IG Cashback Offer Explained – Earn 10% on Your Invested Portfolio (December 2025)

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection (£120,000 per person)

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Affiliate disclosure. Broker buttons and "Get Started" links are affiliate links. We may earn a commission if you open an account — at no extra cost to you. This never affects our ratings, rankings, or recommendations, which are based solely on our independent testing methodology.

Contact: info@theinvestorscentre.co.uk

The IG Cashback Offer lets new UK investors earn 10 percent back on their invested portfolios. To qualify, you must open an eligible account before 31 December 2025, place a first trade of at least 50 GBP, and maintain a minimum 50 GBP portfolio. Your capital is at risk.

New customers only. Max payout 200 GBP.

📢 December 8th 2025 Update

Great news! The IG cashback offer has been increased to 10% and the maximum pay-out has been raised to £200.

Quick Answer – How Do You Claim the IG Cashback Offer?

Open a new IG ISA GIA or SIPP before 31 December 2025.

Make a first trade of at least 50 GBP between 21 November and 31 December 2025.

Maintain a portfolio worth 50 GBP or more from January to March 2026.

IG applies 10 percent cashback according to their terms and conditions.

What are the key terms and eligibility requirements?

The offer applies to UK residents aged 18 plus who have never held an IG share dealing account.

You must open a qualifying ISA GIA or SIPP before 31 December 2025, place a 50 GBP trade, and maintain a 50 GBP minimum portfolio.

Maximum cashback is 200 GBP. T&Cs apply.

| Requirement | Detail |

|---|---|

| Residence | UK only |

| Age | 18 plus |

| Account type | New ISA GIA or SIPP |

| Minimum trade | 50 GBP |

| Minimum portfolio | 50 GBP value until March 2026 |

| Maximum payout | 200 GBP |

Description: Table showing the essential IG Cashback Offer eligibility rules.

Who are IG?

IG is a long-established FTSE 250 investment provider offering regulated share dealing services in the UK. Known for transparent fees and reliable tools, IG serves beginners and experienced investors. As an FCA-regulated firm, it follows strict client money protections, helping ensure a secure environment for new account holders.

Why is IG a trusted UK investment platform?

IG is a long established UK investment provider and a FTSE 250 company. Its platform is known for transparent pricing, reliable execution, and accessible tools for beginners. Investors can access a wide selection of shares and ETFs within a regulated trading environment.

Is IG regulated and secure for investors?

Yes. IG is authorised and regulated by the Financial Conduct Authority. Client funds must be held separately under FCA safeguarding rules. These protections help ensure financial stability and operational standards that support safe account opening and investing.

Do You Need a Promo Code for IG’s Cahback Offer

No promo code is required. Simply open a qualifying IG Share Dealing account via the campaign link on this page, meet the trading and deposit criteria. As long as you meet the eligibility criteria.

68% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

Can Existing IG Customers Claim the Cashback Offer?

The offer is restricted to new share dealing customers only. Anyone who has previously held an IG ISA, GIA, or SIPP cannot claim the cashback. However, users with only CFD or spread betting accounts remain eligible, provided they have never opened an IG share dealing product before.

What counts as a “new customer”?

You qualify as a new customer if you have never held an IG ISA GIA or SIPP. Previous users of these accounts are excluded. Demo users and holders of non share dealing IG products do not lose eligibility unless they previously opened a share dealing account.

What if you have an IG trading or spread betting account already?

You can still participate if you only hold CFD or spread betting accounts. The exclusion applies specifically to former IG share dealing customers. As long as you have never opened an IG ISA GIA or SIPP before, you remain eligible for the cashback promotion.

What are the required steps to earn 10% cashback?

Open a new IG account before 31 December 2025, place a 50 GBP trade, and keep at least 50 GBP invested until March 2026. IG then calculates 10 percent cashback on your daily average invested value, up to a maximum of 200 GBP.

Step 1 – How do you open a new share dealing account?

Choose an IG ISA GIA or SIPP, complete the online form, and pass identity checks. Once verified, you can fund the account and place the qualifying trade during the promotional period. Only new share dealing customers are eligible for the cashback.

Step 2 – Why is the first 50 GBP trade important?

The qualifying trade must be at least 50 GBP and executed between 21 November and 31 December 2025. This confirms account activity and starts eligibility tracking. Without a qualifying trade, the account does not meet the minimum conditions for the cashback reward.

Step 3 – How do you maintain a 50 GBP portfolio until March 2026?

You must keep 50 GBP or more invested from January to March 2026. This can be a single share or multiple holdings. Falling below 50 GBP may cause ineligibility, so topping up is recommended if market movements reduce your balance.

What is the maximum payout and when is cashback applied?

The maximum payout is 200 GBP. Cashback is applied after IG verifies all eligibility criteria following the promotional period. No manual claim is needed. The reward is added to your qualifying IG account according to IG’s published terms and conditions.

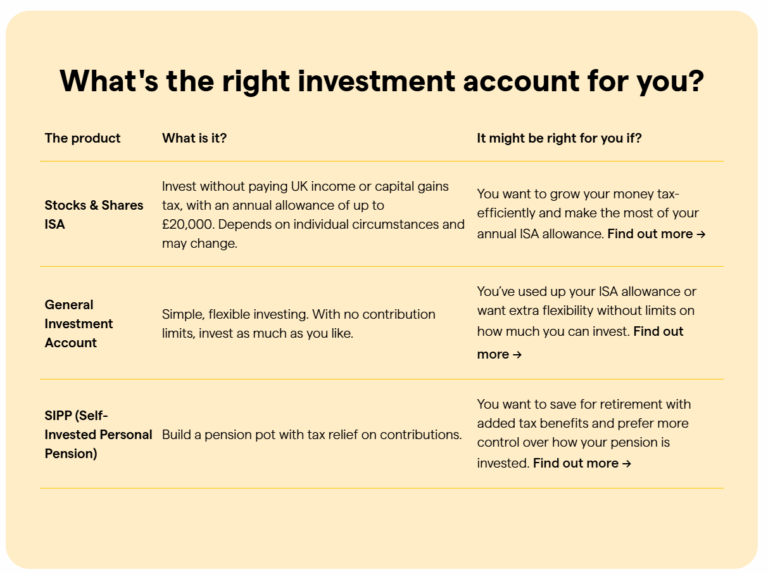

Which IG Accounts Qualify for the Cashback? (ISA, GIA, or SIPP?)

All three IG share dealing account types—ISA, GIA, and SIPP—qualify for the cashback offer. The account must be newly opened before 31 December 2025 and meet the trade and balance conditions. Cashback does not differ by account type; only tax treatment varies between products.

Can you choose any share-dealing product?

Yes. You can earn cashback through a new ISA, GIA, or SIPP as long as it is a new share dealing account. Each product is eligible if opened within the promotional window, followed by a qualifying trade and the required invested balance.

Does the cashback differ depending on the account type?

No. All eligible account types offer the same cashback rate and maximum payout. Differences relate to tax benefits, not promotion value. The reward is based solely on your invested amount and compliance with the promotional terms.

Do all shares and ETFs qualify for cashback?

Yes. Most shares and ETFs on IG’s platform qualify. The offer is based on your invested value, not the instrument type, as long as positions are standard share dealing assets held within your eligible account.

Are there restricted asset classes or markets?

Yes. CFDs, spread bets, options, and leveraged products are excluded. Only standard share dealing positions held in an ISA, GIA, or SIPP count toward the cashback calculation.

Is the IG Cashback Offer Worth It for New Investors?

For beginners, the IG Cashback Offer provides a simple, predictable incentive with low entry requirements. The 10 percent reward helps offset early costs and encourages consistent investing. Although the 200 GBP cap is modest, the offer remains competitive among low-minimum UK investment promotions.

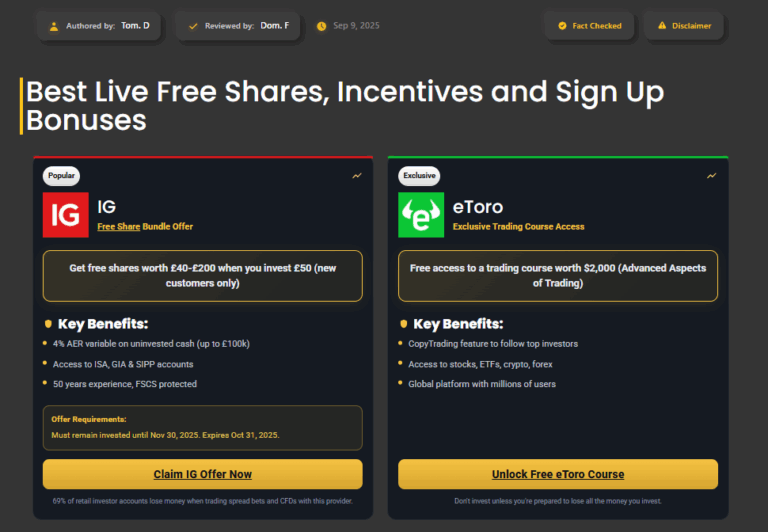

How does IG’s cashback compare with other UK investing promotions?

IG’s offer is simpler than multi-tier free share promotions or high-deposit incentives. Its 10 percent rate is competitive for low-minimum deals, and the clear eligibility steps reduce confusion.

See our Deals & bonuses page for the best live deals in investing, trading and crypto.

Final Thoughts – Is the IG Cashback Offer a Good Deal for 2025?

The IG Cashback Offer provides a simple, transparent incentive for new investors with modest starting balances. The 10 percent reward helps offset early costs and encourages steady investing. While capped at 200 GBP, it remains a solid entry-level benefit for those opening their first IG share dealing account.

Featured Broker

- Advanced charting tools

- Wide asset selection

- Trusted FCA regulation

New Offer: 10% Cash Back on your invested portfolio*

68% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

FAQs

Is the cashback taxable in the UK?

Cashback is usually treated as a reward, not investment income, though tax treatment can vary. Cashback in an ISA is sheltered. GIA or SIPP users should check HMRC guidance or seek advice for specific circumstances.

Can I withdraw money before March 2026 and still qualify?

Yes, but your invested value must remain above 50 GBP. Withdrawals that cause your balance to drop below the requirement may disqualify you. Keep your portfolio steady to maintain eligibility.

What if I miss the promotional deadline?

Missing the 31 December 2025 deadline means you cannot join the promotion. IG may offer future incentives, but this campaign ends on the stated date.

Can I switch from a demo to a full account and still qualify?

Yes. Demo accounts do not affect eligibility. You qualify as long as you have never opened an IG share dealing account before and complete the promotional steps.

Does this work for joint accounts?

No. Joint accounts are not eligible. The promotion applies only to individual new share dealing customers.

References

IG 10 Percent Cashback Terms and Conditions

https://www.ig.com/uk/5-percent-cashback-nov-25

IG Investments – Share Dealing Account Information

https://www.ig.com/uk/share-dealing

FCA Register – IG Markets Limited

https://register.fca.org.uk