- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer: Can You Use MEXC in the UK?

No. MEXC is not available to UK residents. The UK is listed as a restricted region on MEXC’s official site, and the exchange appears on the FCA Warning List. UK investors cannot legally open or verify accounts with MEXC, nor access its trading services.

Trade Smarter with MEXC

Access 3,000+ cryptocurrencies

0%*

Trading Fees

40M+

Active Users

3,000+

Cryptocurrencies

170+

Countries

Crypto trading involves risk. Not available in all regions.

What Is MEXC?

MEXC is a global crypto exchange with 40+ million users across 170 countries, supporting more than 2,000 cryptocurrencies and 3,000 trading pairs. Known for its low fees and derivatives market, MEXC ranks among the top five globally for futures trading volume in 2025.

| Feature | Description |

|---|---|

| Spot & Futures Trading | Trade crypto with tight spreads across spot and futures markets |

| Copy Trading | Follow and replicate strategies from top-performing traders |

| Launchpad & Airdrops | Early access to token launches and frequent airdrop opportunities |

| High Leverage | Up to 200x leverage available on selected futures contracts |

| Minimal KYC | Trade, deposit, and withdraw with limited ID verification requirements |

Is MEXC Safe and Legit?

MEXC is a global crypto exchange with 40+ million users across 170 countries, supporting more than 2,000 cryptocurrencies and 3,000 trading pairs. Known for its low fees and derivatives market, MEXC ranks among the top five globally for futures trading volume in 2025.

MEXC is not FCA licensed in the UK and does not provide FSCS coverage. It does, however, publish proof-of-reserves data and undergoes third-party audits. While this builds trust, the absence of local regulation may concern UK investors prioritising compliance and accountability.

FCA Regulated Alternatives

Since MEXC is restricted in the UK and not FCA authorised, UK investors must use compliant exchanges. FCA-regulated platforms like Coinbase, Kraken, and eToro allow safe access to crypto while providing stronger investor protection. These alternatives offer regulated custody and align with local compliance standards.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

What Can You Trade and Earn on MEXC?

Internationally, MEXC offers over 2,080 coins and 3,000 trading pairs, including major cryptocurrencies and niche altcoins. The platform also supports staking, savings products, futures, copy trading, and Launchpad features. However, UK investors cannot access these services, and should instead use FCA-approved exchanges.

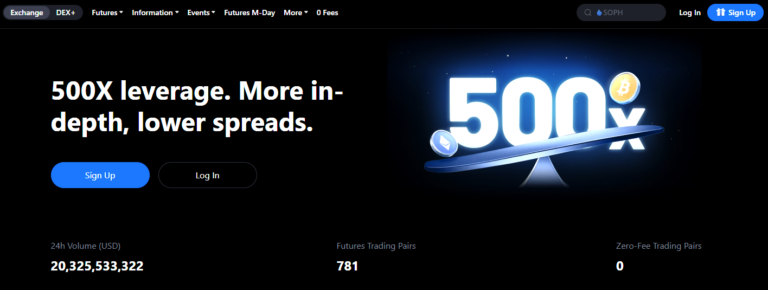

What about Derivatives and Leverage?

MEXC supports futures, perpetual swaps, and leveraged tokens with leverage up to 200x on some contracts. These products attract advanced traders but also carry high risk. UK users must complete risk acknowledgments under FCA rules before accessing derivatives.

Does MEXC off Staking and Yield Products?

Yes. MEXC provides staking, flexible savings, and high-yield opportunities on assets like ETH, USDT, and stablecoins. Rates vary, and higher yields may come with risks tied to liquidity or volatility. For UK investors, staking provides extra income but without FCA protections.

What about Launchpad and New Listings?

MEXC Launchpad gives early access to token sales, often before listings on major exchanges. This can be profitable but risky, as new tokens may be highly volatile. UK users should approach Launchpad participation with caution, given the lack of FCA oversight.

| Feature | Description | Benefits | Ideal For |

|---|---|---|---|

| Spot Trading | Trade over 1,600 crypto pairs across major, DeFi, meme, and niche tokens | Access to early listings, deep liquidity, low fees | All users |

| Futures & Leverage | Derivatives contracts with up to 200x leverage on select pairs | High potential returns, risk management tools included | Advanced traders |

| Staking & Savings | Earn passive income via flexible or fixed lockups of crypto assets | Competitive APRs, auto-compound options | Passive investors |

| Launchpad | Get early access to token sales and exclusive project listings | Potential for high-growth investments, regular airdrops | Altcoin explorers |

| Grid Trading Bots | Automate trades within a defined price range using custom settings | Hands-off trading in sideways or volatile markets | Intermediate traders |

| Leveraged Tokens | 3x Long/Short tokens that don’t require margin or liquidation management | Simplified leveraged exposure with reduced risk | Tactical altcoin traders |

| ETFs & Index Tokens | Bundled crypto exposure (e.g., DeFi index, AI coin basket) | Diversified investing in specific themes | Strategic investors |

What Are the Fees on MEXC?

Globally, MEXC charges 0% maker fees and very low 0.05% taker fees on spot trading. Futures trading costs are even lower, at 0% maker and 0.02% taker. These rates undercut most competitors, but UK users cannot legally access MEXC to benefit from them.

| Activity | Fee (Standard) | MX Token Discount |

|---|---|---|

| Spot Trading | 0.1% | 0.08% |

| Futures Trading | 0.00% / 0.01% | Tiered |

| Deposit | Free | N/A |

| Withdrawal | Variable (network-based) | N/A |

Any Hidden Charges?

MEXC does not charge crypto deposit fees. Network fees apply on withdrawals, and fiat costs vary depending on payment method. Discounts are offered for using MX tokens. These advantages remain inaccessible to UK users due to regulatory restrictions.

How Easy Is It to Use MEXC?

Globally, MEXC provides a modern web interface and mobile app with advanced charts, futures tools, and copy trading. For beginners, the design may feel complex. In the UK, MEXC is unavailable, so local investors should choose user-friendly FCA-regulated exchanges like Coinbase or eToro.

Is MEXC beginner-friendly?

MEXC offers tutorials, an academy, and copy trading, which can help beginners. However, the advanced trading tools and derivatives make it less intuitive than beginner-focused platforms. For UK users, the question is moot — MEXC is unavailable, and regulated exchanges like Coinbase are better suited.

Do You Need KYC to Use MEXC?

Yes. Globally, MEXC requires Know Your Customer (KYC) verification to access full trading limits, staking, and withdrawals. Verification tiers unlock higher transaction limits and additional services. UK residents cannot complete KYC on MEXC, as the platform prohibits account creation locally.

What are the KYC Requirements?

MEXC KYC generally involves government-issued ID, facial recognition, and proof of address. Higher levels require enhanced documentation. These measures align with anti-money laundering rules but remain irrelevant for UK investors, as MEXC accounts cannot be opened or verified in the UK.

How Does MEXC Compare to Other Major Exchanges?

Globally, MEXC undercuts most exchanges on fees and coin variety, but it lacks FCA regulation. Coinbase, Kraken, and eToro offer fewer tokens but provide UK compliance, customer protection, and safer fiat integration. For UK investors, regulated exchanges remain the only viable choice.

What Are the Pros and Cons of MEXC in 2025?

The low fees alone make it worth considering, especially if you’re an active trader. Plus, the sheer number of coins available means I can get in early on tokens before they show up on more mainstream platforms.

That said, it’s not perfect. If you’re someone who needs a lot of customer handholding or bank integration, it might not be your first choice.

| Pros | Cons |

|---|---|

| Low fees across spot and futures | Not FCA/SEC regulated |

| Massive altcoin and new coin access | Limited fiat on/offramps |

| Copy trading, staking, and launchpad options | No live customer chat |

| High leverage with deep liquidity | Slight learning curve for some tools |

| Good mobile + desktop experience |

How Do You Get Started with MEXC?

Internationally, creating an account involves registering, completing KYC, depositing funds, and trading. However, UK investors cannot sign up or verify accounts on MEXC due to FCA restrictions. Instead, UK users should open accounts with FCA-registered platforms like Coinbase, Kraken, or eToro.

Final Verdict

MEXC is a competitive global exchange offering low fees, derivatives, and broad asset coverage. However, it is restricted in the UK and not FCA regulated. For British investors, regulated platforms like Coinbase, Kraken, and eToro remain the only safe, compliant choices in 2025.

TIC Rating 3/5.

Trade Smarter

Access 3,000+ cryptocurrencies

0%

Trading Fees

40M+

Active Users

3,000+

Cryptocurrencies

170+

Countries

Crypto trading involves risk. Not available in all regions.

FAQs

Can I use MEXC without completing KYC?

Yes, you can trade and withdraw crypto on MEXC without KYC, up to a daily limit. However, KYC is required for access to all their services.

What fees does MEXC charge?

MEXC charges 0.1% on spot trades and as low as 0.00%/0.01% on futures. Fees are even lower if you hold MX tokens.

Does MEXC support fiat deposits and withdrawals?

Fiat support is limited. MEXC partners with third-party services for credit/debit card purchases, but bank transfers are not widely available.

What makes MEXC different from their competitors?

MEXC lists over 1,600 altcoins and offers higher leverage, lower fees, and faster access to new tokens.

Is MEXC available in the UK?

No. MEXC is restricted in the UK and appears on the FCA warning list. Residents cannot sign up, verify accounts, or trade.

References

- MEXC Official – Trading Fee Schedule

- https://www.fca.org.uk/news/warnings/mexc-global-ltd

- MEXC Glossary – Crypto Regulation

- MEXC Learn – How to Perform KYC Verification on MEXC?

- MEXC – New Listing Calendar