinbase, Kraken, and eToro, I've covered everything in my dedicated look at whether IG is good for crypto.

Crypto Snapshot – Key Facts at a Glance

| Feature | Details |

|---|---|

| Trading Fee | 1.49% flat (no hidden charges) |

| Minimum Trade | £1 |

| Coins Available | 55+ (BTC, ETH, SOL, XRP, meme coins, DeFi) |

| Ownership | Real coins (beneficial ownership) |

| Custody | Cold storage via third-party custodian |

| Wallet Transfers | Not available |

| Staking | Not available |

| FSCS Protection | No (same for all UK crypto platforms) |

| FCA Status | Registered under Money Laundering Regulations |

Where Does IG Fall Short?

While IG delivers a polished experience overall, it's not perfect. Costs can feel slightly high for active traders, and some tools lean toward complexity. Support isn't 24/7, which can frustrate global users. These are minor flaws, but worth noting for transparency.

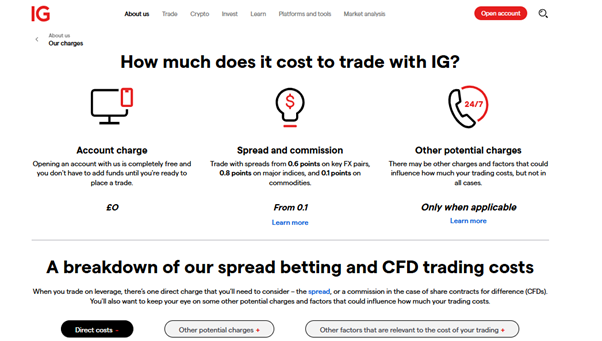

Are IG's Trading Costs Competitive Enough?

Not entirely. IG's spreads are fair but not market-leading. Active traders might find cheaper options elsewhere. However, the cost is offset by strong reliability, precise execution, and access to a broad range of markets. It's a trade-off between pricing and overall quality.

How Do IG’s Fees Compare to Other UK Brokers?

| Broker | Average Forex Spread | Share Commission | Withdrawal Fee | Inactivity Fee | Overall Cost Rating |

|---|---|---|---|---|---|

| IG | 0.6 pips (EUR/USD) | £3 per trade | None | £12 after 24 months | 4.2/5 |

| Pepperstone | 0.1–0.3 pips (Raw account) | None | None | None | 4.6/5 |

| CMC Markets | 0.7 pips (EUR/USD) | 0.10% (min £9) | None | £10 after 12 months | 4.4/5 |

| eToro | 1.0 pips (EUR/USD) | 0% (built into spread) | $5 per withdrawal | $10 after 12 months | 4.0/5 |

| Plus500 | 0.8–1.0 pips (EUR/USD) | None | None | $10 after 3 months | 3.9/5 |

Do the Charts and Research Tools Empower or Overwhelm?

They're powerful, but dense. IG's charting suite offers depth, indicators, and customisation that advanced traders love — yet beginners may find it intimidating. The learning curve is steep at first, though once mastered, the tools become a serious trading advantage.

How Good Is IG's Customer Support When It Matters?

IG's support is generally reliable but not always available when needed. Live chat and phone lines operate during business hours, not round-the-clock. Responses are professional and informed, yet the lack of 24/7 coverage is a drawback for night or weekend traders.

Summary Table – IG's Weak Spots and Common Gripes

| Aspect | Issue | Impact |

|---|---|---|

| Trading Costs | Spreads slightly above some rivals | Higher costs for active traders |

| Charting Tools | Complex for beginners | Steep learning curve |

| Platform Depth | Overwhelming at first | Requires adjustment |

| Customer Support Hours | Limited availability | Delays outside UK hours |

| Minor Interface Clutter | Too many menus | Slower navigation early on |

| Overall Weakness Rating | 3/5 | Solid platform with fixable flaws |

Can IG Be Trusted with Your Money?

Yes — IG remains one of the safest brokers in the UK. It's highly regulated, transparent, and financially stable. Client funds are segregated, data security is tight, and its long history in the industry inspires strong confidence for serious traders.

Who Regulates IG and What Protections Do You Actually Get?

IG is regulated by the Financial Conduct Authority (FCA) in the UK, plus several top-tier global bodies. Client money is held in segregated accounts, and UK traders benefit from FSCS protection up to £85,000. Regulation is robust, clear, and consistently enforced.

How Secure Are Client Funds and Personal Data?

Security is excellent. IG uses bank-grade encryption, two-factor authentication, and strong internal controls. Personal and financial data are protected at every stage. Regular audits and strict compliance policies ensure your account remains shielded from breaches or misuse.

Did I Feel Safe Using IG Day to Day?

Absolutely. Every transaction, login, and withdrawal felt secure. There were no unexpected errors or system issues. IG’s transparency and professional design inspire confidence — it feels like a broker that takes safety seriously, not as a slogan but as standard practice. I’ve gone deeper on this topic in my full breakdown of whether IG is safe and how its protections work.

Security Checklist – What IG Gets Right on Safety

| Security Area | Details | Rating |

|---|---|---|

| Regulation | FCA & Tier-1 global oversight | 5/5 |

| Fund Protection | Segregated client accounts | 5/5 |

| Compensation Scheme | FSCS up to £85,000 | 5/5 |

| Data Encryption | Bank-level SSL encryption | 5/5 |

| Two-Factor Authentication | Available on all platforms | 4/5 |

| Transparency & Reporting | Regular independent audits | 5/5 |

| Overall Security Rating | — | 4.9/5 – Outstanding |

How Does IG Stack Up Against Its Competitors?

IG still holds its ground among top-tier brokers. It's not the cheapest, but its reliability, market range, and educational depth stand out. Against names like CMC or Pepperstone, IG feels more complete — a polished, well-regulated platform built for long-term traders. For a direct head-to-head, my eToro vs IG comparison breaks down where each broker leads.

Where Does IG Clearly Have the Edge?

IG leads in trust, stability, and platform depth. Its FCA regulation, extensive market coverage, and educational tools are unmatched in the UK scene. Few brokers combine professional execution with a beginner-friendly interface quite as effectively as IG does. If you're new to the platform, my guide on whether IG is good for beginners covers what to expect when starting out.

Which Brokers Still Outperform IG in Key Areas?

Some competitors beat IG on cost and customer support. Pepperstone offers lower spreads for forex scalpers, and CMC Markets provides slightly faster support response times. Capital.com also undercuts IG on spreads while offering a slicker mobile experience — I’ve compared the two in detail in my Capital.com vs IG breakdown. If you prioritise ultra-low fees or constant service availability, those might appeal more.

Which Asset Classes Can You Access with Each Broker?

| Broker | Forex | Shares | Commodities | Crypto | ETFs | Spread Betting |

|---|---|---|---|---|---|---|

| IG | Yes | Yes | Yes | Yes (Direct, 55+ coins) | Yes | Yes |

| Pepperstone | Yes | Limited | Yes | Yes (CFDs) | No | No |

| CMC Markets | Yes | Yes | Yes | Yes (CFDs) | Yes | Yes |

| eToro | Yes | Yes | Yes | Yes (Direct & CFDs) | Yes | No |

| Plus500 | Yes | Yes | Yes | Yes (CFDs) | Limited | No |

Why Have I Stuck with IG Despite Its Flaws?

IG feels dependable. Even with minor drawbacks, it consistently performs. Platform stability, solid research, and transparent pricing make it a broker I can rely on. It's less about chasing the lowest fee, more about trusting your trading environment fully.

Comparison Table – IG vs the Rest

| Broker | Best For | Key Strength | Key Weakness | Overall Rating |

|---|---|---|---|---|

| IG | Balanced traders (UK focus) | Regulation, reliability, tools | Slightly higher fees | 4.6/5 |

| Pepperstone | Active forex traders | Low spreads, fast execution | Limited education | 4.6/5 |

| CMC Markets | Chart-focused traders | Advanced tools, analytics | Interface complexity | 4.5/5 |

| eToro | Social trading enthusiasts | Copy trading, accessibility | Wider spreads | 4.4/5 |

| Plus500 | Casual CFD traders | Simplicity, clean design | Lacks depth and features | 3.8/5 |

What Are the Biggest Pros and Cons of Using IG?

After spending considerable time testing IG across multiple account types, here’s how the strengths and weaknesses balance out in practice.

Pros and Cons of Using IG

Pros

- FCA-regulated with FSCS protection and segregated client funds

- Huge market range covering shares, forex, indices, crypto, ETFs, and spread betting

- Professional-grade platform with excellent charting and research tools

- Strong educational resources through IG Academy and a full-featured demo account

Cons

- Spreads slightly above the cheapest competitors like Pepperstone

- Customer support not available 24/7 which can frustrate weekend traders

- Platform depth can feel overwhelming for complete beginners

- No crypto wallet withdrawals or staking on the direct ownership service

So, Is IG the Right Choice for You?

If you value security, stability, and depth, yes. IG suits traders who want a professional-grade broker with a proven record. It’s best for those serious about trading — less for those chasing the lowest spreads or flashy features. Long-term investors may also want to explore IG’s Stocks and Shares ISA for tax-efficient share dealing.

Final Thoughts – My Closing Verdict

IG earns its reputation. The platform is polished, execution is fast, and regulation is rock solid. Fees aren't the lowest, but reliability and depth make it a strong pick for serious UK traders who value stability over cost-cutting.

What's Changed in 2026?

The biggest change is crypto. IG dropped the old Uphold partnership and launched its own direct crypto service — you can now buy and own real coins at a flat 1.49% fee with no hidden charges. That's a genuine upgrade. Beyond that, IG remains FCA-regulated with FSCS protection on eligible accounts. MetaTrader 4 still supported. Spreads competitive. Inactivity fee unchanged at £12 after 24 months. For the full detail on the new crypto offering, see my breakdown of whether IG is good for crypto.

68% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

FAQs

What asset classes can you trade with IG?

IG offers access to a wide range of markets — forex, indices, shares, commodities, ETFs, bonds, and more. You can trade these through CFDs or spread betting, depending on your account type and preferences.

Can you trade cryptocurrencies with IG?

Yes. IG now offers direct crypto ownership — you can buy and hold real coins (not CFDs) from a range of 55+ cryptocurrencies at a flat 1.49% fee. Crypto CFDs and spread bets remain restricted to professional clients only. See my full IG crypto breakdown for fees, coins, and how it compares.

Does IG support third-party trading platforms like MetaTrader 4 or ProRealTime?

Yes, IG supports both MT4 and ProRealTime in addition to its proprietary web and mobile platforms. These integrations offer flexibility for automated strategies and more advanced charting.

What's the minimum deposit required to start trading with IG?

There's no strict minimum, but most UK traders deposit around £250 when funding by card. Bank transfers are accepted with no set limit, making IG accessible for both small and larger accounts.

Does IG charge any hidden or ongoing fees?

IG is transparent with costs. There are no deposit or withdrawal fees, though overnight funding applies to leveraged positions. A £12 inactivity fee kicks in only after two years of no account activity.

Is IG regulated and safe for UK traders?

Yes. IG is authorised and regulated by the Financial Conduct Authority (FCA) and has been operating since 1974. Client funds are held in segregated accounts, and eligible balances are protected by the FSCS up to £85,000. For a deeper look, see my full breakdown of whether IG is safe.

Does IG offer a Stocks and Shares ISA?

Yes. IG offers a Stocks and Shares ISA with access to UK and international shares, ETFs, and investment trusts. There’s no annual management fee, and you can shelter up to £20,000 per tax year. I’ve reviewed it in full in my guide on IG’s ISA offering.

Is IG good for beginners or better suited to experienced traders?

IG works well for both. The platform’s layout is clean and the IG Academy provides structured learning for newer traders. That said, the sheer number of tools and markets can feel overwhelming at first. I’ve covered this in detail in my guide to whether IG is good for beginners.

Can you spread bet with IG?

Yes. IG is one of the most established spread betting platforms in the UK, offering tax-free profits on a wide range of markets including forex, indices, shares, and commodities. Spread betting profits are exempt from Capital Gains Tax for UK residents.

How does IG compare to eToro for UK traders?

IG offers deeper market access, stronger regulation, and more advanced tools, while eToro leads on social trading features and simplicity. IG is the better fit for serious traders; eToro suits casual investors who value copy trading. I’ve compared them side by side in my eToro vs IG comparison.

References

- ✓ 17,000+ markets including shares & forex

- ✓ ProRealTime & MT4 platform access

- ✓ Weekend & out-of-hours trading

68% of retail investor accounts lose money when trading spread bets and CFDs with this provider.