- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection (£120,000 per person)

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Affiliate disclosure. Broker buttons and "Get Started" links are affiliate links. We may earn a commission if you open an account — at no extra cost to you. This never affects our ratings, rankings, or recommendations, which are based solely on our independent testing methodology.

Contact: info@theinvestorscentre.co.uk

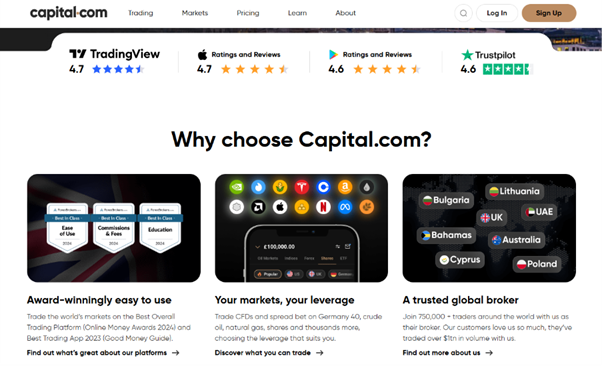

Quick Verdict: Is Capital.com Worth It?

Capital.com is an excellent choice for UK traders seeking commission-free CFDs with lightning-fast execution. With 5,000+ markets, 0.6-pip EUR/USD spreads, and FCA regulation, it suits active traders and spread bettors. Beginners may find the lack of real shares limiting.

Who Should Use Capital.com?

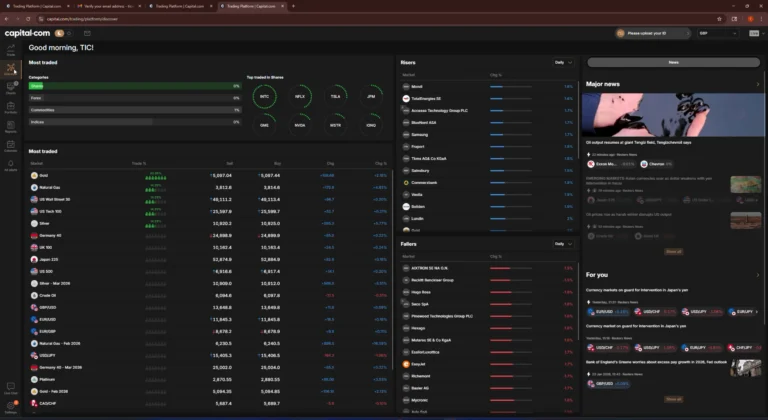

Capital.com is best for: active traders who want commission-free CFD trading with tight spreads, UK spread bettors seeking tax-efficient trading, and day traders who value fast execution speeds. The platform’s TradingView integration and 100+ technical indicators make it particularly suitable for chart-focused strategies.

You should avoid Capital.com if: you want to buy and hold real shares (Capital.com only offers CFDs), you’re seeking cryptocurrency exposure in the UK (not available to retail clients), or you prefer trading on MetaTrader 5 (only MT4 is supported).

Capital.com At A Glance

Capital.com is an excellent choice for UK traders seeking commission-free CFDs with lightning-fast execution. With 5,000+ markets, 0.6-pip EUR/USD spreads, and FCA regulation, it suits active traders and spread bettors. Beginners may find the lack of real shares limiting

| TIC Rating | 4.7/5 |

| Trustpilot | 4.6/5 (13000+ reviews) |

| UK Regulator | FCA (Licence 793714) |

| Minimum Deposit | £20 |

| Trading Fees | 0% commission - spreads from 0.6 pips |

| Available Markets | 5000+ CFDs - 4700+ spread betting |

| Deposit Methods | Bank transfer - debit/credit card - Apple Pay |

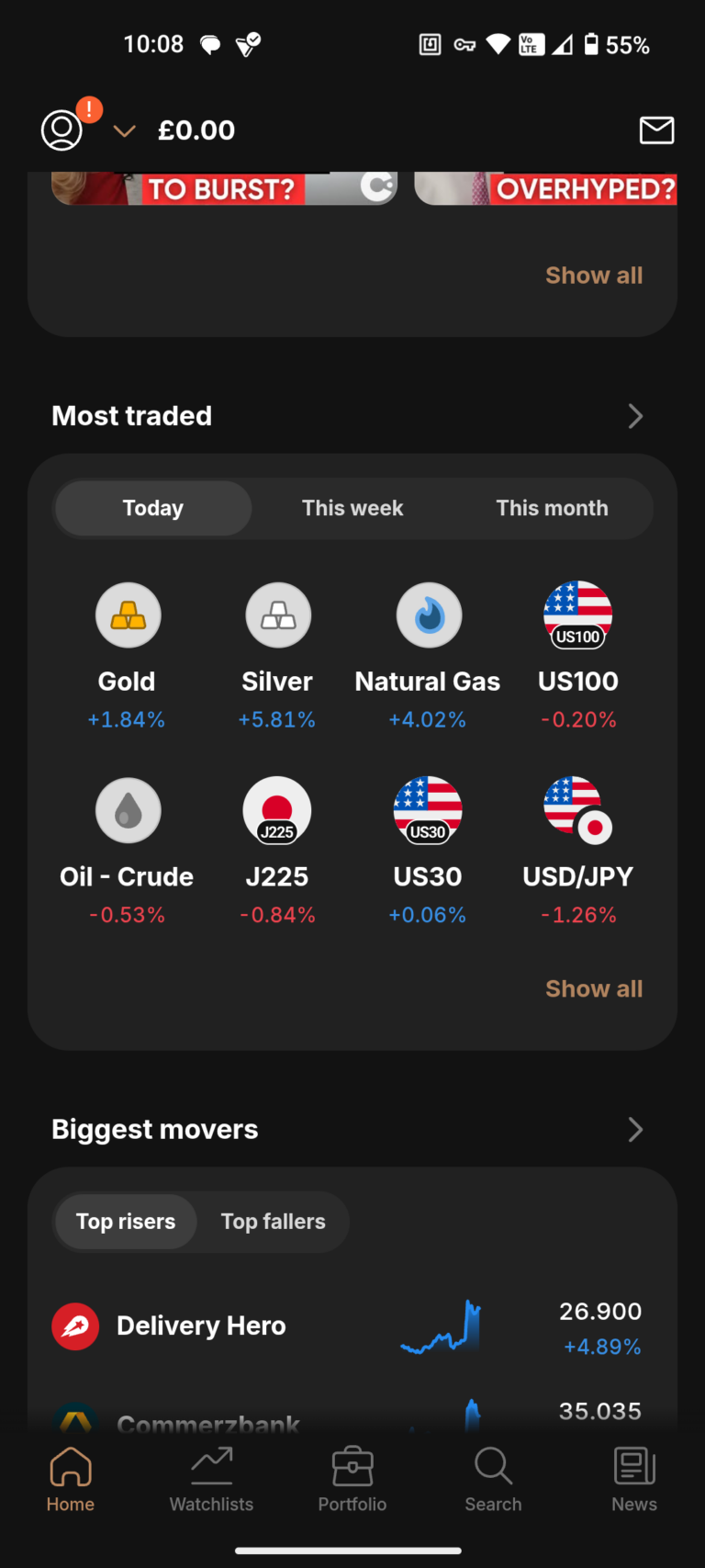

| Mobile App | Yes (iOS & Android) |

| FSCS Protection | Up to £120000 |

| Spread Betting | Yes (UK only - tax-free profits*) |

| 1X Account | Yes (non-leveraged - UK only) |

| Best For | Active traders - spread bettors - day traders |

*Tax treatment depends on individual circumstances and may change.

How Do We Rate Capital.com?

We evaluate Capital.com across six key categories, with two independent experts scoring each area. Their scores are averaged to produce our final TIC Rating of 4.7/5.

| Category | Adam | Thomas | Average |

|---|---|---|---|

| Fees | 4.8 | 4.9 | 4.85 |

| Security | 4.8 | 4.7 | 4.75 |

| Ease of Use | 4.9 | 4.8 | 4.85 |

| Features | 4.5 | 4.6 | 4.55 |

| Customer Support | 4.6 | 4.5 | 4.55 |

| Asset Range | 4.6 | 4.7 | 4.65 |

| OVERALL | 4.7 | 4.7 | 4.70 |

Our Methodology

Every platform review at The Investors Centre is independently scored by two financial experts: Adam Woodhead and Thomas Drury. Each expert evaluates the platform across six categories—Fees, Security, Ease of Use, Features, Customer Support, and Asset Range—with scores averaged to produce our final TIC Rating.

Our process includes hands-on testing with funded accounts, verification of regulatory status through the FCA register, and fee data sourced directly from Capital.com’s official documentation. We also monitor Trustpilot reviews for customer sentiment trends.

What Are Capital.com's Biggest Strengths?

Commission-free trading with competitive spreads — Capital.com charges 0% commission across all markets, with EUR/USD spreads averaging just 0.6 pips and GBP/USD at 1.3 pips. ForexBrokers.com named it Best in Class for Commission & Fees in 2025.

Lightning-fast execution — with an average execution speed of 0.014 seconds, Capital.com is among the fastest CFD brokers available. This matters for active traders where milliseconds can affect fill prices.

UK-exclusive account options — the 1X non-leveraged account and spread betting are only available to UK clients. Spread betting profits are tax-free (tax treatment depends on individual circumstances and may change), making Capital.com particularly attractive for UK traders.

What Are Capital.com's Main Drawbacks?

No real share ownership — Capital.com only offers CFDs and spread betting, not actual shares. If you want to buy and hold stocks for dividends or long-term investment, you’ll need to look elsewhere.

No cryptocurrency trading for UK retail clients — following FCA restrictions, Capital.com cannot offer crypto CFDs to UK retail traders. Professional clients may still access crypto markets.

Limited platform choice — while the proprietary platform and TradingView integration are excellent, the only third-party option is MT4. Traders wanting MT5 or cTrader will need to consider alternatives.

How Much Does Capital.com Cost?

Capital.com operates on a spread-only model with no commission on any market. This transparent pricing structure makes it easy to calculate trading costs upfront.

What Are Capital.com’s Trading Fees?

All trading on Capital.com is commission-free. The broker makes money through spreads—the difference between buy and sell prices. Here’s how the spreads compare across major markets:

| Market | Spread | Notes |

|---|---|---|

| EUR/USD | 0.6 pips | Among lowest in industry |

| GBP/USD | 1.3 pips | Competitive for majors |

| UK 100 | 1 point | FTSE 100 index CFD |

| Share CFDs | Variable | 4000+ shares available |

Fees accurate as of February 2026. Source: Capital.com official fee schedule. Fees may change—always verify on Capital.com’s website before trading.

Are There Any Deposit or Withdrawal Fees?

Capital.com does not charge fees for deposits or withdrawals. This applies across all payment methods, including bank transfers, debit/credit cards, and Apple Pay. The minimum deposit is £20 regardless of payment method.

| Method | Deposit Fee | Withdrawal Fee | Speed |

|---|---|---|---|

| Bank Transfer | Free | Free | 1-2 business days |

| Debit/Credit Card | Free | Free | Instant |

| Apple Pay | Free | Free | Instant |

Capital.com processes 98.91% of withdrawals within 24 hours, with 86.99% completed within just 5 minutes.

What About Overnight Fees?

Overnight financing charges apply to leveraged CFD positions held past market close. However, Capital.com’s 1X account (available to UK clients only) does not incur overnight swap fees on share positions, making it suitable for longer-term CFD strategies without leverage.

Are There Any Hidden Fees?

Capital.com maintains a transparent fee structure with no custody fees, no account maintenance fees, and no inactivity fees mentioned in their documentation. Currency conversion fees may apply if you trade instruments denominated in a different currency to your account base currency.

Is Capital.com Safe and Regulated?

Capital.com is authorised and regulated by the Financial Conduct Authority (FCA) under licence number 793714. You can verify this directly on the FCA register. For more detail, see our full Capital.com safety analysis.

Beyond FCA regulation, Capital.com holds licences from four additional global regulators: CySEC (Cyprus), ASIC (Australia), SCB (Bahamas), and SCA (UAE). This multi-jurisdictional oversight provides additional operational transparency.

UK client protections include:

FSCS protection up to £120,000 — If Capital.com were to fail, eligible clients could claim compensation through the Financial Services Compensation Scheme, which increased its limit from £85,000 in December 2025.

Segregated client funds — Your money is held separately from Capital.com’s operational funds in accounts with top-tier banks.

Negative balance protection — Retail clients cannot lose more than their deposited funds.

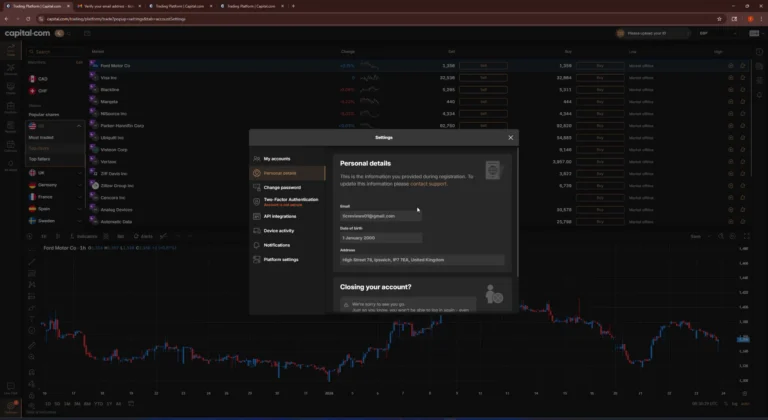

Security features include two-factor authentication (2FA), ISO certification, PCI DSS compliance, and encrypted TLS data transmission. Capital.com has not suffered any publicised security breaches.

What Account Types Does Capital.com Offer?

Capital.com offers three main account types for UK clients: the standard CFD account, the 1X non-leveraged account, and a spread betting account. Each serves different trading styles and tax situations.

What Is the 1X Account?

The 1X account is Capital.com’s non-leveraged trading option, exclusive to UK clients. With one-for-one market exposure, you buy and sell CFDs without margin requirements. The key advantage is no overnight swap fees on share positions, making it suitable for traders who want to hold positions longer without incurring daily financing charges. You still don’t own the underlying shares, but you avoid the complexity and cost of leverage.

Is Spread Betting Available?

Yes, Capital.com offers spread betting exclusively to UK clients across 4,700+ markets. Spread betting profits are free from Capital Gains Tax and Stamp Duty, making it potentially more tax-efficient than CFD trading for profitable traders. For a broader comparison, see our guide to the best spread betting brokers in the UK.

Tax treatment depends on individual circumstances and may change. If you’re unsure, consult a tax professional.

Is Capital.com Good For Beginners?

Capital.com scored Best in Class for Ease of Use at the ForexBrokers.com 2025 awards, and the platform’s clean interface supports this. Navigation is intuitive, with clear buy/sell buttons and straightforward order entry. The mobile app mirrors the desktop experience closely.

For learning, Capital.com offers Investmate—a free educational app with bite-sized lessons under three minutes each. The main platform includes a demo account with virtual funds so you can practice without risking real money. The broker also runs a YouTube channel with over 240,000 subscribers featuring market analysis and educational content.

However, beginners should understand that CFD trading carries significant risk. Capital.com’s own risk warning states that 60% of retail investor accounts lose money when trading spread bets and CFDs with this provider. The platform is genuinely easy to use, but the products themselves are complex instruments that require proper understanding before trading with real funds.

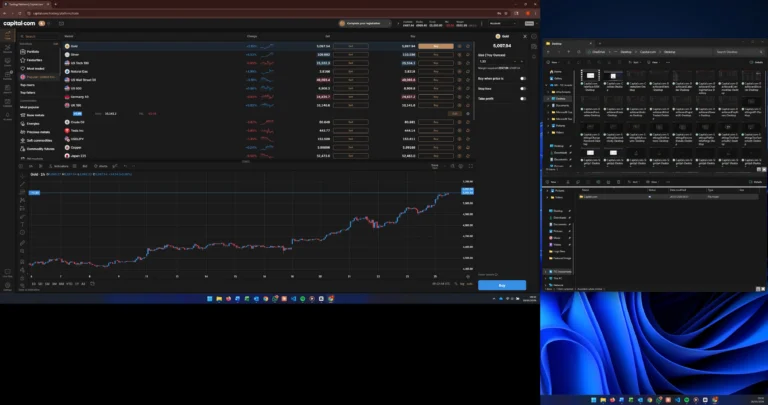

My First Impressions of Capital.com

I signed up to Capital.com 12 months ago as part of my research for The Investors Centre, and I’m still using them personally today—it’s now my primary platform for CFD trading. Opening the account took about five minutes, with ID verification surprisingly fast. My first trade was a £50 position on GBP/USD; the order executed instantly and the fee breakdown was clear before I confirmed.

Over the past year I’ve tested both the CFD and spread betting accounts extensively. What keeps me coming back is the TradingView integration—having professional-grade charts within the broker’s platform, rather than switching between tabs, genuinely improves the experience. The mobile app mirrors this well; I’ve executed trades on my commute without issues. My only frustration was discovering crypto isn’t available for UK accounts, which I only realised after searching for Bitcoin.

— Adam Woodhead, The Investors Centre

How Do You Open A Capital.com Account?

Opening an account with Capital.com is straightforward and typically takes 5-10 minutes. Here’s the step-by-step process:

Step 1: Visit Capital.com and click ‘Trade Now’ or ‘Create Account’. You can also download the mobile app first.

Step 2: Enter your email address and create a password, or sign up using Google or Apple.

Step 3: Complete the suitability questionnaire. This assesses your trading experience and understanding of CFD risks—required by FCA regulation.

Step 4: Verify your identity by uploading a photo ID (passport or driving licence) and proof of address (utility bill or bank statement).

Step 5: Choose your account type: CFD, spread betting, or 1X (non-leveraged). You can open multiple account types later.

Step 6: Fund your account with a minimum of £20 using bank transfer, card, or Apple Pay.

Step 7: Start trading. Consider using the demo account first to familiarise yourself with the platform without risking real money.

How Does Capital.com Compare to Alternatives?

Capital.com competes directly with other UK CFD brokers. Here’s how it stacks up against popular alternatives. For detailed comparisons, see our Capital.com vs Trading 212 and XTB vs Capital.com guides.

| Broker | Min Deposit | EUR/USD Spread | UK Regulation | Best For |

|---|---|---|---|---|

| Capital.com | £20 | 0.6 pips | FCA | Active CFD traders |

| eToro | $100 | 1.0 pips | FCA | Copy trading |

| IG | £0 | 0.6 pips | FCA | Range of markets |

| XTB | £0 | 0.8 pips | FCA | Real shares + CFDs |

Capital.com’s key advantages are its tight spreads, fast execution, and UK-exclusive features like spread betting and the 1X account. IG offers a wider market range, while XTB provides real share dealing alongside CFDs—something Capital.com lacks.

Final Thoughts

Capital.com delivers where it matters most for active UK traders: tight spreads, fast execution, and a genuinely user-friendly platform. The 0% commission model keeps costs predictable, while UK-exclusive features like spread betting and the 1X account add flexibility you won’t find with offshore brokers.

The limitations are worth considering. No real share ownership means Capital.com isn’t suitable for traditional buy-and-hold investing. The lack of UK crypto access will disappoint some traders. And if MT5 or cTrader are important to your strategy, you’ll need to look elsewhere.

For its intended audience—active CFD traders, spread bettors, and those who value execution speed—Capital.com earns its 4.7/5 rating. The platform does what it does well, and the Good Money Guide Best Trading App 2025 award reflects genuine quality rather than marketing spend.

Beginner Friendly

Beginner Friendly

Minimum

Dealing Fees

Platform Fee

FAQs

Is Capital.com Legit in the UK?

Yes, Capital.com is authorised and regulated by the Financial Conduct Authority (FCA licence 793714). UK clients are protected by the FSCS up to £120,000 and benefit from negative balance protection.

What Is the Minimum Deposit for Capital.com?

The minimum deposit is £20 (or equivalent in EUR/USD) across all payment methods, including bank transfer, debit/credit card, and Apple Pay. There are no deposit fees.

Does Capital.com Charge Commission?

No, Capital.com charges 0% commission on all markets. The broker makes money through spreads—the difference between buy and sell prices. EUR/USD spreads start at 0.6 pips.

Can You Trade Crypto on Capital.com UK?

No, cryptocurrency CFDs are not available to UK retail clients due to FCA restrictions introduced in 2021. Professional clients may still access crypto markets after meeting eligibility criteria.

Is Capital.com Good for Day Trading?

Yes, Capital.com suits day traders well. The 0.014-second average execution speed, TradingView integration, and commission-free trading make it competitive for short-term strategies. See our dedicated analysis on Capital.com for day trading.

How Long Do Capital.com Withdrawals Take?

Capital.com processes 98.91% of withdrawals within 24 hours, with 86.99% completed in under 5 minutes. Bank transfers may take 1-2 additional business days depending on your bank.

References

- Charges & Fees | Capital.com UK

- Capital Com (UK) Limited – FCA Registration

- Capital.com Reviews | Read Customer Service Reviews of capital.com

- FCA Register — Capital Com (UK) Limited (regulatory status, FRN 793714)

- Trustpilot — Capital.com reviews (4.6/5 rating, 13,000+ reviews as of November 2025)