Best Platform for Scalping UK 2026 (Tested)

If you've landed here from my broader best day trading platforms UK guide, this page exists for a reason: scalping is not day trading. The criteria are different, the platforms that win are different, and the mistakes that cost you money are different. I tested four brokers over 14 weeks with real money to find which ones actually hold up when you're targeting 3–5 pips and every millisecond of execution matters.

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

What Is the Best Trading Platform for Scalping in the UK?

Capital.com is my top pick for scalping in the UK in 2026. It's the broker I'd hand to most scalpers and tell them to get started — and the reasons are in the detail below.

Capital.com for most scalpers — execution reported at 14ms, zero commission, and a proprietary platform built for rapid entries. Pepperstone's Razor account on cTrader if you trade 30+ times per session and want raw spreads from 0.0 pips with order book depth. Spreadex if tax efficiency is your priority — spread betting profits are CGT-exempt. IG if you need guaranteed stops to manage tail risk through volatile sessions.

| If You Want | Choose | Why |

|---|---|---|

| Best overall for most scalpers | Capital.com | 14ms execution, zero commission, clean proprietary platform |

| Raw spreads + order book depth | Pepperstone | 0.0 pip raw spreads on Razor, cTrader DOM, lowest all-in cost at 30+ trades/session |

| Tax-free scalping profits | Spreadex | Spread betting CGT exemption, FCA-authorised since 1999 |

| Guaranteed stop protection | IG | GSLOs eliminate gap risk, broadest market range (15,000+ markets) |

60% of Retail CFD Accounts Lose Money

72% of retail CFD accounts lose money.

65% of retail CFD accounts lose money.

68% of Retail CFD Accounts Lose Money

How Do These Scalping Platforms Compare?

| # | Broker | Best For | EUR/USD Spread | Commission | Execution Speed | Min. Deposit | Get Started |

|---|---|---|---|---|---|---|---|

| 1 | Capital.com | Commission-free scalping | From 0.6 pips | None | 14ms reported | $20 | Visit |

| 2 | Pepperstone | Raw spread scalping | From 0.0 pips (Razor) | $3/lot per side (cTrader) | Sub-30ms reported | £0 | Visit |

| 3 | Spreadex | Tax-free spread betting | From 0.6 pips | None | Not published | £0 | Visit |

| 4 | IG | Guaranteed stops | From 0.6 pips | None (spread bet) | Not published | £0 | Visit |

How Did I Test These Brokers?

I opened live-funded accounts with all four brokers and scalped EUR/USD and GBP/USD during London session hours (08:00–12:00 GMT) over a 14-week period from September to December 2025. No demo accounts. Real money, real spreads, real slippage.

I measured three things that matter for scalping and almost nothing else: the spread at point of execution (not the "from" figure on the broker's website), the time between clicking "buy" and receiving a fill confirmation, and the difference between my requested price and my actual fill price — slippage. I also tested one-click trading responsiveness on M1 charts during high-volatility windows around 08:00 GMT opens and US pre-market.

I did not test algorithmic scalping via EAs, VPS-hosted strategies, or after-hours scalping. This review is for manual scalpers working London hours. For the full testing process, see the review methodology page.

What Did Each Broker Score?

| Feature | Capital.com | Pepperstone | Spreadex | IG |

|---|---|---|---|---|

| FCA Reg # | 793714 | 684312 | 190941 | 195355 |

| One-Click Trading | ✓ | ✓ (cTrader native) | ✓ | ✓ |

| Depth of Market | ✗ | ✓ (cTrader, MT5) | ✗ | ✓ (L2 Dealer) |

| Guaranteed Stops | ✓ | ✗ | ✓ | ✓ |

| Spread Betting | ✓ (UK) | ✓ | ✓ | ✓ |

| Platforms | Proprietary, MT4, TradingView | cTrader, MT4, MT5, TradingView | Proprietary, TradingView | Proprietary, MT4, ProRealTime |

| FSCS Protected | ✓ (£85,000) | ✓ (£85,000) | ✓ (£85,000) | ✓ (£85,000) |

Here Are The Top 4 Best Platforms for Scalping in the UK:

1. Capital.com – Best Overall Pick

2. Pepperstone – Best for Raw Spread Pricing

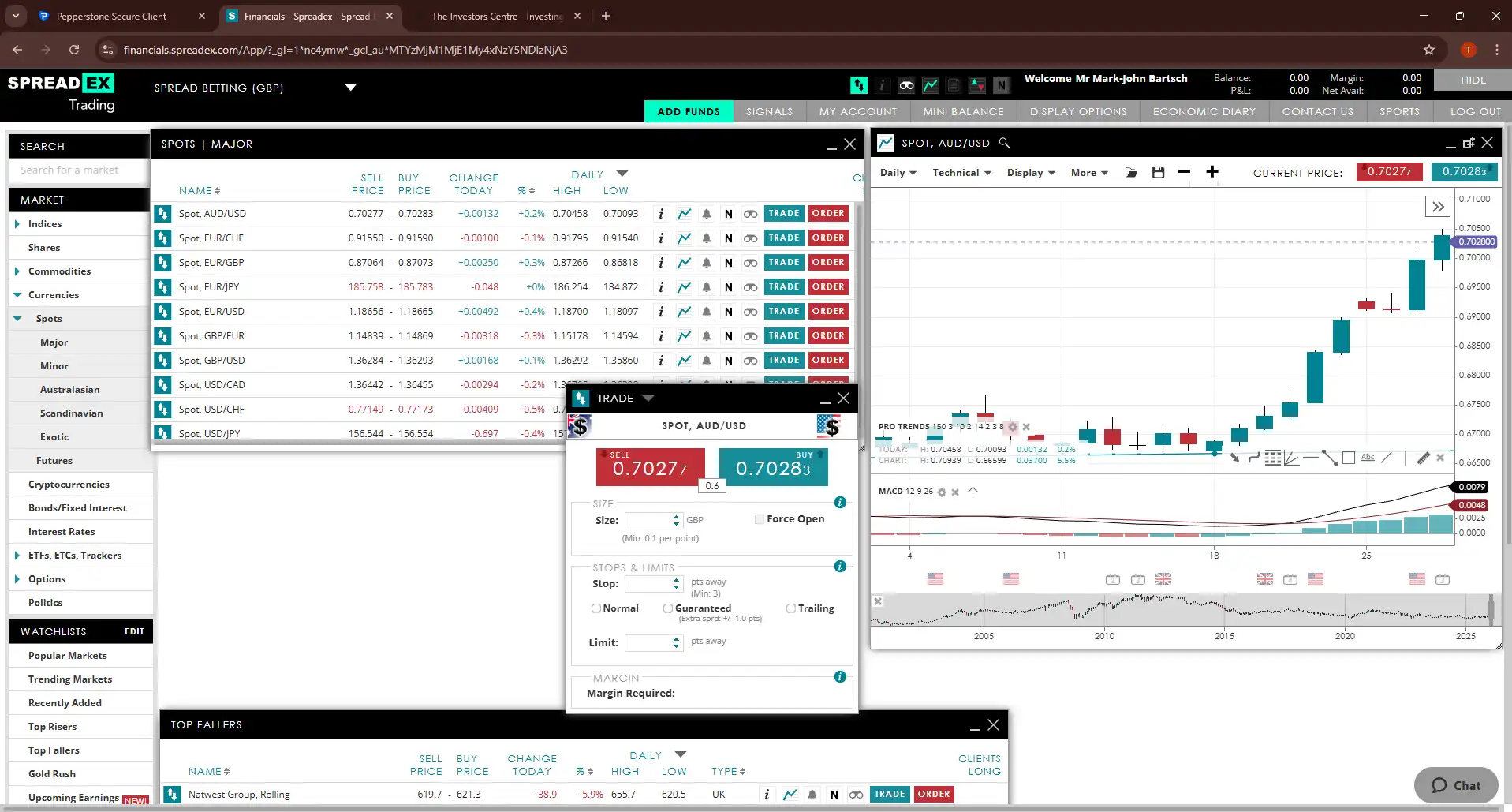

3. Spreadex – Best for Tax-Free Spread Betting

4. IG – Best for Risk Management

Capital.com – Best Overall Pick

Because it removes the friction that kills most scalping setups. No commission to calculate per trade. The fastest published execution on this list. A proprietary platform that loads fast, charts responsively on M1 timeframes, and handles one-click entries without hesitation. For the majority of scalpers — particularly those who don't want to manage raw spread accounts or calculate per-lot commissions — Capital.com delivers the cleanest experience I tested. Fill quality during my London session testing was consistently tight.

The spread is wider than Pepperstone's Razor raw spread, but there's nothing on top — no hidden costs. For scalpers trading smaller position sizes or fewer than 20 trades per session, the all-in cost is comparable to or cheaper than a raw spread plus commission model. The TradingView integration adds serious charting depth without leaving the Capital.com ecosystem.

Pros

- 14ms reported execution — fastest on this list

- Zero commission on all trades

- Proprietary platform built for rapid one-click entries

- TradingView integration for advanced charting

Cons

- No depth-of-market display for order flow analysis

- Lacks advanced order types found on cTrader

- Spreads wider than Pepperstone's Razor raw account

Why Did Capital.com Come Out on Top?

Because it removes the friction that kills most scalping setups. No commission to calculate per trade. The fastest published execution on this list. A proprietary platform that loads fast, charts responsively on M1 timeframes, and handles one-click entries without hesitation. For the majority of scalpers — particularly those who don't want to manage raw spread accounts or calculate per-lot commissions — Capital.com delivers the cleanest experience I tested.

Where Does Capital.com Fall Short?

Two places. First, there's no depth-of-market display. If your scalping strategy relies on reading order flow and the liquidity stack before entering, Capital.com can't show you that — you'll need Pepperstone's cTrader. Second, while Capital.com now offers guaranteed stops — a genuine risk management advantage — the platform lacks the advanced order types and liquidity visualisation that cTrader provides.

What Is the Verdict on Capital.com for Scalping?

Capital.com is the best starting point for most scalpers in the UK. Fast execution, no commission, and a platform that doesn't get in the way. If you need order book depth or the absolute tightest raw spreads, Pepperstone is the upgrade — but Capital.com gets more right for more people.

| Metric | Value |

|---|---|

| FCA Registration | 793714 |

| EUR/USD Spread | From 0.6 pips |

| Commission | None |

| Execution Speed | 14ms reported |

| Min. Deposit | $20 by card |

| FSCS Protected | ✓ (£85,000) |

Pepperstone – Best for Raw Spread Pricing

For high-frequency scalpers, the Razor account numbers are hard to argue with. I recorded EUR/USD spreads averaging 0.1 pips on the Razor account during London hours, with a flat $3 per side commission per standard lot on cTrader ($6 round-trip). On a 1-lot EUR/USD scalp targeting 3 pips, the all-in cost is roughly 0.55 pips (spread plus commission converted). On Capital.com's spread-only model, the cost is 0.6 pips. The gap is small per trade, but across 40+ trades a session, it compounds. Slippage was negligible on liquid pairs during normal session hours.

Note: if you use Pepperstone's Razor account on MT4 or MT5 instead of cTrader, the commission is slightly higher at $3.50 per side ($7 round-trip). For scalping, cTrader is the better platform anyway — so the lower commission is a bonus.

Pepperstone's real scalping advantage is cTrader. The depth-of-market panel is integrated directly into the order entry — I can see the liquidity stack and place orders from the same view without switching windows. One-click trading on cTrader is genuinely one click, not a confirmation dialogue pretending to be fast. It supports cBots for automated scalping, and the M1 and tick chart rendering is responsive without the lag I occasionally noticed on MT4. If you're committed to MetaTrader, my best MT4 broker UK guide covers that angle — but for scalping, cTrader is the stronger platform.

Pros

- EUR/USD raw spreads from 0.0 pips on Razor account

- cTrader depth-of-market integrated into order entry

- Genuine one-click execution on cTrader

- Supports cBots for automated scalping strategies

Cons

- No guaranteed stops — exposed to gap risk during news events

- Commission adds up on smaller position sizes

- MT4/MT5 commission higher than cTrader ($3.50 vs $3 per side)

Is the Razor Account Genuinely Better?

For high-frequency scalpers, yes — the numbers are hard to argue with. I recorded EUR/USD spreads averaging 0.1 pips on the Razor account during London hours, with a flat $3 per side commission per standard lot on cTrader ($6 round-trip). On a 1-lot EUR/USD scalp targeting 3 pips, the all-in cost is roughly 0.55 pips (spread plus commission converted). On Capital.com's spread-only model, the cost is 0.6 pips. The gap is small per trade, but across 40+ trades a session, it compounds.

What's the Catch with Pepperstone?

No guaranteed stops. During high-impact news events — NFP, rate decisions, flash moves — your stop can fill well beyond the set level. For intraday scalping on liquid pairs during normal London hours, this is rarely an issue. But if you scalp through data releases, you're carrying tail risk that IG's guaranteed stops would eliminate.

What Is the Verdict on Pepperstone for Scalping?

Pepperstone's Razor account on cTrader is the most technically capable scalping setup in the UK. It beats Capital.com on raw cost per trade for high-volume scalpers. Choose it over Capital.com if you trade 30+ times per session and want order book depth.

| Metric | Value |

|---|---|

| FCA Registration | 684312 |

| EUR/USD Spread | From 0.0 pips (Razor) |

| Commission | $3/lot per side (cTrader) |

| Execution Speed | Sub-30ms reported |

| Min. Deposit | £0 |

| FSCS Protected | ✓ (£85,000) |

Spreadex – Best for Tax-Free Spread Betting

More than most scalpers realise. Spread betting profits are currently exempt from Capital Gains Tax. If you're a profitable scalper generating, say, £500/week in net gains, that's £26,000/year. After the £3,000 CGT allowance for 2025/26, a higher-rate taxpayer would owe roughly £5,520 in CGT on CFD profits. With Spreadex's spread betting account, that bill is £0. The tax saving alone is worth more than any spread differential between brokers.

Spreadex has been FCA-authorised since 1999 and recently added TradingView integration for charting alongside their proprietary platform. Execution during London hours was clean — I experienced minimal requotes on EUR/USD and GBP/USD, with fills landing where expected. Guaranteed stops are available when opening a trade, adding a risk management layer that Pepperstone lacks. Note that Spreadex's guaranteed stops must be placed at the point of trade entry — they can't be added to an existing position later.

Pros

- Spread betting profits are CGT-exempt — potentially thousands saved per year

- FCA-authorised since 1999 — longest track record on this list

- TradingView integration for advanced charting

- Guaranteed stops available at trade entry

Cons

- No MT4, no cTrader, no depth-of-market display

- Guaranteed stops must be placed at entry — cannot add later

- Execution speed not published

How Much Does the Tax Advantage Actually Matter?

More than most scalpers realise. Spread betting profits are currently exempt from Capital Gains Tax. If you're a profitable scalper generating, say, £500/week in net gains, that's £26,000/year. After the £3,000 CGT allowance for 2025/26, a higher-rate taxpayer would owe roughly £5,520 in CGT on CFD profits. With Spreadex's spread betting account, that bill is £0. The tax saving alone is worth more than any spread differential between brokers.

Why Isn't Spreadex the Top Pick Then?

Platform depth. No MT4, no cTrader, no depth-of-market display. The proprietary platform handles straightforward scalping — enter on signal, tight stop, quick exit — but lacks the advanced order types and liquidity visualisation that dedicated scalping platforms offer. If your strategy is technically simple and tax efficiency is the priority, Spreadex is the right call. If you need order book tools or algorithmic execution, it's not.

What Is the Verdict on Spreadex for Scalping?

Spreadex is the smartest choice for profitable UK scalpers who want to keep every pip. The CGT exemption on spread betting is a genuine structural advantage. The platform is functional rather than exceptional — pair it with TradingView for charting and you've got a solid setup.

| Metric | Value |

|---|---|

| FCA Registration | 190941 |

| EUR/USD Spread | From 0.6 pips |

| Commission | None |

| Execution Speed | Not published |

| Min. Deposit | £0 |

| FSCS Protected | ✓ (£85,000) |

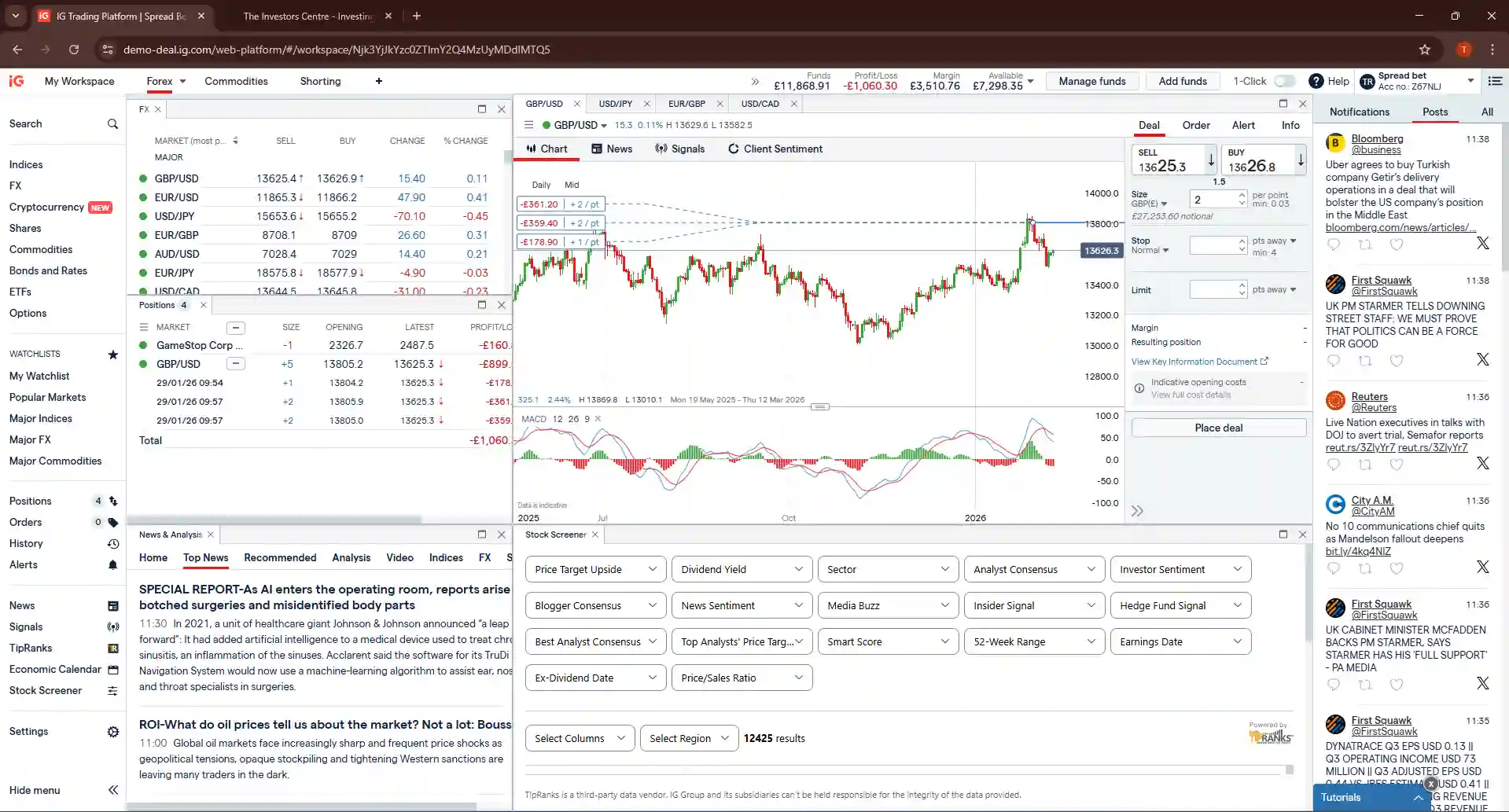

IG – Best for Risk Management

When the market gaps through your stop level — something that happens more often than scalpers like to admit. A standard stop-loss on a 3-pip scalp might fill at -8 pips during a surprise rate comment or flash crash. IG's guaranteed stop-loss orders (GSLOs) eliminate that entirely: you exit at exactly the price you set, even through gaps. There's a premium for GSLOs, but it's a known, budgetable cost — not an unknown tail risk.

IG's platform ecosystem is the broadest here: their proprietary web platform, MT4, and ProRealTime (which has its own scalping mode pairing order book depth with chart-based execution). With access to over 15,000 spread betting markets, IG gives scalpers the widest instrument range — useful if you scalp indices, commodities, or individual shares alongside forex. Execution quality during my testing was reliable, though IG doesn't publish speed figures for comparison.

Pros

- Guaranteed stop-loss orders eliminate gap risk entirely

- Broadest market range — 15,000+ spread betting markets

- ProRealTime scalping mode with order book depth

- Reliable execution quality during London session testing

Cons

- No raw spread account — spread-only pricing at parity with competitors

- Execution speed not published for comparison

- Higher all-in cost than Pepperstone for pure forex scalping

When Do Guaranteed Stops Actually Save a Scalper Money?

When the market gaps through your stop level — something that happens more often than scalpers like to admit. A standard stop-loss on a 3-pip scalp might fill at -8 pips during a surprise rate comment or flash crash. IG's guaranteed stop-loss orders (GSLOs) eliminate that entirely: you exit at exactly the price you set, even through gaps. There's a premium for GSLOs, but it's a known, budgetable cost — not an unknown tail risk.

Why Does IG Rank Fourth?

Cost. IG doesn't offer a raw spread account comparable to Pepperstone's Razor, and the spread-only pricing is at parity with Capital.com and Spreadex rather than beating them. For pure forex scalping where every 0.1 pip of spread matters, the all-in cost at IG is higher than Pepperstone and delivers no execution speed advantage over Capital.com. IG earns its place when risk management and market breadth matter more than squeezing every fraction from your entry price.

What Is the Verdict on IG for Scalping?

IG is the right choice for scalpers who trade through volatile periods or across multiple asset classes. Guaranteed stops are a genuine edge that no other broker on this list offers at the same scale. For cost-first forex scalpers, Capital.com or Pepperstone is the better fit.

| Metric | Value |

|---|---|

| FCA Registration | 195355 |

| EUR/USD Spread | From 0.6 pips |

| Commission | None (spread bet) |

| Execution Speed | Not published |

| Min. Deposit | £0 (bank transfer) |

| FSCS Protected | ✓ (£85,000) |

What Makes Scalping Different From Day Trading?

This isn't a rehash of my day trading page with different broker names. If you've read that guide, forget the criteria — scalping rewrites them.

Why Does Execution Speed Suddenly Matter So Much?

A swing trader waiting for a 50-pip move doesn't care whether their order fills in 30ms or 300ms. A scalper targeting 3–5 pips on EUR/USD during the London–New York overlap cares enormously. At 100ms+ execution, slippage on a 3-pip target can eat the entire trade. Both Capital.com and Pepperstone publish execution speeds well below 50ms — the threshold where manual scalping becomes viable.

Why Do Raw Spreads Change the Maths?

On a standard 1.0-pip EUR/USD spread, a scalper targeting 3 pips pays 33% of their gross profit in spread costs before slippage. On a 0.1-pip raw spread plus commission, that drops to roughly 12–15%. Over 30–50 trades per session, the compounding effect is the difference between a profitable month and a losing one.

Does the Platform Matter More Than the Broker?

For scalping, yes. cTrader's depth-of-market display and native one-click execution are purpose-built for this. Capital.com's proprietary platform handles rapid entries well for a web-based tool. MetaTrader 4 works but feels dated — the one-click panel is functional but clunky. The platform is the interface between your decision and your money. For scalping, it's the most important choice you make.

What About Tax?

Spread betting profits (available at Spreadex, IG, and Capital.com in the UK) are currently free of Capital Gains Tax and stamp duty. CFD profits attract CGT at 18% (basic rate) or 24% (higher rate) for the 2025/26 tax year. For a profitable scalper generating hundreds of small gains per week, the tax wrapper matters. If you're new to these distinctions, my guide to spread betting vs CFDs explains the mechanics.

What Are the Key Risks of Scalping?

| Risk | What It Means | What I'd Do |

|---|---|---|

| Slippage during news | Stops can fill 5–20 pips beyond the set level during NFP, rate decisions, or flash crashes. On a 3-pip target, this wipes the trade. | Avoid scalping in the 5 minutes either side of major data releases. Use IG's guaranteed stops if trading through events. |

| Overtrading | Scalping's pace makes it easy to chase losses. Three losing trades trigger emotional trading that compounds fast. | Set a daily loss limit — I use 2% of account. Hit it, close the platform. No exceptions. |

| Spread widening | Outside the London–New York overlap (13:00–17:00 GMT), EUR/USD spreads can double even on raw accounts. | Only scalp during London session (08:00–12:00 GMT) and the overlap window. Outside these hours, the maths stops working. |

| Leverage magnification | At 30:1 on forex, a 10-pip adverse move on 1 lot costs £100. Scalpers often size up because targets are small. | Risk no more than 1% per trade. On a £10,000 account, that's £100 maximum — adjust lot size, not risk tolerance. |

| Platform failure | Internet drops or platform freezes leave you stuck in a position. Seconds matter for scalpers. | Wired connection, not Wi-Fi. Broker's mobile app on standby for emergency closes. |

If you're new to leveraged trading, my guide to CFD trading for beginners covers position sizing and risk management fundamentals before you attempt scalping.

Final Thoughts

Scalping demands more from your broker than any other trading style. The margins are razor-thin, the execution window is measured in milliseconds, and the wrong platform choice compounds into losses across hundreds of trades per week. Capital.com gets the fundamentals right for most scalpers — fast execution, zero commission, and a clean platform. Pepperstone's Razor account on cTrader is the upgrade for high-volume traders who want raw spreads and order book depth. Spreadex makes the most sense if you're profitable and want to keep every pip tax-free. IG is the safety-first option when guaranteed stops matter more than cost.

Whichever you choose, start during London session hours, keep your risk under 1% per trade, and never scalp through major data releases without guaranteed stops. The broker is the tool — the discipline is what makes it work.

Trading CFDs and spread bets carries a high level of risk. You should consider whether you understand how these products work and whether you can afford to take the high risk of losing your money.

FAQs

Is scalping legal in the UK?

Yes, and all four brokers on this page explicitly allow it. Some brokers elsewhere impose minimum hold times or trade frequency limits — always check terms before opening an account. The FCA does not prohibit scalping as a strategy.

Do I need a raw spread account for scalping?

It depends on volume. A raw spread account like Pepperstone's Razor gives you the tightest possible entry and exit prices with a flat commission on top. For scalpers placing 30+ trades per day, the cumulative saving is significant. For less active scalpers — say, 5–15 trades per session — Capital.com's commission-free spread model works out comparable or cheaper because there's no per-lot fee eating into smaller positions.

Is spread betting or CFD trading better for scalping?

I covered the tax maths in the criteria section above — the short answer is that spread betting's CGT exemption usually outweighs slightly wider spreads for profitable scalpers. The other factor is product mechanics: spread betting uses points-based sizing (e.g., £1 per point), while CFDs use lot-based sizing. Some scalpers find point-based sizing more intuitive for quick position management. Both product types are available at Spreadex, IG, and Capital.com. For the full comparison, see my guide on whether spread betting or CFDs suit your strategy.

What execution speed do I need?

Under 50ms is the realistic minimum for forex scalping during liquid sessions. Both Capital.com and Pepperstone publish figures comfortably within this range — check the comparison table above. Above 100ms, slippage becomes frequent enough to erode your edge. If your broker doesn't publish execution speed data, that's itself a red flag for scalpers.

How much money do I need to start scalping?

You can open an account with $20 at Capital.com or £0 at Pepperstone. Practically, I'd suggest at least £1,000–£2,000 to size positions properly while keeping risk under 1% per trade. Undercapitalised scalping forces you into either oversized positions or targets too small to cover the spread — neither is sustainable.

What's the best timeframe for scalping?

Most scalpers work on M1 (one-minute) charts for entries with M5 or M15 for trend context. Tick charts are popular among forex scalpers using cTrader. Match your timeframe to your hold period — if you're targeting 3–5 pip moves, M1 entries with M5 confirmation is a solid starting framework.