- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer: Should You Pick Binance or Coinbase?

If you want low fees and hundreds of coins, Binance is hard to beat — but it’s less regulated and trickier for beginners. Coinbase is simpler, FCA registered, and beginner-friendly, though you’ll pay higher fees. Your choice depends on costs vs simplicity.

Author’s Comment

“While Binance offers an impressive range of coins and low fees, its ongoing regulatory uncertainty makes it less reassuring for UK users. Coinbase remains the stronger, more transparent choice overall — it’s FCA registered, easier to use, and better suited to investors who value safety over speculative trading features.” – Thomas Drury

What’s new for 2026?

We’ve updated this comparison to reflect Coinbase’s expanded Advanced Trade features, Binance’s continued regulatory challenges in the UK, and the latest fee structures on both platforms. Coinbase remains the safer choice for UK investors seeking FCA oversight.

Verdict Summary

| Category | Coinbase Verdict | Binance Verdict |

|---|---|---|

| Overall Rating | 4.4 / 5 | 3.8 / 5 |

| Best For | Beginners and UK investors wanting a regulated exchange | Experienced traders comfortable with global regulation gaps |

| Ease of Use | Exceptionally user-friendly; ideal for newcomers | Feature-rich but cluttered; steeper learning curve |

| Regulation | FCA registered and publicly listed company | Not FCA regulated; operates under regional entities |

| Fees | Higher nominal fees but transparent pricing | Low trading fees but less clarity around compliance and support |

| Security | Strong oversight, cold storage, and insured cash balances | Solid technical security but limited transparency |

| Customer Support | Email, chat, and phone support available | Ticket-based system; slower response times |

| Trust & Transparency | High – clear governance and audited financials | Moderate – ongoing regulatory scrutiny in several regions |

| Final Verdict | Coinbase is the safer, more dependable choice for most UK investors. | Binance suits advanced users seeking low fees and broad altcoin access, but carries higher risk. |

What Are Binance and Coinbase?

Both are global crypto giants. Binance leads in coin variety and trading volume, while Coinbase dominates among UK beginners for safety and simple buys. Each offers wallets, apps, and secure ways to trade, but their scale and regulation differ.

How Big Are These Exchanges & Where Do They Operate?

Binance serves over 120 million users in 100+ countries, focusing on emerging markets and altcoins. Coinbase, a listed US firm, serves around 100 countries with 100 million+ users, leaning heavily on regulated Western markets like the UK, EU, and US.

Who Regulates Each Platform and How Transparent Are They?

Coinbase is FCA and SEC registered, files audited reports, and follows strict banking-style rules. Binance lacks consistent global headquarters, operating under various regional entities. It’s regulated in the EU but not the UK, raising more compliance questions.

Binance vs Coinbase Platform Stats

| Platform | Users (M) | Countries Served | Founded | Regulation Highlights |

|---|---|---|---|---|

| Binance | 120+ | 100+ | 2017 | EU, Dubai, offshore HQ |

| Coinbase | 100+ | 100 | 2012 | FCA, SEC, listed NASDAQ |

Binance – Overview

Binance is one of the world’s largest cryptocurrency exchanges, offering hundreds of digital assets, ultra-low trading fees, and powerful tools for both beginners and advanced traders. While not FCA-regulated in the UK, it remains a top choice for users comfortable navigating a global platform.

Pros & Cons

- Wide Range of Cryptocurrencies

- Low Trading Fees

- Advanced Features & Tools

- Not Regulated in Some Regions (e.g., UK)

- Complex for Beginners

- Past Regulatory Scrutiny

| Category | Details |

|---|---|

| Minimum Deposit | ~£15 (via card/crypto) |

| Trading Fees | £0 on crypto spot trades (standard fees apply) |

| Available Account Types | Spot, Margin, Futures, Earn |

| Regulatory Status | Not FCA regulated (operates under global licenses) |

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Coinbase – Overview

Coinbase is a trusted, beginner-friendly crypto exchange known for its clean interface, strong regulatory compliance, and simple GBP deposit options. As a publicly listed company regulated in multiple jurisdictions, it offers a secure entry point into crypto for UK investors.

Pros & Cons

- User-Friendly Interface

- Regulated & Trusted in the U.S.

- Secure Custody & Insurance

- High Fees on Standard Platform

- Limited Altcoin Selection (Compared to Binance)

- Occasional Service Disruptions

| Category | Details |

|---|---|

| Minimum Deposit | No fixed minimum (from ~£2 with card) |

| Trading Fees | Included in spread (no fixed trading commission) |

| Available Account Types | Standard, Coinbase Advanced, Custody |

| Regulatory Status | Registered as a cryptoasset business with the FCA |

Note: Coinbase supports GBP deposits and withdrawals via Faster Payments, and offers linked PayPal withdrawals for added convenience.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Which Platform Is Easiest to Use?

Coinbase is famously beginner-friendly, guiding you from signup to first crypto buy in minutes. Binance’s interface feels busier, with advanced charts and order types, better suited to those with some trading experience. Your choice depends on how hands-on you want to be.

How Smooth Is Sign Up & Verification?

Both platforms offer fast signups with ID uploads. Coinbase’s KYC is slightly quicker and less prone to rechecks. Binance may request extra proofs like utility bills, especially after large deposits, which can slow things down for new UK users.

Is the Website & App Beginner-Friendly?

Coinbase is cleaner and simpler, with big buy/sell buttons and fewer technical distractions. Binance has more menus and pro-level options on its homepage, which can overwhelm new users but gives experienced traders more tools right away.

What’s It Like Trading on Mobile?

Both apps are polished and stable. Coinbase feels like a banking app—perfect for casual buys. Binance’s app offers powerful charts, staking dashboards, and deeper trading tools. Great if you’re active, but a bit much for simple long-term holds.

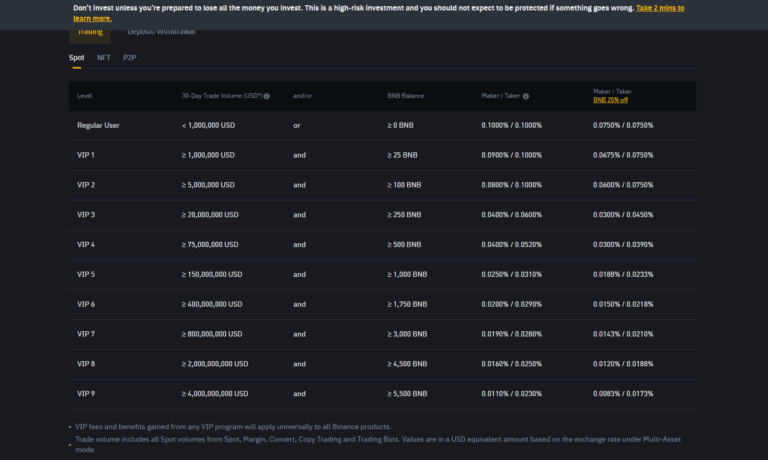

Who Offers Lower Fees & Better Costs?

Binance generally beats Coinbase on costs. Its spot trading fees start around 0.1%, far below Coinbase’s ~1.5% instant buys. Binance’s small withdrawal costs also edge out Coinbase’s higher spreads. But Coinbase is simpler for UK bank transfers with no cash withdrawal fees.

How Do Trading & Withdrawal Fees Compare?

Binance is built for low-cost trades, appealing to frequent buyers. Coinbase charges higher instant buy fees but waives most cash withdrawal costs. Frequent traders or those buying many coins will notice bigger savings sticking with Binance.

Are There Any Hidden Charges to Watch For?

Coinbase builds spreads of ~0.5% into its prices, plus higher fees on small card purchases. Binance’s costs mainly appear as transparent trading commissions. For both, watch for conversion charges if moving between currencies.

Are There Any Hidden Charges to Watch For?

| Platform | Trading Fees | Withdrawal Fees | FX / Conversion Fees |

|---|---|---|---|

| Binance | ~0.1% spot trades | Varies by crypto, low | Minimal if staying in crypto |

| Coinbase | ~1.5% instant buy | £0 on bank withdrawals | ~0.5% built into spread |

How Safe Are These Crypto Platforms?

Both platforms offer solid security — cold storage, 2FA, insurance, and strict compliance. Coinbase stands out for being FCA and SEC regulated, while Binance’s more scattered licensing makes some UK investors cautious. Still, both protect funds better than many smaller exchanges.

What Security & Insurance Measures Do They Use?

Coinbase insures USD balances, keeps 98% of crypto offline, and has robust regulatory oversight. Binance also claims >95% cold storage, uses insurance pools, and offers device + withdrawal whitelists. Both feature mandatory two-factor authentication for all accounts.

Can You Trust Them With Your Money?

For UK and EU users, Coinbase generally inspires more trust due to its transparent financials and FCA regulation. Binance is still massive and secure, but its patchwork of global licenses means slightly more regulatory grey areas.

Security & Regulation Checklist

| Feature | Binance | Coinbase |

|---|---|---|

| Cold Storage | ~95%+ | ~98% |

| 2FA Required | Yes | Yes |

| Proof of Reserves | Partial (internal attestations) | Public audits filed |

| Insurance | SAFU fund (crypto losses) | FDIC-style cash insurance up to limits |

| FCA Regulated | (EU + other licenses) | Yes (UK & EU) |

What Cryptos & Unique Features Can You Get?

Binance lists over 350 cryptocurrencies — everything from tiny altcoins to major DeFi tokens. Coinbase is simpler, with ~200 coins but focuses on quality and education. Each offers staking, while Binance adds NFT markets and launchpads, and Coinbase has “earn” videos.

How Many Coins & Markets Are Available?

Binance dominates for altcoin hunters, offering hundreds more trading pairs. Coinbase limits its listings to coins it considers more vetted and secure, which helps beginners avoid low-quality projects but offers fewer choices.

What Makes Each Platform Stand Out?

Binance is for explorers: tons of tokens, advanced order types, and extras like liquidity farming or NFT drops. Coinbase is for learners: clean interface, step-by-step buys, and paid tutorials that literally give you free crypto for studying coins.

Coins, Staking & Special Features Compared

| Platform | # of Coins | Staking | Copy Trading | NFTs / Other Features |

|---|---|---|---|---|

| Binance | 350+ | Yes | No | Binance NFT, Launchpad |

| Coinbase | ~200 | Yes | No | Earn-to-learn rewards |

Which Platform Has the Better Wallet?

Both exchanges offer built-in custodial wallets for quick storage and trading. Binance also provides Trust Wallet for full control. Coinbase’s separate Wallet app does the same. The best choice depends on whether you want convenience or direct control of your crypto keys.

How Secure Are Binance vs Coinbase Wallets?

Both secure hot wallets with cold storage backups, encryption, and multi-sig protections. For ultimate security, use their standalone wallet apps like Trust Wallet (Binance) or Coinbase Wallet, which keep your private keys in your control, away from exchange risks.

Should You Use Their Wallets or Store Crypto Yourself?

For small, frequent trades, in-app wallets are fine. But for long-term holds, a personal wallet — software or hardware — cuts reliance on any exchange’s solvency. Many investors keep a portion on platforms for speed, moving the bulk offline.

How Good Is Customer Support & Learning Help?

Coinbase edges ahead for straightforward help, clearer guides, and actual phone support. Binance’s help centre is vast but can be confusing. Both have solid FAQs, ticket systems, and learning hubs, but Coinbase feels more tailored to true beginners.

What Happens If You Need Help Fast?

Coinbase offers live chat and emergency phone support for locked accounts. Binance sticks mostly to tickets and live chat queues. In practice, both respond within hours to a day, but Coinbase’s dedicated phone line gives extra peace of mind.

Which Platform Teaches Beginners More?

Coinbase wins for structured education. Its “earn to learn” quizzes pay you crypto for completing lessons on blockchain basics. Binance has deep articles and academy videos, better for users once they know the fundamentals.

Who Is Each Platform Best For?

Choosing the right exchange depends on your priorities. Binance offers low fees and deep markets for altcoin fans, while Coinbase keeps it simple and regulated, perfect for UK or EU beginners who value ease and security over niche tokens.

Who Should Try Binance?

Binance is ideal for experienced traders chasing low fees, leverage, or exotic coins. If you want staking, launchpads, or hundreds of altcoins, it’s your playground. Just be comfortable with a more complex interface and varied global regulation.

Who Should Try Coinbase?

If you’re new to crypto, value FCA regulation, and want fast, simple buys, Coinbase is your pick. It’s beginner-proof, has insurance on cash balances, and offers bite-sized learning that literally pays you crypto to understand what you’re buying.

Final Verdict: Which Exchange Should You Choose?

For most UK newcomers, Coinbase’s simplicity and FCA safeguards make it the safest start. If you’re ready to dive deeper into altcoins and manage slightly more complex tools, Binance saves money on trades—though its UK regulatory status remains uncertain heading into 2026. Many investors use both platforms for different goals.

Top 5 Exchanges

1

eToro

Investing in crypto carries a high level of risk.

2

Coinbase

Investing in crypto carries a high level of risk.

3

Bitpanda

Investing in crypto carries a high level of risk.

4

Uphold

Investing in crypto carries a high level of risk.

5

OKX

Investing in crypto carries a high level of risk.

FAQs

Is Binance available in the UK?

Binance is not available in the UK primarily due to regulatory restrictions imposed by UK financial authorities, such as the Financial Conduct Authority (FCA).

Which is cheaper, Binance or Coinbase?

Binance. Its fees start around 0.1%, versus Coinbase’s ~1.5% instant buy rates. For frequent trades, Binance’s savings add up fast.

Can I hold my coins in Binance or Coinbase long term?

Yes, both have secure wallets. But for serious sums, consider moving to a personal hardware wallet for maximum control and safety.

Is my money insured on these platforms?

Coinbase insures cash balances up to typical banking limits but not crypto itself. Binance uses an internal SAFU fund for some emergencies. Always secure your accounts with strong 2FA.

References

- Binance Official Website – About Binance

- Coinbase Official Website – About Coinbase

- Financial Conduct Authority (FCA) – Crypto Firms List & Warnings

- Trustpilot Reviews – Binance and Coinbase

- App Store Ratings – Binance and Coinbase