Crypto Platforms with the Lowest Fees

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Dom Farnell

Co-Founder

Dom is a Co-Founder of TIC, a passionate investor and seasoned blog writer with a keen interest in financial markets and wealth management. "My goal is to empower individuals to make informed investment decisions through informative and engaging content."

Twitter ProfileAuthor Bio

How We Test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Please keep in mind that Crypto assets are volatile and currently unregulated. This volatility presents risk to your investment, and you may lose your funds. Profits from Cryptocurrency sales may be subject to Capital gains tax under UK law.

Quick Answer: Which Crypto Platform has the lowest fees?

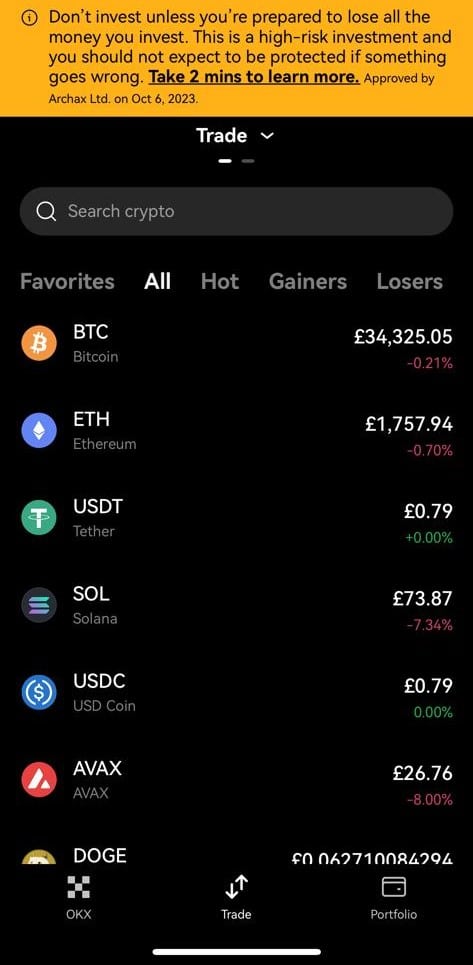

For those seeking a crypto trading platform with notably low fees, OKX emerges as a leading choice. Renowned for its competitive fee structure, OKX caters to both novice and advanced traders, offering an extensive range of digital assets and advanced trading features, making it an optimal selection for cost-efficient cryptocurrency trading.

Page Contents:

- Cryptocurrency Platform Fee Comparison Table

- Overview of Crypto Trading Platforms

- Understanding Fees in Cryptocurrency Trading

- The Search for Low Fees

- The Significance of Maker and Taker Fees

- Top 5 Cheapest Crypto Exchanges for Low Fees

- Specialised Trading Options and Fees

- Strategies to Reduce Trading Fees

- Additional Costs and Considerations

- References

- FAQs

Cryptocurrency Platform Fee Comparison Table

Cryptocurrencies Available | 4.7/5 | 4.8/5 | 4.3/5 | 4.7/5 | 4/5 |

User Experience | 4.1/5 | 4.1/5 | 4.5/5 | 4.3/5 | 3.8/5 |

Fees | 4.4/5 | 4.6/5 | 3.5/5 | 4.2/5 | 3.7/5 |

Mobile App | 4.5/5 | 4.3/5 | 4.4/5 | 4.4/5 | 3.9/5 |

Community | 4.2/5 | 4.4/5 | 3.9/5 | 4.1/5 | 3.8/5 |

Staking | 4.4/5 | 4.9/5 | 4.0/5 | 4.2/5 | 3.9/5 |

Transparency | 4.3/5 | 4.6/5 | 4.2/5 | 4.5/5 | 3.7/5 |

Advanced Trading Tools | 4.6/5 | 4.7/5 | 4.1/5 | 4.4/5 | 3.8/5 |

UK Accessibility | 3.5/5 | 4.0/5 | 3.9/5 | 4.3/5 | 3.6/5 |

Overall Review Score | 4.35/5 | 4.5/5 | 4.1/5 | 4.1/5 | 3.7/5 |

Overview of Crypto Trading Platforms

In the dynamic world of digital finance, cryptocurrency trading platforms have emerged as pivotal arenas for buying, selling, and exchanging a myriad of digital assets.

These platforms are not just gateways to the cryptocurrency markets; they are the backbone of the crypto trading ecosystem, offering tools, resources, and services that cater to a diverse range of participants, from novice traders to sophisticated investors.

Understanding the landscape of these platforms is essential for anyone looking to navigate the crypto world effectively.

One critical factor that every trader must consider is the cost of trading—specifically, the fees charged by these platforms.

The importance of low trading fees cannot be overstated, as they directly impact the profitability of trading activities. Lower fees mean that traders can execute more transactions without significantly eroding their potential gains, making it a key consideration when choosing a platform.

This section will delve into the intricacies of crypto trading platforms and elucidate why low fees play a crucial role in trading success.

Cryptocurrency trading platforms are the hubs where digital assets are exchanged. These platforms vary widely in terms of functionality, security, asset availability, and, crucially, fee structures.

Some are designed for beginners, offering straightforward user interfaces and basic trading options, while others are tailored for advanced traders, featuring complex tools and advanced trading features like margin trading and futures contracts.

The choice of platform can significantly affect a trader’s strategy and outcomes, making it crucial to select one that aligns with their trading goals and experience level.

Importance of Low Fees in Crypto Trading

Fees are a fundamental aspect of trading on cryptocurrency platforms. They can include trading fees (maker/taker fees), withdrawal fees, and sometimes even deposit fees. These fees can quickly accumulate, especially for active traders, eating into profits and affecting the overall trading strategy.

Low fees can be a competitive advantage for trading platforms, attracting users who are keen to maximize their returns on investment. Furthermore, platforms that offer tiered fee structures provide incentives for higher volume trading, which can be particularly appealing for serious traders aiming to minimize costs while maximizing trades.

Understanding Fees in Cryptocurrency Trading

What Are Trading Fees?

Trading fees are charges imposed by cryptocurrency exchanges for facilitating buy and sell orders on their platforms.

These fees are essential for the operation and maintenance of the exchange, supporting a secure, efficient, and scalable trading environment.

Typically, trading fees are calculated as a percentage of the trade’s total value, varying widely among exchanges and often influenced by factors such as the user’s trading volume, the type of trade (maker vs. taker), and the use of the exchange’s native tokens for transactions.

The Impact of Fees on Crypto Trading

The impact of trading fees on crypto trading can be significant, especially for active traders and those with high trading volumes. Even seemingly small fees can add up, reducing overall profitability.

For traders employing strategies that require frequent trades, such as day trading or scalping, the cumulative effect of these fees becomes a crucial factor in their net returns.

Understanding and managing trading fees is therefore essential for optimizing trading strategies and maximizing gains in the volatile crypto market.

Types of Fees: From Trading to Withdrawal

Cryptocurrency exchanges typically levy various types of fees, including but not limited to:

Trading Fees: These include maker fees (charged for adding liquidity to the market by creating a limit order) and taker fees (charged for removing liquidity by filling an order already in the exchange’s order book).

Withdrawal Fees: Charges for withdrawing digital assets from the exchange to an external wallet. These fees can vary significantly depending on the blockchain network’s congestion and the specific cryptocurrency.

Deposit Fees: While less common, some exchanges charge fees for depositing funds or cryptocurrencies.

Other Fees: These can include inactivity fees, margin trading fees, and fees for special services like instant buy/sell or using fiat currency conversion services.

Comparing Fee Structures Across Crypto Exchanges

Fee structures can vary dramatically across cryptocurrency exchanges, making comparison a critical step for traders.

Some platforms offer a flat fee model, while others adopt a tiered structure where fees decrease with higher trading volumes. Several exchanges incentivize the use of their native tokens by offering discounted fees when paid with the token.

Additionally, differences in maker and taker fees encourage traders to consider their trading style when choosing an exchange.

For example, a trader who primarily provides liquidity to the market might prefer an exchange with lower maker fees.

Understanding these differences is vital for traders to choose the most cost-effective platform that aligns with their trading habits and volume.

The Search for Low Fees

In the competitive world of cryptocurrency trading, the hunt for platforms with low fees is relentless.

Traders from all backgrounds strive to maximize their profits by minimizing the costs associated with their trading activities.

This section delves into the concept of low trading fees, the dynamics of maker and taker fees, their attraction for high volume traders, and the benefits of tiered fee structures.

Defining Low Trading Fees

Low trading fees are essentially lower costs charged by cryptocurrency exchanges for executing buy or sell orders. These fees are deemed “low” relative to the average fees across the industry or in comparison to direct competitors.

The definition of low trading fees can be subjective and varies based on the trader’s perspective; however, it typically refers to fee rates that are below the industry standard of 0.1% to 0.25% for each trade.

Exchanges may offer low fees as a strategy to attract new users and retain high volume traders by making it more cost-effective to trade on their platform.

The Significance of Maker and Taker Fees

Maker and taker fees are central to the fee structure of most cryptocurrency exchanges, influencing trading strategies and liquidity.

Makers add liquidity to the market by placing orders that are not immediately matched with an existing order, hence “making” the market. Takers remove liquidity by filling orders that are already on the order book, hence “taking” the market.

Typically, maker fees are lower than taker fees because makers provide a beneficial service to the exchange by adding liquidity, which is crucial for maintaining a healthy trading environment.

Understanding the interplay between these fees can help traders make informed decisions and optimize their trading costs.

How Low Fees Attract High Volume Traders

High volume traders, such as day traders and institutional investors, often execute a large number of trades over a short period. Consequently, even marginally lower fees can significantly impact their overall profitability.

Low fees can be a compelling incentive for these traders, drawing them to platforms where their high-volume trading strategies can be executed more cost-effectively.

Additionally, exchanges that offer low fees for high volume trading can benefit from increased liquidity and trading activity, creating a vibrant and dynamic trading environment.

Tiered Fee Structures Explained

Tiered fee structures offer a way for exchanges to cater to a broad spectrum of traders, from casual to high volume, by adjusting fees based on the trader’s activity level.

In a tiered system, the fees decrease as a trader’s monthly or 30-day trading volume increases. This structure rewards the most active traders with lower fees, encouraging more trading activity and providing an incentive for traders to concentrate their trades on a single platform to benefit from reduced costs. T

iered fee structures are a win-win for both exchanges and traders: they promote higher trading volumes and liquidity while allowing traders to reduce their trading costs significantly.

By prioritizing low fees, understanding the nuances of maker and taker fees, and leveraging tiered fee structures, traders can significantly enhance their trading outcomes.

As the cryptocurrency market continues to evolve, staying informed about fee structures and seeking the most cost-effective trading environments will remain crucial for trading success.

Top 5 Cheapest Crypto Exchanges for Low Fees

The landscape of cryptocurrency trading is vast, with each platform offering unique benefits, trading features, and fee structures designed to meet the needs of diverse trader demographics.

From spot trading to futures, options, and beyond, selecting the right exchange is crucial for optimizing trading strategies and maximizing profitability.

The best exchanges combine low fees with robust trading features, high security, and excellent customer service to offer a superior trading experience.

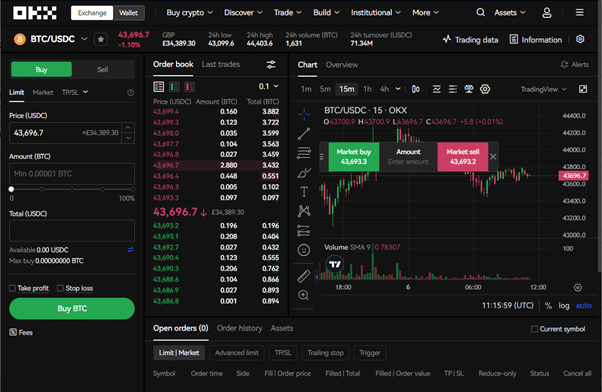

Exchange 1: Fee Structure and Benefits – OKX

OKX stands out for its competitive fee structure, making it an attractive option for traders looking for low-cost trading opportunities.

It employs a tiered fee system where trading fees decrease as the user’s trading volume increases.

This structure incentivizes high-volume trading with significantly reduced costs. OKX supports a wide range of cryptocurrencies and trading pairs, offering spot, futures, options, and perpetual swaps trading.

The exchange also provides advanced trading features like margin trading and a user-friendly interface suitable for both beginners and experienced traders.

Fee Structure: Tiered, based on 30-day trading volume.

Benefits: Low fees for high-volume traders, extensive range of trading options, and advanced trading tools.

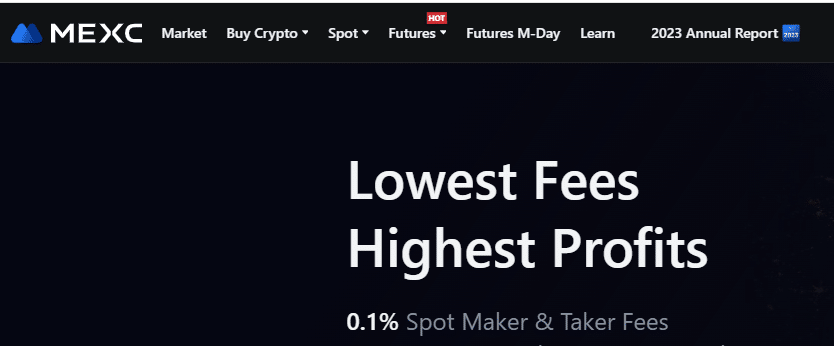

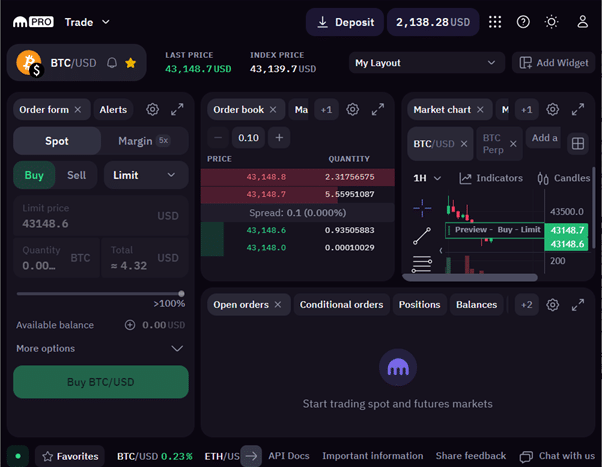

Exchange 2: MEXC – Advanced Trading Features and Fees

For traders interested in futures trading with a keen eye on keeping costs low, MEXC is a compelling choice.

It offers a comprehensive suite of trading options, including spot, margin, and an extensive selection of futures contracts.

MEXC is known for its low futures trading fees, which can be further reduced for users who hold the exchange’s native MX token.

Fee Structure: Competitive futures trading fees with discounts for MX token holders.

Advanced Trading Features: Offers up to 200x leverage on futures contracts, alongside innovative products like ETFs and index futures.

Exchange 3: User Experience and Low Fee Model

An exchange that combines a stellar user experience with a low fee model is Binance. Known for its user-friendly interface, Binance caters to traders of all experience levels.

It offers a comprehensive range of trading options, including spot, futures, and options trading, with one of the industry’s lowest fee structures for spot trading.

Fee Structure: Low trading fees for spot markets, with further discounts available for using BNB (Binance Coin) for fee payment.

User Benefits: Extensive educational resources, a secure and intuitive trading environment, and a vast ecosystem of crypto services.

Exchange 4: Withdrawal Fees and User Benefits – Kraken

Kraken emphasizes security and user benefits, alongside a competitive fee structure. It offers low withdrawal fees across a wide range of cryptocurrencies, making it cost-effective for traders to move their assets.

Kraken also provides advanced trading features like margin and futures trading in a regulatory-compliant environment.

Fee Structure: Competitive withdrawal fees and reasonable trading fees.

User Benefits: Strong focus on security, regulatory compliance, and accessible customer support.

Exchange 5: Deposit Fees and Trading Volumes – Coinbase

Coinbase is renowned for its ease of use, making it an excellent choice for beginners. While its trading fees are generally higher than those of other exchanges listed here, Coinbase offers low deposit fees for bank transfers and high liquidity, facilitating quick and easy trades.

Fee Structure: Higher trading fees with low deposit fees for bank transfers.

Trading Volumes: High liquidity across major trading pairs.

Each of these exchanges offers unique advantages and fee structures designed to cater to different trading strategies and preferences.

Whether you prioritize advanced trading features, user experience, low withdrawal fees, or trading volumes, there’s an exchange that fits your needs.

Traders should consider their specific requirements and perform due diligence to select the exchange that best aligns with their trading goals.

Specialised Trading Options and Fees

Margin Trading and Associated Fees

Overview: Margin trading allows traders to borrow funds to increase their trading position beyond what would be available from their cash balance alone.

Fees:

Interest Rates: Traders pay interest on the funds borrowed for margin trading.

Varies by Platform: Rates and fees depend on the exchange and the amount of leverage used.

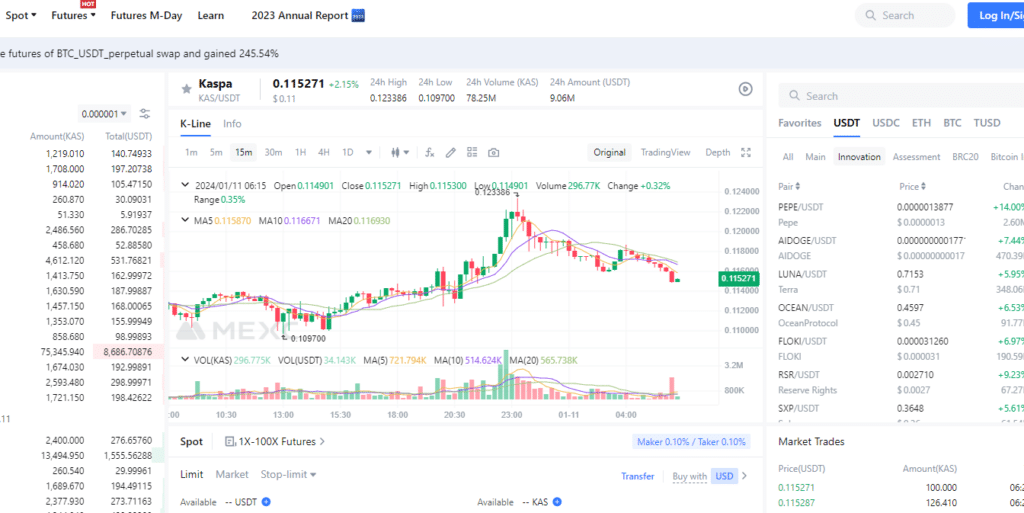

Futures Trading in Crypto: A Cost Perspective

Basics: Futures contracts enable traders to buy or sell a specific cryptocurrency at a predetermined price at a future date.

Cost Implications:

Trading Fees: Generally lower than spot markets but vary across platforms.

Settlement Fees: Some exchanges charge fees upon the settlement of the futures contract.

Understanding Crypto Futures Trading Fees

Structure: Includes maker and taker fees, with some exchanges offering tiered pricing based on monthly trading volume.

Discounts:

Native Tokens: Using an exchange’s native token can often provide discounts on trading fees.

Volume-Based Discounts: Higher trading volumes can lead to lower fee rates.

The Role of Advanced Trading Tools in Fee Structures

Tools: Includes stop-loss orders, limit orders, and automated trading bots.

Impact on Fees:

Usage Fees: Some advanced tools may incur additional fees.

Efficiency Gains: Proper use can enhance trading efficiency and potentially offset the cost of higher fees.

In summary, specialized trading options like margin and futures trading offer advanced traders the leverage and flexibility to pursue sophisticated strategies but come with their own sets of fees and costs.

Understanding these fees and how they fit into the broader fee structure of a crypto exchange is crucial for traders looking to optimize their trading outcomes.

Traders should carefully consider these costs along with the potential benefits of using advanced trading tools and platforms offering competitive fee structures to maximize their trading potential.

Strategies to Reduce Trading Fees

Use Limit Orders: Avoid higher taker fees by placing limit orders instead of market orders.

Leverage Fee Discounts: Some exchanges offer discounts for using their native tokens or for holding a certain amount of cryptocurrency in your exchange wallet.

Increase Trading Volume: Many exchanges offer tiered fee structures, where higher trading volumes lead to lower fees.

Choose the Right Exchange: Research and select exchanges known for their low fee structures.

Benefits of Using a Crypto Exchange Account

Consolidated Trading: Centralize your trading activities for better management and potential volume-based fee discounts.

Access to Advanced Tools: Enjoy features like detailed analytics, automated trading, and more, which can improve trading efficiency.

Security Features: Benefit from enhanced security measures provided by exchanges to protect your assets.

How Trading Volume Affects Fees

Tiered Structures: Higher trading volumes often qualify for lower trading fees under tiered pricing models.

Incentives for Liquidity: Exchanges reward high-volume traders as they provide liquidity, which is crucial for a healthy trading environment.

The Advantages of Low Fees for Advanced Traders

Increased Profitability: Lower fees mean a higher portion of gains is retained, boosting overall profitability.

Flexibility in Trading Strategies: Advanced traders can execute high-frequency trading strategies more cost-effectively.

Additional Costs and Considerations

Withdrawal Fees Across Platforms

Varies Widely: Withdrawal fees differ significantly among platforms and can depend on the specific cryptocurrency.

Network Fees: Be aware of network fees for blockchain transactions, which are separate from the exchange’s withdrawal fees.

The Impact of Deposit Fees on Trading Strategy

Direct Cost: While less common, deposit fees can directly impact the cost basis of your investments, affecting overall strategy.

Choosing Platforms: Opt for platforms with low or no deposit fees to maximize your investment.

Bank Transfer Fees: What Traders Should Know

Fiat Deposits: Bank transfer fees for fiat deposits can vary and might be influenced by your bank’s policies and international transfer costs.

Speed and Cost: Weigh the balance between the speed of the transfer and the associated costs, as some faster options may incur higher fees.

Transaction Fees in Volatile Market Periods

Increased Costs: During periods of high volatility, transaction fees can spike, especially for urgent transfers.

Strategic Planning: Plan your trading and withdrawal activities to avoid peak times, potentially reducing costs.

Understanding and strategically navigating trading and additional fees are crucial for maximizing the efficiency and profitability of your cryptocurrency trading activities. Advanced traders, in particular, can benefit significantly from lower fees, while all traders should remain vigilant about the various costs associated with trading and transferring digital assets.

FAQs

The best cryptocurrency exchanges are characterized by low trading fees, a wide range of crypto assets, robust security measures to protect user funds, and user-friendly platforms for both novice and experienced crypto traders. They offer diverse trading options, including the ability to buy crypto, trade Bitcoin, and access advanced trading features.

Centralized exchanges act as third-party intermediaries in transactions, offering enhanced trading speed and convenience, with a variety of payment methods including fiat currencies. Decentralized exchanges allow direct peer-to-peer transactions, providing greater privacy and reduced risk of centralized control over user funds.

To find the cheapest crypto exchange, traders should look for platforms that offer low trading fees, including competitive maker and taker fees, and tiered fee structures that reward high-volume trading. Researching and comparing multiple exchanges can help identify the one that offers the best rates for your trading needs.

A crypto wallet is essential for securely storing crypto coins outside of trading platforms, providing traders with control over their private keys and reducing the risk of losing assets due to exchange hacks. It’s crucial for managing and accessing your crypto assets efficiently.

Tiered fee structures incentivize high-volume trading by progressively lowering trading fees for traders who reach higher trading volume thresholds. This can significantly reduce costs for active traders, enhancing profitability.

Withdrawal fees can add significant costs to trading activities, especially when moving assets frequently between exchanges or to external wallets. Traders should factor in these fees when calculating the total cost of trading and choose exchanges with reasonable withdrawal rates.

Crypto trading platforms that support instant payment methods, such as credit cards and e-wallets, provide convenience and rapid access to the market, allowing traders to capitalize on market opportunities quickly. They facilitate easy fiat to crypto transactions, enhancing the trading experience.

The best cryptocurrency exchanges implement a range of security measures, including two-factor authentication, encryption, cold storage for the majority of assets, and regular security audits to safeguard users’ funds against unauthorized access and cyber threats.

The best crypto exchange offers a wide range of investment opportunities, including access to a variety of crypto coins, futures trading, margin trading, and staking options, allowing traders to diversify their portfolios and explore different market strategies.

Comparing multiple exchanges is crucial for finding the best rates, lowest fees, and most favorable trading conditions. Each platform has its unique features, fee structures, and supported assets, affecting overall profitability and trading experience.

Related Articles

Gain access to the #1 market leading investing platform

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.