Is eToro Safe? A 2026 Security & Regulation Review for UK Investors

Choosing the right investment platform starts with one key question: can you trust it with your money? eToro is one of the most popular trading apps in the UK, offering stocks, ETFs, crypto, and CFDs — but is this platform actually safe to use? In this guide, we break down eToro's FCA regulation, security measures, account protection, and fees so you can decide whether it's the right platform for your needs.

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer — Is eToro Safe?

Yes, eToro is a legitimate, Nasdaq-listed broker (ETOR), authorised by the UK's FCA and other global authorities. Following its May 2025 IPO, eToro offers enhanced financial transparency alongside investor protection, strong encryption, and secure fund storage. While fees and CFDs require caution, the platform is safe for UK users.

Is eToro Legit and Regulated?

Yes — eToro is a legitimate and fully regulated trading platform. It operates under strict financial supervision across multiple jurisdictions, including the UK, EU, and Australia. Its regulatory status helps ensure user protection, platform transparency, and responsible financial conduct.

Is eToro FCA Regulated in the UK?

Yes. eToro (UK) Ltd is authorised and regulated by the Financial Conduct Authority (FCA), under firm reference number 583263. This ensures the company complies with UK standards for safeguarding client money, operational integrity, and offering fair, transparent investment services.

What Investor Protections Does eToro Offer?

UK clients benefit from FSCS protection up to £85,000 if eToro were to go bankrupt. Client funds are also held in segregated accounts, separate from eToro's own money. This structure limits risk and aligns with regulatory expectations for investor safety.

Has eToro Ever Been Hacked or Compromised?

eToro has never suffered a confirmed system breach affecting client funds. As a Nasdaq-listed company since May 2025, eToro now faces enhanced cybersecurity disclosure requirements under SEC regulations. The platform applies bank-level encryption, segregated client money, and strict internal access controls. Past phishing attempts targeted users externally, but no major compromise of trading accounts has been recorded since 2007.

| Jurisdiction | Regulator | FCA Regulated? | Notes |

|---|---|---|---|

| United Kingdom | FCA | Yes | Client funds held in segregated accounts |

| European Union | CySEC | Yes | MiFID II + MiCA permit (Feb 2025) |

| Australia | ASIC | Yes | Held to Australian financial standards |

| USA | FinCEN + SEC | Registered | MSB registered; Nasdaq-listed (ETOR) since May 2025 |

| UAE | FSRA (ADGM) | Yes | Abu Dhabi Global Market licence (2023) |

What Security Features Does eToro Use to Protect Your Account?

eToro uses multiple layers of protection including encryption, two-factor authentication (2FA), segregated accounts, and advanced monitoring systems. These features are designed to safeguard both your personal data and financial assets against fraud, unauthorised access, and common online threats.

How Is Your Personal Data Secured on eToro?

eToro uses 256-bit SSL encryption to protect user data during transmission. It complies with data protection regulations like GDPR, and access to sensitive information is strictly controlled within the platform's infrastructure to reduce the risk of breaches or misuse.

What Does Two-Factor Authentication (2FA) Do?

Two-Factor Authentication (2FA) adds a second layer of login protection. Even if your password is compromised, 2FA requires a unique code—usually sent to your phone—before access is granted. It significantly reduces the chance of unauthorised logins or account takeovers.

What Are Common Security Risks Users Should Watch For?

Phishing scams, fake login pages, and social engineering are common threats. Users should only log in via eToro's official site or app, enable 2FA, and avoid sharing personal or login information. eToro will never request sensitive details via email or text.

| Security Feature | Enabled? | Description |

|---|---|---|

| SSL Encryption | Yes | Secures all transmitted data |

| 2FA (Two-Factor Authentication) | Yes | Optional but highly recommended |

| Segregated Client Funds | Yes | Funds stored separately from company money |

| FSCS Protection | Yes | Up to £85,000 for investments (UK users) |

| Withdrawal Confirmation | Yes | Email verification required |

| Public Company Transparency | Yes | Nasdaq-listed (ETOR) with SEC reporting requirements |

What Are the Pros of Using eToro?

Is eToro Safe for Beginners?

Yes. eToro's clear dashboard, CopyTrader tools, and educational materials make it suitable for new investors. Accounts include two-factor authentication and withdrawal verification. Beginners should use small positions at first, especially with CFDs, which can amplify both potential returns and losses.

How Easy Is eToro's Platform to Use?

eToro's interface is designed for simplicity. Beginners can navigate easily with intuitive tools, straightforward trade execution, and helpful onboarding guides. However, some advanced traders may find the platform lacking depth for more complex strategies.

Does eToro Really Offer Commission-Free Trading?

Yes, eToro offers commission-free trading on stocks and ETFs. However, spreads still apply, and additional charges may occur for withdrawals, inactivity, and currency conversion. Always review the full fee table to understand your real trading costs.

What's the Mobile App Experience Like?

The eToro app is clean, responsive, and ideal for managing trades on the go. Features like CopyTrader, watchlists, and charting tools work smoothly, although it may feel limited for users wanting deep technical analysis or advanced order types.

What Are the Risks or Downsides of Using eToro?

Are CFDs Risky for New Investors?

Yes. CFDs are leveraged, meaning small market moves can lead to big gains—or losses. Many beginners underestimate the risk. It's essential to understand margin, stop-losses, and how quickly a position can move against you before trading CFDs.

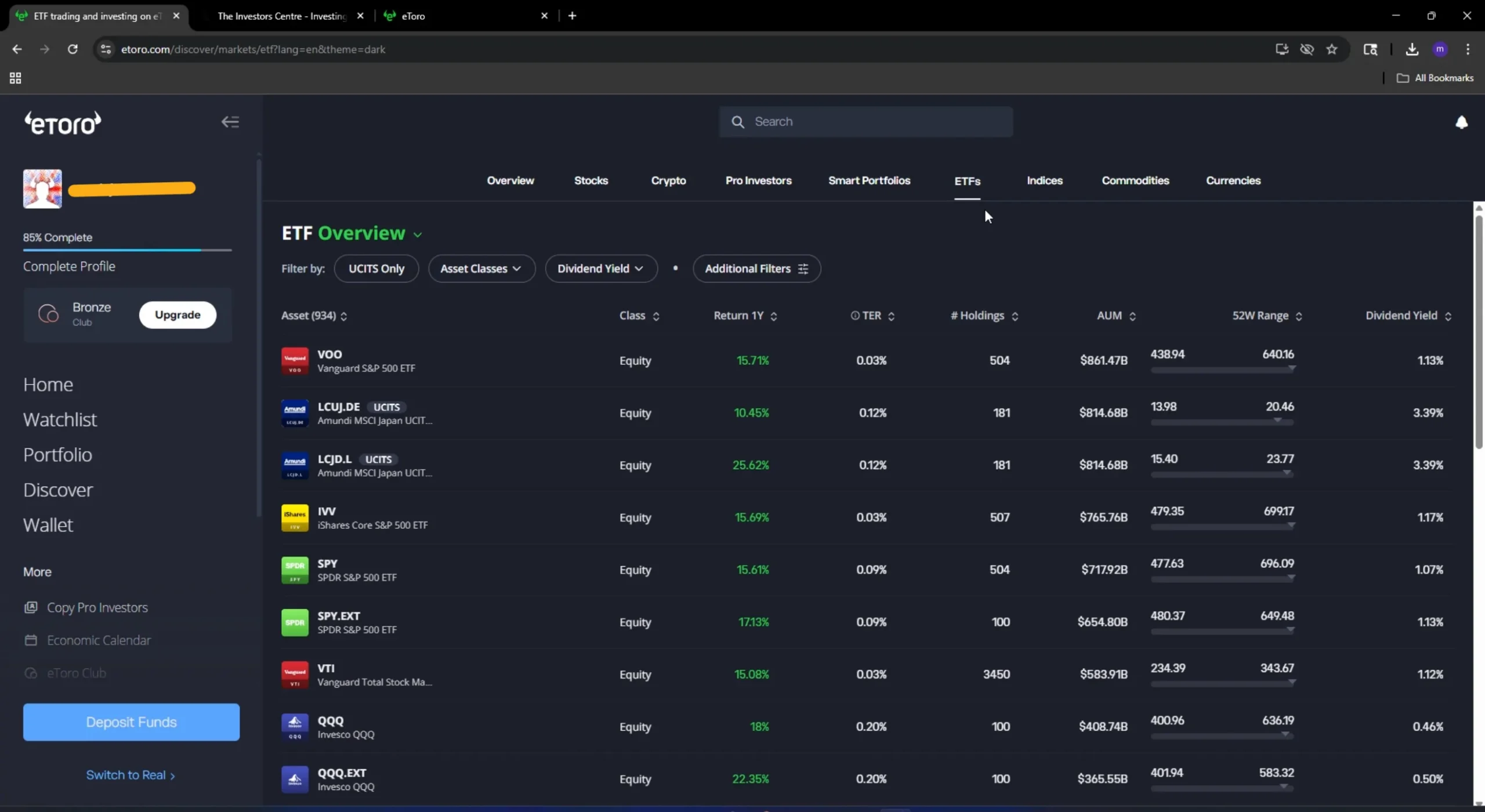

Are There Limitations for ETF Investors?

eToro's ETF selection is narrower than some competitors. Passive UK investors seeking niche funds or detailed fund info may find it lacking. Still, it covers major global ETFs and offers commission-free trading on many core options.

What Are the Platform's Main Weaknesses?

Key weaknesses include limited asset variety for advanced investors, withdrawal and conversion fees, and the lack of tools like MetaTrader. While great for beginners, traders with complex strategies or tax-efficient investing needs may outgrow the platform.

Is Your Money Safe with eToro?

Where and How Are Client Funds Stored?

Client funds are held in segregated bank accounts with tier-1 institutions, meaning your money is kept separate from eToro's operational funds. This setup helps protect your assets if the company experiences financial difficulties or insolvency.

Is There FSCS Protection for eToro Users?

Yes, UK users registered under eToro (UK) Ltd are protected by the Financial Services Compensation Scheme (FSCS), covering up to £85,000 if eToro fails. However, FSCS does not cover trading losses—only broker insolvency or fund mismanagement.

How Does eToro Handle Withdrawal Security?

eToro uses multi-step verification for all withdrawal requests. This includes email confirmation and two-factor authentication (2FA). Funds are typically returned to the original payment method, adding an extra layer of fraud prevention and compliance.

| Broker | Regulator | Client Fund Segregation | FSCS Coverage | 2FA Enabled |

|---|---|---|---|---|

| eToro | FCA UK | Yes | Up to £120,000 | Yes |

| Interactive Brokers | FCA UK | Yes | Up to £120,000 | Yes |

| Plus500 | FCA UK | Yes | Up to £120,000 | Yes |

What Are eToro's Fees — and Are There Any Hidden Costs?

What Are the Main Charges UK Users Should Know?

Inactivity Fee: $10/month after 12 months of no login. Withdrawal Fee: $5 per withdrawal. Conversion Fee: Applies to GBP deposits/withdrawals since eToro uses USD. Review the full fee schedule to avoid surprises.

How Do CFD Spreads and Leverage Add to Cost?

Spreads vary by asset and are the primary cost of CFD trading. Leverage magnifies potential returns but also increases losses and risks. Overnight and weekend holding fees apply, which can make long-term leveraged positions costly.

| Fee Type | Cost | Details |

|---|---|---|

| Stock & ETF Trading | £0 commission | Spread applies |

| Withdrawal Fee | $5 flat fee | Applies to all withdrawals |

| Inactivity Fee | $10/month | Charged after 12 months of no activity |

| Currency Conversion | ~0.5% | Charged on non-USD deposits/withdrawals |

| CFD Spread | From 1 pip | Varies by asset class |

Final Verdict — Is eToro a Safe Platform for UK Investors?

eToro is a legitimate, Nasdaq-listed (ETOR) and well-regulated platform offering robust account protection and fund segregation. Following its successful May 2025 IPO, eToro now provides enhanced financial transparency through quarterly SEC filings.

UK clients benefit from FCA oversight and FSCS coverage up to £120,000. While market risk remains, eToro's operational safeguards and public company accountability make it a safe choice for everyday investors.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 50% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

FAQs

Is eToro regulated in the UK?

Yes, eToro is authorised and regulated by the Financial Conduct Authority (FCA) under reference number 583263, ensuring compliance with strict UK financial laws.

Is my money protected if eToro goes bust?

Yes. UK clients are covered by the Financial Services Compensation Scheme (FSCS), which protects up to £85,000 if eToro fails.

Has eToro ever been hacked?

No confirmed major security breaches have been reported. eToro uses strong cybersecurity measures, including SSL encryption and 2FA.

Are eToro's fees really zero commission?

Yes, stock and ETF trades are commission-free. However, other costs apply, such as withdrawal, conversion, and inactivity fees.

Is eToro good for beginners?

Yes. eToro's user-friendly platform and CopyTrader feature make it ideal for new investors. But beginners should be cautious with CFDs due to higher risk.