Quick Answer: Why Is XRP Dropping? And Why Has XRP Dropped in November 2025?

XRP has dropped sharply in November 2025 due to a broader crypto sell-off, whale selling, leveraged position liquidations and fading optimism over a potential XRP ETF approval. Uncertainty around Ripple’s legal case and weak technical support levels have accelerated the decline.

Live Price and Key Levels

You can insert a live XRP price widget or TradingView chart here to ensure real-time updates.

Key levels to monitor:

Support: $2.00

Deeper support: $1.80–$1.70

Resistance: $2.30, $2.50 and $2.70

Psychological target: $3.00 if bullish momentum returns

Why Is XRP Dropping Right Now?

XRP’s November decline is driven by three core factors: overall crypto market weakness, XRP-specific sell pressure and missed expectations over an XRP ETF approval. Bitcoin and Ethereum also fell after weaker economic data and lower ETF inflows, dragging altcoins like XRP down with them. Whales moved tokens onto exchanges, triggering liquidations when prices broke below key support around $2.30. Traders expected progress on an XRP Spot ETF, but no SEC approval or timeline emerged, leading to disappointment and profit-taking. You can embed a live price widget here for real-time updates.

Market-wide crypto sell-off

Barron’s reported a major market correction across Bitcoin, Ethereum and altcoins following reduced institutional inflows and interest rate uncertainty.

XRP-specific pressures

Whale wallets transferred large XRP amounts to exchanges. Ripple’s scheduled token unlocks also added to supply concerns.

Technical breakdown

Once XRP lost support around $2.30 and then $2.10, algorithmic selling and futures liquidations accelerated losses.

Are XRP ETF expectations affecting the price drop?

Yes. Interest in a potential XRP Spot ETF grew after Bitcoin and Ethereum ETF approvals. Asset managers such as Franklin Templeton and Bitwise updated filings for XRP-related funds, lifting price above $2.60 earlier in the month. But when no approval timeline came from the SEC, optimism faded. Analysts noted that ETF expectation turned into disappointment, worsening the pullback when combined with whale selling and weak market sentiment.

Exchanges for XRP.

For more on the best exchanges to trade XRP see our How to buy XRP page, pictured below.

What Are Analysts Saying About the XRP Drop?

Analysts widely agree that XRP’s decline is driven more by fading momentum and macro pressure than by a single failure.

TipRanks noted XRP lost institutional interest after futures open interest dropped to around $4.3 billion.

TheStreet highlighted bearish technical patterns, with analysts warning price rejection near $2.70 signalled deeper weakness.

Barron’s connected XRP’s fall to one of the largest liquidation events of 2025 across the crypto market.

Economic Times added that $1.5 billion in XRP value was wiped in hours after breaking below $2.60. Analysts now view $2 as a critical support zone.

Analyst Outlooks (TipRanks, TheStreet, Barron’s, Economic Times)

TipRanks reports weaker institutional sentiment.

TheStreet warns XRP is technically vulnerable.

Barron’s links the drop to wider market liquidation.

Economic Times notes XRP lost over 6%, erasing $1.5 billion in hours.

Many analysts say recovery depends on market stability, ETF news and holding $2 support.

Has the SEC vs Ripple Case Affected XRP’s Drop?

Yes, indirectly. No major ruling was released in November 2025, but continued legal uncertainty affects confidence. Institutions remain cautious while potential fines and appeals remain unresolved.

Current stage of the case

Ripple’s earlier partial legal win stands, but remedies and penalties are still pending.

Confidence impact

Without final clarity, investors hesitate to commit heavily to XRP during market declines.

Is XRP Being Manipulated or Affected by Whales?

Whale-controlled wallets still hold large XRP supplies. In November, several transferred coins to exchanges before the drop. This doesn’t confirm manipulation, but concentrated selling influences price movements and triggers liquidations in highly leveraged market conditions.

On-chain whale movements

Transfers from long-held wallets often precede volatility, especially when reaching exchanges.

Exchange-driven swings

Low liquidity moments and automated trading can amplify price crashes rapidly.

What Is XRP and What Makes It Volatile?

XRP is a cryptocurrency designed for cross-border payments using the Ripple network. Its price is influenced by adoption, network activity, legal rulings, Bitcoin trends and trader speculation. Unlike stablecoins, XRP is highly sensitive to sentiment and macroeconomic risk.

Other Reasons XRP Has Dropped in the Past

XRP has experienced several major price drops before November 2025, often tied to legal uncertainty, market crashes and token supply increases. Previous declines have followed Bitcoin-led corrections, such as during the FTX collapse and interest rate hikes in 2023–2024. Ripple’s monthly escrow unlocks can increase circulating supply, creating selling pressure when market demand is weak. Other drops have occurred during delays in major financial partnerships or when XRP underperformed against faster-growing competitors. Historically, XRP is highly sensitive to liquidity changes, Bitcoin dominance and regulatory news.

XRP's Price Drop Relative to Bitcoin and Ethereum

XRP’s November 2025 decline is part of a wider crypto market correction, but it has fallen harder than Bitcoin and Ethereum in percentage terms. While Bitcoin dropped around 8% and Ethereum 10%, XRP lost over 15%, showing weaker investor confidence and higher volatility during this sell-off.

Is XRP following Bitcoin’s trend?

Yes. When Bitcoin began falling due to reduced ETF inflows and macroeconomic uncertainty, XRP followed. Bitcoin still drives overall crypto market sentiment, and altcoins like XRP typically react more sharply during downturns.

The Bottom Line

A recovery is possible if XRP holds above $2, Bitcoin stabilises and no negative legal or regulatory developments appear. Long-term recovery depends on adoption of the XRP Ledger, regulatory clarity and potential approval of an XRP ETF in 2026 or later.

Short-term recovery triggers

A bounce could occur if XRP holds above $2.00, ETF optimism returns or whale wallets start accumulating again.

Long-term factors

Ripple’s partnerships, faster cross-border settlement solutions and legal resolution could support long-term growth.

Should You Buy, Sell or Hold XRP During a Drop?

This depends on risk tolerance. Selling locks in losses, holding requires patience and buying should only be considered if you understand the risks. UK investors must also consider capital gains tax and should keep records for HMRC. There is still a lot of positive sentiment that XRP is a good investment.

Risk management tips

Avoid high leverage, set stop-loss levels, diversify and withdraw long-term holdings to secure XRP wallets.

Tax and regulation (UK-specific)

Gains from XRP are taxable. Losses can be reported to offset future gains. HMRC classifies crypto as property, not currency.

Final Thoughts

XRP’s drop in November 2025 stems from broader market weakness, ETF uncertainty and whale selling. While the project remains active and technically strong, it carries high volatility. UK investors should manage risk carefully, avoid emotional decisions and track live price movements.

FAQs

Because of a wider crypto sell-off, whale selling, futures liquidations, weak technical support and delayed XRP ETF approval expectations.

Yes. Analysts warn that losing $2 support could lead to a fall towards $1.80 or even $1.70 if selling pressure increases.

Often, yes. XRP is closely correlated with Bitcoin. When Bitcoin falls sharply, altcoins like XRP tend to drop more aggressively.

It would face major pressure and potential exchange delistings. However, the XRP Ledger would still operate because it is decentralised.

Unlikely. XRP still has liquidity, trading volume and institutional users. Price drops reflect volatility, not total collapse.

References

TipRanks – What on Earth Happened to XRP’s Price?

TheStreet – XRP Crypto Analyst Warning

Barron’s – Bitcoin, Ethereum and XRP Crypto Sell-Off

Economic Times – XRP Price Crashes, $1.5 Billion Erased

CoinMarketCap – XRP Live Price & Market Data

Ripple – Official XRP Escrow and Token Release Reports

TradingView – XRP/USD Live Chart

CryptoPotato – XRP ETF Filings and Analyst Coverage

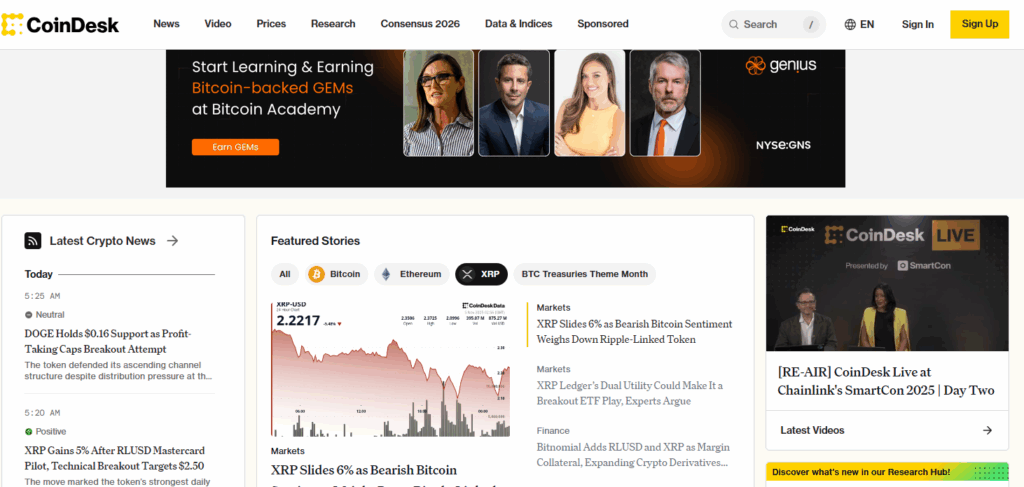

CoinDesk – XRP ETF and Regulatory Developments