Best Platform for Trading Silver UK (2026)

Silver has had a remarkable run — surging from around $29 per ounce at the start of 2025 to $71.65 by year-end, then pushing above $80 in January 2026. If you're looking to trade silver from the UK, the platform you choose matters more than most guides let on.

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

What Is the Best Platform for Trading Silver in the UK?

Capital.com is my pick for most UK silver traders — commission-free XAG/USD via spread bets (tax-free) and CFDs, with TradingView integration and a £20 minimum deposit. Spreadex is the better choice if you want silver futures and options within a spread betting wrapper — no daily funding on futures positions. IG has the deepest silver product range I've found anywhere: spot, futures, options, and weekend trading across both spread bets and CFDs.

| If You Want | Choose | Why |

|---|---|---|

| Best all-round silver platform | Capital.com | Lowest spreads ($0.020), £20 min deposit, tax-free spread betting |

| Silver futures & options (tax-free) | Spreadex | Quarterly futures with no daily funding, options from 3 pts |

| Deepest silver product range | IG | Spot, futures, options, weekend trading — spread bets & CFDs |

60% of Retail CFD Accounts Lose Money

65% of retail CFD accounts lose money.

68% of Retail CFD Accounts Lose Money

How Do the Top Silver Trading Platforms Compare?

How Did We Test These Silver Trading Platforms?

I evaluated these three brokers specifically for silver trading. Silver liquidity peaks during the London-New York overlap (13:30–16:30 GMT). That's when I recorded the tightest spreads. Avoid the Asian session (00:00–07:00 GMT) — spreads widen significantly.

For my full methodology, see the review methodology page.

What Did We Actually Test?

| Test Area | What I Did |

|---|---|

| Spreads | Recorded XAG/USD spreads during London session (08:00–16:30 GMT) and the London-New York overlap (13:30–16:30 GMT) across all three platforms |

| Product range | Verified which silver products each broker offers UK retail clients — spot, futures, options — via spread bets, CFDs, or both |

| Charting | Tested silver-specific tools: gold-silver ratio overlays, price alerts, chart trading, TradingView integration quality |

| Funding costs | Monitored actual daily funding charges on held spot silver positions |

| Regulation | Confirmed FCA registration at register.fca.org.uk for all three brokers |

Here Are the Top 3 Silver Trading Platforms in the UK:

1. Capital.com — Best for Most UK Silver Traders

2. Spreadex — Best for Silver Futures & Options via Spread Betting

3. IG — Best for Experienced Silver Traders

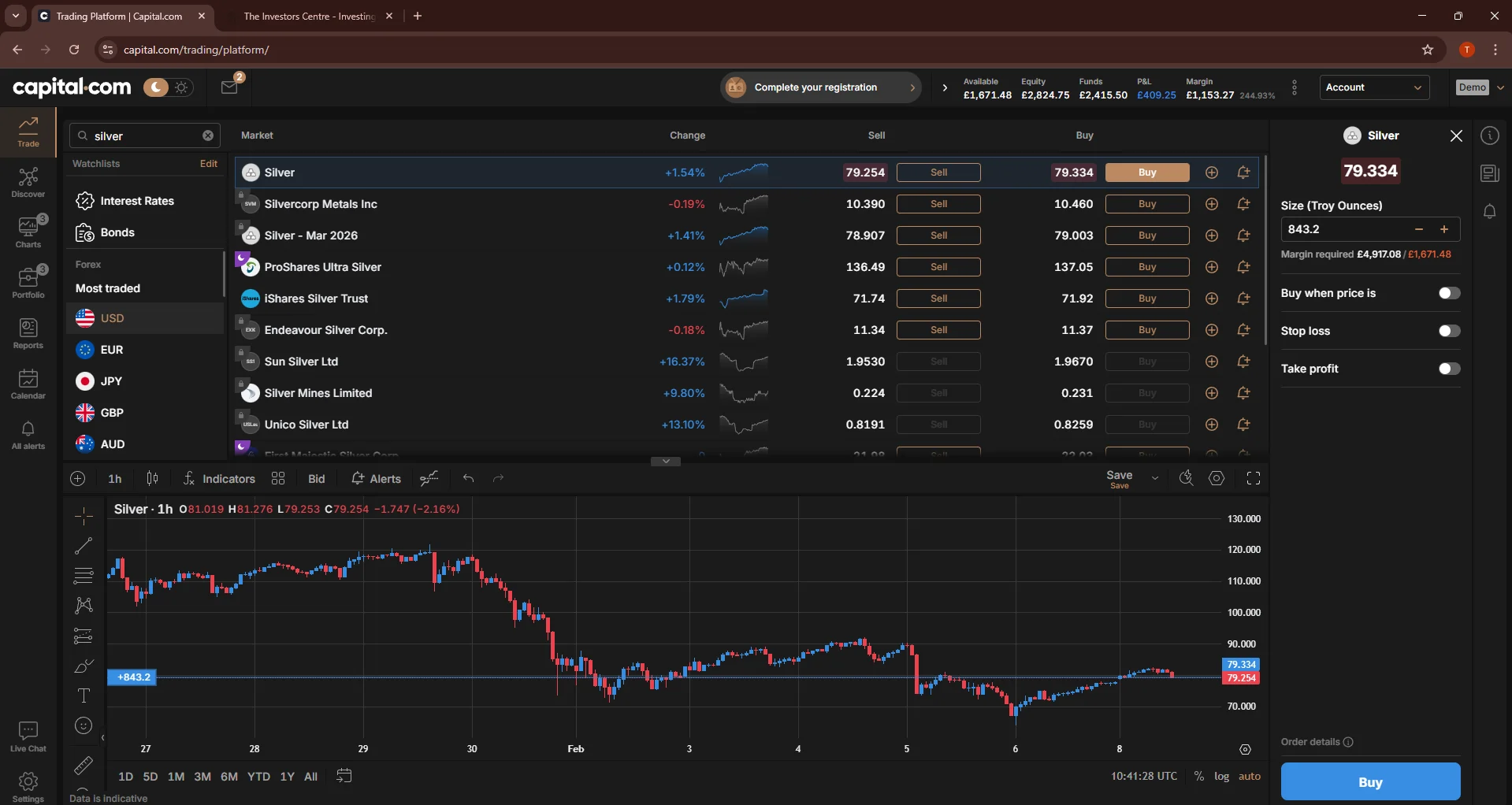

Capital.com — Best for Most UK Silver Traders

Capital.com is where I'd point most people starting with silver. The XAG/USD spread of $0.020 sits below the industry average of $0.022 (across 100+ brokers surveyed by BrokerChooser), there's zero commission, and UK clients get both spread betting and CFD accounts — so you choose the tax wrapper that suits your stage.

The TradingView integration is genuinely useful for silver. I used it to run gold-silver ratio overlays alongside price alerts — the kind of analysis that matters when the ratio is sitting at ~59:1, well below the long-term 60–80 average, suggesting relative silver strength.

Pros

- $0.020 XAG/USD spread — below the industry average of $0.022

- Zero commission on silver trades

- Both spread betting (tax-free) and CFD accounts available

- TradingView integration for gold-silver ratio analysis

Cons

- No silver futures available

- No silver options

- Overnight funding on all spot positions — no way to avoid it for silver

What Are Capital.com's Silver Trading Fees?

Capital.com charges zero commission on silver trades. The cost is built into the spread — $0.020 on XAG/USD, which is competitive against the industry average of $0.022 across 100+ brokers surveyed by BrokerChooser. However, every spot position held overnight incurs a funding charge. Capital.com's unleveraged 1X mode — which eliminates overnight charges — is limited to equities and indices, so it's not an option for silver.

| Fee Type | Cost | Notes |

|---|---|---|

| XAG/USD Spread | $0.020 | Below industry average ($0.022) |

| Commission | £0 | Commission-free on all silver trades |

| Overnight Funding | Variable | Applied daily on held spot positions |

| Minimum Deposit | £20 | Low barrier to entry |

What Silver Products Does Capital.com Offer?

Capital.com offers spot XAG/USD via both spread bets and CFDs — so UK clients choose the tax wrapper that suits their stage. Spread betting profits are entirely tax-free, while CFD losses can offset other capital gains. The TradingView integration is genuinely useful for silver, supporting gold-silver ratio overlays and price alerts directly within the platform. Capital.com also supports MT4 for traders who prefer that interface.

The limitation is clear: no silver futures and no silver options. If you need to hold positions for days or weeks without cumulative overnight funding, you'll need Spreadex or IG.

Is Capital.com Regulated for Silver Trading in the UK?

Capital.com is authorised and regulated by the Financial Conduct Authority (FCA) under registration number 793714. UK retail clients benefit from FSCS protection up to £85,000 and negative balance protection — you cannot lose more than your deposited funds. FCA rules cap silver leverage at 10:1 for retail traders.

| Metric | Value |

|---|---|

| FCA Registration | 793714 |

| Silver Leverage (Retail) | 10:1 |

| FSCS Protection | Up to £85,000 |

| Negative Balance Protection | Yes |

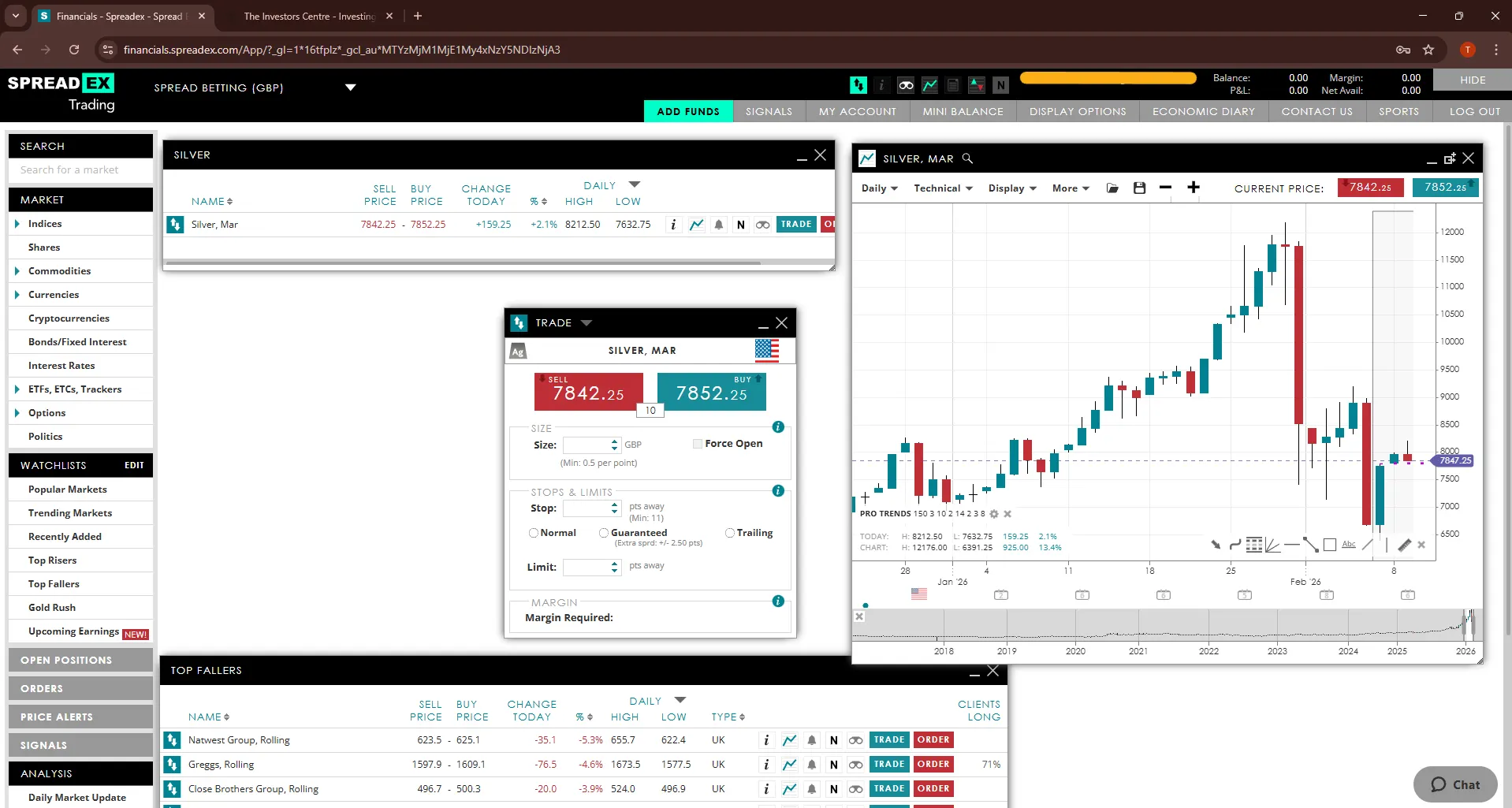

Spreadex — Best for Silver Futures & Options via Spread Betting

Spreadex has been a UK spread betting specialist since 1999, and what distinguishes it for silver is the product depth within that tax-free wrapper. You get spot silver (daily), quarterly futures, and options — all as spread bets.

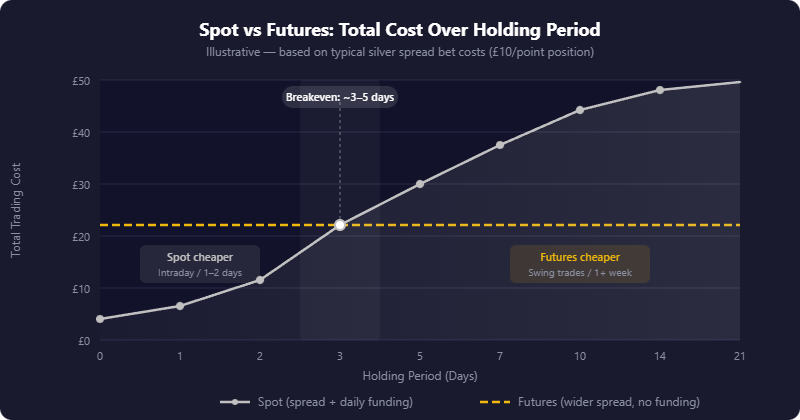

The quarterly futures matter. When I modelled holding costs on a multi-week silver position, the cumulative daily funding on spot positions exceeded the wider futures entry spread within about four days. For a gold-silver ratio trade — where you're holding both legs for potentially weeks — futures on both sides means zero daily funding drag. That's a meaningful edge on a paired trade.

Pros

- Silver futures as tax-free spread bets — no daily funding charges

- Silver options from 3 points spread ($50/pt) for defined-risk exposure

- UK spread betting specialist since 1999

- Spot, quarterly futures, and options all within one wrapper

Cons

- No weekend silver trading

- Smaller overall market range compared to IG

- Position sizing requires discipline — daily moves of 200–400+ cents are routine at ~$80/oz

What Are Spreadex's Silver Trading Fees?

Spreadex charges no commission on silver spread bets. The cost is the spread — from 2 points on spot XAG/USD. Quarterly futures carry a wider entry spread but eliminate daily funding entirely, which makes them cheaper for positions held beyond about four days. Silver options are available from 3 points spread at $50 per point.

| Fee Type | Cost | Notes |

|---|---|---|

| XAG/USD Spot Spread | From 2 points | Daily funded positions |

| Quarterly Futures Spread | Wider than spot | No daily funding — cheaper after ~4 days |

| Silver Options | From 3 pts ($50/pt) | Defined-risk — max loss capped at premium |

| Minimum Deposit | £0 | No minimum deposit required |

What Silver Products Does Spreadex Offer?

Spreadex offers spot silver (daily), quarterly futures, and options — all as tax-free spread bets. When spread betting on silver with Spreadex, you trade per cent movement — a £1-per-point bet gains or loses £1 for every one-cent move in XAG/USD. At ~$80/oz, daily moves of 200–400+ cents are routine, so position sizing discipline matters here.

Spreadex silver options give you defined-risk exposure without the margin call danger of leveraged spot — unusual among UK retail brokers. You can buy a call on a silver breakout with your maximum loss capped at the premium paid.

Is Spreadex Regulated for Silver Trading in the UK?

Spreadex is authorised and regulated by the Financial Conduct Authority (FCA) under registration number 190941. As a UK-based spread betting specialist operating since 1999, Spreadex provides FSCS protection up to £85,000 and negative balance protection for retail clients.

| Metric | Value |

|---|---|

| FCA Registration | 190941 |

| Silver Leverage (Retail) | 10:1 |

| FSCS Protection | Up to £85,000 |

| Operating Since | 1999 |

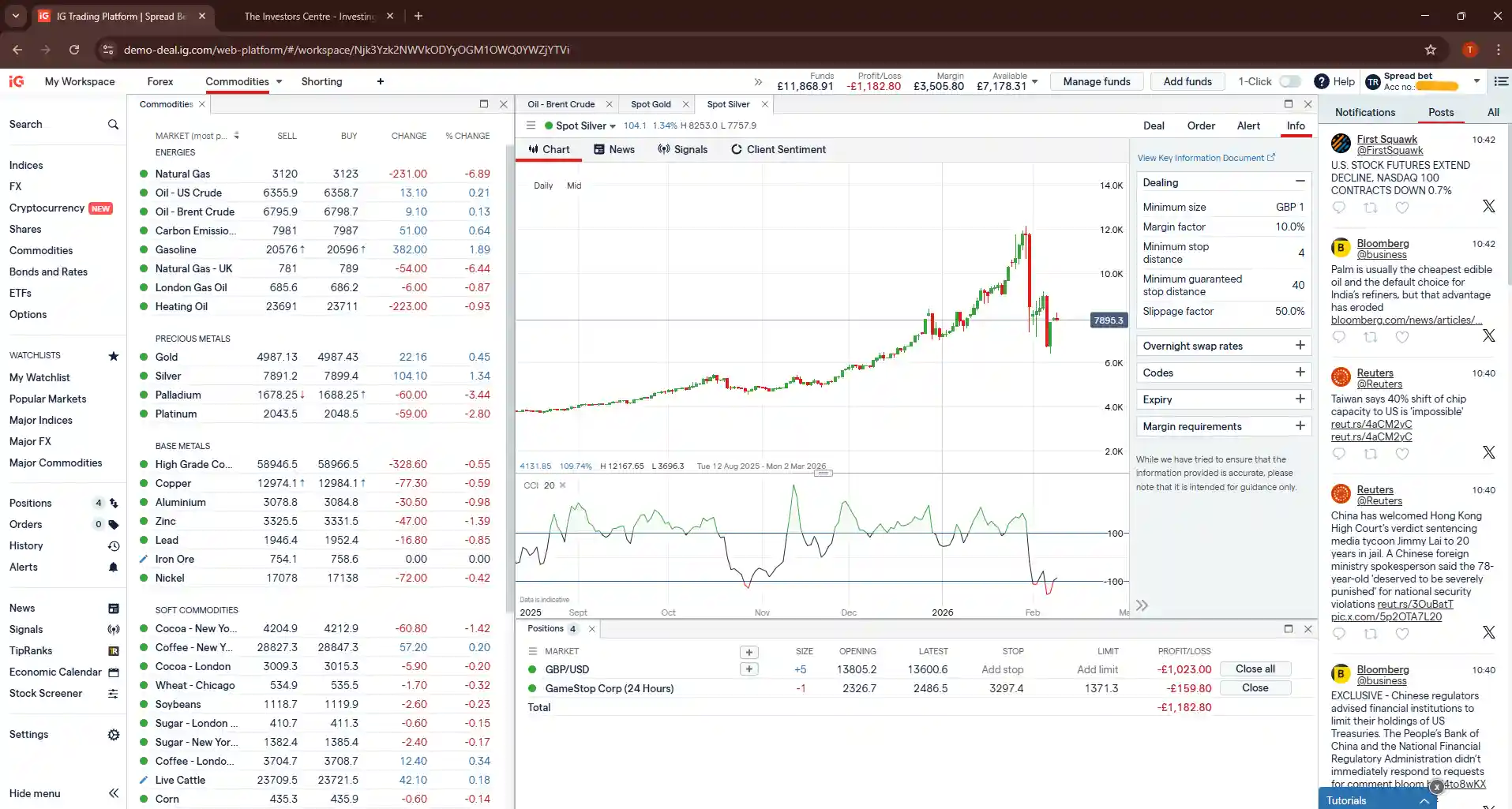

IG — Best for Experienced Silver Traders

IG was founded in 1974 as Investors Gold Index. Precious metals are what the company was built on, and for silver, it shows — this is the deepest product range I've found at any UK broker.

You get spot, quarterly futures (COMEX-based), options, and Weekend Spot Silver — all available via both spread bets and CFDs. The standard silver CFD is 5,000 troy ounces ($50 per point), mirroring the COMEX contract, with mini versions available for smaller accounts.

Pros

- Deepest silver product range — spot, futures, options, and weekend trading

- Weekend Spot Silver lets you trade when every other broker is closed

- Multiple platforms: IG Web, MT4, TradingView, ProRealTime, L2 Dealer

- Both spread bets and CFDs on all silver products

Cons

- 17,000+ markets can feel like overkill if you only want XAG/USD

- Standard silver CFD is 5,000 oz ($50/pt) — large for smaller accounts

- Wider spreads during weekend trading hours

What Are IG's Silver Trading Fees?

IG's spot XAG/USD spread is $0.020 — matching Capital.com and sitting below the industry average. Overnight funding on spot silver uses a tom-next spread plus an admin fee — the UK spread betting product details currently show 0.8% per annum, though I'd check the current rate on your account. Reports suggest IG has recently adjusted fees on spot metals in some regions. Quarterly futures carry a wider entry spread but eliminate daily funding entirely.

| Fee Type | Cost | Notes |

|---|---|---|

| XAG/USD Spot Spread | $0.020 | Matches industry-leading rate |

| Overnight Funding | ~0.8% p.a. | Tom-next + admin fee on spot positions |

| Quarterly Futures | Wider spread | COMEX-based, no daily funding |

| Weekend Silver | Wider spread | Premium for weekend access |

| Minimum Deposit | £0 | No minimum deposit required |

What Silver Products Does IG Offer?

IG offers the deepest silver product range I've found at any UK broker: spot, quarterly futures (COMEX-based), options, and Weekend Spot Silver — all available via both spread bets and CFDs. The standard silver CFD is 5,000 troy ounces ($50 per point), mirroring the COMEX contract, with mini versions available for smaller accounts.

The weekend trading is worth highlighting. IG's Weekend Spot Silver lets you hold or open positions on Saturday and Sunday when every other broker is closed. If silver gaps on geopolitical news over a weekend, you can react rather than wait for Sunday night's open. Spreads are wider during weekend hours, but the access itself is the differentiator.

Is IG Regulated for Silver Trading in the UK?

IG operates under two FCA registrations: IG Markets Ltd (195355) for CFDs and IG Index Ltd (114059) for spread betting. Founded in 1974, IG is one of the longest-established trading providers in the UK. Clients benefit from FSCS protection up to £85,000, negative balance protection, and segregated client funds.

| Metric | Value |

|---|---|

| FCA Registration (CFDs) | 195355 (IG Markets) |

| FCA Registration (Spread Betting) | 114059 (IG Index) |

| Silver Leverage (Retail) | 10:1 |

| FSCS Protection | Up to £85,000 |

| Founded | 1974 |

Why Does Silver Need Different Selection Criteria?

Most "best broker for commodities" guides treat gold and silver identically. They shouldn't. Three structural differences change which platform works best.

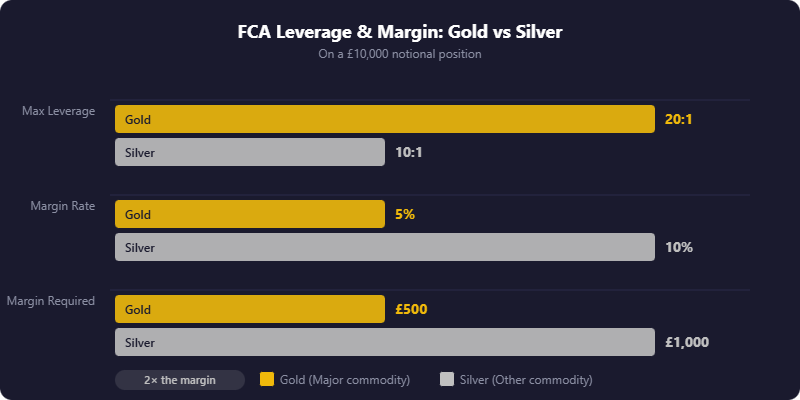

What Is the Leverage Gap Between Gold and Silver?

Under ESMA's product intervention measures (adopted by the FCA), silver is classified as an "other commodity" — not a major commodity like gold. Silver requires double the margin of gold for the same notional exposure. At current prices (~$80/oz), a 100-oz position ($8,000 notional) ties up $800 in margin. A 10% adverse move — which happens on major event days — would consume 100% of that margin. Gold's higher leverage makes it more dangerous per unit of capital, but silver's higher volatility (typically 2–4% daily vs gold's 1–2%) more than offsets this. If you're deciding between the two metals, my gold trading platform guide covers the different leverage dynamics in detail.

| Commodity | FCA Classification | Max Leverage | Margin Required | Margin on £10,000 Position |

|---|---|---|---|---|

| Gold | Major commodity | 20:1 | 5% | £500 |

| Silver | Other commodity | 10:1 | 10% | £1,000 |

| Oil (Brent/WTI) | Other commodity | 10:1 | 10% | £1,000 |

What Is the Tax Advantage for UK Silver Traders?

This is the biggest structural edge for UK silver traders, and I'm surprised how often it's glossed over. On a £10,000 silver profit, a higher-rate taxpayer keeps £10,000 via spread betting versus £8,320 via CFDs. That's £1,680 per year — and it compounds. Once you're consistently profitable, trading silver as a spread bet rather than a CFD is one of the simplest ways to improve net returns. If you're new to spread betting, my best spread betting platforms guide covers the basics. (CGT rates: GOV.UK 2025/26.)

| Spread Betting | CFDs | |

|---|---|---|

| Capital Gains Tax | Exempt | 18% (basic rate) or 24% (higher rate) above £3,000 allowance |

| Loss offset | No | Yes — losses reduce your CGT bill |

| Best for | Profitable traders | Traders who expect losses (learning phase) |

How Does Spot vs Futures Affect Overnight Funding?

Every leveraged spot silver position held overnight incurs a funding charge. At current interest rates, this erodes multi-day positions meaningfully. Futures products — available at Spreadex and IG but not Capital.com — eliminate daily funding entirely in exchange for a wider entry spread. The breakeven is typically 3–5 days: hold longer than that, and futures are cheaper. This distinction matters for platform choice: if you're holding silver positions for more than a few days, you need a broker that offers futures — which immediately narrows the field.

| Holding Period | Spot | Futures | My Recommendation |

|---|---|---|---|

| Intraday | Tighter spread, no funding | Wider spread, no benefit | Use spot |

| 1–3 days | Spread + funding | Wider spread, no funding | Calculate both |

| 1+ weeks | Significant cumulative funding | Wider spread only | Futures |

What Are the Key Risks of Trading Silver?

Silver is not a gentle market. Before committing real capital, understand what you're dealing with. Most retail traders do not profit from leveraged silver trading. If you're new to silver, start with a demo account before committing real capital at 10:1 leverage. If you're new to leveraged trading more broadly, my guide to getting started with CFD trading covers the mechanics in more depth.

| Risk | What It Means | What I'd Do |

|---|---|---|

| High daily volatility | 2–4% typical, 5–10% on event days | Size positions conservatively; use stop losses |

| Leverage at 10:1 | A 5% move = 50% P&L on margin | Never use full margin capacity — I keep usage below 30% |

| Overnight funding drag | Daily charges compound on multi-day spot holds | Switch to futures for swing trades (Spreadex, IG) |

| Industrial demand exposure | Solar, EV, electronics slowdown triggers sell-offs | Watch PMI data and industrial output |

| Liquidity gaps | Wider spreads in Asian session | Trade during London/New York overlap |

| Weekend gaps | Sunday open can gap significantly from Friday close | Reduce exposure before weekends, or use IG's weekend silver |

Final Thoughts

Here's the thing most commodity broker lists get wrong: silver is not gold. The FCA caps retail leverage on silver at 10:1, half the 20:1 available on gold. That changes your margin requirements, your position sizing, and ultimately which broker makes sense. Combine that with the spread betting tax advantage — unique to UK traders — and silver deserves its own shortlist.

For most UK silver traders, Capital.com is the best starting point — low barrier to entry, competitive spreads, and tax-free spread betting. If you need futures to avoid overnight funding on longer holds, Spreadex is the specialist choice. And if you want every silver product type under one roof — including weekend trading — IG has the deepest range available.

If you're after a broader comparison, see my guide to the best CFD brokers in the UK.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

FAQs

Is it better to trade silver as a spread bet or CFD in the UK?

Spread betting, in most cases. Profits are entirely tax-free — no CGT, no stamp duty. CFD profits attract CGT at 18% or 24% above your £3,000 annual allowance (2025/26 rates). The one CFD advantage: losses offset other capital gains. If you're still learning and expect losses, that offset has value. Once you're consistently profitable, spread betting saves you 12–17% on gains. I cover the full comparison in my spread betting vs CFDs guide.

What is the FCA leverage limit on silver?

10:1 — meaning 10% margin. This is lower than gold's 20:1 because silver is classified as an "other commodity" under ESMA rules, not a major commodity. A £10,000 silver position requires £1,000 in margin, versus £500 for gold.

What is the best time to trade silver?

The London-New York overlap, 13:30–16:30 GMT. That's when I recorded the tightest spreads and deepest liquidity. Silver also reacts sharply to US data releases (NFP, CPI, Fed decisions) typically at 13:30 GMT. Avoid the Asian session when spreads widen.

Can I trade silver futures via spread betting in the UK?

Yes — Spreadex and IG both offer silver futures as tax-free spread bets. Capital.com offers spot silver only. For positions held beyond 3–5 days, futures typically work out cheaper because you avoid cumulative daily funding charges.