How to Buy XRP In The UK In (2026 Update)

Explore our curated list of reputable exchanges , each rigorously tested with Purchasing and Trading Real XRP. All brokers are accessible to traders in the United Kingdom.

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

How Do You Buy XRP in the UK?

To buy XRP in the UK, use a regulated crypto exchange such as eToro or Bitpanda, complete identity verification, deposit funds, search for XRP, and place your order. Always review fees, prioritise platform security, and consider moving your crypto to a private wallet for added protection.

What Are the Steps to Buy XRP in 2026?

Step 1: Choose a Reliable Cryptocurrency Exchange

Start your XRP purchase by selecting a trusted UK-based crypto exchange. Look for FCA regulation, clear fees, strong security, and beginner-friendly design to ensure a safe and smooth experience.

What Should You Look for in a Cryptocurrency Exchange?

Focus on regulation, low fees, secure login options like 2FA, and ease of use. These factors ensure your money is protected while making your XRP buying process as simple as possible.

How Do the Top UK Crypto Exchanges Compare?

eToro offers user-friendly access with low fees and FCA oversight. Coinbase is intuitive but slightly more expensive. Uphold provides low-cost access but with fewer education tools. All are accessible to UK users.

| Feature | eToro | Coinbase | Uphold |

|---|---|---|---|

| Supported Payment Methods | Bank transfer, debit/credit card | Bank transfer, debit/credit card | Bank transfer, debit/credit card |

| Fees | 1% trading fee | 1.49% per trade | 0.99% per trade |

| Minimum Deposit | £10 | £1 | £10 |

| User-Friendliness | Very High | High | Medium |

| Security Features | 2FA, insurance | 2FA, insurance | 2FA, encryption |

| UK Regulation Status | FCA-compliant | FCA-compliant | FCA-compliant |

Which Exchange Should You Use to Buy XRP?

eToro is best suited to beginners who value simplicity and an intuitive interface. Coinbase offers an easy setup and strong trust credentials, though fees are higher. For confident, fee-conscious users, Uphold remains a solid alternative. Choose the platform that best matches your experience level and budget.

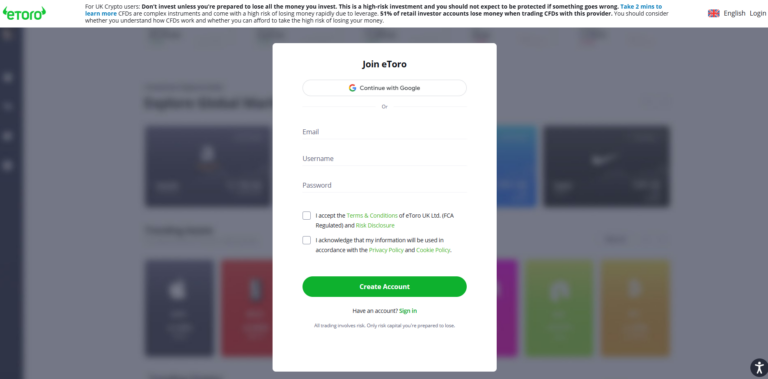

Step 2 – Create and Secure Your Account

Once you've chosen an exchange, sign up with your details and complete identity verification. Secure your account by enabling two-factor authentication (2FA) to protect against unauthorised access. A strong, unique password is also essential for safety.

How Do You Create an Account on a Crypto Exchange?

Visit your chosen exchange, enter your personal details, and verify your identity with official documents. This process usually takes a few minutes. Once verified, you can access the platform, fund your account, and begin trading XRP.

How Can You Keep Your Exchange Account Secure?

Enable two-factor authentication (2FA), use a strong password, and avoid using the same login credentials across platforms. Only access the exchange through official apps or websites and be cautious of phishing attempts pretending to be the exchange.

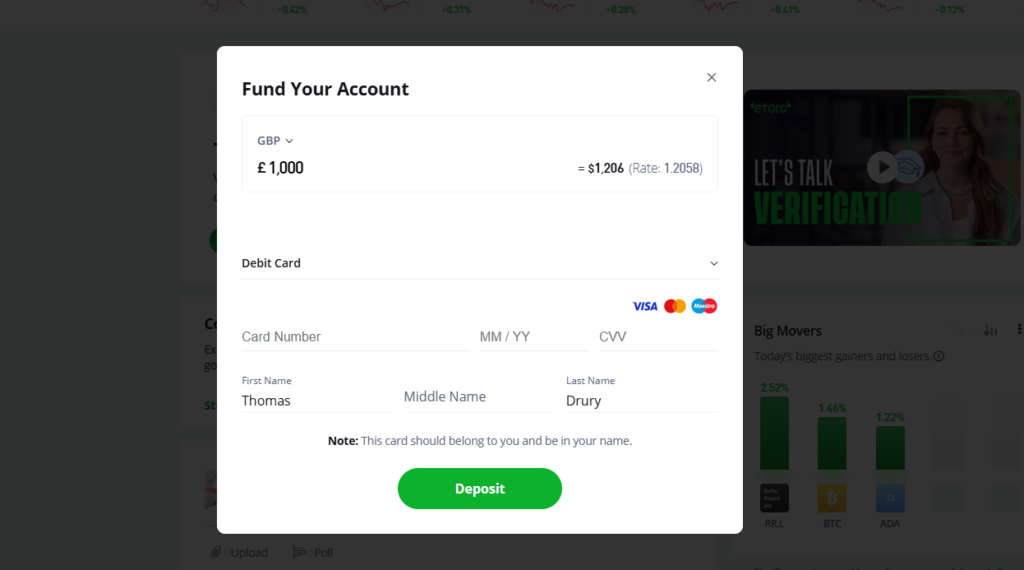

Step 3 – Deposit Funds Into Your Account

Log in to your exchange, go to the "Deposit" section, and choose a payment method. Enter your amount, confirm the details, and complete the deposit. Funds typically appear instantly or within 1–3 business days, depending on the method.

How Do You Deposit Money Into a Crypto Exchange?

Navigate to your chosen exchange's deposit section, select your preferred payment method, enter the amount, and follow the on-screen instructions. Confirm the transaction and wait for the funds to appear in your account balance before proceeding to buy XRP.

What Are the Most Common Payment Methods for UK Users?

Bank transfers have low fees but take longer. Debit/credit cards are fast but often cost more. PayPal offers convenience but charges higher fees. Choose based on speed, cost, and preference for one-off or recurring crypto purchases.

| Payment Method | Processing Time | Fees | Best For |

|---|---|---|---|

| Bank Transfer | 1–3 business days | £1–£5 (or free) | Large deposits, lower fees |

| Debit/Credit Card | Instant | 1.5%–3% per transaction | Small, quick deposits |

| PayPal | Instant | 2%–3% per transaction | Convenience and flexibility |

What Should You Know Before Depositing Funds?

Check deposit fees, processing times, and platform limits. Always use a payment method in your name to avoid rejections. Avoid public Wi-Fi and phishing links when making transactions. Double-check account details before confirming to prevent costly errors.

Step 4 – Place Your Buy Order for XRP

Once your account is funded, search for XRP on your chosen exchange. Select "Buy," choose the order type (market or limit), enter the amount, review details, and confirm. Your XRP will be credited to your account wallet after purchase.

How Do You Buy XRP on an Exchange?

Log in, search for "XRP," and click "Buy." Choose a market order for immediate purchase or a limit order to set your own price. Enter the amount in GBP or XRP, review the fee breakdown, then confirm the transaction.

What Does a Typical XRP Transaction Cost?

If XRP is £0.50 and you spend £100 with a 1.5% fee, you'll pay £1.50 in fees and receive 197 XRP. Costs vary by exchange, payment method, and market spread. Always check the fee preview before confirming your order.

| Detail | Example Value |

|---|---|

| Amount to Spend (GBP) | £100 |

| Current XRP Price | £0.50 |

| Fees | £1.50 (1.5%) |

| XRP Purchased | 197 XRP |

How Can You Buy XRP More Effectively?

Start with small amounts to learn the process. Avoid buying during price spikes. Compare fees between exchanges and payment methods. Use limit orders if you want better entry prices, and ensure the platform shows clear cost breakdowns before confirming.

Step 5 – Store Your XRP Safely

After buying XRP, move it off the exchange for better security. Use a private wallet you control to reduce the risk of hacks or outages. Storing XRP yourself gives more protection and long-term control over your investment.

Why Should You Store XRP Outside of an Exchange?

Exchanges can be hacked, go offline, or impose withdrawal limits. Storing XRP in your own wallet gives you full ownership and security. It also protects your funds if the exchange experiences regulatory issues, operational failures, or insolvency.

What Types of Wallets Can You Use to Store XRP?

Options include hardware wallets (most secure), software wallets (easy access), and mobile wallets (convenient for daily use). Exchange wallets offer minimal protection. For long-term holding, a hardware wallet like Ledger or Trezor is recommended for enhanced security.

| Wallet Type | Security Level | Accessibility | Cost | Best For |

|---|---|---|---|---|

| Hardware Wallet | Very High | Moderate | £50–£200 | Long-term storage |

| Software Wallet | Medium | High | Free/Low | Frequent transactions |

| Mobile Wallet | Medium | Very High | Free | On-the-go usage |

| Exchange Wallet | Low | Very High | Free | Temporary storage only |

How Do You Transfer XRP to a Personal Wallet?

Open your wallet, find your XRP address and destination tag if needed. On the exchange, go to XRP, click "Withdraw," paste your wallet address and tag, enter the amount, and confirm. Always double-check details to avoid irreversible mistakes.

How Can You Keep Your XRP Wallet Secure?

Back up your recovery phrase securely, enable PIN or biometric protection, and avoid sharing your keys. Never store private keys online. For large amounts, test small transfers first. Only download wallet apps from verified sources to avoid phishing or malware.

Best Places to Buy XRP in the UK 2026?

#1 Bitpanda – Best for Wide Asset Selection

Bitpanda is an excellent UK option for XRP: FCA-registered, intuitive interface, and a wide range of over 600 digital assets. You own real XRP, with transparent pricing and multiple deposit methods including bank transfer and PayPal. Ideal for beginners seeking a user-friendly European platform.

What are the fees and charges to buy XRP?

A flat 1.49% fee applies to all XRP buy and sell trades on Bitpanda, built into the quoted price. Bank transfer deposits are free, while withdrawals to an external wallet incur a variable fee depending on XRP network conditions at the time of transfer.

Pros & Cons

Pros:

- Choose from more than 600 cryptocurrencies, plus crypto index products

- Security standards backed by ISO 27001 certification

- Deposit and withdraw funds without paying fees

Cons:

- Hot wallet setup—not designed for long-term cold storage

- Platform custody means it isn't fully non-custodial

- Less Web3 and DeFi functionality compared with some competitor wallets

DON'T INVEST UNLESS YOU'RE PREPARED TO LOSE ALL THE MONEY YOU INVEST. THIS IS A HIGH-RISK INVESTMENT AND YOU SHOULD NOT EXPECT TO BE PROTECTED IF SOMETHING GOES WRONG.

Visit Bitpanda | Read Our Full Bitpanda Review

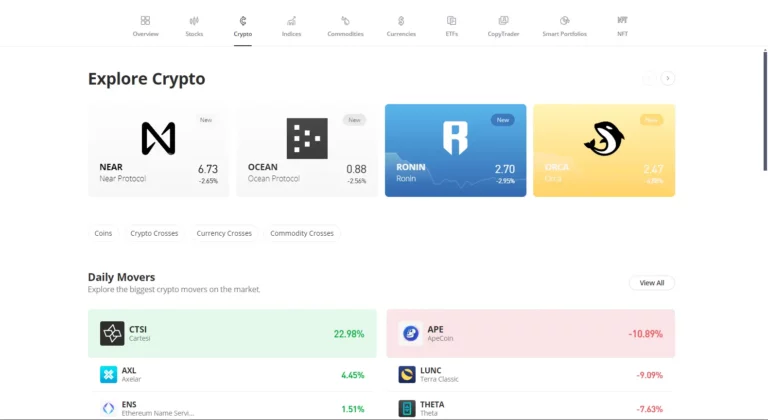

#2 eToro – Best in class for ease of use, simplicity and quick sign up

eToro is a superb UK option for XRP: FCA-regulated, intuitive interface, and social trading via CopyTrader. You own real XRP, with transparent fees and multi-asset access. Ideal for beginners seeking simplicity and security.

What are the fees and charges to buy XRP?

A flat 1% fee applies to all XRP buy and sell trades on eToro, built into the quoted price. Withdrawals to an external eToro Money wallet incur a 2% fee (capped at around $100), plus the applicable blockchain network fee.

Pros & Cons

Pros:

- FCA-regulated and secure ownership.

- Easy interface and instant setup.

- CopyTrader for social/investor learning.

Cons:

- 1% buy/sell fee.

- No private key access.

- 2% fee on transfers to external wallet.

Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

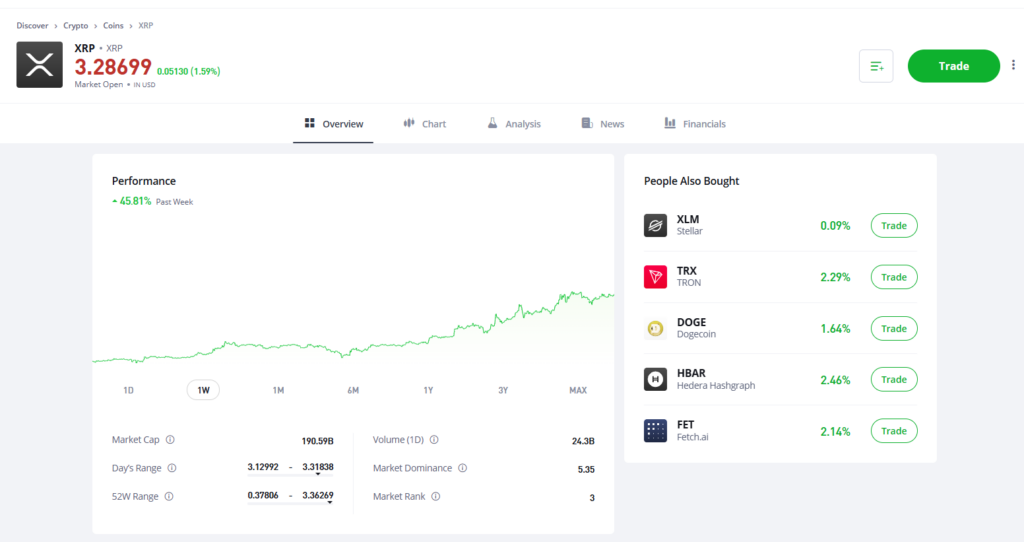

What is XRP?

XRP is a digital currency developed by Ripple Labs to enable fast, low-cost cross-border transactions. Unlike Bitcoin, XRP isn't mined; it uses a unique consensus mechanism. It's designed for efficiency, making it attractive for financial institutions and users seeking rapid, affordable transfers.

How Do XRP Transactions Work?

XRP transactions settle in 3–5 seconds using the Ripple Consensus Protocol, which relies on trusted validator nodes instead of mining. This makes it faster and more energy-efficient than traditional proof-of-work blockchains. It's scalable, with the ability to handle 1,500+ transactions per second.

How Do People Use XRP?

XRP is commonly used for cross-border payments, trading, and remittances. Some use it for e-commerce and micropayments, while others leverage the XRP Ledger for tokenization and smart contracts. It's also popular among crypto investors for its speed, liquidity, and cost-effectiveness.

What's the Difference Between Ripple and XRP?

Ripple is the fintech company building blockchain-based payment solutions. XRP is the digital currency used on the XRP Ledger, which operates independently. While Ripple uses XRP in its products, the asset itself is open-source and can function without Ripple's involvement.

How Does XRP Compare to Other Blockchains?

XRP is faster, cheaper, and more energy-efficient than many other blockchains. Unlike Bitcoin's 10-minute confirmations or Ethereum's gas fees, XRP offers near-instant transactions for a fraction of a penny, making it ideal for real-time payments, though it's less decentralised than some peers.

| Feature | XRP Ledger | Bitcoin | Ethereum |

|---|---|---|---|

| Consensus | RCPA (No Mining) | Proof-of-Work | Proof-of-Stake |

| Speed | 3–5 sec | 10+ min | ~12 sec |

| Scalability | 1,500+ TPS | 7 TPS | ~30 TPS |

| Fees | < £0.01 | High | Medium |

| Energy Use | Low | Very High | Medium |

2025 XRP Price Recap

In 2025, XRP experienced notable volatility against major cryptocurrencies and fiat currencies. Early in the year, renewed optimism around blockchain adoption and strategic partnerships helped lift prices. Mid-year regulatory developments and broader market fluctuations caused sharp pullbacks. By the end of 2025, XRP had retraced much of its earlier gains, reflecting both investor sentiment and macroeconomic pressures. Overall, 2025 highlighted XRP's sensitivity to external news and its potential for rapid moves in both directions.

2026 XRP Market Analysis

In 2026, XRP continues to attract attention as a payments-focused cryptocurrency aimed at fast, low-cost cross-border transfers. Market sentiment is influenced by broader crypto adoption, regulatory clarity in key regions, and partnerships within the financial sector. While XRP has shown resilience during periods of market volatility, price movements remain closely tied to macro trends and investor risk appetite. For UK investors, XRP is best viewed as a higher-risk asset with potential upside, rather than a stable long-term holding.

Should You Buy XRP in 2026?

Buying XRP in 2026 depends on your risk tolerance, time horizon, and view on crypto adoption. XRP remains focused on cross-border payments and institutional use, which gives it a clearer utility case than many tokens. However, regulatory uncertainty, price volatility, and competition from other payment networks remain key risks. For UK investors, XRP may suit a diversified portfolio as a small, speculative allocation rather than a core long-term holding.

FAQs

What should I consider when selecting a wallet for my XRP?

Consider security features, ease of use, and backup options. Hardware wallets offer high security for long-term storage, while mobile or software wallets provide convenience for easy access and transfers.

Is XRP subject to the same volatility as other cryptocurrencies?

Like all cryptocurrencies, XRP is subject to market volatility. Its price can fluctuate significantly due to various factors, including market sentiment, technological developments, and regulatory news. See our page Why is XRP Price Dropping?

Are there any specific regulations for buying XRP in the UK that I should be aware of?

UK residents should be aware of the Financial Conduct Authority (FCA) guidelines on cryptocurrencies. It's important to use a compliant exchange and be mindful of potential changes in cryptocurrency regulations.

How does XRP differ from Bitcoin, and does it affect how I should approach buying it?

XRP differs from Bitcoin in its primary purpose and technological infrastructure. XRP is designed for fast and efficient cross-border transactions, and it operates on a unique consensus protocol rather than traditional mining. This should be considered when evaluating its potential longevity and stability as an investment.

References

- ✓ Crypto, stocks, ETFs & metals

- ✓ Fractional investing from €1

- ✓ Automated savings plans available

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more