Is IG Good for Day Trading? My Honest Take

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer: How Good is IG for Day Trading?

IG remains a strong choice for day trading in 2026, offering an intuitive platform, competitive fees, fast execution, and wide market access. It suits both beginners and experienced traders who want reliable tools, strong regulation, and a stable environment for short-term trading strategies.

Author’s Comments

After trading on IG for several months, I found it incredibly reliable and precise, but not beginner-friendly. The platform shines for active traders who rely on analysis and execution speed, yet feels overwhelming if you’re just starting or prefer app-based simplicity.

Summary Table: IG Day Trading Verdict

| Category | Rating | Verdict |

|---|---|---|

| Ease of Use | 4.0/5 | Clean but data-heavy interface |

| Tools & Charts | 4.6/5 | Excellent analysis suite |

| Fees | 3.8/5 | Tight spreads but extra charges |

| Safety | 4.8/5 | Fully FCA-regulated and insured |

| Overall | 4.2/5 | Great for experienced traders |

How Did I Start Using IG for Day Trading?

Getting started with IG was smooth and professional. Account setup and KYC verification took under 24 hours, and the dashboard was immediately accessible. Depositing funds via UK bank transfer was simple, and I was able to place my first live trade within minutes.

What Do I Like Most About IG?

IG feels built for serious traders — fast execution, tight spreads, and institutional-grade reliability. Its web and desktop platforms are powerful, and the charting tools stand out. It’s not flashy but delivers consistent performance for high-frequency and intraday trading.

Is IG Easy to Use for Day Traders?

IG’s layout is clear, though dense with information. The interface performs well even during volatile sessions, and order execution is quick. It suits traders who rely on precision and data but can appear intimidating to casual or app-based users.

What Markets Can You Day Trade on IG?

IG now offers direct crypto trading alongside its core markets — forex, indices, and shares. Traders can buy and sell major cryptocurrencies like Bitcoin and Ethereum without relying on CFDs. This gives UK users real crypto exposure while retaining IG’s robust trading infrastructure.

Summary of IG’s market offerings:

| Market Type | Available | Typical Spread | Notes |

|---|---|---|---|

| Forex | Yes | From 0.6 pips | Fast execution |

| Indices | Yes | From 0.8 pts | Global coverage |

| Crypto | Yes | From 0.2% | Real crypto trading available in the UK |

| Shares | Yes | From 0.1% | Ideal for day trading |

Are IG’s Fees a Dealbreaker for Day Traders?

IG’s spreads are competitive, starting from 0.6 pips on major forex pairs. However, inactivity fees of £12/month can sting if you’re not trading regularly. Overall, fees are fair for active users but less appealing for those who trade sporadically.

Summary of IG Fees for Day Traders:

| Fee Type | IG | eToro | Plus500 |

|---|---|---|---|

| Spread | From 0.6 pips | From 1 pip | From 0.8 pips |

| Commission | £0 on CFDs | £0 | £0 |

| Inactivity | £12/month | £10/month | £10/month |

Are the Charting Tools Enough for Professionals?

Yes — IG’s integration with ProRealTime, along with MT4 and MT5 compatibility, makes it excellent for advanced traders. It offers custom scripting, automated trading, and more indicators than most competitors. Beginners may not use half of what’s available, though.

Is IG Too Complex for Beginners?

IG’s interface and tool depth can overwhelm first-time traders. The platform assumes users already understand leverage, margins, and order types. While powerful, it’s not the most beginner-friendly — exchanges like eToro or Bitpanda are far easier to grasp initially.

Should You Use IG for Day Trading?

Transfer Offer

Transfer Offer

68% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

FAQs

What is IG, and is it suitable for day trading?

IG is a leading trading platform that offers a wide range of financial instruments, including forex, stocks, indices, and cryptocurrencies. It is suitable for day trading due to its fast execution speeds, advanced charting tools, and competitive spreads. However, the platform’s suitability depends on your trading strategy and experience level.

What are the key features of the IG trading platform for day traders?

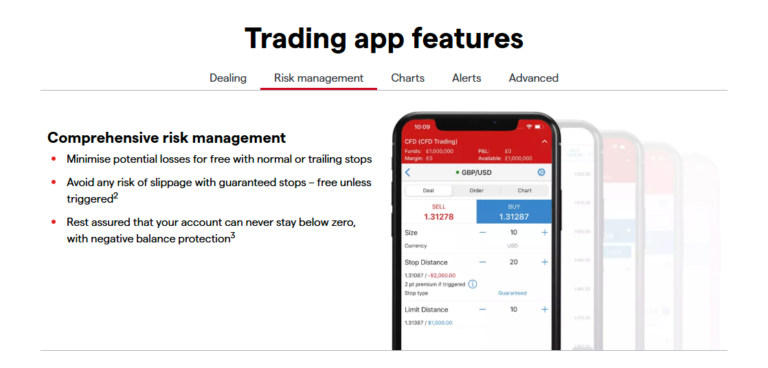

IG provides several features beneficial to day traders, including:

- Real-time market data and advanced charting tools.

- Customizable trading interface and risk management features.

- Access to a wide range of financial instruments.

- Competitive pricing with low spreads and commissions.

- Mobile and web platforms for trading on the go.

Does IG offer educational resources for beginner day traders?

Yes, IG offers a variety of educational resources, including webinars, tutorials, articles, and demo accounts. These resources help traders develop skills, understand market dynamics, and test strategies without risking real money.

Are there any downsides to using IG for day trading?

While IG is a robust platform, some potential downsides include:

- Inactivity fees for dormant accounts.

- High fees for overnight holding of leveraged positions.

- Advanced tools may be overwhelming for beginners.

These factors should be considered before committing to the platform.

Can IG be integrated with third-party tools for advanced day trading strategies?

Yes, IG can be integrated with third-party platforms such as MetaTrader 4 (MT4) and ProRealTime, allowing advanced traders to utilize additional tools for automation, algorithmic trading, and detailed technical analysis.