Is City Index Good for Day Trading? – UK Review 2025

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer: Can You Day Trade Effectively on City Index?

City Index offers a reliable trading environment suitable for UK day traders. With fast trade execution, responsive platforms, and access to 13,500+ markets, it supports active strategies. The combination of competitive spreads and advanced tools makes day trading achievable for both beginners and experienced traders.

Authors Comments

From personal experience, City Index provides smooth order execution and a highly intuitive interface. Day trading across forex, indices, and shares felt responsive, with minimal lag. Platform stability and analytics tools make monitoring positions efficient, while spreads and costs are reasonable for high-frequency trading strategies.

City Index Overview

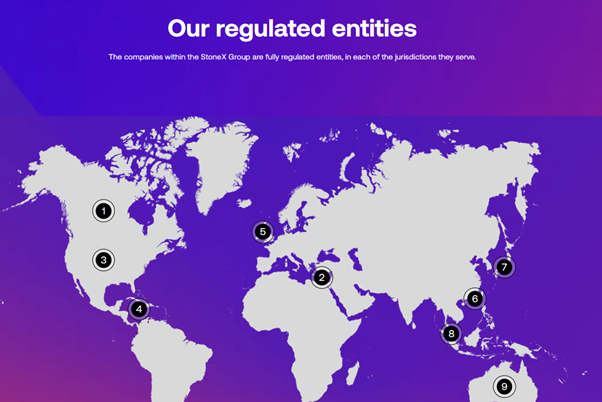

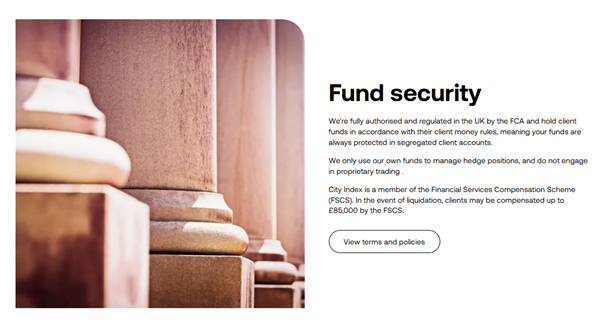

City Index is a well-established UK broker and part of the NASDAQ-listed StoneX Group. Founded in 1983, it is FCA-regulated and trusted by over 1 million clients worldwide. The broker offers a wide range of markets, award-winning platforms, and extended trading hours — giving traders more flexibility and access than many competitors.

- Minimum Deposit: £0

- Regulation: FCA (UK)

- Trading Platforms: WebTrader, TradingView, MT4 (Note: no MT5 support)

-

Market Access:

- 13,500+ markets

- Forex, Shares, Indices, Commodities, Metals

- Spread betting available for UK clients

- Extended Trading Hours: Access to after-hours trading on major US shares, one of the few UK brokers to offer this level of coverage.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

How Does City Index Support Day Traders?

City Index caters to active traders through a variety of platforms and features designed for fast, informed decision-making. The integration of TradingView, MT4, and WebTrader ensures flexibility, while mobile apps allow monitoring and trading on the go.

What trading platforms does City Index offer for day trading?

City Index provides WebTrader, TradingView integration, MetaTrader 4, and a mobile trading app. Each platform supports multiple asset classes, real-time data, customizable charts, and fast order execution, allowing traders to implement day trading strategies efficiently from desktop or mobile devices.

How do these platforms cater to the needs of active traders?

Platforms offer lightning-fast execution, advanced charting tools, customizable alerts, and integration with Performance Analytics. Traders can quickly respond to market movements, analyze trends, and manage risk in real time, essential for successful intraday trading across forex, indices, shares, and commodities.

| Feature | WebTrader | TradingView | MT4 | Mobile App |

|---|---|---|---|---|

| Execution Speed | <1 sec | <1 sec | <1 sec | <1 sec |

| Charting Tools | 80+ indicators | 100+ indicators | 50+ indicators | 50+ indicators |

| Alerts | Customizable | Price & indicator alerts | EA alerts | Push notifications |

| Customization | Layouts & watchlists | Chart styles & scripts | Indicators & EAs | Watchlists & quick trade |

| Asset Classes | Forex, Indices, Shares, Commodities, Metals (CFDs) | Forex, Indices, Shares, Commodities, Metals (CFDs) | Forex, Indices, Shares, Commodities (CFDs) | Forex, Indices, Shares, Commodities, Metals (CFDs) |

What Are the Costs for Day Trading on City Index?

Costs for day trading are transparent. Spreads vary depending on the market, commissions are minimal for most assets, and overnight financing is clearly stated. Traders can use different account types to manage fees efficiently.

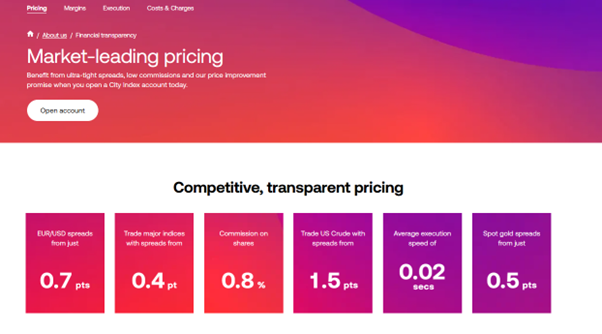

What spreads and commissions should day traders expect?

Forex spreads start from 0.8 pips on the Standard Account and 0.5 pips on the MT4 Account for major pairs, ensuring transparency and competitiveness. Indices and shares are offered with competitive variable spreads. Commissions are generally zero on standard accounts, with MT4 providing slightly lower spreads for FX. Overall costs remain in line with leading UK brokers.

Are there any hidden fees or overnight financing costs?

City Index provides full transparency on overnight financing, interest on positions, and margin requirements. There are no hidden account maintenance or inactivity fees, making it easier for day traders to calculate precise costs for intraday strategies.

Table: Overall costs for different asset classes and account types

| Asset Class | Standard Account Spread | MT4 Account Spread | Commission | Overnight Fees |

|---|---|---|---|---|

| Forex | From 0.8 pips | From 0.5 pips | None | Applies |

| Indices | From 0.5 pts | From 0.4 pts | None | Applies |

| Shares | From 0.08% | From 0.08% | None (except some markets) | Applies |

| Commodities | Variable | Variable | None | Applies |

| Metals | Variable | Variable | None | Applies |

What Tools and Resources Are Available for Day Traders?

City Index offers a robust suite of tools for day traders. Platforms integrate advanced charting, technical indicators, risk management tools, alerts, and performance analytics. Educational resources, including tutorials and webinars, help traders understand market conditions and optimize intraday strategies across multiple asset classes.

What charting and analysis tools are provided?

WebTrader, MT4, and TradingView provide customizable charts, over 100 indicators, drawing tools, and automated alerts. Traders can track trends, plot support/resistance levels, and perform multi-timeframe analysis for forex, indices, commodities, and shares. These tools facilitate quick, informed decisions during volatile intraday conditions.

Are there risk management tools like stop-loss and alerts?

City Index platforms allow setting stop-loss, take-profit, trailing stops, and custom alerts for price movements or technical signals. These features help manage potential losses, protect profits, and support disciplined execution for active traders managing multiple positions simultaneously.

Does City Index provide educational resources for active traders?

Yes. City Index provides webinars, video tutorials, trading guides, and a Trading Academy. These resources teach intraday strategies, technical analysis, and risk management, helping both beginners and experienced traders refine their skills and make informed trading decisions.

What Are the Pros and Cons of Using City Index for Day Trading?

- Fast trade execution (<1 second)

- Advanced charting and technical tools

- Multiple platforms: WebTrader, MT4, TradingView, Mobile

- Risk management features: stop-loss, take-profit, alerts

- Transparent pricing, FCA-regulated

- Overnight financing fees for CFD positions

- Platform may feel complex for beginners

- Limited commission-free access on certain markets

- Some asset classes have wider spreads

- Leverage may increase risk for inexperienced traders

How Does City Index Compare to Other Brokers for Day Trading?

| Feature | City Index | eToro | Saxo |

|---|---|---|---|

| Execution Speed | <1 sec | Moderate | Fast |

| Platforms | WebTrader, MT4, TradingView, Mobile | Web, Mobile | SaxoTraderGO, Mobile |

| Charting Tools | 100+ indicators, drawing tools | Basic indicators | Advanced indicators |

| Alerts & Risk Tools | Custom alerts, stop-loss, take-profit | Limited | Alerts & risk management |

| Fees/Spreads | Competitive, transparent | Higher spreads | Similar spreads, slightly higher fees |

| Leverage | Up to 30:1 (FX) | Up to 30:1 (FX) | Up to 30:1 (FX) |

What features give City Index an advantage over competitors?

City Index offers faster execution, multiple advanced platforms, and extensive charting and risk tools. Performance Analytics and real-time alerts give traders an edge over eToro and Saxo, especially for high-frequency intraday strategies.

Are there other brokers that might be more suitable in certain scenarios?

eToro is beginner-friendly with social trading features, while Saxo provides institutional-grade tools for professional traders. For simple trading or copy trading, they may appeal more, but City Index outperforms in speed, platform versatility, and intraday control.

Final Verdict: Is City Index Suitable for Day Trading?

City Index is ideal for UK day traders seeking fast execution, advanced platforms, and risk management tools. It is best for intermediate to experienced traders needing reliability and flexibility. Beginners may benefit from a demo account before trading live.

Who would benefit most from using City Index for day trading?

Active UK traders trading forex, indices, and shares will benefit most. Those requiring speed, advanced charting, and multiple platforms for intraday strategies gain a clear advantage. Beginners should practice with a demo account to become comfortable with the tools and market conditions.

Trade Global Markets With Confidence

- £0 Minimum Deposit

- 13,500+ Global Markets

- Extended Trading Hours

68% of retail investor accounts lose money when trading CFDs with this provider

FAQs

What is the minimum deposit for day trading on City Index?

Minimum deposits vary by account type but generally start from £100 for standard accounts and higher for MT4 or corporate accounts.

Does City Index offer leverage for day trading?

Yes, UK traders can access leverage up to 30:1 on major forex pairs, with lower limits for indices and commodities in line with FCA and ESMA regulations.

Can I trade on City Index using mobile devices?

Yes, City Index offers a fully-featured mobile app compatible with iOS and Android, supporting charting, alerts, order execution, and account management.

Are there restrictions on trading hours for day traders?

Standard market hours apply, but forex and major indices are generally available 24/5. CFD trading may be subject to market session times.

How can I open a demo account to practice day trading on City Index?

You can register a risk-free demo account online in minutes, which mirrors live market conditions and provides full platform access for practice and strategy testing.

References

- City Index – Wikipedia

- Market-Leading Trade Prices – City Index UK