Trading 212 Promo Code UK | Get a Free Fractional Share Worth Up to £100 in 2026

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: How Do I Get a Free Fractional Share with Trading 212?

Getting your free share only takes a couple of minutes:

- Download the Trading 212 app or visit the website.

- Create an account and enter your details.

- Enter promo code TIC when prompted or use a referral link.

- Verify your identity and National Insurance number.

- Deposit a minimum of £1.

- Receive your free share (worth up to £100) within 1–3 business days.

Use code TIC now — it's quick, secure, and could land you a big-name stock.

Is This the Best Offer in the Market?

Compare offers and pick the best one for your deposit amount

$50 Welcome Bonus

Guaranteed value for new users

- New users only

- No minimum deposit

- Choose from 6 stocks

UK Tiered Bonus

Bonus scales with deposit

Free Share

Random share worth up to £100

- New customers only

- Use code TIC

- Random stock allocation

- ISA eligible

What is the Trading 212 Free Share Offer?

Trading 212 rewards new customers with a free share when they open an account and deposit £1 or more. Using the exclusive promo code TIC unlocks this offer, giving beginners a low-risk introduction to investing while showcasing Trading 212's commission-free platform.*

*Other fees may apply. See terms and fees.

Use code TIC to get a free fractional share worth up to £100

What is the maximum share value?

The free fractional share is selected at random, with values ranging from a few pounds to a maximum of £100. Popular companies are often included in the selection pool, giving customers the chance to receive a well-known stock as their introductory reward.

Who is eligible?

The offer is available to UK residents who are new to Trading 212. Eligibility requires creating an account, verifying your identity, and depositing at least £1. Existing users cannot claim unless they joined recently and haven't already used a referral or code.

When does the promo run?

The Trading 212 free share promotion runs throughout 2026, though offers are subject to change. Users should claim soon after registering, as the code must be entered within ten days. Always confirm the latest terms on Trading 212's official website or app.

How Do You Claim a Free Fractional Share with Trading 212?

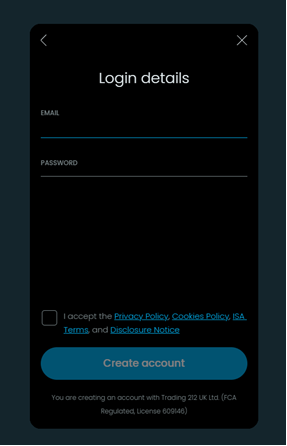

Step 1 – Download the Trading 212 app or register online

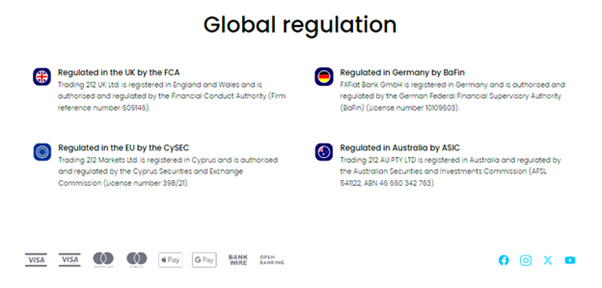

Start by downloading the free Trading 212 app from the App Store or Google Play, or register on their official website. The platform is fully FCA-regulated, making it a secure and straightforward way to begin your investing journey.

Step 2 – Enter promo code TIC during sign-up (or within 10 days after registering)

During the account creation process, enter promo code TIC when prompted. If you've already signed up, you can still apply the code within ten days through the app's promo section, provided no other referral or promotional code has been used.

Step 3 – Verify your ID and National Insurance number

As part of Trading 212's regulatory compliance, you'll need to verify your identity and provide your National Insurance number. This ensures account security, meets FCA requirements, and confirms eligibility before any deposits or free shares can be credited to your account.

Step 4 – Deposit at least £1

To unlock the offer, deposit a minimum of £1 into your Trading 212 account. Deposits are fast and secure, with multiple funding options. This small amount qualifies you for the free share allocation and allows you to begin trading immediately.

Step 5 – Receive your free fractional share (within 1–3 working days)

Once your account is verified and your deposit clears, Trading 212 allocates a free fractional share automatically. The share appears in your portfolio within one to three business days, with values ranging from a few pounds to as much as £100.

Always double-check on the official site or during signup to confirm availability in your country.

Do You Need a Promo Code for Trading 212's Free Share Offer?

Yes, you'll need to use promo code TIC or a referral link to qualify. Without a code, the free share will not be applied. You can still enter the code within ten days if you recently registered without one.

Can I claim the offer if I already signed up?

Yes, if you registered within the last ten days and didn't already use a referral, you can still claim the offer. Simply log into the app, go to the promo section, enter code TIC, deposit £1, and receive your share.

Can I combine with referral links?

No, you cannot combine multiple promotions. The free share offer works with either the promo code TIC or a referral link, but not both. Users must choose one method during account creation to activate the reward successfully.

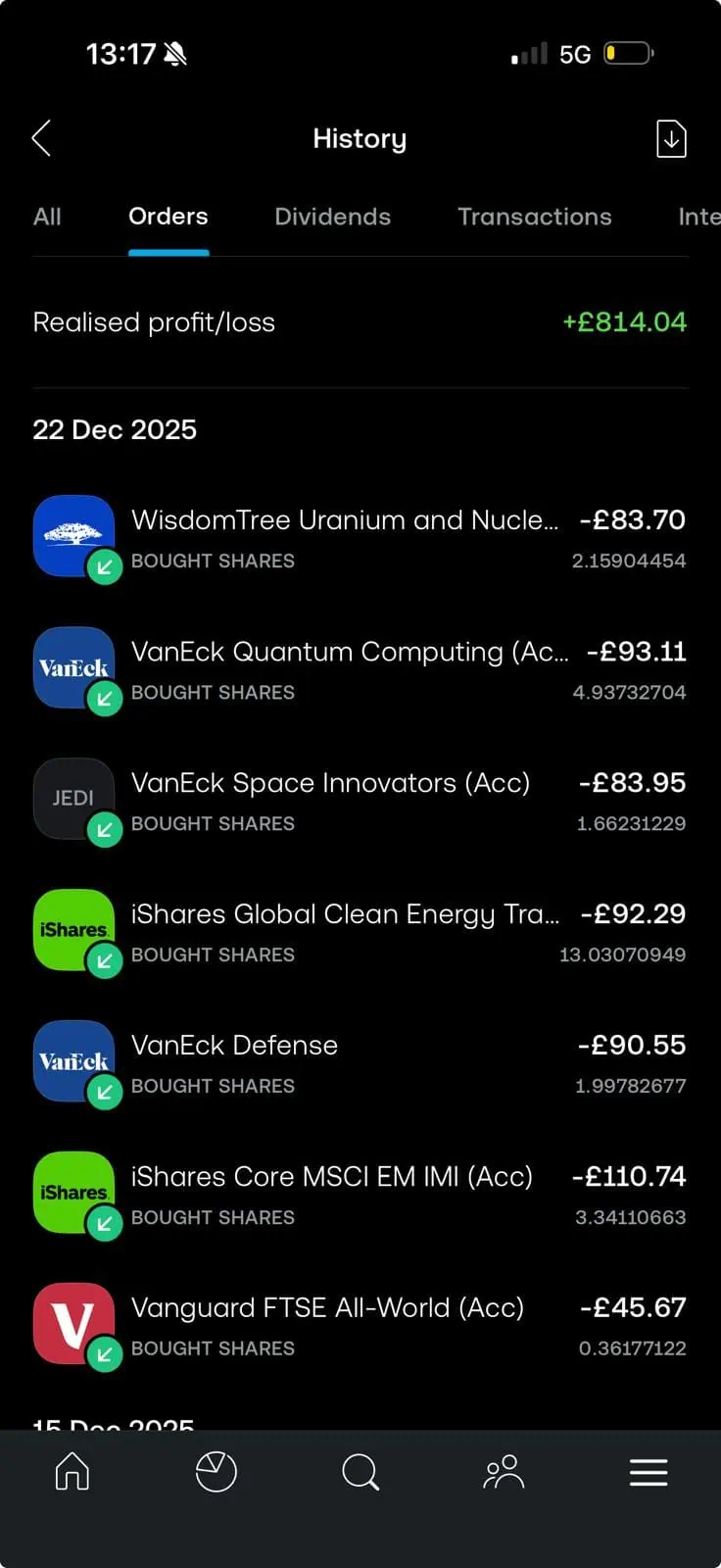

What Stock Can You Receive with Trading 212?

Trading 212 allocates free shares randomly, with values ranging from £1 to £100. Popular companies are often included, making it possible to receive recognisable stocks. Once credited, shares can usually be sold or held, giving users flexibility in how they use their reward.

What is the share value range?

The value of your free share will be between £1 and £100, selected at random. While many users receive lower-value shares, there's always the chance of being rewarded with higher-value stock from a major listed company.

Can you sell or withdraw the free share?

Yes, once the free share is credited to your account, you can either hold it as an investment or sell it. Proceeds from a sale can then be withdrawn or reinvested, giving users complete flexibility after receiving their reward.

Is the share allocation random or fixed?

Share allocation is random, meaning neither Trading 212 nor the customer can choose which stock is received. This element of chance keeps the promotion fair while offering the excitement of potentially landing a big-name stock worth significantly more than the minimum.

Why Choose Trading 212 in 2026?

Trading 212 remains one of the UK's most accessible investment platforms in 2026. With commission-free trading, tax-efficient ISA options, and FSCS protection, it offers beginners and experienced investors alike a safe, flexible way to invest from as little as £1.

Is Trading 212 beginner-friendly?

Yes. Trading 212 is designed for beginners with zero commission fees, a clean, intuitive app, and fractional investing starting from £1. This makes it easy to build a portfolio without large upfront costs, perfect for new investors learning the ropes.

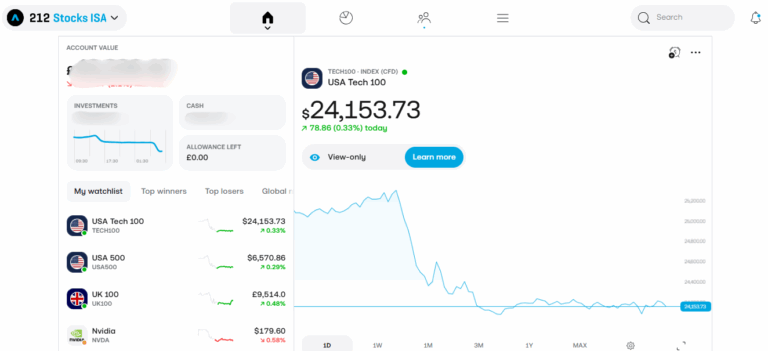

Does Trading 212 offer ISAs?

Trading 212 provides a Stocks and Shares ISA, allowing UK investors to grow investments tax-efficiently. Capital gains and dividends within the ISA are shielded from tax, making it an attractive choice for those building wealth with long-term, cost-effective investing strategies.

Is the Trading 212 Free Share Offer Secure?

Yes. Trading 212's promotion is backed by strong regulation, FSCS protection, and transparent terms. The offer is straightforward: deposit £1, use promo code TIC, and receive a free share. Security and compliance are at the heart of the process.

Will My Trading Account be FSCS Protected?

Customer funds are safeguarded by the Financial Services Compensation Scheme (FSCS) up to £85,000. This means if Trading 212 were ever to fail, users' eligible deposits would still be protected under the same framework applied to UK banks.

Final Thoughts – Is the Trading 212 Free Share Offer Worth It?

If you're looking to dip your toes into investing without much commitment, this is hard to beat. Deposit £1, use code TIC, and you could walk away with a free share worth up to £100. Trading 212 is FCA-regulated, FSCS protected, and offers commission-free trading — so there's minimal downside. Just don't expect to land the full £100 every time.

What's Changed in 2026?

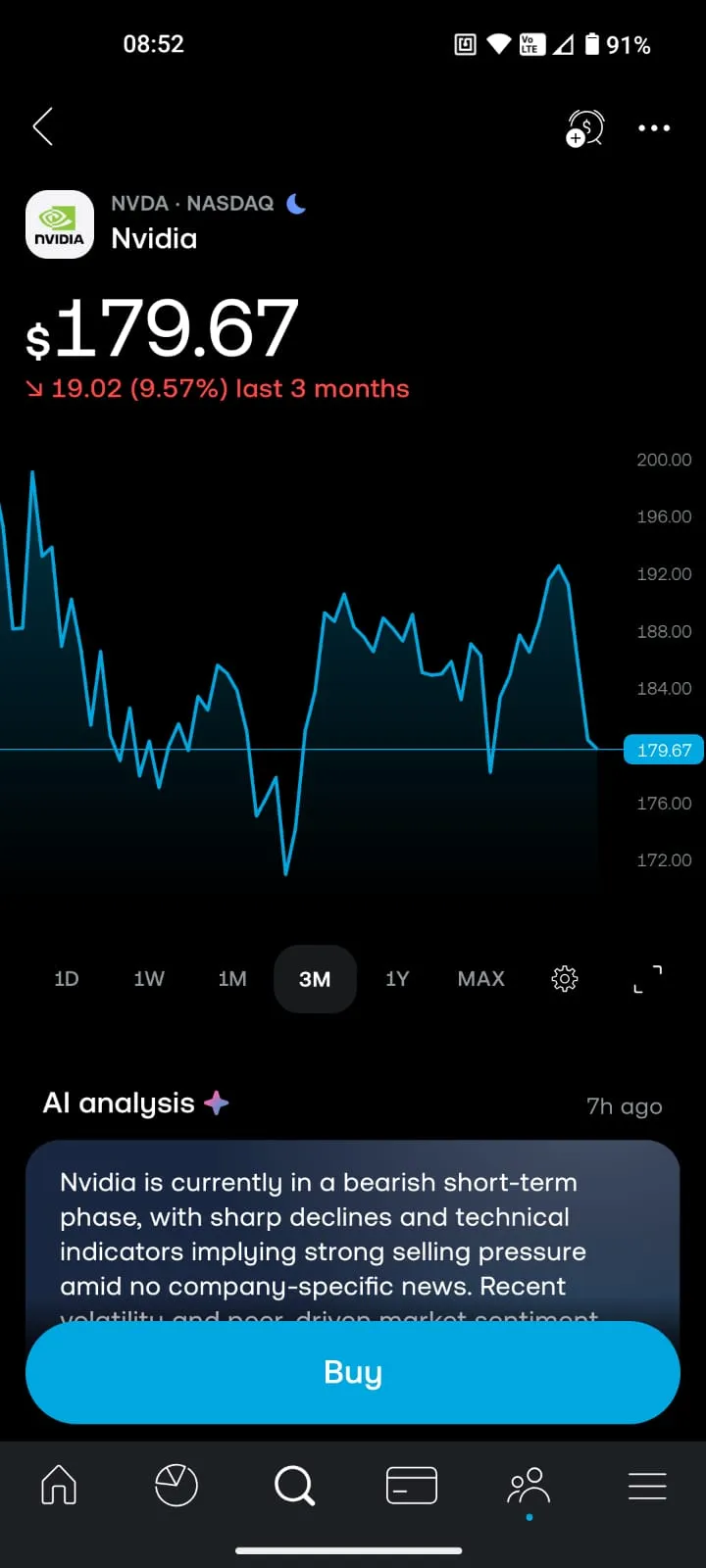

Trading 212 enters 2026 in a significantly stronger position than 12 months ago, with over 4.5 million funded accounts and more than £25 billion in client assets. Here's what's new, what's improved, and what's stayed the same since our last review:

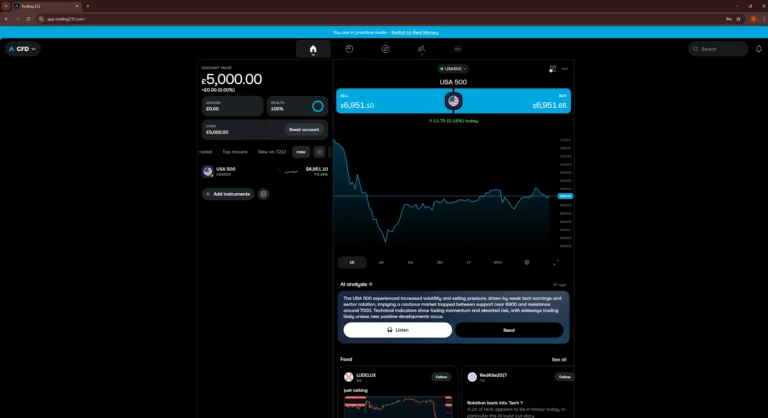

- AI Analysis feature launched — users now get AI-powered stock insights directly within the app, making fundamental research more accessible for beginners.

- Spare change and cashback investing added — card payments are automatically rounded up and the difference invested, helping users build consistent habits with minimal effort.

- App redesign rolled out then reversed — a bubble-style portfolio layout launched in late 2025 but was pulled within weeks after widespread user backlash. The original layout has been restored.

- Commission-free trading remains fully intact — zero commission on stocks and ETFs, no platform fees, no ISA fees, and no inactivity charges.

- ISA allowance stays at £20,000 for the 2025/26 tax year, with no changes to the Stocks & Shares ISA or Cash ISA wrapper.

- 0.15% FX fee unchanged — still the only meaningful cost for most investors trading non-GBP assets.

- Promo code TIC still active — new users receive a free fractional share worth up to £100 with a £1 minimum deposit. Must be entered within 10 days of registration.

- Still no SIPP — despite ongoing community demand, Trading 212 has not launched a pension product. If that's a priority, Freetrade, AJ Bell, or Interactive Brokers remain the alternatives.

FAQs

Does Trading 212 Offer a SIPP or Pension Account?

No, Trading 212 does not currently offer a SIPP (Self-Invested Personal Pension) as of February 2026. While the platform has hinted at a potential launch, no confirmed date has been announced. If pension investing is a priority, alternatives like Interactive Brokers, AJ Bell, or InvestEngine offer commission-competitive SIPPs. Trading 212 does offer a Stocks & Shares ISA and Cash ISA for tax-efficient investing.

How Does Trading 212 Make Money if Trading Is Free?

Trading 212 generates revenue primarily through its CFD (Contract for Difference) trading arm, where 72–75% of retail accounts lose money. Additional income comes from the 0.15% FX conversion fee on non-base-currency trades, interest earned on uninvested client cash held in segregated accounts, securities lending (which users can opt out of), and premium card features. This freemium model allows the Invest and ISA accounts to remain genuinely commission-free.

Do I Need to Pay Tax on Trading 212 Profits in the UK?

It depends on which account you use. Profits within a Trading 212 Stocks & Shares ISA are completely tax-free — no capital gains tax or dividend tax applies up to the £20,000 annual ISA allowance. However, profits in the standard Invest account are subject to capital gains tax once you exceed the £3,000 annual CGT allowance (2025/26 tax year). Trading 212 provides an annual tax report to help with self-assessment filing, and automatically submits a W-8BEN form for US stock holdings to reduce US dividend withholding tax from 30% to 15%.

Can I Transfer an Existing ISA to Trading 212?

Yes, Trading 212 supports inbound ISA transfers from other providers. The process is initiated within the app and typically takes 4–8 weeks depending on your current provider. Trading 212 does not charge any transfer fees on their end, though your outgoing provider may apply exit charges. During the transfer, your investments may be sold and repurchased (in-specie transfers are not currently supported for all assets), so check for any potential tax implications if transferring from a non-ISA account.

What Happens to My Money if Trading 212 Goes Bust?

Trading 212 UK Ltd is authorised by the FCA and participates in the Financial Services Compensation Scheme (FSCS). Your investments are held in segregated accounts, meaning they are kept separate from Trading 212's own company funds. In the unlikely event of insolvency, eligible UK clients are protected up to £85,000 per person under the FSCS for investment claims. Your actual shares and ETFs are held in your name via a nominee structure, so they would typically be returned to you rather than forming part of Trading 212's assets in administration.

Is Trading 212 Better Than Freetrade or InvestEngine in 2026?

Each platform suits a different investor. Trading 212 offers the widest asset range (10,000+ stocks and ETFs), a competitive interest rate on uninvested cash, and multi-currency accounts — making it the strongest all-rounder for self-directed investors. Freetrade offers a similar commission-free model with a SIPP option (from £9.99/month), which Trading 212 lacks. InvestEngine is ETF-only but excels at automated portfolio management with zero platform fees, making it better for purely passive investors. For most UK beginners wanting a single app to manage an ISA with individual stock access, Trading 212 remains the strongest choice in 2026.

References

- ✓ Deposit £500–£999 → Get £40

- ✓ Deposit £1k–£4,999 → Get £100

- ✓ Deposit £5k–£9,999 → Get £300

- ✓ Deposit £10,000+ → Get £500

61% of retail CFD accounts lose money when trading CFDs with this provider.