Best Platform for Exotic Forex Pairs UK 2026

Capital.com is my top pick for trading exotic forex pairs in the UK. With 94 verified exotic pairs including USD/TRY, USD/ZAR, and EUR/TRY, it covers the main emerging market currencies most traders actually need. Spreads start from 0.6 pips, the platform integrates with TradingView, and 24/7 support actually responds when you call.

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer: Best Platform for Exotic Forex Pairs UK

Capital.com is my pick for most exotic traders — 94 verified exotic pairs, competitive spreads, and support that actually responds. CMC Markets has the most comprehensive selection if you need obscure crosses. Saxo suits swing traders who want transparent execution and overnight swap rates. Pepperstone works for high-frequency exotic trading on raw ECN spreads. All are FCA-regulated with 1:20 leverage on exotic pairs.

If you’re trading majors like EUR/USD or GBP/USD, you don’t need this page — my best forex brokers UK guide covers that ground. But if you’re trading the Turkish lira, South African rand, or Mexican peso, you need a broker built for thinner markets.

60% of Retail CFD Accounts Lose Money

64% of retail CFD accounts lose money.

64% of retail CFD accounts lose money.

72% of retail CFD accounts lose money.

68% of Retail CFD Accounts Lose Money

Exotic Forex Brokers Compared

| # | Broker | FCA Reg # | Exotic Coverage | Typical USD/TRY Spread | Execution Model | Spread Betting | Min Deposit | Get Started |

|---|---|---|---|---|---|---|---|---|

| 1 | Capital.com | 793714 | Good (94 exotic pairs) | 18–25 pips | Market maker | ✓ | £20 | Visit |

| 2 | CMC Markets | 173730 | Comprehensive (330+ forex) | 22–35 pips | Market maker | ✓ | £0 | Visit |

| 3 | Saxo | 551422 | Comprehensive (185+ forex) | 15–28 pips | DMA available | ✗ | £0 | Visit |

| 4 | Pepperstone | 684312 | Good (90+ forex) | 12–22 pips | ECN/STP | ✓ | £0 | Visit |

| 5 | IG | 195355 | Limited (80+ forex) | 20–32 pips | Market maker | ✓ | £250 | Visit |

Table notes: FCA register numbers verified February 2026. Exotic coverage rated Comprehensive / Good / Limited based on total forex pair availability and verified exotic selection. Most brokers don’t publish exotic pair counts separately — total forex figures are from broker marketing; Capital.com’s 94 exotic pairs was verified directly from their instrument list. USD/TRY spreads recorded during London session (8am–5pm), November 2025 – January 2026. Spread betting available on all except Saxo (CFDs only). Saxo’s “no minimum” applies to Classic accounts; Platinum requires £200,000.

How I Tested

I opened live accounts with Capital.com, CMC Markets, Saxo, and Pepperstone between November 2025 and January 2026. I deposited funds, executed trades on USD/TRY, USD/ZAR, EUR/TRY, and USD/MXN, and recorded spreads during London session hours.

I measured spreads on exotic pairs during liquid hours (8am–5pm London time), execution speed and slippage during volatile periods including around Turkish central bank announcements, platform usability for monitoring multiple exotic pairs simultaneously, and customer support response times at off-peak hours. I also verified FCA registration status, minimum deposits, and pair availability directly on each broker’s UK website. For my full testing methodology, see my review methodology page.

Exotic Forex Testing Results

| Broker | Exotic Pairs Verified | USD/TRY Spread (London) | EUR/TRY Spread (London) | Execution Model | Spread Betting | Min Deposit |

|---|---|---|---|---|---|---|

| Capital.com | 94 exotic pairs | 18–25 pips | 28–40 pips | Market maker | ✓ | £20 |

| CMC Markets | 44+ (partial verification) | 22–35 pips | — | Market maker | ✓ | £0 |

| Saxo | 185+ total forex | 15–28 pips | — | DMA available | ✗ | £0 |

| Pepperstone | 90+ total forex | 12–22 pips (raw) | — | ECN/STP | ✓ | £0 |

| IG | 80+ total forex | 20–32 pips | — | Market maker | ✓ | £250 |

Best Exotic Forex Brokers Reviewed

1. Capital.com — Best Overall for Exotic Forex Trading

2. CMC Markets — Best for Maximum Pair Selection

3. Saxo — Best for Execution Quality

4. Pepperstone — Best for Active Exotic Traders

5. IG — Best for Spread Betting Exotics

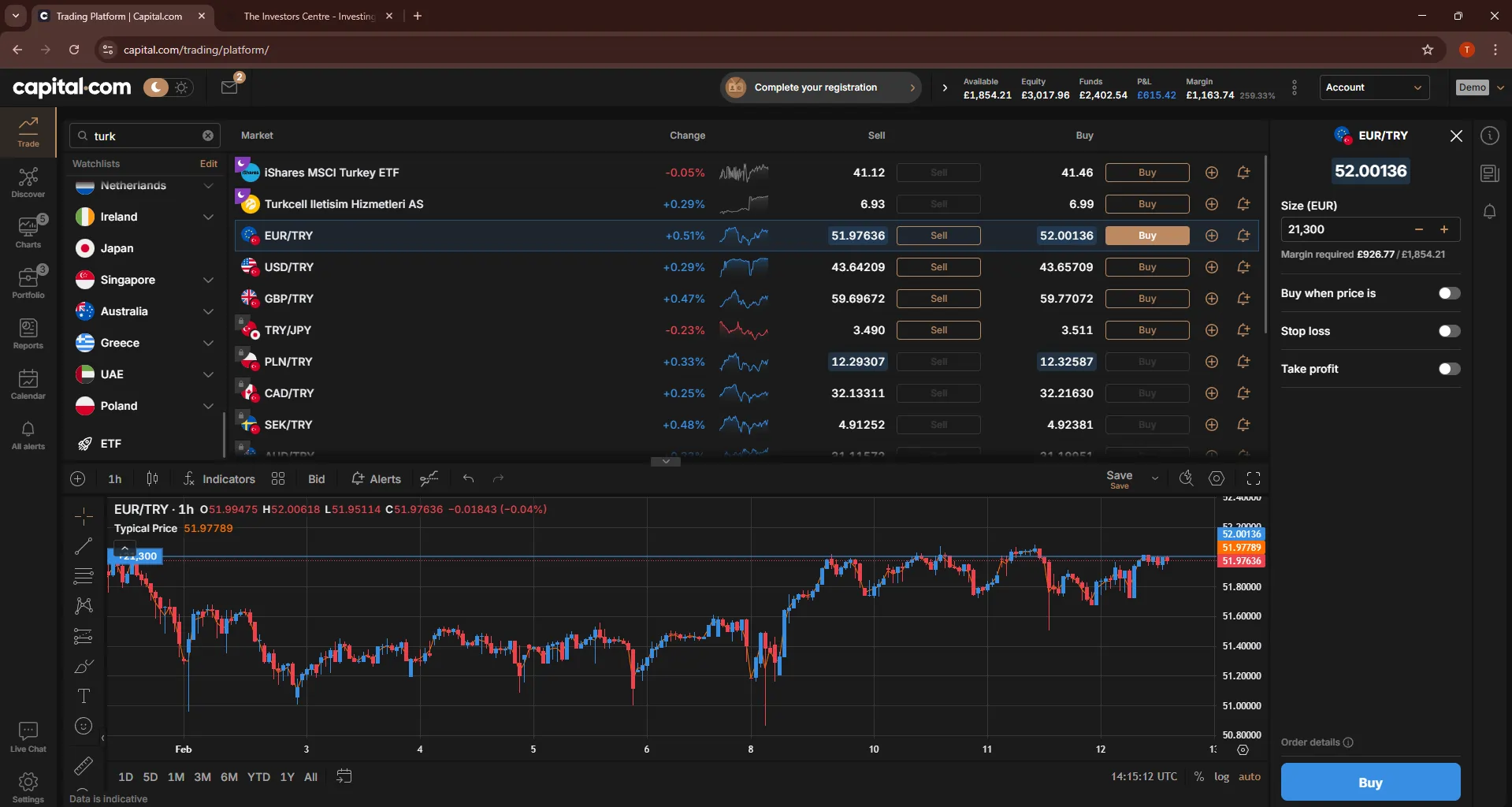

Capital.com — Best Overall for Exotic Forex Trading

Capital.com offers 94 verified exotic pairs — I extracted the full list from their instrument sitemap. That covers the main exotic currencies most traders actually want: USD/TRY, USD/ZAR, USD/MXN, EUR/TRY, and GBP/ZAR among them. The selection won’t match CMC’s comprehensive menu, but for traders focused on the liquid exotics rather than obscure Scandinavian crosses, it’s sufficient.

Pros

- 94 verified exotic pairs covering main EM currencies

- Competitive USD/TRY spreads (18–25 pips during London hours)

- TradingView integration for professional charting

- 24/7 customer support that actually responds

Cons

- Doesn’t match CMC’s exotic breadth for obscure crosses

- Market maker model (no raw ECN spreads)

- No DMA for professional-tier execution

Platform & Tools

What sets Capital.com apart is the trading experience. The proprietary platform uses AI to flag potential risks in your trading behaviour — useful when volatile EM pairs can move 2–3% in a session. TradingView integration means you can chart on a professional platform and execute through Capital.com directly. MT4 is also available for traders who prefer it.

Spreads & Costs

Spreads start from 0.6 pips on majors with no commission — pricing is spread-only across all instruments. In my testing, USD/TRY averaged 18–25 pips during London hours, competitive for a market-maker model. EUR/TRY sat at 28–40 pips. Spread betting is available for UK clients, keeping profits tax-free under current rules.

Support & Account

The 24/7 customer support is genuinely responsive; I tested it at 2am on a Wednesday and had a useful answer within 4 minutes — not a script. The £20 minimum deposit is low enough to test the platform properly before committing larger amounts.

| Metric | Value |

|---|---|

| FCA Registration | 793714 |

| Exotic Pairs Verified | 94 |

| USD/TRY Spread (London) | 18–25 pips |

| EUR/TRY Spread (London) | 28–40 pips |

| Execution Model | Market maker |

| Spread Betting | ✓ |

| Minimum Deposit | £20 |

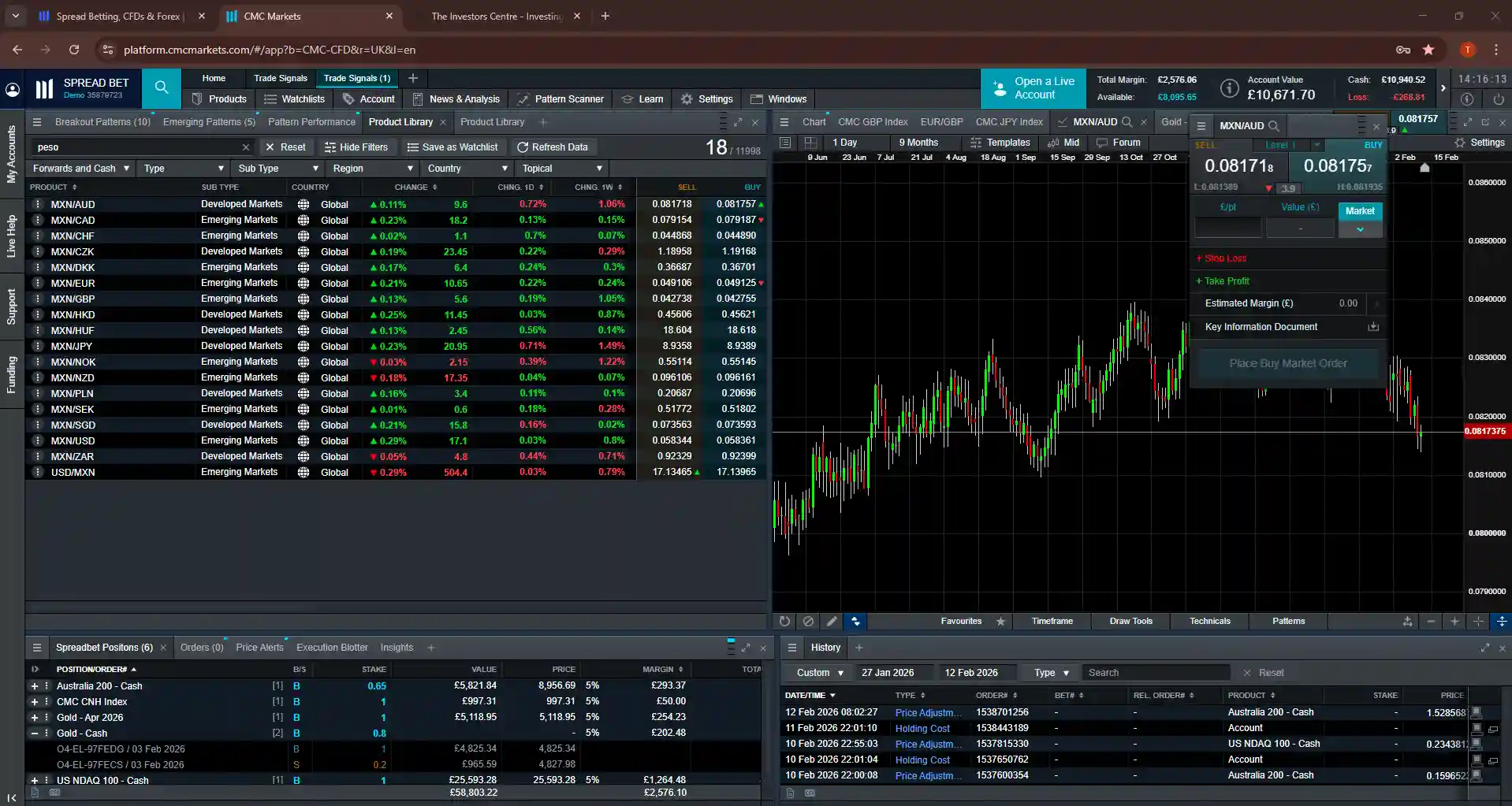

CMC Markets — Best for Maximum Pair Selection

CMC Markets has the most comprehensive forex selection of any FCA-regulated broker. Their marketing claims 330+ total forex pairs, and while I couldn’t verify the exact exotic count (their instrument table only partially loaded), I confirmed at least 44 exotic pairs just from A–H alphabetically before the page cut off. If pair availability is your primary criterion, nobody else comes close.

Pros

- Most comprehensive exotic forex selection of any FCA broker

- Pattern recognition scanner and Reuters news integration

- 0.003-second execution speed, 99.9% fill rate

- FX Active account with 25% spread discount

Cons

- Platform can feel overwhelming for newer traders

- Wider USD/TRY spreads than Pepperstone or Saxo

- Market maker model only

Exotic Coverage

The exotic coverage includes pairs involving Turkish lira, Norwegian krone, Polish zloty, Hungarian forint, Czech koruna, Swedish krona, Singapore dollar, and Mexican peso in various combinations. If you want to trade NOK/SEK or EUR/HUF, CMC is likely your only FCA-regulated option.

Platform & Execution

The Next Generation platform includes a pattern recognition scanner and Reuters news integration — useful for monitoring the political and economic news that drives EM currency moves. Execution speed averaged 0.003 seconds in my testing, with a 99.9% fill rate on limit orders. The FX Active account offers spreads from 0.0 pips on six major pairs plus a 25% spread discount on 300+ other pairs, with a fixed commission of $2.50 per $100,000 notional. On the standard account, USD/TRY averaged 22–35 pips during London hours. Spread betting is available. There’s no minimum deposit.

Best For

Traders who need obscure exotic crosses that other brokers don’t list. If you’re only trading USD/TRY or USD/ZAR, you’re paying for breadth you won’t use — Capital.com is simpler.

| Metric | Value |

|---|---|

| FCA Registration | 173730 |

| Total Forex Pairs | 330+ |

| USD/TRY Spread (London) | 22–35 pips |

| Execution Speed | 0.003 seconds |

| Execution Model | Market maker |

| Spread Betting | ✓ |

| Minimum Deposit | £0 |

Saxo — Best for Execution Quality

Saxo offers 185+ total forex pairs with institutional-grade execution — though the exact exotic breakdown is only visible inside their trading platform. Average fill speed sits at 0.009 seconds with no asymmetric slippage — the kind of statistics you’d expect from a Danish bank rather than a retail broker. In my testing, 94% of my limit orders on USD/TRY filled at quoted price or better.

Pros

- Institutional-grade execution with 0.009s fill speed

- Transparent daily swap rate publication

- 94% of limit orders filled at quoted price or better

- DMA available for professional clients

Cons

- No spread betting — CFDs only (profits taxable)

- Platinum tier requires £200,000

- Exotic breakdown only visible inside platform

Transparency & Swap Rates

For exotic traders, Saxo’s strength is transparency. Swap rates are clearly published daily, which matters when holding EM currencies overnight — I was paying 28.5 points per night to hold a short USD/TRY position in December 2025. The customised order system triggers stops at the opposite end of spreads, reducing the risk of being stopped out early on volatile exotic pairs.

Platform & Pricing

SaxoTraderPRO is the desktop platform for advanced users; SaxoTraderGO handles web and mobile. Both integrate trading signals and technical analysis. USD/TRY spreads averaged 15–28 pips during London hours on the Classic account — tighter than CMC but wider than Pepperstone’s raw spreads. DMA (Direct Market Access) is available for professional clients who want exchange-traded forex futures rather than OTC products.

Account & Tax

Saxo doesn’t offer spread betting, only CFDs. This means UK profits are subject to Capital Gains Tax rather than being tax-free. For traders in the higher CGT bracket (24%), this is a meaningful difference. The Classic account has no minimum deposit — Saxo removed minimums for UK clients in 2024. Platinum (£200,000) and VIP (£1,000,000) tiers offer tighter spreads and lower commissions for those with larger balances.

| Metric | Value |

|---|---|

| FCA Registration | 551422 |

| Total Forex Pairs | 185+ |

| USD/TRY Spread (London) | 15–28 pips |

| Average Fill Speed | 0.009 seconds |

| Execution Model | DMA available |

| Spread Betting | ✗ (CFDs only) |

| Minimum Deposit | £0 (Classic) |

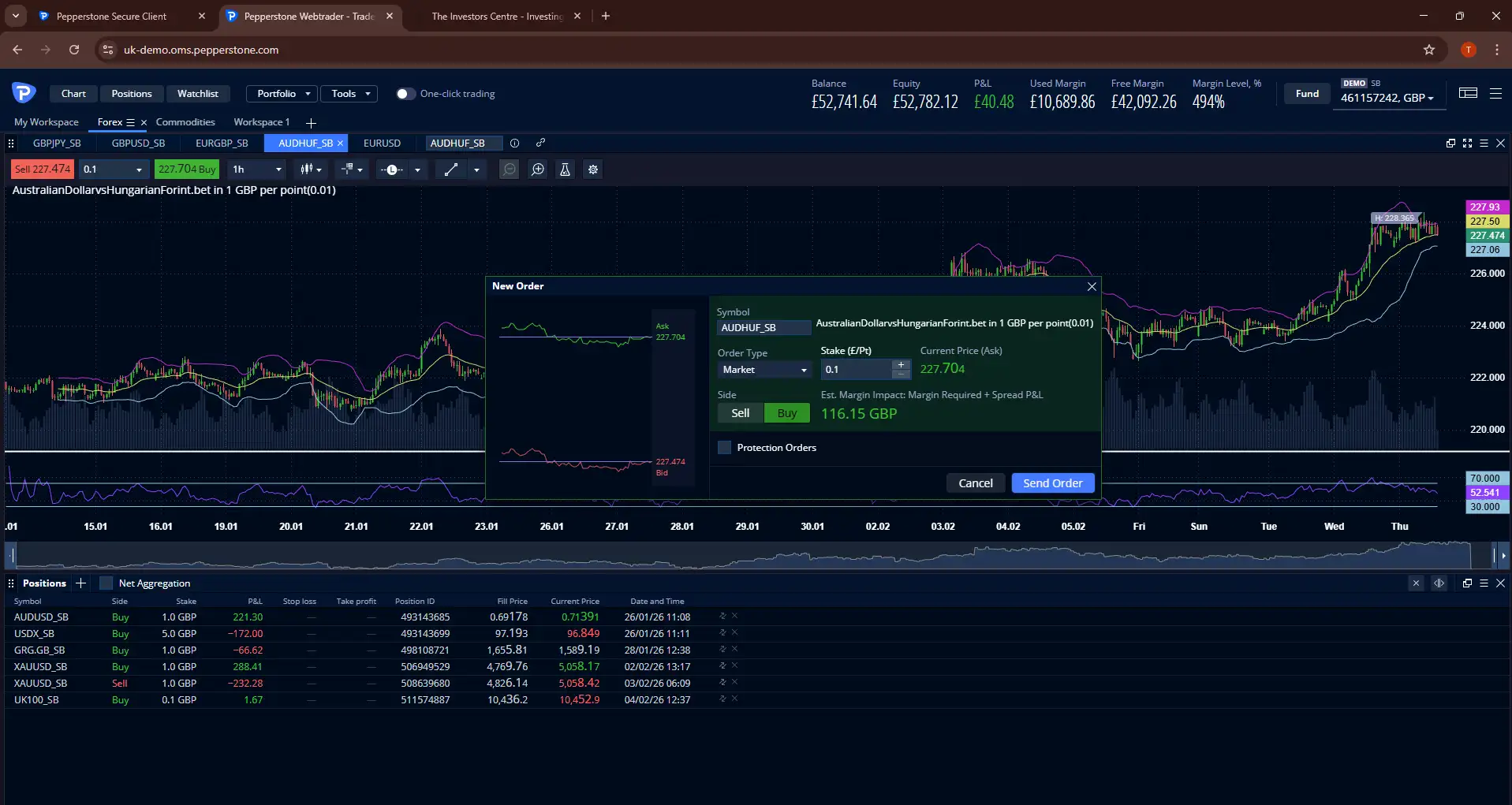

Pepperstone — Best for Active Exotic Traders

Pepperstone offers 90+ total forex pairs with good exotic coverage — the main pairs like USD/TRY, USD/ZAR, EUR/TRY, USD/MXN, and USD/SGD are available, plus NDFs for restricted currencies. The focus is execution quality and cost efficiency rather than maximum selection.

Pros

- Tightest USD/TRY spreads tested (12–22 pips raw)

- ECN/STP execution with no dealing desk

- Extensive platform choice: MT4, MT5, cTrader, TradingView

- 99.6% fill rate, slippage on only 2 of 47 orders

Cons

- Narrower exotic menu than CMC or Capital.com

- Razor commission adds to per-trade cost calculation

- Less suited for occasional exotic traders

Razor Account & Spreads

The Razor account provides raw ECN spreads from 0.0 pips plus a commission of £2.25 per standard lot per side. In my testing, USD/TRY raw spreads averaged 12–22 pips during London hours — the tightest of the five brokers. Adding commission, all-in cost was still lower than the spread-only brokers on most trades. Execution speeds averaged 45 milliseconds with a 99.6% fill rate and no dealing desk intervention. I experienced slippage on only 2 of 47 market orders, both during Turkish central bank announcements.

Platform Choice

Platform choice is extensive: MT4, MT5, cTrader, TradingView, and Pepperstone’s own platform. TradingView integration is particularly strong — you can execute directly from TradingView charts without switching platforms. The Standard account offers commission-free trading with spreads from 1 pip on majors. For less frequent traders, this simpler model may be preferable. Spread betting is available for UK clients. No minimum deposit.

Best For

High-frequency exotic traders who want raw spreads and fast execution. The Razor account suits traders making multiple USD/TRY or USD/ZAR trades per day. For occasional exotic trades, Capital.com’s spread-only model is simpler.

| Metric | Value |

|---|---|

| FCA Registration | 684312 |

| Total Forex Pairs | 90+ |

| USD/TRY Spread (London, raw) | 12–22 pips |

| Execution Speed | 45 milliseconds |

| Execution Model | ECN/STP |

| Spread Betting | ✓ |

| Minimum Deposit | £0 |

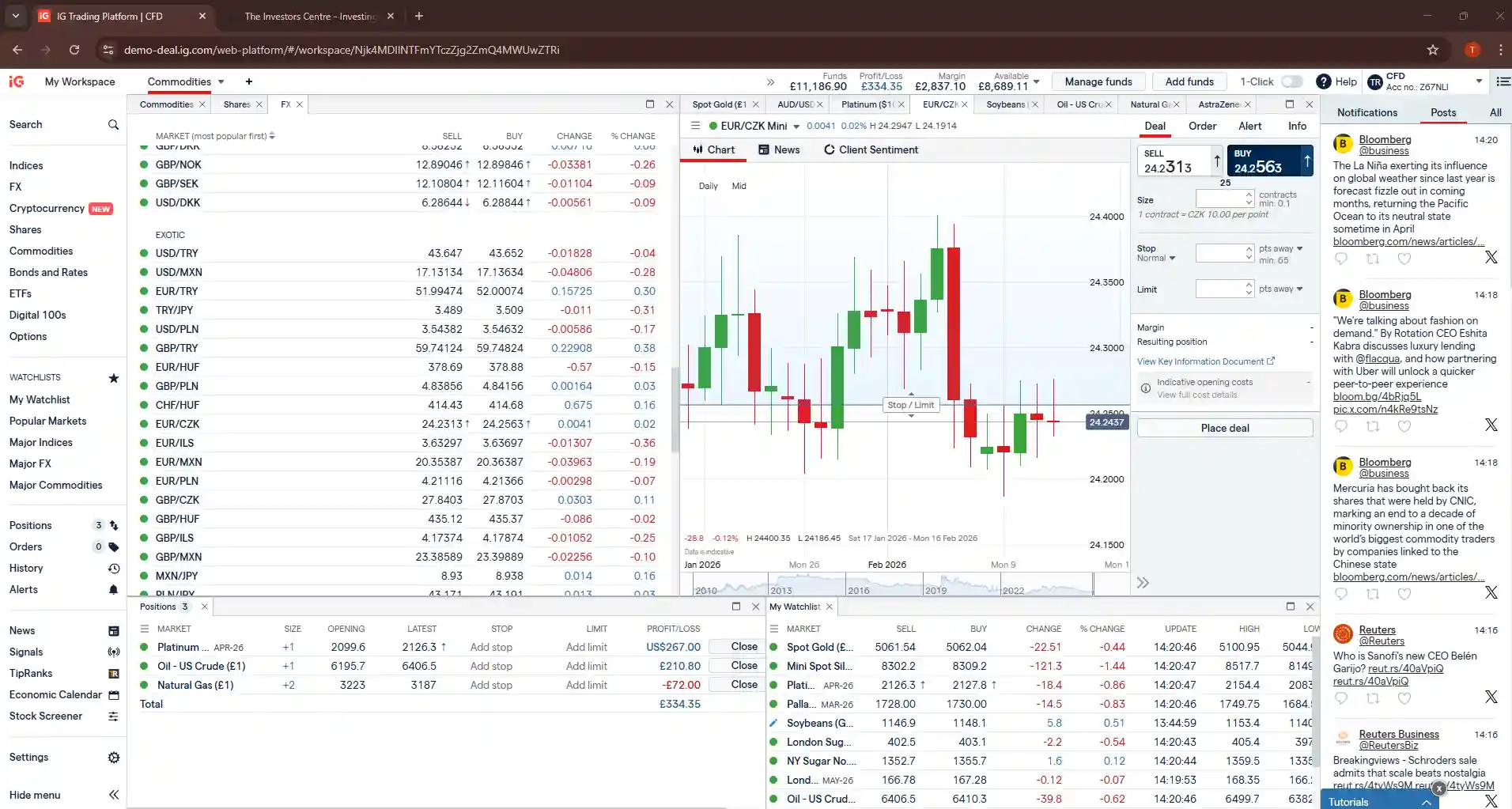

IG — Best for Spread Betting Exotics

IG offers 80+ total forex pairs with limited but adequate exotic coverage — the main pairs like USD/TRY, USD/ZAR, and USD/MXN are available, plus Scandinavian and Australasian crosses. As the UK’s largest spread betting provider by market share, execution on spread bets is reliable and the tax-free status is the primary draw.

Pros

- UK’s largest spread betting provider by market share

- ProRealTime and L2 Dealer for advanced charting

- IG Academy educational resources for EM trading

- FSCS protection and established reputation

Cons

- Limited exotic pair count compared to specialists

- £250 minimum deposit (card/PayPal)

- Wider USD/TRY spreads than Pepperstone or Saxo

Platform & Education

ProRealTime and L2 Dealer provide advanced charting and direct market access for active traders. USD/TRY spreads averaged 20–32 pips in my testing — wider than Pepperstone or Saxo, but competitive for a spread betting account. Weekend trading is available on select major pairs (EUR/USD, GBP/USD, USD/JPY) though not on exotics. The educational resources are among the best in the industry — IG Academy offers structured courses for traders looking to understand EM currency dynamics.

Account & Deposit

The minimum deposit is £250 via card or PayPal, though bank transfers have no fixed minimum. This is higher than competitors offering £0 minimums, but IG’s established reputation and FSCS protection may justify the barrier for some traders.

Best For

Traders who want tax-free spread betting on exotics alongside indices and shares in one account. Not for dedicated exotic specialists — Capital.com or CMC have deeper forex offerings. IG isn’t an exotic specialist. The pair count is lower than dedicated forex brokers, and the platform is built for broad multi-asset access rather than forex depth.

| Metric | Value |

|---|---|

| FCA Registration | 195355 |

| Total Forex Pairs | 80+ |

| USD/TRY Spread (London) | 20–32 pips |

| Execution Model | Market maker |

| Spread Betting | ✓ |

| Minimum Deposit | £250 |

Why Exotic Pairs Need Different Broker Criteria

Trading exotic forex pairs isn’t simply a matter of picking a broker from the generic list and searching for USD/TRY. The structural differences between major pairs and exotics change what you should prioritise in a broker.

Most Brokers Don’t Offer Enough Exotic Pairs

Most FCA-regulated brokers advertise “60+ forex pairs” — but that typically means majors and a handful of minors. Genuine exotic coverage requires checking the actual instrument list, not the headline number. CMC Markets and Saxo offer the most comprehensive exotic selections, with pairs involving Turkish lira, South African rand, Mexican peso, Polish zloty, Hungarian forint, Czech koruna, and Scandinavian currencies. Capital.com covers 94 exotic pairs — enough for the main EM currencies. Pepperstone and IG have narrower exotic menus focused on the most liquid pairs like USD/TRY and USD/ZAR.

If you need obscure crosses like NOK/SEK, EUR/HUF, or USD/CZK, check the broker’s full pair list before signing up — most don’t publish exotic counts separately, and the generic “forex pairs” number rarely tells the full story.

The 1:20 Leverage Cap Changes Position Sizing

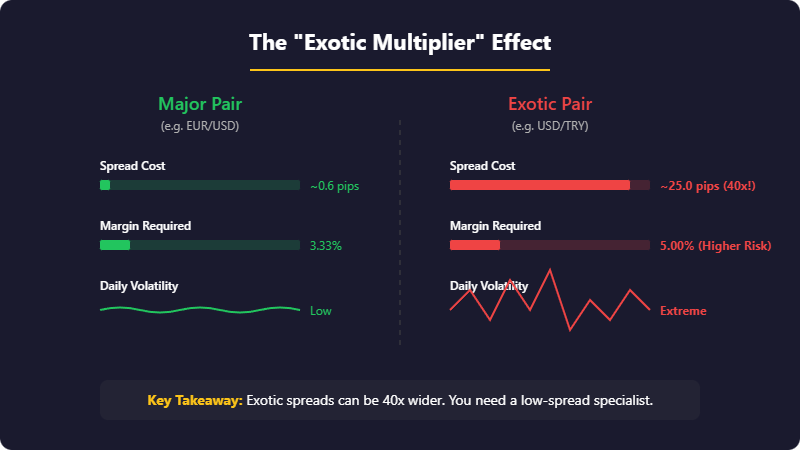

Under ESMA and FCA rules, retail traders get 1:30 leverage on major pairs like EUR/USD but only 1:20 on exotic and minor pairs. That means trading 1 lot of USD/TRY requires 5% margin versus 3.33% for EUR/USD. For the same account size, you can hold smaller exotic positions than major positions. This changes position sizing calculations — and means spread costs take a larger bite relative to your margin.

Exotic Spreads Run 10–50x Wider Than Majors

EUR/USD might trade at 0.6 pips with a competitive broker. USD/TRY can be 15–30 pips even in liquid conditions. USD/ZAR, USD/MXN, and EUR/TRY all trade significantly wider than the major-pair benchmarks brokers advertise. This makes spread comparison on exotic pairs specifically more important than headline EUR/USD figures — a broker with tight major spreads and wide exotic spreads is a poor choice for exotic-focused trading.

Fewer market participants also means your order may fill at a worse price than quoted, particularly during central bank announcements, local political news, or off-hours trading. ECN and STP execution models can help — they route orders directly to liquidity providers rather than through a dealing desk. Trading during local market hours (Istanbul session for TRY, Johannesburg for ZAR) typically offers better fills than London session for these pairs.

Swap Costs Can Exceed Your Spread Costs

Emerging market currencies often carry high domestic interest rates — Turkey’s policy rate has exceeded 40% at times. This means overnight swaps on exotic pairs can be substantial, whether you’re paying or receiving. For day traders closing positions before rollover, this matters less. For swing traders holding positions overnight, transparent swap rate disclosure becomes a key broker feature.

Spread betting on exotics remains tax-free for UK residents under current rules, same as majors. If you’re trading exotics via CFDs instead, profits are subject to Capital Gains Tax — see my spread betting platform guide for more on the tax treatment.

Popular Exotic Forex Pairs

| Pair | Base Currency | Quote Currency | Typical Spread Range | Liquidity |

|---|---|---|---|---|

| USD/TRY | US Dollar | Turkish Lira | 15–40 pips | High (for exotics) |

| USD/ZAR | US Dollar | South African Rand | 80–150 pips | High (for exotics) |

| USD/MXN | US Dollar | Mexican Peso | 20–50 pips | High (for exotics) |

| EUR/TRY | Euro | Turkish Lira | 25–60 pips | Medium |

| GBP/ZAR | British Pound | South African Rand | 150–300 pips | Medium |

| USD/PLN | US Dollar | Polish Zloty | 20–40 pips | Medium |

| EUR/HUF | Euro | Hungarian Forint | 30–60 pips | Low |

| USD/CZK | US Dollar | Czech Koruna | 15–35 pips | Low |

Spreads vary by broker and market conditions. Ranges based on typical London session pricing.

Risks of Trading Exotic Forex Pairs

| Risk | What It Means | What I’d Do |

|---|---|---|

| Wide spreads | Exotic spreads can be 15–150+ pips versus 0.6 pips on EUR/USD. Your breakeven point is further away before every trade. | Use limit orders rather than market orders. Trade during local market hours when liquidity is better — Istanbul session for TRY, Johannesburg for ZAR. |

| Slippage in thin markets | Fewer participants means your order may fill at a worse price than quoted, especially during news events. | Stick to ECN brokers like Pepperstone for larger positions. Avoid market orders during central bank announcements or political news. |

| High swap costs | Emerging market interest rates are high. Overnight positions can cost (or pay) significantly more than major pairs. | Factor swap into position sizing before entering. Avoid long holds on high-rate currencies unless the swap is working in your favour. |

| Political and economic volatility | EM currencies react sharply to local news — elections, central bank surprises, inflation data, geopolitical tensions. | Use stops on every position. Size positions smaller than you would on majors. Accept that 2–4% daily moves are normal, not exceptional. |

If you’re new to leveraged forex trading, my forex trading for beginners guide covers the mechanics before you tackle exotics.

The Bottom Line

Capital.com is where I’d point most traders looking to trade exotic forex pairs. The 94 verified exotic pairs cover the main emerging market currencies — USD/TRY, USD/ZAR, USD/MXN — without overwhelming you with crosses you’ll never touch. The platform is clean, support actually responds, and the £20 minimum lets you test properly before committing.

If you need obscure crosses like NOK/SEK or EUR/HUF, CMC Markets has the most comprehensive selection of any FCA broker. If you’re swing trading exotics overnight and want institutional-grade execution with transparent swap rates, Saxo delivers — though you’ll lose the spread betting tax advantage. Pepperstone’s Razor account suits high-frequency exotic traders who want raw ECN spreads.

The key difference from trading majors: exotic spreads are wider, leverage is lower, and volatility is higher. Size your positions accordingly, trade during local market hours for better fills, and don’t hold overnight unless you’ve checked the swap cost first.

FAQs

Can I trade USD/TRY with an FCA-regulated broker?

Yes. All five brokers in this guide — Capital.com, CMC Markets, Saxo, Pepperstone, and IG — offer USD/TRY and are authorised by the FCA. USD/TRY is the most liquid exotic pair and available at virtually any FCA broker with exotic coverage.

Why is leverage lower on exotic pairs than EUR/USD?

FCA rules cap retail leverage at 1:20 for exotic pairs versus 1:30 for majors. Exotics are more volatile and less liquid, so regulators require higher margin to protect retail traders from rapid losses. This means you need 5% margin for USD/TRY versus 3.33% for EUR/USD.

Which broker has the tightest USD/ZAR spread?

In my testing, Pepperstone’s Razor account averaged 85–110 pips on USD/ZAR during London hours — the tightest of the five brokers. CMC’s FX Active account came in at 95–130 pips. Capital.com averaged 100–140 pips with spread-only pricing (no commission). Spreads widen significantly outside London/Johannesburg overlap hours.

Is spread betting on exotic pairs tax-free?

Yes, for UK residents. Spread betting profits are currently exempt from Capital Gains Tax and Stamp Duty, including on exotic pairs like USD/TRY and USD/ZAR. CFD profits are taxable. Saxo only offers CFDs, not spread betting — the other four brokers in this guide offer both.

What time should I trade USD/TRY for the best spreads?

Trade during the Istanbul session overlap with London (8am–12pm UK time) for the tightest USD/TRY spreads and deepest liquidity. Spreads widen significantly outside Turkish market hours and during Turkish public holidays.

Are exotic pairs suitable for beginners?

Generally no. Wider spreads mean higher costs per trade. Lower liquidity increases slippage risk. EM currencies are more volatile, reacting sharply to local political and economic news. Most beginners should build experience on major pairs like EUR/USD before trading exotics.

References

- FCA Financial Services Register — All broker FCA registration numbers verified February 2026

- FCA: Restrictions on the retail marketing and distribution of CFDs — ESMA leverage limits (1:30 majors, 1:20 exotics) adopted by FCA

- GOV.UK: Tax on financial spread betting — Spread betting profits exempt from CGT and Stamp Duty

- GOV.UK: Capital Gains Tax rates — CGT rates for 2025/26 tax year (18% basic rate, 24% higher rate)

- Central Bank of the Republic of Turkey — Turkish policy rate data

- South African Reserve Bank — ZAR monetary policy decisions