Best Binance Alternatives Available in the UK

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom is a Co-Founder and of TIC. A passionate investor and seasoned blog writer with a keen interest in financial markets and wealth management.My goal is to empower individuals to make informed investment decisions through informative and engaging content.

Twitter ProfileAuthor Bio

How We Test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Please keep in mind that Crypto assets are volatile and currently unregulated. This volatility presents risk to your investment, and you may lose your funds. Profits from Cryptocurrency sales may be subject to Capital gains tax under UK law.

Quick Answer: Which are the Best Alternatives to Binance in 2024?

Binance Alternative Comparison Table

Cryptocurrencies Available | 4.3/5 | 4.8/5 | 4.7/5 | 4.7/5 | 4.2/5 |

User Experience | 4.5/5 | 4/5 | 4.1/5 | 4.3/5 | 4/5 |

Fees | 3.5/5 | 4.1/5 | 4.4/5 | 4.2/5 | 4.1/5 |

Mobile App | 4.4/5 | 4/5 | 4.5/5 | 4.4/5 | 4/5 |

Community | 3.9/5 | 4.9/5 | 4.2/5 | 4.1/5 | 3.9/5 |

Staking | 4.0/5 | 4.5/5 | 4.4/5 | 4.2/5 | 3.8/5 |

Transparency | 4.2/5 | 4.1/5 | 4.3/5 | 4.5/5 | 4/5 |

Advanced Trading Tools | 4.1/5 | 4.6/5 | 4.6/5 | 4.4/5 | 4.1/5 |

UK Accessibility | 1/5 | 4.7/5 | 3.5/5 | 4.3/5 | 3.8/5 |

Overall Review Score | 3.9/5 | 4.7/5 | 4.35/5 | 4.3/5 | 3.9/5 |

Top 5 Best Alternatives to Binance Reviewed

Etoro - Best Overall Alternative Including Multi-asset Trading

eToro is a multi-asset platform, not just a crypto exchange. While it offers trading for some cryptocurrencies, it also focuses on stocks, ETFs, and other financial instruments.

Pros

Cons

- Social trading features: Unique platform that allows users to copy the trades of successful investors.

- Regulated and secure: Heavily regulated, offering a secure trading environment.

- Wide range of assets: Not just crypto; offers stocks, commodities, and forex trading.

- User-friendly interface: Great for beginners and those new to trading.

- Higher fees for certain trades: Spread fees can be higher than some competitors.

- Limited crypto trading tools: More focused on traditional assets than advanced crypto trading features.

- Withdrawal and inactivity fees: Charges fees for withdrawals and inactivity.

- Customer service can be slow: Some users report slow response times.

Fees

Spread-based fees (variable)

Withdrawal fees apply

Exchange Features

Social trading features, copy trading, limited crypto selection, no staking

Crypto Assets Available

120+ coins and tokens available

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Etoro vs Binance Compared

Etoro and Binance represent two titans in the cryptocurrency exchange and trading arena, each with unique offerings that cater to diverse trader needs. Here’s how they stack up against each other:

Platform Features: Etoro sets itself apart with its social trading platform, allowing users to copy the trades of successful investors, a feature not available on Binance. Binance, however, offers a broader range of trading options, including spot, futures, margin trading, and a decentralized exchange (DEX), appealing to a wide spectrum of traders from beginners to professionals.

User Experience: Both Etoro and Binance boast user-friendly interfaces, but they serve different user bases. Binance is celebrated for its comprehensive suite of tools that cater to traders looking for depth and complexity, while Etoro’s platform is designed to simplify trading decisions through social trading features, making it especially appealing to beginners and those interested in a more communal trading experience.

Fee Structure: Etoro primarily uses a spread-based fee model, which can offer cost savings in certain scenarios, especially for long-term investors. Binance is known for its low fee structure, further reduced by using Binance Coin (BNB) for transactions, making it one of the most cost-effective options in the market.

Crypto Staking: Both platforms offer crypto staking, but they approach it differently. Etoro provides a straightforward staking service with competitive rewards for supported cryptocurrencies. Binance expands on this with a more extensive staking and savings products lineup, catering to users looking for passive income opportunities across a wider range of assets.

Investment Options: Etoro offers a more diversified investment experience beyond cryptocurrencies, including stocks, commodities, and forex trading, positioning it as a one-stop-shop for broader financial trading activities. Binance, while primarily focused on cryptocurrency, has begun to branch out into offering tokenized versions of stocks and other assets, though its core remains deeply rooted in crypto.

Global Reach: Both platforms have a substantial international footprint, but Binance’s sheer volume and extensive list of supported cryptocurrencies and services make it a global leader in the cryptocurrency market. Etoro, with its unique social trading platform, appeals to users in markets where social investment strategies and a mix of asset classes are in demand.

In conclusion, Binance is a powerhouse for cryptocurrency enthusiasts and traders seeking a comprehensive, low-fee trading platform with a wide array of services. Etoro, on the other hand, is distinguished by its social trading features, appealing to those new to trading or interested in combining cryptocurrency trading with traditional financial markets, all within a community-oriented environment. The choice between Etoro and Binance depends largely on the individual’s trading style, desired investment options, and the value placed on community and educational resources.

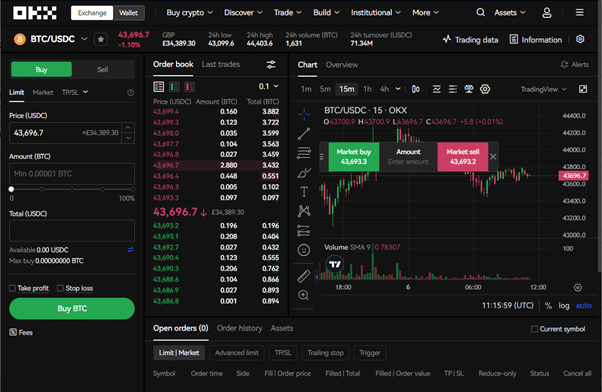

OKX - Best Overall Alternative

OKX Exchange, established in 2017 and headquartered in Seychelles, is a dynamic player in the global cryptocurrency market, offering a wide array of trading options and advanced security measures.

Pros

Cons

- Over 300 Cryptocurrencies Available

- Advanced Trading Tools: Such as real-time charts, technical analysis tools & more.

- High Liquidity

- Robust Security Protocols

- Highly Functional Mobile App

- Competitive Fee Structure: Loyalty and higher volume trading rewarded

- Global Compliance and KYC Standards

- DeFi OKX Wallet

- Limited Services for UK Users: Restrictions on services like Derivatives, OKX Earn, and Crypto Loans in the UK market.

- Higher Fees for Low-Volume Traders: The tiered fee structure may be less favourable for users with lower trading volumes.

- Credit & Debit Card Purchase Fees Higher fees compared the bank transfers.

Please keep in mind that Cryptocurrency assets are volatile and currently unregulated. This volatility presents risk to your investment, and you may lose your funds. Profits from Cryptocurrency sales may be subject to Capital gains tax under UK law.

OKX vs Binance Compared

In the dynamic realm of cryptocurrency trading platforms, OKX and Binance stand out as leading exchanges, each offering unique advantages to their users. While both are renowned for their extensive security measures and a wide array of trading options, they cater to different user needs and preferences.

User Experience: Binance, with its comprehensive suite of tools and features, caters to both novice and experienced traders. Its platform is known for a balance between complexity and user-friendliness. OKX, while also user-friendly, offers a trading environment that appeals to traders looking for advanced trading options like futures and margin trading.

Trading Options and Selection: Both exchanges boast a vast selection of cryptocurrencies, but Binance takes the lead with its unparalleled range of altcoins and trading pairs. OKX also offers a wide variety of options but shines in its offerings of derivative products.

Fee Structure: Binance is celebrated for its low trading fees and a tiered structure that benefits high-volume traders. OKX, on the other hand, also presents a competitive fee model but differentiates itself with additional benefits for OKB token holders.

Security Measures: Security is paramount for both OKX and Binance, with each employing industry-leading protocols. While both provide robust security features, OKX introduces unique measures for user protection and account safety.

Global Reach: Binance’s global footprint is massive, offering services in numerous countries along with a variety of fiat-to-crypto gateways. OKX matches this with significant international reach, supporting many local currencies and payment methods, offering flexibility for global traders.

Ideal User Base: Binance is often the go-to for users seeking a mix of simple and advanced trading features, extensive educational resources, and a vibrant community. OKX, with its focus on advanced trading functionalities, is more suited to experienced traders and those looking for innovative trading products.

Regulatory Compliance: Both platforms strive for compliance with global regulatory standards, but Binance has faced more scrutiny in various jurisdictions. OKX emphasizes its commitment to compliance and security, aiming to provide a secure trading environment.

Choosing between OKX and Binance comes down to personal trading preferences and needs. Binance is ideal for those who value an extensive selection of cryptocurrencies and competitive fees, along with a strong community. OKX, however, is a compelling choice for traders seeking advanced features, derivative trading options, and a platform that combines innovation with user-centric security measures.

Kraken - Best for Security

Founded in 2011, Kraken.com is a leading cryptocurrency exchange known for its extensive cryptocurrency options, strong security, and user-friendly platform, catering to both new and experienced traders.

Pros

Cons

- Over 220 Cryptocurrencies Available

- Enhanced Security Protocols: Including 2fa

- The Intuitive User Interface: For both novice and experienced traders.

- Competitive Staking Options

- Robust Mobile App

- Low Trading Fees: Competitive fee structure, Inc lower rates on Kraken Pro.

- Advanced Trading Tools on Kraken Pro: Inc Stop-losses and charting options

- Complexity for Beginners on Kraken Pro: Advanced featured and detailed interface can be intimidating.

- Limited Trading Features for UK Users: restrictions on trading options such as futures and margin trading.

- Credit & Debit Card Purchase Fees Higher fees compared the bank transfers.

Please keep in mind that Cryptocurrency assets are volatile and currently unregulated. This volatility presents risk to your investment, and you may lose your funds. Profits from Cryptocurrency sales may be subject to Capital gains tax under UK law.

Kraken Vs Binance

Kraken and Binance are both heavyweight contenders in the cryptocurrency exchange arena, each offering distinct advantages tailored to different segments of the market. Here’s a closer look at how they compare:

Lower Fees: Kraken is known for its competitive fee structure, often offering lower transaction and trading fees than many competitors, including Binance in some scenarios. This makes Kraken an attractive option for high-volume traders looking to minimize costs.

Proof of Reserves (PoR): Kraken distinguishes itself with a commitment to transparency, employing a Proof of Reserves audit system. This practice ensures that the exchange can publicly verify the possession of all its clients’ funds, a level of transparency that bolsters user trust significantly. Binance, while also prioritizing security, does not currently utilize a PoR system.

Leverage trading and futures: Kraken offers comprehensive options for leverage trading and futures contracts, catering to the needs of advanced traders seeking to amplify their trading strategies. Binance also offers these features, presenting a vast array of trading options and financial products, making it a robust platform for users interested in more complex trading mechanisms.

Target Audience: Kraken positions itself as an exchange that appeals to a wide range of users but is particularly attractive to more experienced traders due to its detailed trading options, lower fees, and transparency measures. Binance, with its extensive ecosystem, appeals to both beginners and advanced users by offering a wide range of services, from basic spot trading to complex derivatives and financial products.

Security and Trust: Both Kraken and Binance are renowned for their security measures. Kraken’s Proof of Reserves audit adds an extra layer of trust for users, while Binance’s comprehensive security protocols and insurance fund protect against potential losses from hacks.

Fees and Cost-Effectiveness: While Kraken offers a fee structure that benefits high-volume traders, Binance is also competitive, especially with its BNB token offerings that provide transaction fee discounts, appealing to a broad user base.

Trading Options and Flexibility: Both exchanges offer a variety of trading options, including spot, margin, futures, and more. However, Binance extends its offerings to include a wider range of altcoins, tokens, and innovative financial products.

Global Accessibility: Binance boasts one of the largest global footprints in the crypto exchange industry, offering its services to a vast international audience with support for multiple fiat currencies. Kraken also maintains a significant global presence, with a focus on regulatory compliance in the markets it serves.

In conclusion, while Binance is celebrated for its extensive ecosystem, wide range of trading options, and global reach, making it suitable for users of all levels, Kraken carves out a niche for traders who prioritize competitive fees, advanced trading features, and a commitment to transparency through its Proof of Reserves system.

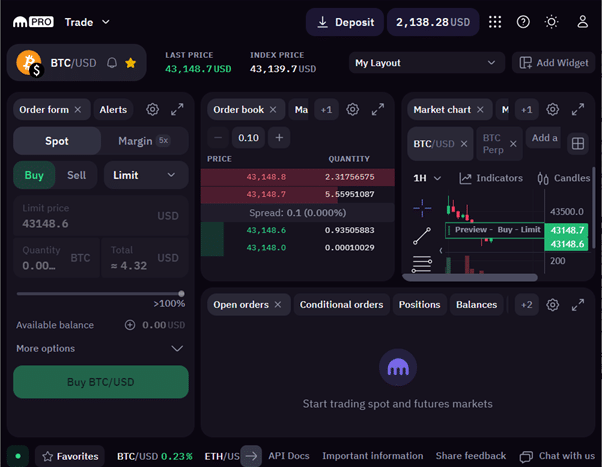

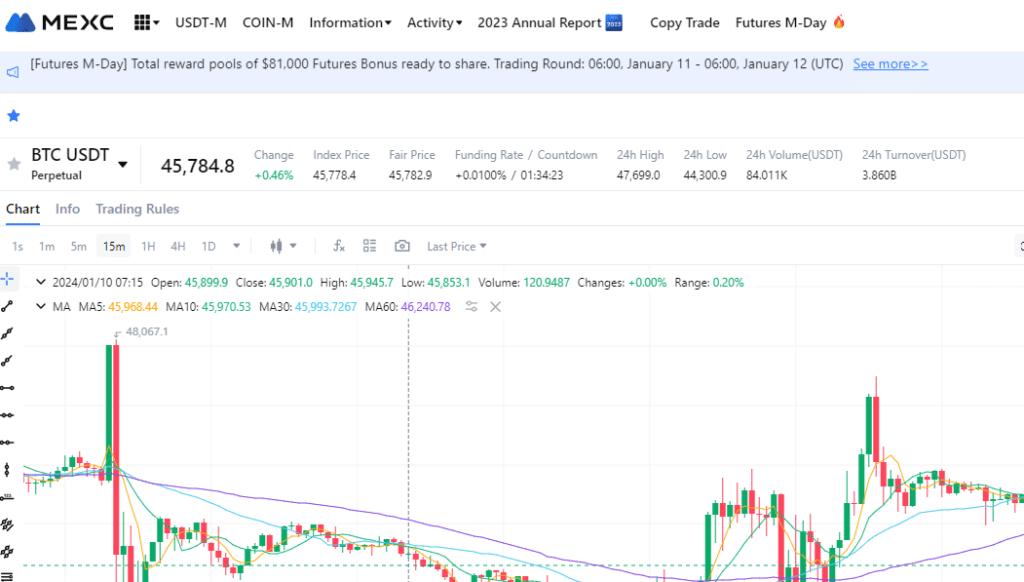

MEXC - Best Exchange for Traders

MEXC is a leading global cryptocurrency exchange known for its wide array of digital assets, including Kaspa, and its user-friendly trading platform. It stands out for its robust security measures, competitive fees, and a strong commitment to customer support, catering to both novice and experienced crypto traders.

Pros

Cons

- Wide Range of Cryptocurrencies

- User-Friendly Interface: The platform is designed to be intuitive, catering to both beginners and experienced traders. This includes easy navigation, clear market data, and straightforward trading processes.

- Robust Security Measures: MEXC implements high-level security protocols, including SSL encryption, two-factor authentication (2FA), and multi-signature wallets, to ensure the safety of users' funds and personal information.

- Competitive Fees: The exchange offers reasonable transaction fees, which is an important consideration for traders concerned about cost efficiency.

- Complexity for Absolute Beginners: Despite its user-friendly design, absolute beginners might still find the world of cryptocurrency trading overwhelming, including navigating various trading tools and understanding market dynamics.

- Limited Educational Resources: Compared to some other platforms, MEXC may offer fewer resources for educating new traders about the complexities of cryptocurrency trading and investment strategies.

- Regulatory Uncertainties: As with many cryptocurrency exchanges, evolving regulations in different countries could impact the platform’s operations or the availability of certain features in the future.

Please keep in mind that Cryptocurrency assets are volatile and currently unregulated. This volatility presents risk to your investment, and you may lose your funds. Profits from Cryptocurrency sales may be subject to Capital gains tax under UK law.

MEXC vs Binance Compared

MEXC and Binance are both prominent figures in the cryptocurrency exchange landscape, each bringing unique features and benefits to the table. Here’s a detailed comparison:

MEXC Instant Buy/Sell: MEXC distinguishes itself with an ‘Instant Buy/Sell’ feature, facilitating quick and straightforward trades at pre-set prices. This functionality is akin to Binance’s simplicity in executing trades, though MEXC often features a broader array of cryptocurrencies available for instant transactions, appealing to users seeking convenience without the need to monitor market trends closely.

User Interface and Ease of Use: Both MEXC and Binance prioritize user experience, offering platforms that cater to both novice and experienced traders. While Binance is renowned for its comprehensive ecosystem and relatively user-friendly interface, MEXC also provides an intuitive trading environment, albeit with a focus that slightly leans more towards users familiar with cryptocurrency trading.

Cryptocurrency Selection: Binance is celebrated for its vast selection of cryptocurrencies, arguably one of the largest in the market, catering to a wide variety of interests and trading strategies. MEXC competes by offering an extensive selection as well, including access to many emerging and less mainstream cryptocurrencies, which may appeal to users looking for diverse trading opportunities.

Fee Structure: MEXC’s competitive fees are a significant draw for active traders, potentially offering lower costs compared to Binance’s already competitive fee schedule. Binance users can benefit from discounted fees by using Binance Coin (BNB) and participating in the tiered fee structure based on trading volume.

Target Audience: Binance serves a broad audience, from beginners to advanced traders, with its wide range of services, including spot trading, futures, staking, and more. MEXC, while also catering to a diverse user base, might appeal more to traders looking for specific advanced features or access to a wide variety of altcoins.

Global Reach and Accessibility: Binance boasts one of the most extensive global reaches among cryptocurrency exchanges, supporting a multitude of fiat currencies and payment methods. MEXC also offers significant global accessibility, with a strong presence in various regions and support for multiple languages, making it a viable option for users worldwide.

In conclusion, while Binance remains a powerhouse in the cryptocurrency exchange industry, known for its extensive ecosystem, vast cryptocurrency selection, and innovative services, MEXC presents itself as a formidable competitor, especially for users interested in a wide array of cryptocurrencies and competitive trading fees. Both platforms offer unique advantages, making the choice between them dependent on individual trading needs and preferences.

CoinJar - Easiest to Use

CoinJar is celebrated for its simplicity and ease of use, making it an excellent choice for those new to cryptocurrency trading. It offers a streamlined interface and a straightforward fee structure, catering well to casual investors and beginners.

Pros

Cons

- User-Friendly Interface

- Simple Fee Structure Transparent and uncomplicated fees, making it easy for users to understand their costs.

- Mobile App Efficiency

- Fiat Currency Support

- Speedy Transactions

- Bundled Investments: Provides a unique feature of bundled cryptocurrency investments for diversification.

- Limited Cryptocurrency Selection: Offers fewer cryptocurrencies compared to larger exchanges.

- Higher Fees for Convenience: While user-friendly, fees can be higher compared to more complex platforms.

- Limited Advanced Features: Not as feature-rich for experienced traders looking for advanced trading tools.

Please keep in mind that Cryptocurrency assets are volatile and currently unregulated. This volatility presents risk to your investment, and you may lose your funds. Profits from Cryptocurrency sales may be subject to Capital gains tax under UK law.

Coinjar vs Binance Compared

Coinjar, while not as widely recognized as the behemoth Binance in the cryptocurrency exchange market, offers its own set of appealing features. Here’s a breakdown of how Coinjar compares with Binance:

User Interface and Accessibility: Both Coinjar and Binance prioritize a user-friendly experience, catering to newcomers in the crypto world. Binance, however, offers a more extensive suite of tools and features that, while beneficial to experienced traders, can be overwhelming for beginners. Coinjar’s interface is simpler, which might be more appealing to those just starting out or who prefer ease of use over complexity.

Fee Structure: Coinjar is known for its competitive fee structure, especially for users conducting smaller transactions. Binance also boasts a highly competitive fee model, often more advantageous for high-volume traders, particularly when utilizing Binance Coin (BNB) for transactions, which provides additional discounts.

Range of Services: Binance offers a broad spectrum of services, including a vast array of trading options, futures, staking, savings accounts, and an NFT marketplace, dwarfing Coinjar’s more modest offerings. Coinjar focuses on basic trading options and wallet services, catering to users who prefer simplicity.

Target Audience: Coinjar is ideally suited for beginners or those engaging in crypto trading on a smaller scale due to its straightforward approach and competitive fees. Binance, with its comprehensive ecosystem, targets a wider range of users, from novices to seasoned traders looking for depth, variety, and global market engagement.

Cryptocurrency Selection: Binance is unmatched in its cryptocurrency selection, offering one of the largest assortments of digital currencies and trading pairs in the market. Coinjar offers a more curated selection, sufficient for those new to trading or interested in the most popular cryptocurrencies.

Global Reach: Binance’s global footprint is expansive, serving users worldwide with multiple fiat gateways, making it a global leader in the cryptocurrency space. Coinjar, while offering reliable services, has a more concentrated presence in specific regions, which might limit its appeal to users outside those areas.

In summary, Binance stands out as a versatile, all-encompassing platform that caters to a wide spectrum of users with its vast array of services and global reach. Coinjar, on the other hand, positions itself as an accessible entry point for newcomers or those who prefer a straightforward, no-frills trading experience with competitive fees. The choice between Coinjar and Binance ultimately depends on the user’s individual needs, trading volume, and preference for simplicity versus a broad range of features.

References

FAQs

Binance stands out in the crypto market for offering an advanced trading platform with comprehensive futures trading options. This allows traders to speculate on the future price of crypto assets with leverage, providing opportunities for significant returns. Binance’s platform supports a wide variety of cryptocurrencies, offering low trading fees and a user-friendly interface for both beginner and advanced traders.

Binance prioritizes the security of digital assets with stringent security measures, including two-factor authentication (2FA), cold storage solutions for the majority of crypto assets, and an insurance fund to protect against potential breaches. These efforts are designed to safeguard users’ accounts and provide a secure trading environment on the cryptocurrency exchange platform.

Yes, Binance allows users to deposit fiat currencies using bank transfers among other deposit methods. This feature makes it easier for users to buy crypto directly with their traditional bank accounts, enhancing the platform’s accessibility and convenience for a global user base seeking diverse payment methods.

Binance offers several advantages, including lower fees, a diverse range of trading options, and access to a vast selection of major coins and new tokens. Its fee structure is highly competitive, appealing to both beginner and advanced traders. Additionally, Binance’s mobile apps ensure traders can manage their portfolios and trade on the go, making it a top choice among cryptocurrency exchanges.

Binance supports beginner traders with an extensive array of educational resources, including articles, tutorials, and videos on trading skills, market trends, and the basics of cryptocurrency trading. These resources are aimed at helping novice traders navigate the crypto space confidently, making Binance not just a trading platform but also a learning hub for users at all levels.

Related Articles

Epilogue

He has over a decade experience in finance and holds Chartered Status in the financial industry, Thomas’s specialty is trading CFDs, Forex and Day Trading.

His crypto portfolio is heavily weighted towards Bitcoin and Ethereum, but enjoys trading low cap crypto’s with higher volatility. Thomas’s favourite trading strategy is break out Trading.

How This Content Was Created: Our assessment of the the the best alternatives to Binance in the UK is rooted in rigorous research and firsthand experience. Here’s our methodology:

Platform Testing: We actively tested multiple platforms over a span of six months, analysing their functionalities, ease of use, and reliability.

Fee Analysis: Each platform’s fee structure was dissected to ascertain its competitiveness in the market.

User Feedback: We engaged with real users and considered their reviews and experiences, lending a holistic perspective to our evaluation.

Market Dynamics: Regular updates from industry news, changing regulations, and market dynamics ensure the guide remains current and reliable.

AI-Assistance: While human judgment and expertise are at the core of our assessments, we utilized AI tools to improve structure, critique our work.

Note: Our use of AI tools is strictly for data gathering and content assistance. All conclusions drawn and recommendations made are based on human analysis and judgment.

Why This Content Was Created: Our primary objective in creating this guide is to empower traders, both seasoned and novices, with impartial, comprehensive, and actionable information to make informed decisions.

We understand the complexity of the stock trading world and aim to simplify it for our readers.

While we hope our content is discoverable by those seeking insights, our main priority is to provide genuine value to our visitors.

We staunchly oppose content creation practices that manipulate search rankings or violate any standards of integrity.

Gain access to the #1 market leading investing platform

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.