Best Trading 212 Alternatives in the UK 2026

I've been using Trading 212 since 2021. It's a solid platform — but it's not the only option, and depending on what you're after, it might not even be the best one for you. After testing over 20 investment apps across real-money accounts, I've narrowed down the four Trading 212 alternatives that genuinely stand out in 2026.

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer – What's the Best Trading 212 Alternative in 2026?

It depends on what you need. If I had to pick one overall alternative, I'd go with eToro — it gives you the widest range of assets with the lowest barrier to entry. But the honest answer is that the "best" alternative changes depending on your priority.

| Your Priority | Best Alternative | Why |

|---|---|---|

| Multi-asset investing as a beginner | eToro | Copy trading, clean interface, 5,000+ assets |

| Established multi-asset platform with ISA | IG | 50+ years operating, flexible ISA, £0 commission from Jan 2026 |

| Leverage trading & CFDs | Capital.com | 3,000+ CFD markets, slick app, competitive spreads |

| Crypto-focused portfolio | Bitpanda | 600+ cryptocurrencies, staking, fractional crypto |

61% of retail CFD accounts lose money.

68% of Retail CFD Accounts Lose Money

60% of Retail CFD Accounts Lose Money

Don’t invest unless you’re prepared to lose all the money you invest.

How Do the Alternatives Compare to Trading 212?

I've split this into two tables to keep things readable on mobile. The first covers what you can trade and how much it costs. The second covers regulation, trust scores, and standout features.

| # | Platform | Asset Types | Stock Commission | Key Fee to Know | Get Started |

|---|---|---|---|---|---|

| — | Trading 212 | Stocks, ETFs, CFDs, Crypto ETNs | £0 | 0.15% FX fee; CFD spreads from 0.5 pips | — |

| 1 | eToro | Stocks, ETFs, Crypto, CFDs, Copy Trading | $1–$2 | ~0.5% FX conversion; $5 withdrawal fee | Visit |

| 2 | IG | Stocks, ETFs, Bonds, CFDs, Spread Bets, Options | £0 | 0.7% FX fee; flexible ISA included | Visit |

| 3 | Capital.com | CFDs only (Stocks, Forex, Crypto, Commodities) | £0 (CFD) | Spread-based: EUR/USD from 0.6 pips | Visit |

| 4 | Bitpanda | Crypto, Precious Metals (UK) | N/A (crypto only in UK) | 0.99%–2.49% crypto spread | Visit |

Note: Bitpanda stocks and ETFs are not available to UK residents. UK users can only access crypto and precious metals on Bitpanda. Data as of March 2026 — verify current fees at each broker's website.

Regulation & Trust

| Platform | FCA Regulated (FRN) | FSCS Protected | Trustpilot Score | Standout Feature |

|---|---|---|---|---|

| Trading 212 | Yes (609146) | Yes — up to £85,000 | 4.6/5 (78,268 reviews) | Commission-free stocks & ISA |

| eToro | Yes (583263) | Yes — up to £85,000 | 4.2/5 (30,408 reviews) | Copy trading & social feed |

| IG | Yes (195355) | Yes — up to £85,000 | 3.9/5 (8,663 reviews) | 50+ year track record, flexible ISA |

| Capital.com | Yes (793714) | Yes — up to £85,000 | 4.6/5 (13,806 reviews) | AI-powered risk alerts |

| Bitpanda | Registered only (928556) | Limited* | 3.9/5 (14,527 reviews) | 600+ cryptos with staking |

*Bitpanda's FCA registration (Bitpanda Custody Ltd) covers certain activities. Crypto assets are not covered by FSCS. FSCS protects up to £85,000 per person per firm for investments. The £120,000 limit refers to deposit protection for banks and building societies, raised in December 2025. Trustpilot data as of March 2026.

How Did I Test These Platforms?

I've held real-money accounts on all four platforms (plus Trading 212) since at least early 2025. My testing process at The Investors Centre involves depositing real funds, executing live trades, testing withdrawals, and using each platform for a minimum of three months before publishing.

For this article specifically, I re-tested each platform between January and March 2026 — checking that fee structures, available assets, and app performance were current. I verified all regulatory data directly on the FCA Register and pulled Trustpilot scores fresh. See our full testing methodology here.

I'm not going to pretend this is perfectly objective. I have personal preferences, and I still actively use Trading 212 alongside these alternatives. But every fact in this article has a verifiable source, and every opinion is clearly flagged as one.

What Did We Measure?

| Criteria | Weight | What We Measured |

|---|---|---|

| Fees | 25% | Spreads vs advertised rates, commissions, FX conversion, withdrawal fees |

| Platform | 20% | Interface design, execution speed, stability, charting tools |

| Assets | 15% | Number and variety of tradeable instruments |

| Mobile | 15% | App quality, feature parity with desktop |

| Tools | 10% | Research, analysis, alerts, copy trading features |

| Support | 10% | Response time, channel availability, quality of help |

| Regulation | 5% | FCA Register verification, FSCS protection |

Here Are My Top 4 Trading 212 Alternatives in Detail

1. eToro — Best for Beginners Who Want Everything in One Place

2. IG — Best Established Multi-Asset Platform (Especially for ISAs)

3. Capital.com — Best for Leverage Trading & CFDs

4. Bitpanda — Best for Crypto Investors

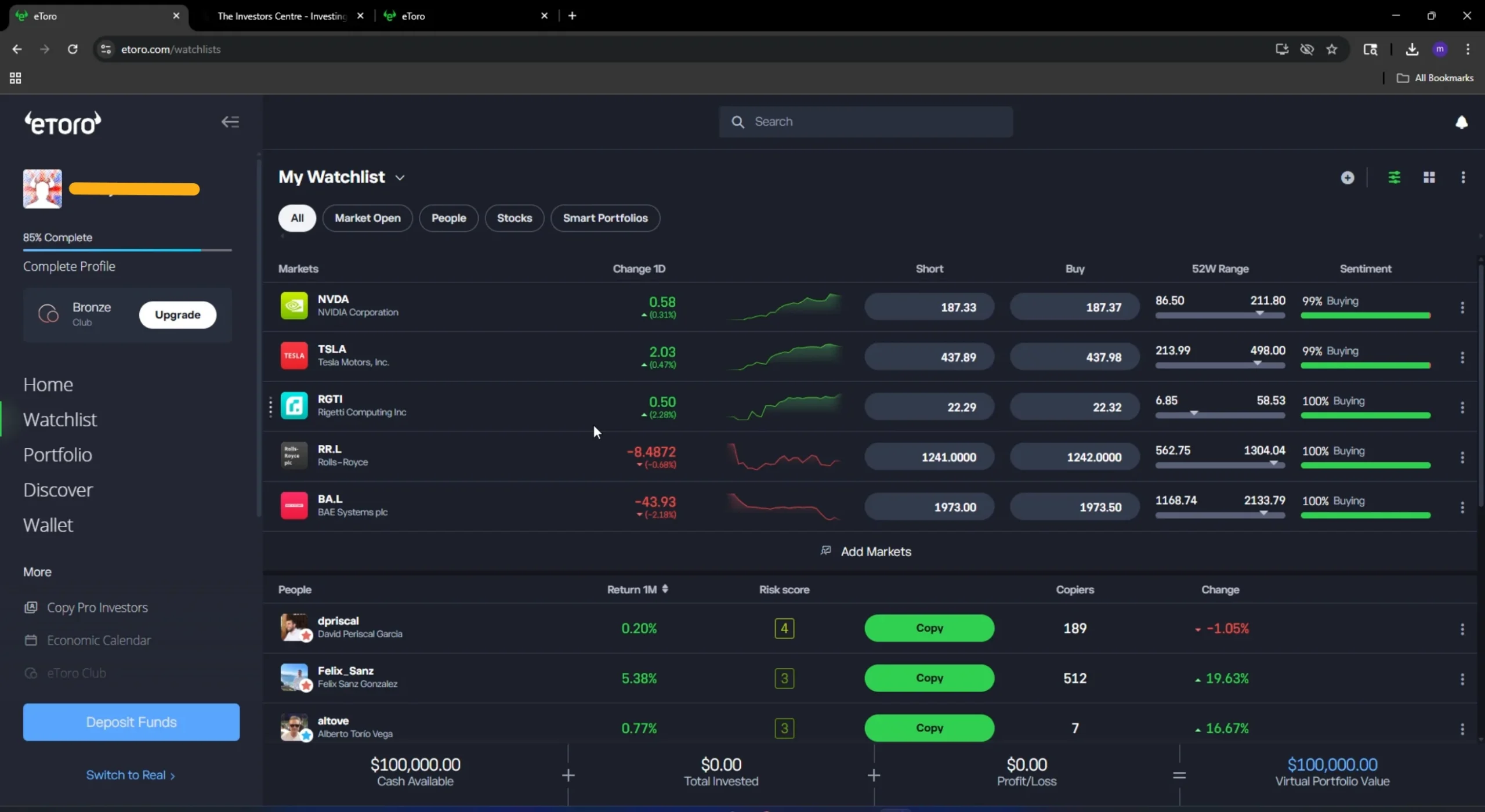

eToro — Best for Beginners Who Want Everything in One Place

eToro is the one I point friends toward when they're just getting started. The interface is genuinely beginner-friendly — not dumbed down, just well designed. You get stocks, ETFs, crypto, and CFDs all in one account, plus the copy trading feature that lets you mirror experienced investors' portfolios.

The minimum deposit is $50 (around £40), which keeps the barrier low. They did introduce a $1–$2 commission on stock trades in 2025, which ended their fully commission-free era. It's still cheap, but worth knowing about.

Pros

- Copy Trading: You can automatically mirror the moves of experienced investors.

- Social Investing: Features a social media-style feed to discuss market news with other users.

- All-in-One Asset Range: Offers stocks, ETFs, and cryptocurrency in one app.

- Beginner Friendly: The interface is highly intuitive and easy to set up.

Cons

- New Fees: No longer fully commission-free; charges a $1–$2 commission on stock trades.

- High FX Costs: Charges a ~0.5% conversion fee on every GBP deposit.

- Withdrawal Fees: There is a flat $5 fee every time you take money out.

My Experience with eToro

I opened my eToro account in March 2022 and deposited £200 to start. Verification took about 15 minutes — they ask for photo ID and a utility bill, standard stuff. The deposit cleared same day via bank transfer.

What actually impressed me was the copy trading. I allocated £500 to mirror a trader focused on FTSE 100 dividend stocks, and over six months the portfolio tracked his moves accurately. The social feed is noisy — lots of hype posts — but you can filter it.

The FX conversion is the real cost here. Every GBP deposit gets converted to USD at roughly 0.5%, which adds up. If you're depositing £1,000, you're losing about £5 upfront before you've traded anything.

How Does eToro Compare to Trading 212?

| Feature | eToro | Trading 212 |

|---|---|---|

| Stock commission | $1–$2 | £0 |

| Copy trading | Yes — full feature | No |

| Crypto | 100+ coins (direct ownership) | Crypto ETNs only (UK) |

| ISA | Yes (0.35% + £3.95/trade) | Yes (free) |

| Minimum deposit | $50 | £1 |

| FX fee | ~0.5% | 0.15% |

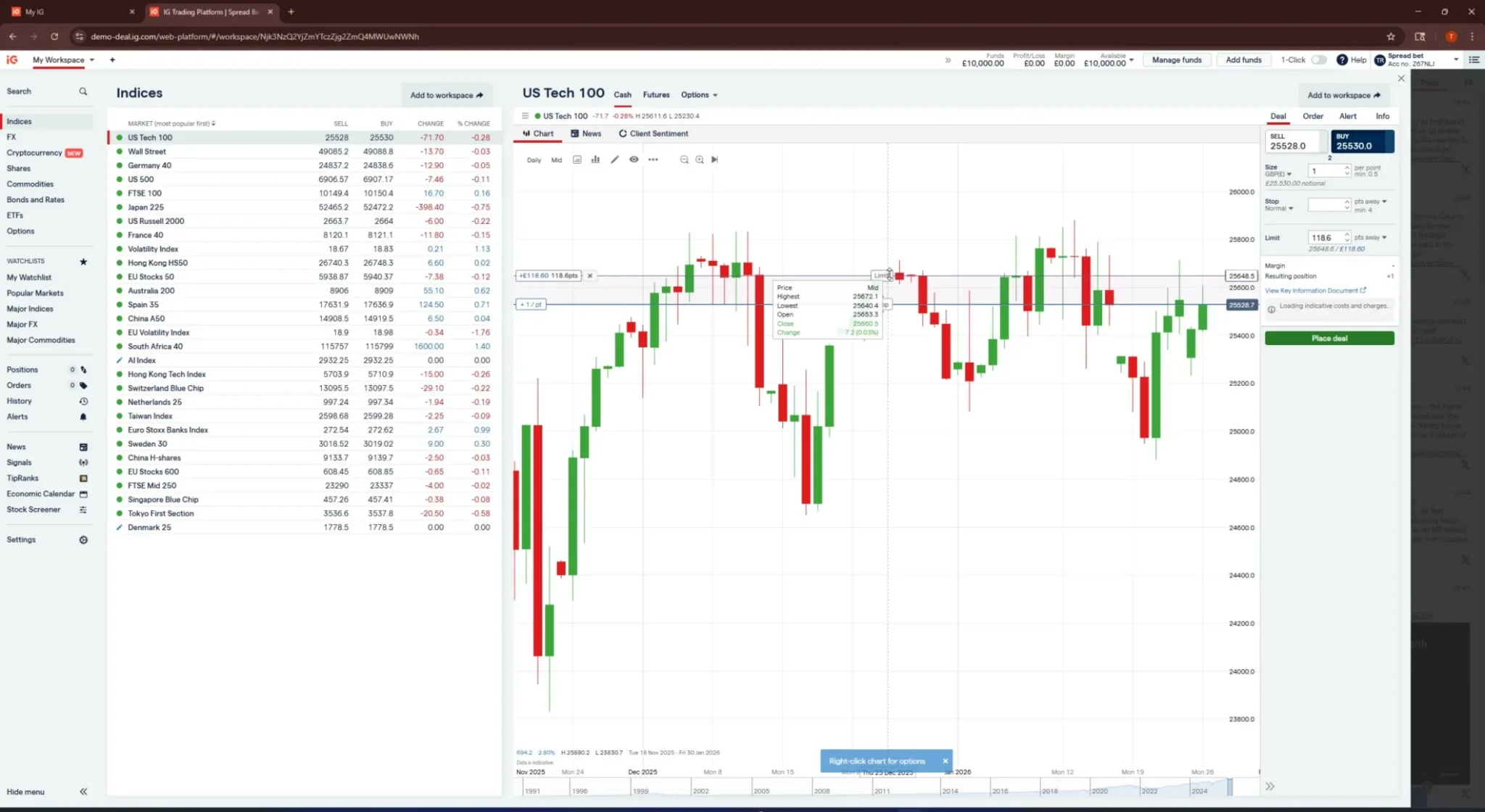

IG — Best Established Multi-Asset Platform (Especially for ISAs)

IG has been around since 1974. That's over 50 years. When people ask me for a "serious" alternative to Trading 212, this is where I point them. It's the most comprehensive platform on this list — stocks, ETFs, bonds, options, spread betting, CFDs, and a genuinely flexible Stocks & Shares ISA.

The big news is that IG dropped commissions to £0 in January 2026 and scrapped their £24/quarter custody fee at the same time. That removes the two biggest reasons people used to avoid them.

Pros

- Low Cost: Zero commission and zero quarterly custody fees (as of January 2026).

- Flexible ISA: Allows you to withdraw and replace money in the same tax year without affecting your £20,000 allowance.

- Massive Selection: Access to over 13,000 assets, including bonds and options which Trading 212 lacks.

- Trusted History: Over 50 years in business and listed on the FTSE 250.

Cons

- Steep Learning Curve: The main platform and mobile app are complex and can overwhelm beginners.

- Higher FX Fees: At 0.7%, their international trade conversion fee is significantly higher than Trading 212's 0.15%.

- No Fractional Shares: You must buy at least one whole share of a company.

Why I Rate IG for ISAs

I transferred my ISA from another provider to IG in September 2025. The whole process took 18 business days — slightly longer than the "15 day" estimate they give you, but not unusually slow for an ISA transfer.

The flexible ISA is the standout. Flexible ISAs let you withdraw and replace money in the same tax year without it counting toward your annual allowance. If you withdraw £2,000, you can put that £2,000 back within the same tax year without it counting toward your £20,000 allowance again. Trading 212's ISA doesn't offer this, and it's a genuine advantage if you might need to access cash temporarily.

The platform itself is more complex than Trading 212. There's a learning curve. The mobile app took me a couple of sessions to feel comfortable with — it's powerful but not as immediately intuitive as Trading 212 or eToro. Once you know where things are, though, it's excellent.

How Does IG Compare to Trading 212?

| Feature | IG | Trading 212 |

|---|---|---|

| Stock commission | £0 (from Jan 2026) | £0 |

| Flexible ISA | Yes | No |

| Asset classes | Stocks, ETFs, bonds, options, CFDs, spread bets | Stocks, ETFs, CFDs |

| Custody fee | £0 (removed Jan 2026) | £0 |

| Track record | 50+ years (est. 1974) | ~10 years (est. 2012) |

| FX fee | 0.7% | 0.15% |

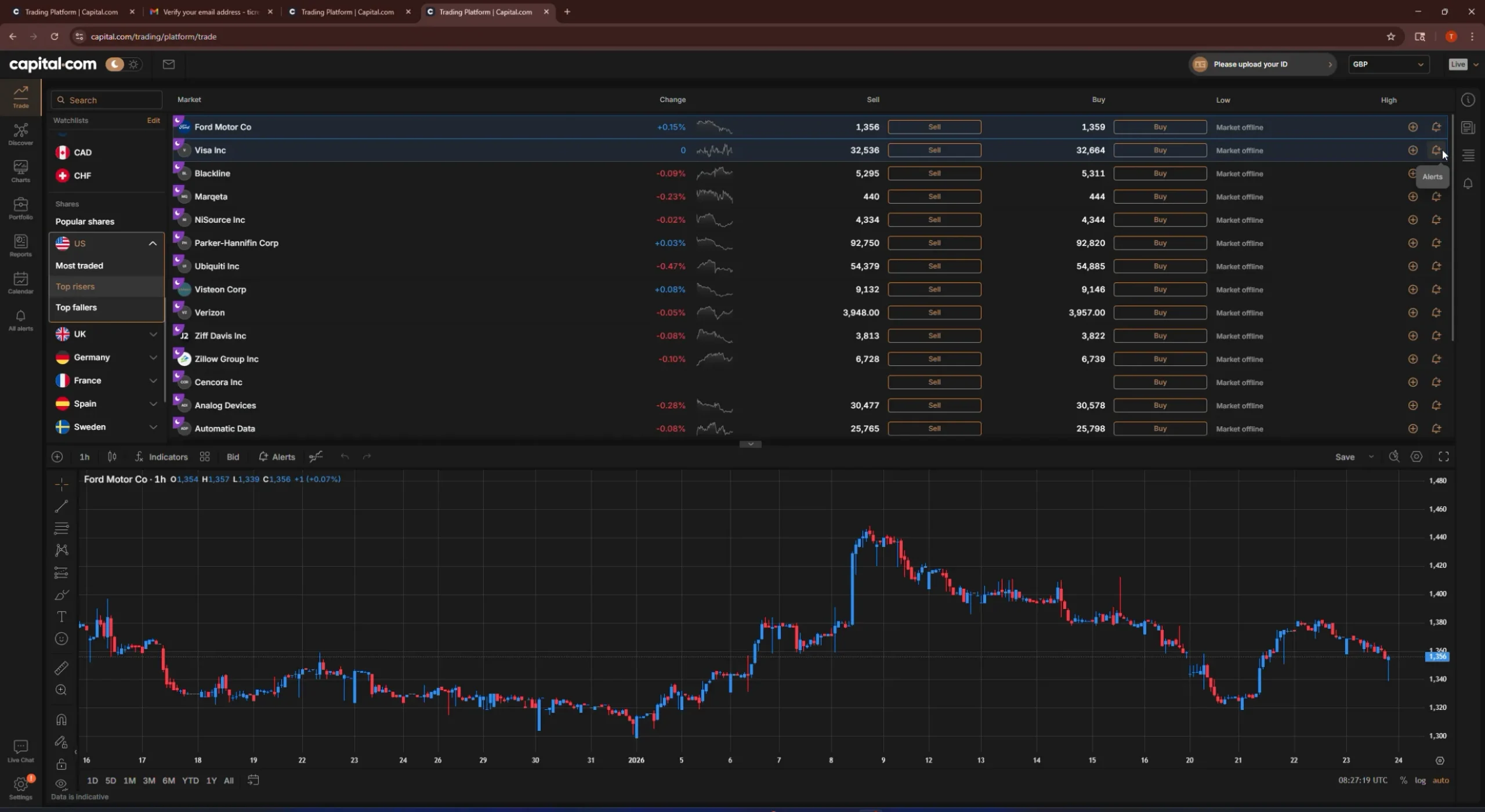

Capital.com — Best for Leverage Trading & CFDs

Capital.com is a different beast to the others on this list. It's a pure CFD broker — you don't own the underlying assets. What you get instead is leverage, the ability to go short, and access to over 3,000 markets including forex, indices, commodities, stocks, and crypto CFDs.

If you're looking for what Trading 212's CFD side does but with a better app and tighter spreads, this is it.

Pros

- Tight Spreads: Often offers lower costs for CFD trading than Trading 212 (e.g., EUR/USD from 0.6 pips).

- Superior App: Features high-speed execution, AI-powered risk alerts, and built-in TradingView charts.

- Low Entry: Start trading with as little as £20 and enjoy fee-free withdrawals.

- Large Market Access: Over 3,000 markets available for short-term leverage trading.

Cons

- CFDs Only: You do not own any underlying stocks or assets; you are only betting on price movement.

- No Long-Term Accounts: Does not offer ISAs, SIPPs, or standard "buy-and-hold" investment accounts.

- High Risk: Leverage can lead to rapid losses; not suitable for passive or beginner investors.

What the App Actually Feels Like

I started using Capital.com in November 2024, initially just to compare their EUR/USD spreads against Trading 212's CFD platform. The spreads were consistently tighter — I was seeing 0.6–0.8 pips on EUR/USD during London session hours versus 0.9–1.2 on Trading 212.

The app is genuinely one of the best I've used. Chart loading is fast, order execution felt instant on my tests, and the AI-powered risk alerts are surprisingly useful. It flagged when I was overexposed to tech-sector CFDs, which I appreciated.

The minimum deposit is £20, and there are no withdrawal fees. That's refreshing compared to eToro's $5 charge. The catch is that this is CFDs only — no ISA, no direct share ownership, no long-term investing.

How Does Capital.com Compare to Trading 212?

| Feature | Capital.com | Trading 212 (CFD) |

|---|---|---|

| CFD commission | £0 (spread-based) | £0 (spread-based) |

| EUR/USD typical spread | From 0.6 pips | From 0.9 pips |

| CFD markets | 3,000+ | 2,000+ |

| Min deposit | £20 | £1 |

| AI risk alerts | Yes | No |

| Withdrawal fees | Free | Free |

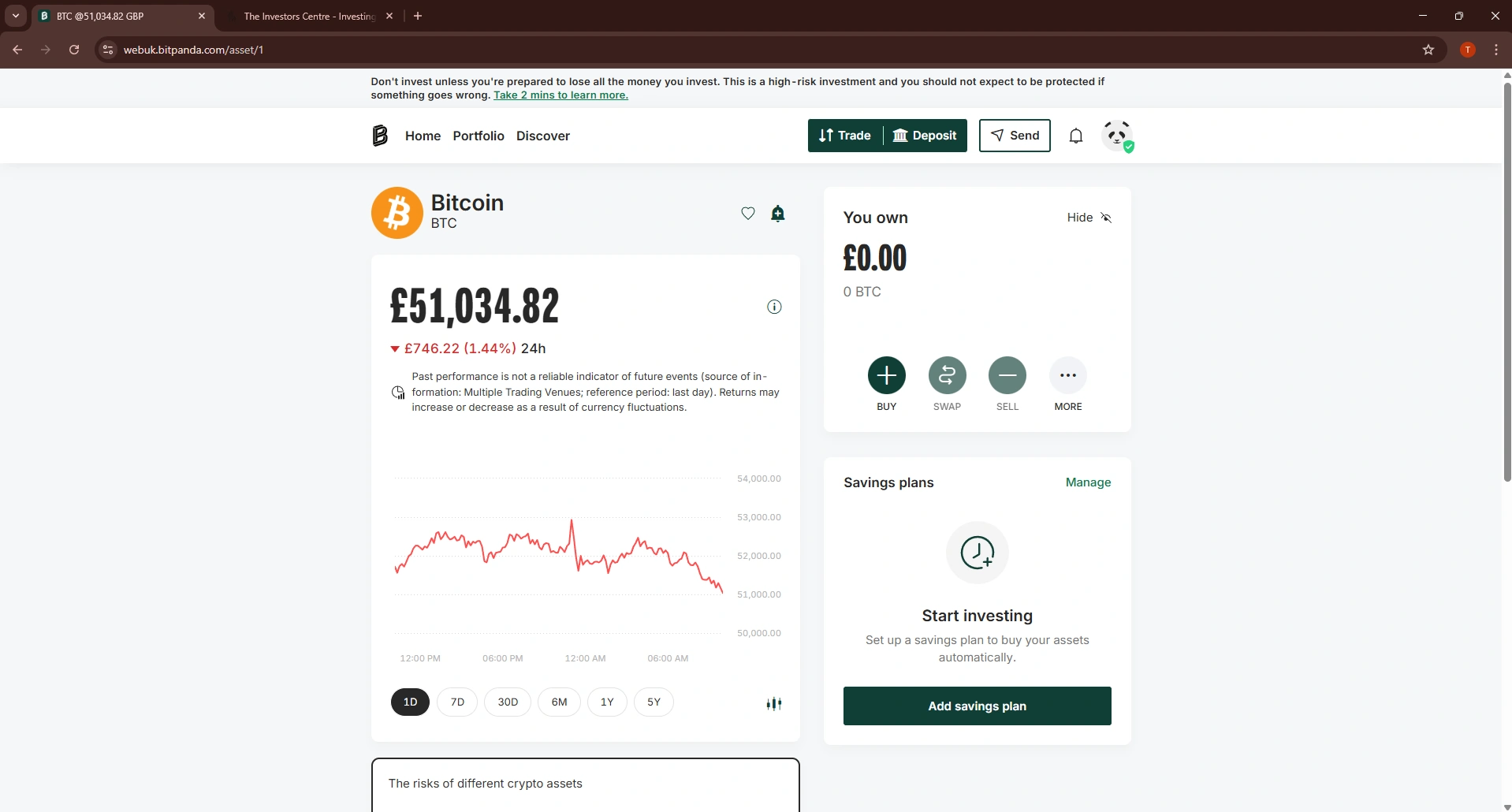

Bitpanda — Best for Crypto Investors

If crypto is your main focus, Bitpanda is the alternative that makes the most sense. It offers over 600 cryptocurrencies — plus staking, crypto indices, and fractional purchases from as little as €1.

It's an Austrian company that entered the UK market with FCA registration in 2022 (Bitpanda Custody Ltd, FRN 928556). Important note for UK users: Bitpanda's stocks and ETFs are not available to UK residents. UK users can only access crypto and precious metals on the platform.

Pros

- Huge Crypto Choice: Offers over 600 cryptocurrencies, far exceeding Trading 212's limited crypto ETNs.

- Staking Rewards: Earn passive income on your crypto holdings with no lock-up periods.

- Crypto Indices: Invest in the "top 5" or "top 10" cryptos with a single click, similar to an ETF.

- Free Transfers: No fees for depositing or withdrawing cash (fiat) via bank transfer.

Cons

- Limited for UK Users: UK residents can only trade crypto and precious metals; stocks and ETFs are restricted.

- Higher Spreads: Crypto spreads range from 0.99% to 2.49%, which can be expensive for frequent traders.

- No FSCS Protection: Unlike stocks, crypto assets are not covered by the £85,000 government protection scheme.

My Crypto Testing

I set up a Bitpanda account in January 2025 with a £300 deposit. Verification was quick — about 10 minutes with a passport scan. The deposit via bank transfer cleared overnight.

The crypto selection is the obvious draw. I tested buying positions in five mid-cap altcoins that weren't available elsewhere, and all executed cleanly. The spreads are the cost here though — 0.99% on Bitcoin, scaling up to 2.49% on smaller altcoins. That's not cheap, but it's transparent and competitive for the breadth of selection.

Staking was easy to set up. I staked some ETH and was earning rewards within 48 hours, no lock-up period required. The yields vary, but it's a feature that adds genuine value for long-term crypto holders.

How Does Bitpanda Compare to Trading 212?

| Feature | Bitpanda | Trading 212 |

|---|---|---|

| Crypto access (UK) | 600+ coins (direct ownership) | Crypto ETNs only |

| Staking | Yes (multiple coins) | No |

| Crypto indices | Yes (BCI Top 5, 10, 25) | No |

| Bitcoin spread | 0.99% | N/A (ETN pricing) |

| Fiat deposit/withdrawal | Free | Free |

| Fractional crypto | Yes (from €1) | Via ETNs only |

Why Would You Switch from Trading 212?

Trading 212 is good at what it does — commission-free stocks, a clean app, and fractional shares. I still use it. But after testing the alternatives side by side, there are a few things it doesn't do well.

There's no leverage trading beyond basic CFDs. The ISA is solid but rigid compared to IG's flexible ISA. Direct cryptocurrency trading isn't available to UK users — you're limited to crypto ETNs. And if you want copy trading or social features, they're simply not there.

I'm not saying you should ditch Trading 212. But if any of those gaps matter to you, one of the four platforms below will fill them. If you're still on the fence about Trading 212 itself, our full Trading 212 review covers everything in detail.

How Do You Switch from Trading 212?

Switching isn't complicated, but it does depend on the account type. You can transfer ISAs between providers without losing your tax-free status. Here's how I'd approach it.

| Step | Action | Detail |

|---|---|---|

| 1 | Open the new account first | Sign up with the alternative broker and complete verification before touching Trading 212 |

| 2 | ISA transfer (if applicable) | Initiate the transfer from the receiving broker, not Trading 212. This preserves your ISA wrapper. Took me around 18 business days when I moved mine to IG |

| 3 | Sell & withdraw (Invest/GIA) | For non-ISA accounts, sell your positions, withdraw the cash, and deposit into the new broker. Withdrawals from Trading 212 usually land within 1–3 business days |

| 4 | Check your tax position | Selling triggers capital gains events. If you're within the £3,000 CGT allowance (2025/26), you won't owe anything |

Note: From April 2024, you can open multiple ISAs of the same type in a single tax year, but the £20,000 combined limit still applies. Time any switch around the tax year if you've already contributed.

Are These Platforms Safe and Regulated?

Every platform on this list is regulated by the Financial Conduct Authority (FCA). I verified each FRN number directly on the FCA Register in March 2026.

All four alternatives — plus Trading 212 itself — are covered by the Financial Services Compensation Scheme up to £85,000 per person per firm for investments. That means if the broker fails and can't return your assets, FSCS covers you up to that limit. The £120,000 figure you might have seen elsewhere applies to deposit protection for banks and building societies, raised in December 2025 — it's a different scheme.

One important caveat: crypto assets are not covered by FSCS regardless of which platform you use. This applies to Bitpanda, eToro's crypto holdings, and any other broker. Keep this in mind when deciding how much to allocate to crypto. If you're looking specifically for regulated crypto options, our best UK crypto exchanges guide covers the landscape.

Final Thoughts

Trading 212 is still one of the best investment apps in the UK — I'm not about to close my account. But it can't do everything, and pretending otherwise doesn't help anyone.

If you're a beginner wanting one app that covers everything, eToro is your best bet. If you want an established platform with a flexible ISA and now-free commissions, IG is hard to beat. If leverage trading is your thing, Capital.com has the best app and tightest spreads I've tested. And if crypto is your priority, Bitpanda gives you a selection that dwarfs everyone else.

Pick the one that matches what you actually need — not what's trending on Reddit.

FAQs

Is Trading 212 actually bad?

No. I still use it. It's excellent for commission-free stock and ETF investing, especially through the ISA. The alternatives on this list aren't "better" across the board — they're better for specific use cases that Trading 212 doesn't cover well, like copy trading, flexible ISAs, leverage, or deep crypto.

Can I transfer my Trading 212 ISA to another broker?

Yes. You initiate the transfer from the receiving broker's side, not Trading 212's. Expect it to take 15–20 business days. Your ISA allowance is preserved during the transfer. I'd recommend timing it so you're not locked out of both platforms at a critical moment.

Which is cheapest for UK stock trading?

Trading 212 and IG are now both £0 commission on UK stocks. The difference comes down to FX fees if you trade international stocks: Trading 212 charges 0.15% and IG charges 0.7%. For purely UK stocks, they're effectively the same cost.

Do I need to pay tax when switching brokers?

If you sell investments in a General Investment Account (GIA), that's a capital gains event. You won't owe tax if your total gains for the year are within the £3,000 CGT allowance (2025/26). ISA transfers don't trigger any tax. Consult HMRC or a tax adviser for your specific situation.

Are my crypto holdings protected by FSCS?

No. Crypto assets are not covered by FSCS on any platform. This is worth repeating because it's a common misconception. The £85,000 FSCS protection only applies to eligible investments like stocks and funds held through an FCA-regulated broker.

Can I buy crypto directly on Trading 212 in the UK?

No. UK residents cannot buy cryptocurrency directly on Trading 212. You can only access Crypto ETNs (exchange-traded notes), which track crypto prices but don't give you direct ownership. For direct crypto ownership, consider platforms like eToro or Bitpanda.

References

- UK Government — Transferring your ISA

- HMRC — Capital Gains Tax allowances

- UK Government — Individual Savings Accounts (ISAs)

- FCA — Cryptoassets consumer guidance

- FSCS — Deposit limit increase (December 2025)

- MoneyHelper — Cash ISAs and savings ISAs

- FCA — Financial Conduct Authority

- FSCS — Investment protection

- FCA Register — Search the FCA Register