How to Buy XRP in the UK

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom is a Co-Founder of TIC, a passionate investor and seasoned blog writer with a keen interest in financial markets and wealth management. "My goal is to empower individuals to make informed investment decisions through informative and engaging content."

Twitter ProfileAuthor Bio

How We Test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Please keep in mind that Crypto assets are volatile and currently unregulated. This volatility presents risk to your investment, and you may lose your funds. Profits from Cryptocurrency sales may be subject to Capital gains tax under UK law.

To buy XRP in the UK, you’ll need to:

Educate yourself about XRP’s fundamentals.

Select a reputable crypto exchange like Coinbase, or Uphold.

Register an account on your chosen exchange, providing necessary personal details and verifying your identity.

Deposit funds using options like bank transfers, credit cards, debit cards, or even Apple Pay & PayPal on some platforms.

Purchase XRP on the exchange. Remember to consider transaction fees. Bonus: For enhanced security, transfer your XRP purchase to a hardware wallet and safeguard your private keys. Only return it to the exchange when selling.

Page Contents:

Step-by-Step Guide on How to Buy XRP

Embark on your journey to buying XRP, a cryptocurrency designed for digital payment networks, with our step-by-step guide tailored for beginners in the UK.

Step 1: Research and Understanding

Before purchasing XRP, understand its purpose as a bridge currency in payment systems. Research the latest developments and regulations concerning XRP, especially given its unique position within the crypto space.

Step 2: Choose a Cryptocurrency Exchange

Find an exchange that supports XRP and is accessible from the UK. Compare their fees, security measures, and user reviews. Coinbase and Uphold are popular choices that list XRP and comply with UK regulations.

Step 3: Create and Secure Your Account

Sign up with your chosen exchange. You’ll need to provide personal information and likely verify your identity to comply with financial regulations. Always enable two-factor authentication for additional security.

Step 4: Deposit Funds

Deposit funds into your account. Most exchanges accept bank transfers and credit cards. Some platforms also support PayPal. Consider the processing times and potential fees for each method.

Step 5: Place a Buy Order for XRP

Navigate the exchange’s platform to find XRP, and place your buy order. You can choose a ‘market’ order for an immediate purchase or a ‘limit’ order to specify a price at which you’re willing to buy.

Step 6: Store Your XRP Safely

After purchasing, you might want to transfer your XRP to a private wallet. There are various types of wallets available, including hardware wallets for maximum security and mobile wallets for convenience.

Step 7: Monitor and Manage Your XRP Investment

Keep an eye on the market and news to manage your investment effectively. Set up price alerts, and consider setting strategic goals for selling or holding your XRP.

Buying XRP in the UK is a straightforward process. By following these steps, you’ll be able to securely purchase and manage your XRP. Remember to invest wisely, stay informed, and be aware of the volatility and regulatory shifts within the cryptocurrency world.

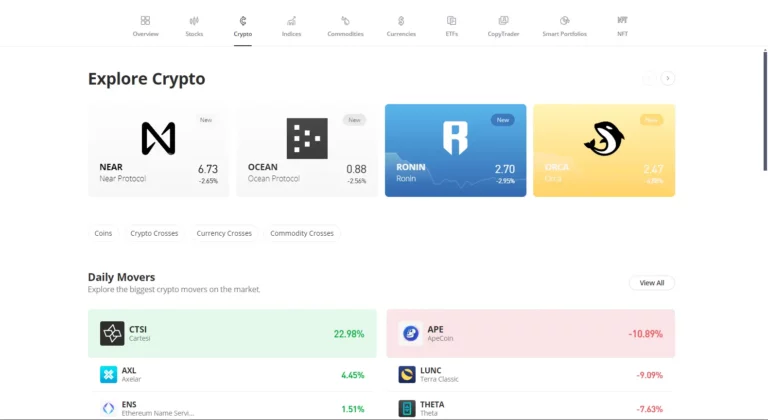

Where to Buy XRP in the UK 2024?

The best place to buy XRP is through an exchange. A Crypto exchange is an online platform that enables users to convert fiat currencies (such as GBP or USD) into other cryptocurrencies. They act as intermediaries, connecting buyers and sellers and providing a digital wallet to store the acquired assets securely. Different crypto exchanges may support a varying range of cryptocurrencies, offering users options to diversify their investment portfolios.

Pros

Cons

- User-Friendly Interface: Easy for all levels.

- Diverse Cryptocurrency Selection: Wide range for portfolio diversification.

- Social Trading Features: Interact, follow, and copy trades.

- Regulated Platform: Trustworthy due to regulation.

- Educational Resources: Helps informed decision-making.

- Limited Cryptocurrency Offerings: Some coins may be missing.

- High Fees: Charges more than some rivals.

- Limited Control of Cryptocurrency: No access to private keys.

- Geographical Restrictions: Not available everywhere.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

TIC Score 4.5/5

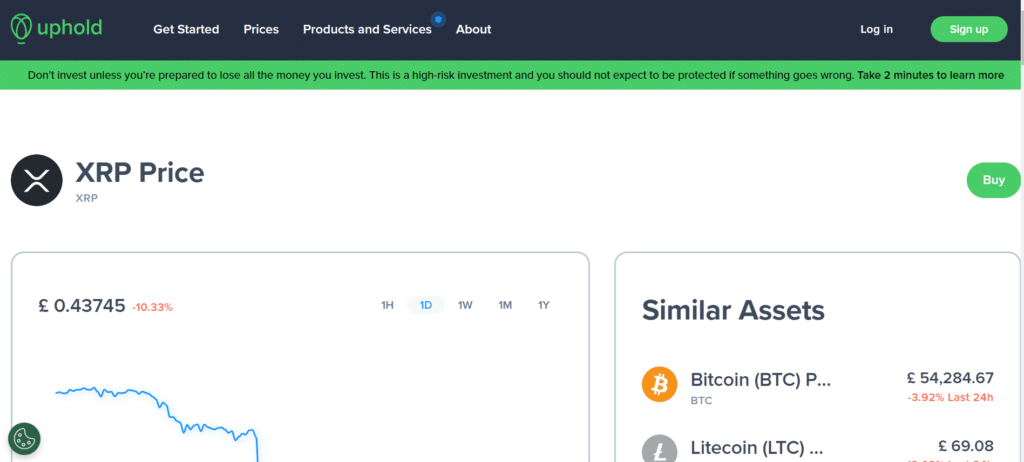

Pros

Variety of Assets: Uphold allows for trading between cryptocurrencies, precious metals, equities, and more. This makes it easy for users to diversify their portfolio and trade XRP against a wide range of assets.

User-Friendly Platform: The Uphold interface is clean and intuitive, making it straightforward for users to buy, sell, or hold XRP, even for those who are new to cryptocurrency trading.

Automatic Conversion: Uphold offers an ‘Anything-to-Anything’ trading experience that lets users automatically convert their assets into XRP without having to go through intermediate conversions, saving time and potential fees.

Cons

Fee Structure: While Uphold prides itself on transparency, some users may find the fees higher compared to other platforms, especially when performing multiple trades or converting between various assets.

Limited Educational Resources: New investors may find a lack of educational materials specifically about XRP and trading strategies on the platform, which could steepen their learning curve.

Restricted Features in Some Countries: Depending on your location, some of Uphold’s features may not be available. This could limit the platform’s utility for some international users interested in trading XRP.

TIC Score 4.35/5

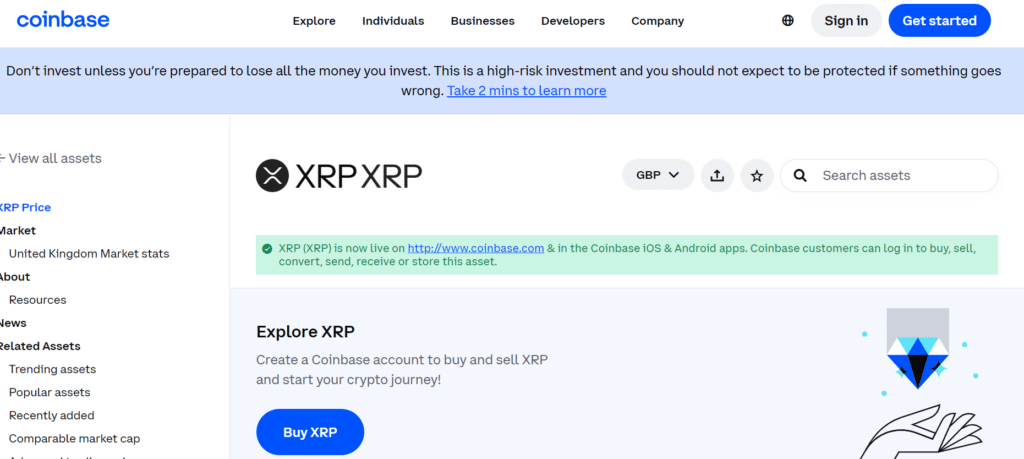

Pros

High Liquidity: Coinbase is one of the largest cryptocurrency exchanges, providing high liquidity and real-time trading for XRP, which can facilitate quicker trades and potentially better prices.

Strong Regulatory Compliance: Coinbase is known for its strong adherence to regulatory compliance, offering a secure platform for users to buy, sell, and store XRP.

User Education: Coinbase provides an extensive range of educational content through Coinbase Learn, helping users understand cryptocurrencies like XRP and the risks and opportunities of trading them.

Cons

Higher Fees: Coinbase typically charges higher fees than some other platforms, especially for small transactions and for users who use the convenience-oriented Coinbase interface as opposed to Coinbase Pro.

Wallet Custody: While convenient, using Coinbase’s wallet means the private keys to your XRP are managed by the exchange, which might not be preferred by those seeking full control over their cryptocurrency.

Potential for Service Delays: During times of high market volatility or technical updates, some users have reported delays in trading or transferring XRP, which could impact timing and investment decisions.

TIC Score 4.3/5

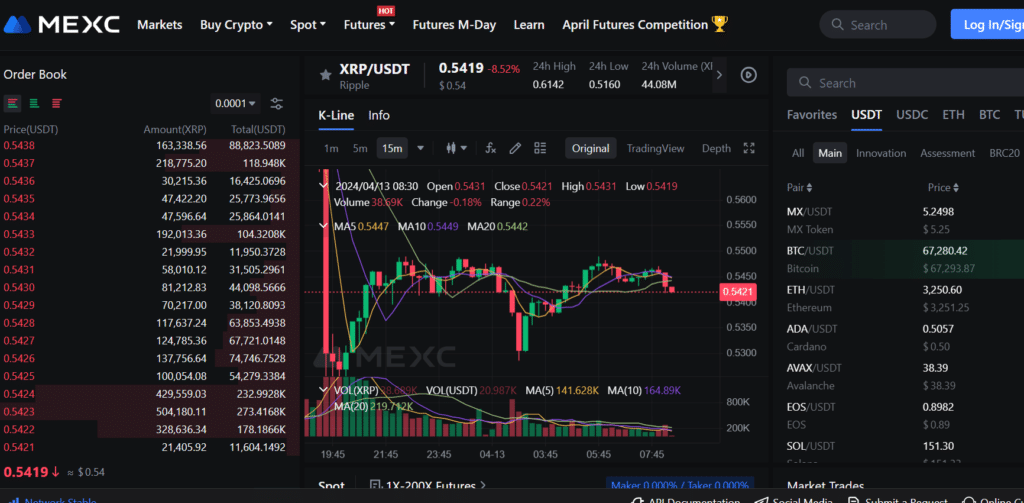

Pros

Competitive Fees: MEXC offers a competitive fee structure for trading, which can be advantageous for active traders looking to minimize costs when buying or selling XRP.

Wide Range of Trading Pairs: MEXC provides an extensive selection of trading pairs, allowing users to trade XRP directly with a variety of cryptocurrencies and stablecoins, enhancing trading flexibility.

Advanced Trading Features: For more experienced traders, MEXC includes advanced trading options such as futures trading and margin trading, offering the potential for leveraged trading of XRP.

Cons

Complex Interface for Beginners: The abundance of advanced trading tools and features might overwhelm new traders who are not yet familiar with such a comprehensive trading environment.

Limited Fiat Support: While MEXC excels in crypto-to-crypto transactions, its support for fiat currencies is not as strong, potentially complicating the process for users wishing to use traditional currency to buy XRP.

Customer Support Concerns: Some users have reported issues with the responsiveness and helpfulness of customer support, which can be a significant drawback, especially in the dynamic and sometimes volatile world of cryptocurrency trading.

What is XRP?

XRP is a digital currency, or cryptocurrency, that is used primarily for digital payments. It was created in 2012 by the company Ripple Labs, which developed a blockchain technology that allows for fast and cost-effective cross-border money transfers. Ripple labs XRP digital currency acts as a bridge between different currencies, enabling transfers to occur more quickly and efficiently than with traditional banking systems and fiat currencies.

Ripple XRP operates on a blockchain, a decentralized and distributed digital XRP ledger that records all transactions across a network of computers. This Ripple blockchain is called the XRP Ledger, and it supports a wide range of decentralized applications and operations.

Unlike many other cryptocurrencies, XRP was not designed to be a store of value or a medium of exchange for goods and services. Instead, XRP was specifically created to facilitate the transfer of other currencies and assets. Banks and mainstream financial institutions can partner with Ripple Labs and use XRP to improve the efficiency of their operations, and individuals can use it to send remittances or other cross-border payments.

XRP is also known for its fast transaction times, often taking just a few seconds to complete, and its low fees for transactions. These features have made it a popular choice for both individuals and institutions looking to move money quickly and inexpensively.

XRP Fact Sheet

-

Launch Year: XRP was launched in 2012 as part of the Ripple payment protocol.

-

Pre-mined Coins: Unlike many cryptocurrencies that require mining, all of XRP’s 100 billion coins were pre-mined.

-

Not Just a Coin: While XRP is a cryptocurrency, Ripple refers to both the platform and the company behind it, aiming to facilitate global money transfers.

-

Fast Transactions: XRP boasts a transaction confirmation time of around 4 seconds, compared to hours for Bitcoin.

-

No Mining: XRP doesn’t use proof-of-work (like Bitcoin), which means it doesn’t consume massive amounts of energy for mining.

-

Strategic Partnerships: Ripple has formed partnerships with key players in the financial industry, including American Express and Santander.

-

Lost Password Story: Stefan Thomas, a former Ripple CTO, is famously known for forgetting the password to a hard drive containing thousands of XRP, worth millions.

-

Legal Battles: Ripple Labs faced legal challenges with the U.S. Securities and Exchange Commission (SEC) regarding whether XRP should be classified as a security.

-

Supply Limit: There’s a maximum supply of 100 billion XRP, with a significant portion held in escrow to be released periodically.

-

Unique Feature: XRP’s consensus ledger is its primary feature, differing from Bitcoin’s proof-of-work and Ethereum’s proof-of-stake systems.

Pros and Cons of XRP

Pros

- Fast Transactions: XRP's quick settlement times can be a significant advantage for businesses and individuals needing to move large amounts of money across borders. Investing in XRP could be a bet on the widespread future adoption of this technology for real-time, cross-border payments.

- Low Fees: The low transaction costs associated with XRP make it attractive for remittance and other types of payments, potentially increasing its adoption and, by extension, its value.

- Scalability: XRP can handle a substantial number of transactions per second, significantly more than other popular cryptocurrencies like Bitcoin. If scalability becomes a major concern for more blockchain networks, XRP might stand out as an efficient option.

- Bank Partnerships: Ripple, the company behind XRP, has established partnerships with numerous banks and financial institutions worldwide. While these partnerships are more for Ripple's payment protocol rather than XRP itself, any positive developments could have a spill over effect on XRP's value.

- Institutional Investment: Ripple's approach is to collaborate with financial institutions and act as a bridge between the old world (banks) and the new world (crypto). This could make it more likely for institutional investors to buy into XRP.

- Diversification: Adding XRP to a cryptocurrency portfolio can help with diversification. Since XRP aims to solve problems specifically in the financial industry, it may not be as correlated with other cryptocurrencies that have different use-cases.

Cons

- Regulatory Risks: XRP has been subject to scrutiny by regulators, notably the U.S. Securities and Exchange Commission (SEC), who argue that it should be classified as a security. A ruling classifying XRP as a security could limit its trading or lead to fines and legal implications for Ripple Labs.

- Market Volatility: Like all cryptocurrencies, XRP is extremely volatile, and while the potential for high returns exists, there is also a high level of risk.

- Competition: While XRP aims to revolutionize cross-border transactions, it faces stiff competition from both traditional financial systems and other cryptocurrencies aiming to serve the same purpose.

- Dependency on Ripple: While XRP is separate from Ripple, the company plays a significant role in its adoption and technological development. Any negative news concerning Ripple could potentially impact XRP's value.

- Potential for Hacks and Scams: XRP exchanges and wallets have been targeted by hacks and scams.

- Learning Curve and Complexity: Understanding XRP and its usage can be challenging for newcomers.

FAQs

Consider security features, ease of use, and backup options. Hardware wallets offer high security for long-term storage, while mobile or software wallets provide convenience for easy access and transfers.

Like all cryptocurrencies, XRP is subject to market volatility. Its price can fluctuate significantly due to various factors, including market sentiment, technological developments, and regulatory news.

UK residents should be aware of the Financial Conduct Authority (FCA) guidelines on cryptocurrencies. It’s important to use a compliant exchange and be mindful of potential changes in cryptocurrency regulations.

XRP differs from Bitcoin in its primary purpose and technological infrastructure. XRP is designed for fast and efficient cross-border transactions, and it operates on a unique consensus protocol rather than traditional mining. This should be considered when evaluating its potential longevity and stability as an investment.

Featured Blogs

Our #1 Recommended Crypto Exchange Platform in the UK

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.