City Index Review 2026 – Honest Take on Fees, Platforms & Safety

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Authors Comments

Using City Index over the past few months, I found it reliable and user-friendly. The platform's advanced tools, low spreads, and FCA regulation make it ideal for UK traders. Demo accounts helped me test strategies, while fund security and transparency offered peace of mind.

Who Are City Index?

City Index is a UK-based broker offering shares CFDs, spread betting, and forex. Part of Nasdaq-listed StoneX Group, it has over 40 years' experience. FCA-regulated, it serves more than 1 million retail clients globally, providing advanced platforms, multiple account types, and access to diverse markets.

| Feature | Detail |

|---|---|

| Founded | 1983 |

| Regulation | FCA UK |

| Parent Company | StoneX Group (NASDAQ: SNEX) |

| Account Types | Standard, MT4, Corporate |

| Markets | Forex, Indices, Shares CFDs, Commodities, Metals |

| Platforms | WebTrader, TradingView, MT4, Mobile App |

| Retail Clients | 1 million+ |

How long has City Index been operating?

City Index has been operating since 1983, providing decades of experience in trading CFDs, forex, and spread betting. Its long track record offers credibility and stability for UK traders seeking a trusted, well-established broker with consistent regulatory oversight.

What markets can I trade on City Index?

Traders can access forex, indices, shares, commodities, and precious metals through CFDs or spread betting. Over 13,500 markets are available, offering both short-term trading and long-term investment opportunities, along with tax-free options for UK spread betting accounts.

What makes City Index stand out from other brokers?

City Index combines decades of experience with award-winning trading platforms, high-speed execution, advanced analytics, and Performance Analytics tools. Its integration with TradingView and MT4 provides flexibility, while FCA regulation ensures robust security and investor protection.

How Easy Is City Index to Use?

City Index is designed for traders of all levels. Its proprietary WebTrader platform, MT4 integration, and mobile app make account creation, deposits, and withdrawals simple. Demo accounts allow practice, while intuitive navigation and advanced charting tools streamline both learning and active trading.

How straightforward is the sign-up process?

Opening an account is fast, typically completed within a few minutes online. Identity verification requires standard documents like proof of ID and address, which usually takes 1–2 business days, allowing quick access to live trading.

Is the user interface beginner-friendly?

The WebTrader interface is clean and intuitive, with easily navigable menus, custom watchlists, and integrated charting. MT4 adds advanced tools for experienced traders, while the mobile app mirrors desktop functionality, enabling seamless transitions between devices.

What account types are available in the UK? (Standard, MT4, Corporate)

City Index offers Standard accounts with WebTrader, MT4 accounts for professional traders seeking automated strategies, and Corporate accounts for businesses needing multiple authorised users. Each account type supports shares CFDs, forex, and spread betting with varying spreads and features.

How fast and reliable are deposits and withdrawals?

Deposits via bank transfer, debit/credit card, or e-wallets are instant or processed within 1–2 business days. Withdrawals are reliable, typically completed in 1–3 business days, depending on the method, ensuring quick access to funds for UK traders.

What Fees and Costs Should You Expect?

City Index offers competitive pricing across CFDs and forex. Spreads are variable but tight, commissions are low or zero for most instruments, and overnight financing applies to leveraged positions

How competitive are spreads, commissions, and overnight fees?

Spreads start as low as 0.8pts for forex on the Standard account and 0.5pts on MT4. Commission-free trading is available for most shares CFDs, while overnight fees apply on leveraged positions. Overall, costs are transparent and comparable to other UK brokers.

How does City Index compare to other UK brokers?

Compared with peers, City Index offers competitive spreads, low commissions, and flexible account types. For a detailed head-to-head breakdown, see my City Index vs Plus500 comparison. While some brokers may provide lower spreads on select instruments, City Index balances affordability with robust tools, market coverage, and FCA regulation, making it highly competitive.

Table – Overall Cost Structure

| Account Type | Spreads (From) | Commission | Overnight Fees |

|---|---|---|---|

| Standard | 0.8 pts | None | Yes |

| MT4 | 0.5 pts | None* | Yes |

| Corporate | Variable | None | Yes |

*Excludes share markets, where commissions may apply.

What Platforms and Tools Does City Index Offer?

City Index provides traders with a choice of WebTrader, MT4, TradingView integration, and a mobile app. Performance Analytics helps monitor trading behaviour. Platforms are designed for both beginners and professional traders, with advanced charting, custom indicators, and automated trading support.

How effective is the web trading platform?

WebTrader is intuitive and powerful, offering integrated charts, over 80 technical indicators, and real-time market data. Users can manage orders, set alerts, and access research tools seamlessly. Its interface is ideal for traders seeking simplicity without sacrificing functionality.

What mobile app features support trading on the go?

The City Index mobile app mirrors WebTrader's functionality, providing full account access, live charts, custom watchlists, alerts, and order management. Its responsive design ensures traders can monitor positions, execute trades, and use advanced tools while away from their desktop.

Table – Platform vs Features Comparison

| Platform | Devices | Charts & Indicators | Order Types | Alerts | Automation | Additional Tools |

|---|---|---|---|---|---|---|

| WebTrader | Desktop/Web | 80+ indicators | Market, Limit, Stop | Yes | Limited | Performance Analytics |

| MT4 | Desktop/Web/Mobile | 100+ indicators | Market, Limit, Stop, EA | Yes | Full | EA & Custom Scripts |

| TradingView | Desktop/Web | 100+ indicators | Market, Limit | Yes | Limited | Community Scripts & Trade Ideas |

| Mobile App | iOS, Android | 80+ indicators | Market, Limit, Stop | Yes | Limited | Watchlists & Alerts |

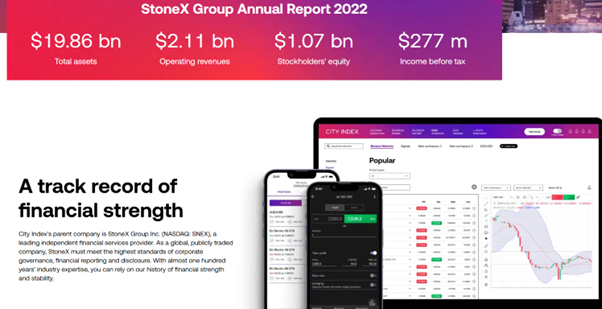

How Safe, Regulated, and Trustworthy Is City Index?

City Index is FCA-regulated in the UK and part of Nasdaq-listed StoneX Group, providing strong regulatory oversight and investor protection. Segregated accounts, FSCS coverage up to £85,000, and corporate safeguards ensure client funds are kept secure and separate from company assets.

How are client funds protected?

Client funds are held in segregated accounts, separate from operational funds, and covered by FSCS protection up to £85,000 for eligible UK clients. Corporate and international accounts benefit from additional protective measures, reducing exposure to broker insolvency risks.

What security features protect personal and financial data?

City Index uses 256-bit encryption, two-factor authentication (2FA), and regular cybersecurity audits to safeguard personal and financial information. Continuous platform monitoring prevents unauthorised access, keeping trading data secure.

What Are the Advantages and Drawbacks of City Index?

| Pros | Cons |

|---|---|

| FCA-regulated and part of Nasdaq-listed StoneX | Variable spreads on certain accounts |

| Segregated accounts + FSCS protection | Overnight fees on leveraged positions |

| Wide market coverage: CFDs on Forex, Shares, Indices, Commodities, Metals | Some advanced tools may overwhelm beginners |

| Award-winning platforms: WebTrader, MT4, TradingView, Mobile | Limited fractional share options |

| Performance Analytics and market research | Demo accounts expire after inactivity |

How Does City Index Compare to Other Brokers in 2025?

City Index offers competitive spreads, strong multi-asset coverage, and advanced tools suitable for active traders. Integration with TradingView and MT4, combined with FCA regulation, positions it as a top choice over brokers like eToro and Saxo for UK traders seeking safety and versatility.

What features give City Index an edge?

Segregated accounts, FSCS protection, award-winning platforms, spread betting options, and broad market access provide advantages for both beginners and advanced traders.

Side-by-Side Comparison Table

| Feature | City Index | eToro | Saxo |

|---|---|---|---|

| FCA-Regulated | Yes | Yes | Yes |

| Account Types | Standard, MT4, Corporate | Standard | Classic, Platinum |

| Platforms | WebTrader, MT4, TradingView, Mobile | Web, Mobile | Web, MT4, SaxoTraderGO |

| Market Coverage | 13,500+ | 2,000+ | 10,000+ |

| Spread Betting | Yes | No | No |

| FSCS Protection | Yes | Yes | Yes |

Final Verdict: Should I Trade with City Index?

City Index is ideal for UK traders prioritising safety, regulatory oversight, and broad market access. Beginners, active traders, and spread betting enthusiasts benefit from its intuitive platforms, robust analytics, and segregated account protections.

Who will benefit most from using City Index?

- UK traders seeking FCA regulation and FSCS protection

- Active forex, CFD, and spread betting traders

- Investors wanting access to multi-asset markets with advanced tools

- Traders needing reliable mobile and desktop platforms

FAQs

Is City Index FCA-regulated?

Yes. City Index is regulated by the UK's Financial Conduct Authority (FCA) and is part of Nasdaq-listed StoneX Group, ensuring robust regulatory oversight and compliance with UK financial laws.

Can I trade CFDs and spread bets safely?

Yes. City Index offers segregated client accounts, FSCS protection up to £85,000 for eligible UK clients, and secure trading platforms with encryption and two-factor authentication, helping mitigate risks associated with leveraged trading.

Which account type is best for beginners?

The Standard Account is most suitable for beginners. It offers a simple WebTrader interface, low minimum deposit requirements, and access to a demo account to practice trading before using real funds.

Does City Index offer a demo account?

Yes. City Index provides a free demo account for all users. This allows beginners and experienced traders to practice trading, test strategies, and familiarize themselves with the platform without risking real money.

What leverage limits are available for UK traders?

Leverage depends on the asset and regulatory limits under ESMA rules. For UK retail clients, leverage on major forex pairs is typically up to 30:1, while minor pairs and commodities have lower limits. Professional accounts may access higher leverage.

References

- Market-Leading Trade Prices – City Index UK

- City Index Reviews | Read Customer Service Reviews of cityindex.com

- StoneX Financial Ltd – FCA Register

- ✓ 13,500+ markets including forex, indices & shares

- ✓ Spread betting & CFD trading on one platform

- ✓ Award-winning AT Pro platform included

68% of retail investor accounts lose money when trading CFDs with this provider