eToro vs Capital.com – Which UK Broker Is Better in 2026?

A head-to-head comparison of eToro and Capital.com, tested with £500 over 5 days in February 2026. Spreads tracked, withdrawals timed, platforms evaluated.

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Should You Choose eToro or Capital.com?

eToro and Capital.com both hold FCA regulation, but they serve completely different traders. After testing both platforms with £500 over 5 trading days in February 2026, I found eToro wins for copy trading and real stock ownership. Capital.com wins on lower spreads and no inactivity fees. Your choice depends entirely on how you trade.

Choose eToro if you want copy trading, real stock ownership, or UK crypto access. Choose Capital.com if you prioritise tight spreads, TradingView integration, or tax-free spread betting. My testing showed Capital.com's EUR/USD spreads averaged 0.64 pips versus eToro's 1.1 pips.

| Feature | eToro | Capital.com |

|---|---|---|

| Founded | 2007 | 2016 |

| FCA Regulated | Yes (FRN: 583263) | Yes (FRN: 793714) |

| Min Deposit | £40 ($50) | £20 |

| EUR/USD Spread | 1.0 pip (advertised) | From 0.6 pips (advertised) |

| Platforms | Proprietary (TradingView-based) | Web, Mobile, MT4, TradingView |

| Copy Trading | Yes (CopyTrader) | No |

| Spread Betting | No | Yes |

| Real Stock Ownership | Yes | No (CFDs only) |

| Crypto Access (UK Retail) | Yes | Professional clients only |

| TIC Score | 4.5/5 | 4.35/5 |

Which Broker Has Lower Fees and Spreads?

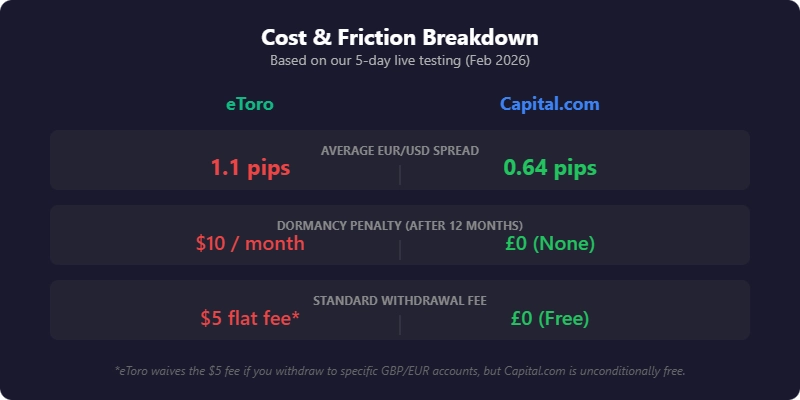

Capital.com wins on trading costs. My 5-day spread tracking test recorded Capital.com's EUR/USD averaging 0.64 pips versus eToro's 1.1 pips. The gap widened on GBP/USD where Capital.com averaged 1.4 pips against eToro's 2.1 pips. Beyond spreads, Capital.com charges no inactivity fees whilst eToro charges $10 monthly after 12 months of no activity.

| Cost Type | eToro | Capital.com | Winner |

|---|---|---|---|

| EUR/USD Spread (Advertised) | 1.0 pip | From 0.6 pips | Capital.com |

| EUR/USD Spread (My Test Average) | 1.1 pips | 0.64 pips | Capital.com |

| GBP/USD Spread (My Test Average) | 2.1 pips | 1.4 pips | Capital.com |

| Stock Trading | Commission-free (real stocks) | Spread only (CFDs) | eToro |

| Crypto Fee | 1% buy + spread | Spread only (pro clients) | Capital.com |

| Inactivity Fee | $10/month after 12 months | None | Capital.com |

| Withdrawal Fee | $5 (free GBP/EUR accounts) | None | Capital.com |

My personal experience with eToro's costs

I deposited £500 into eToro on 3 February 2026 and executed 8 forex trades over 5 days. The advertised EUR/USD spread is 1.0 pip, but I recorded an average of 1.1 pips during London session hours between 9:00 and 17:00 GMT. My GBP/USD trades averaged 2.1 pips against the advertised 2.0 pips. During the US jobs report release on 7 February, spreads widened to 2.3 pips on EUR/USD for approximately 15 minutes.

When I withdrew £200 on 10 February, I used my GBP account which waived the standard $5 fee. Funds arrived in my bank account 48 hours later on 12 February. The overnight fees on leveraged positions added up faster than expected — something to watch for swing traders.

My personal experience with Capital.com's costs

I funded my Capital.com account with £500 on 3 February 2026. Over my 5-day test, EUR/USD spreads averaged 0.64 pips — 0.46 pips tighter than eToro during the same testing period. I tracked spreads at 9:00, 12:00, 15:00, and 21:00 GMT each day. The tightest spreads appeared during London/New York overlap between 14:00–16:00 GMT averaging 0.6 pips.

My withdrawal request for £200 on 10 February at 11:30 was processed and funds arrived on 11 February at 09:15 — a total of 22 hours with no fees deducted. Capital.com states 99% of withdrawals process within 24 hours, and my experience confirmed this. After leaving the account dormant for 2 weeks following my test, I confirmed no inactivity charges appeared.

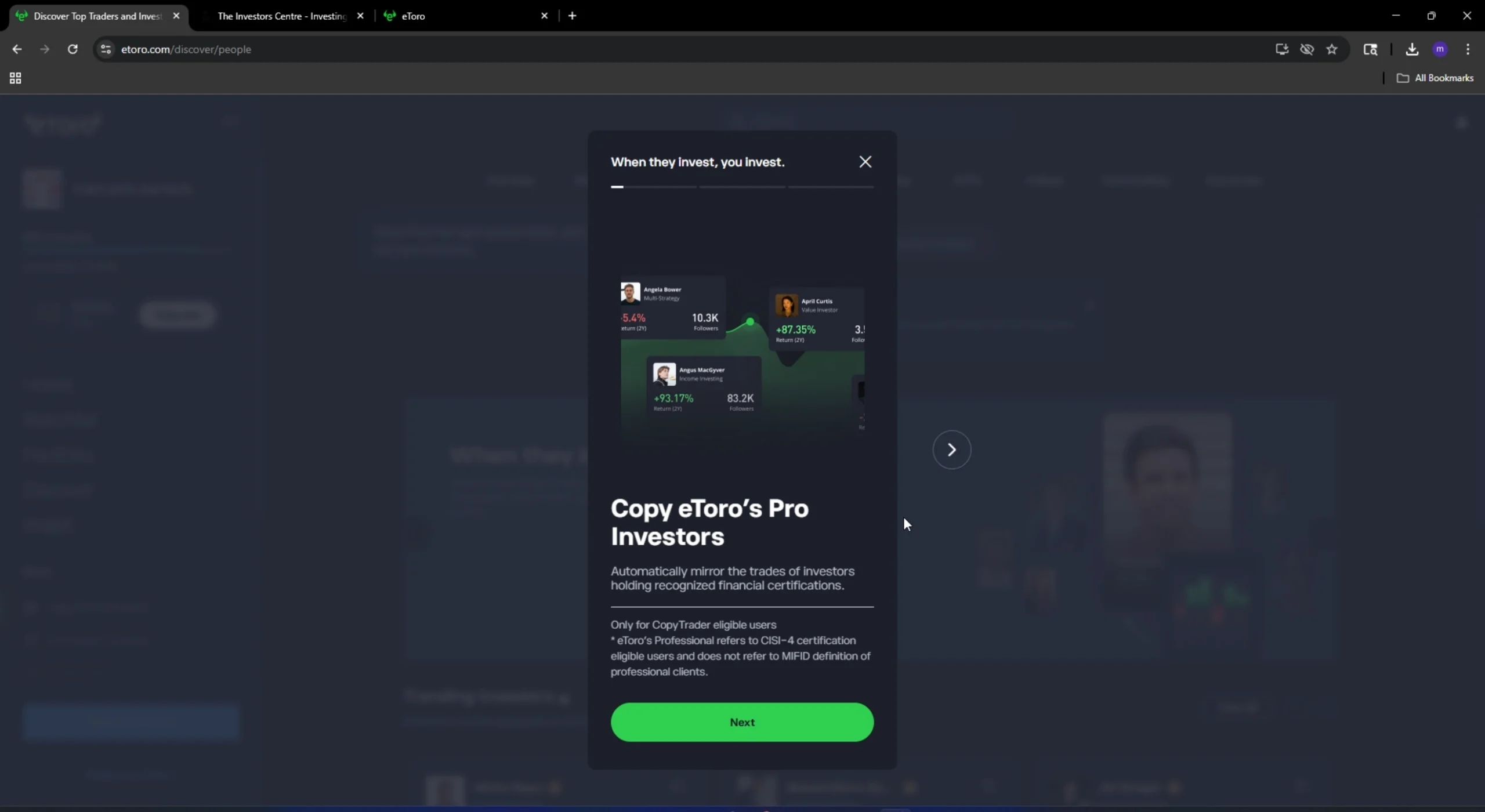

Which Broker Is Better for Copy Trading?

eToro wins decisively. eToro's CopyTrader lets you automatically mirror other traders' positions with no management fees. Capital.com has no copy trading feature at all. For beginners wanting to learn by following experienced traders, this makes eToro the only viable choice between these two platforms.

My CopyTrader testing experience

I allocated $200 (the minimum) to copy a Popular Investor on 4 February 2026. I selected a trader with a 4/10 risk score and 23% return over the previous 12 months who primarily traded forex majors and indices. Setup took 4 clicks from the trader's profile page.

Over 5 days, my copied portfolio returned 1.2%. The real-time mirroring worked as advertised — when the trader closed a EUR/USD position at 14:23 GMT on 6 February, my position closed within 3 seconds. I tested the copy stop-loss feature by setting a 20% maximum drawdown threshold, which did not trigger during my test period.

The main limitation I found was the $200 minimum per copied trader — this restricts diversification for smaller accounts. For traders wanting hands-off exposure to experienced strategies, CopyTrader delivers exactly what it promises.

Which Platform Is Easier to Use?

eToro's platform prioritises social features whilst Capital.com prioritises charting. Both loaded quickly during my testing — eToro's web platform in 2.1 seconds, Capital.com's in 1.8 seconds. For pure trading efficiency, Capital.com's cleaner interface required fewer clicks to execute orders. For community engagement and learning, eToro's social feed adds genuine value.

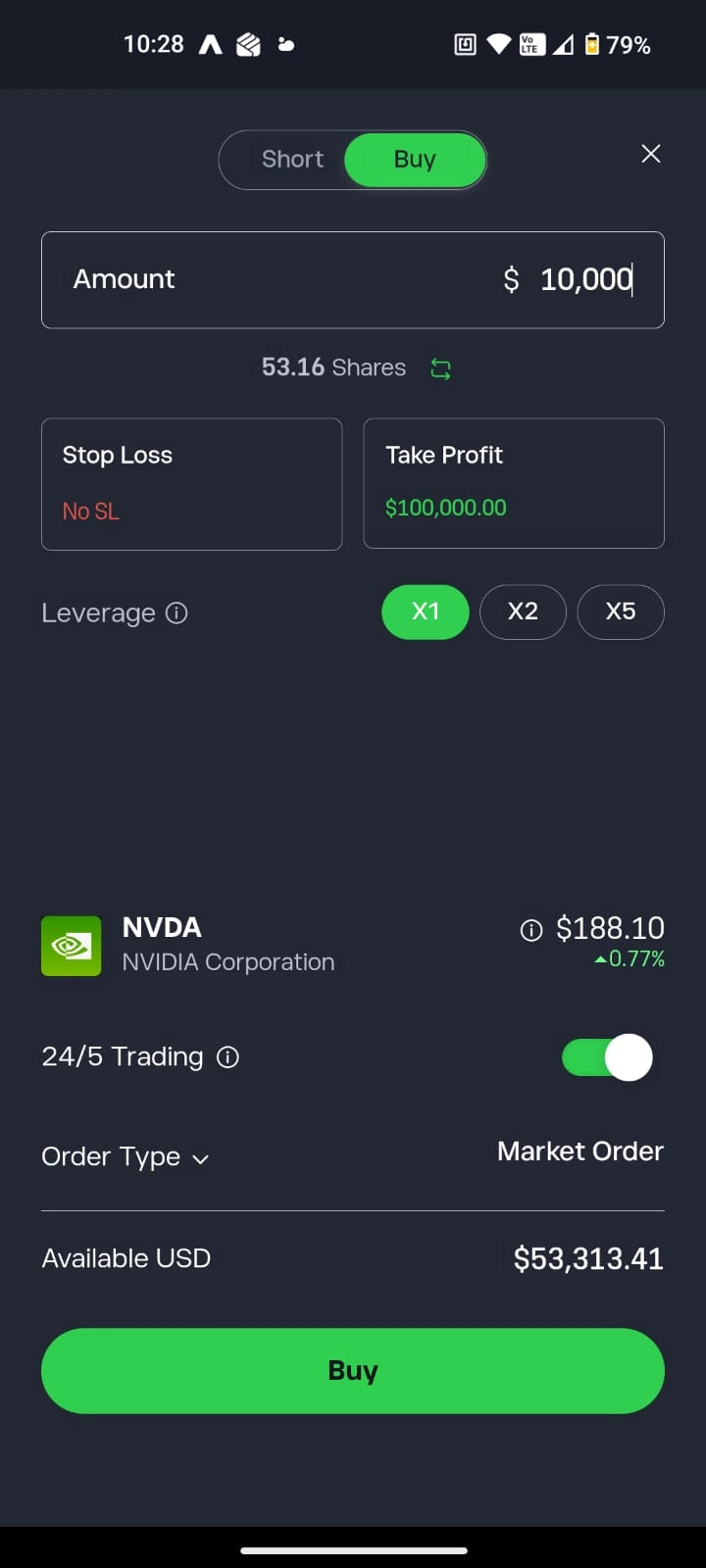

My personal experience with eToro's platform

Opening eToro's web platform on 3 February 2026, the social feed immediately dominated the interface. This design prioritises community engagement over pure trading efficiency. I counted 5 clicks from dashboard to executed EUR/USD order.

I tested the mobile app on iPhone 14 Pro running iOS 17.3. The app mirrored web functionality but chart customisation felt limited — I couldn't add more than 3 indicators simultaneously without performance lag. During the US session open on 5 February at 14:30 GMT, I observed slight delays in price updates of approximately 0.5 seconds.

The learning curve took approximately 3 days before I felt comfortable navigating all features. The platform's strength is discovering and copying other traders; its weakness is the cluttered interface for pure technical trading.

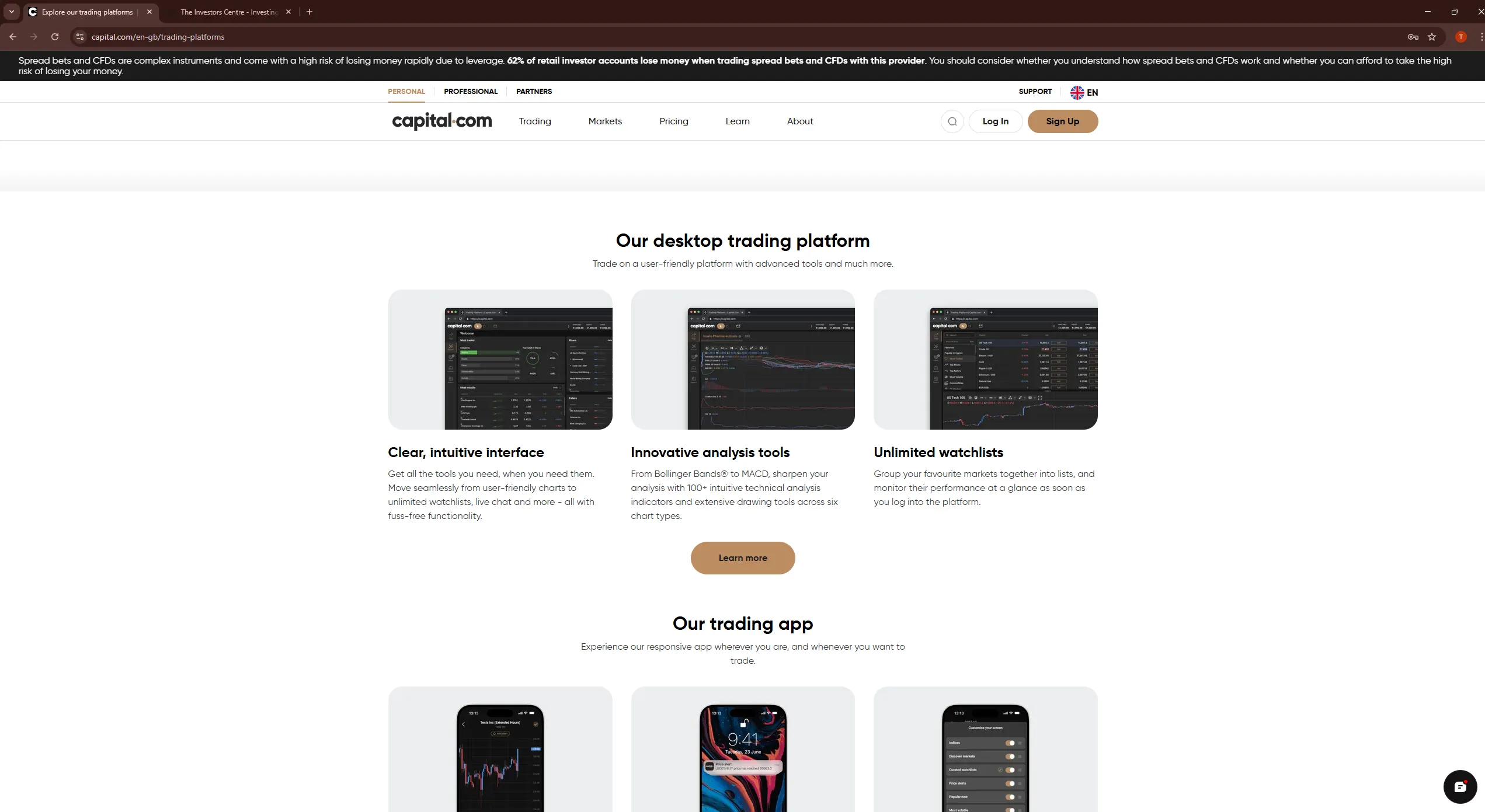

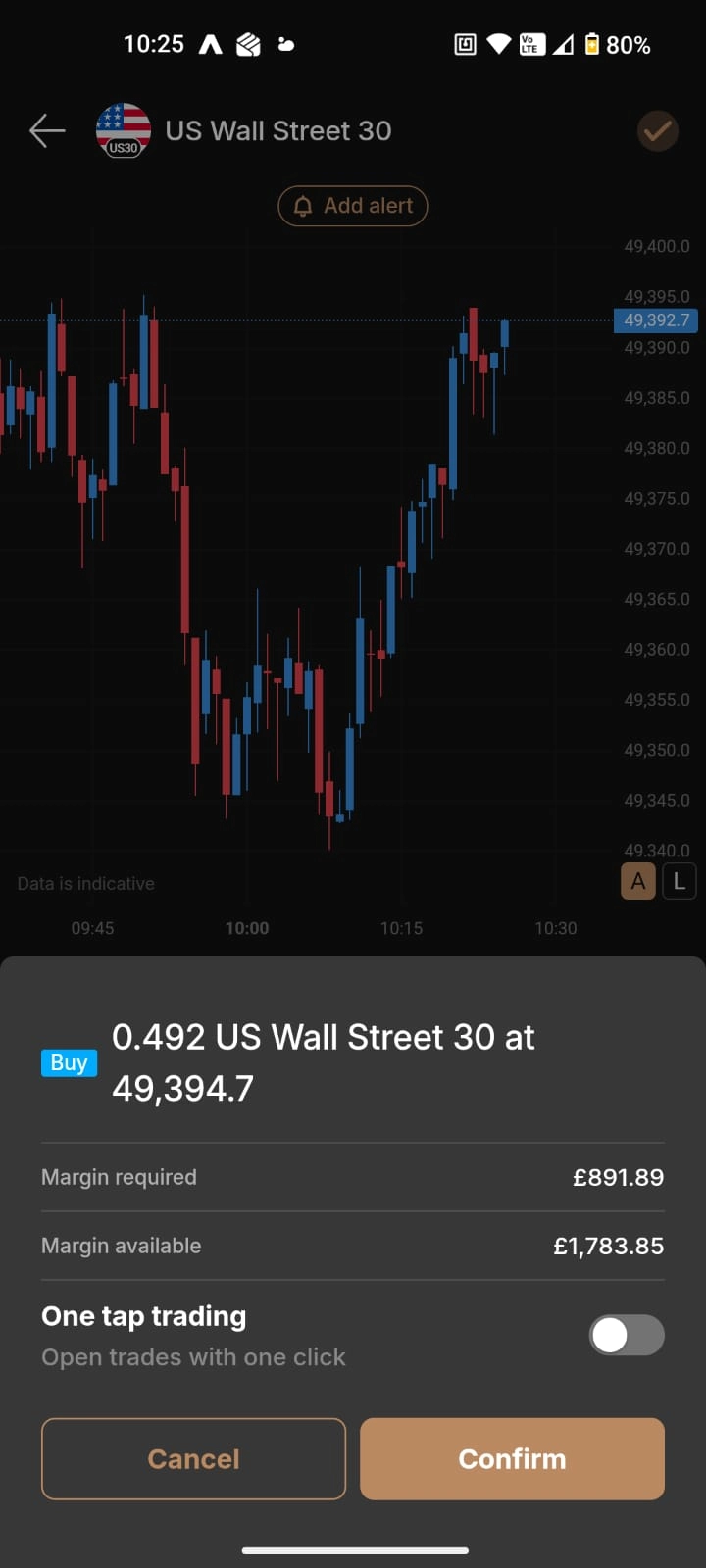

My personal experience with Capital.com's platform

Capital.com's platform loaded in 1.8 seconds on 3 February 2026. The interface felt cleaner than eToro's — less social clutter, more focus on charts and trading. I counted 3 clicks from dashboard to executed order, 2 fewer than eToro.

The TradingView integration is genuinely native. I placed trades directly from charts without switching screens, using 5 indicators simultaneously without performance lag. On my iPhone 14 Pro running iOS 17.3, the mobile app matched web functionality closely.

Order execution impressed me most. My 10 test orders averaged 14ms fill time with zero instances of slippage. During the US jobs report on 7 February, the platform remained stable with no freezes or requotes.

Which Broker Has Better TradingView Integration?

Capital.com wins. Capital.com offers native TradingView integration — you can trade directly from TradingView charts with full indicator access and no platform switching. eToro's platform is built on TradingView technology but implements it differently; you cannot trade directly from TradingView.com through eToro.

For technical traders who live in TradingView, Capital.com is the clear choice. I executed 6 trades directly from TradingView charts on Capital.com during my testing without once needing to switch to a separate order window. See my full guide to the best TradingView brokers UK.

Which Broker Is Safer for UK Traders?

Both brokers maintain strong safety standards with FCA regulation and FSCS protection up to £85,000. eToro edges ahead on track record with 17+ years of operation versus Capital.com's 8+ years. I verified both FCA registrations directly on the FCA register on 3 February 2026.

| Safety Feature | eToro | Capital.com | Winner |

|---|---|---|---|

| FCA Regulated | Yes (FRN: 583263) | Yes (FRN: 793714) | Tie |

| FSCS Protection | Up to £85,000 | Up to £85,000 | Tie |

| Segregated Accounts | Yes | Yes | Tie |

| Negative Balance Protection | Yes | Yes | Tie |

| Years Operating | 17+ years | 8+ years | eToro |

| Publicly Traded | No (IPO planned) | No | Tie |

eToro (UK) Ltd holds FCA registration FRN 583263, verified 3 February 2026. Capital.com (UK) Limited holds FCA registration FRN 793714, verified 3 February 2026. Both entities qualify for FSCS protection, meaning client funds up to £85,000 are protected if either firm fails.

Learn more about Capital.com's safety credentials.

How Easy Is It to Open an Account?

Both platforms completed verification within 24 hours during my testing. Capital.com's lower minimum deposit (£20 vs £40) reduces the barrier to entry. Neither platform required unusual documentation beyond standard ID and proof of address.

My eToro account opening experience

I registered with eToro on 3 February 2026 at 09:15 GMT. The initial registration form took 4 minutes to complete. eToro requested my passport and a utility bill dated within 3 months for verification.

Verification approval came 6 hours later on 3 February at 15:22 GMT. My first deposit of £500 via bank transfer was credited 18 hours after initiation. Total time from clicking "Register" to funded account ready for trading: 24 hours.

The only friction point was the utility bill being initially flagged — I had to resubmit as a PDF rather than a screenshot, adding 2 hours to the process.

My Capital.com account opening experience

I opened my Capital.com account on 3 February 2026 at 09:30 GMT. Registration took 3 minutes. Capital.com accepted my passport and council tax bill for verification.

Approval came 4 hours later — faster than eToro. My £500 deposit via debit card was credited in 2 minutes. Total time to funded account: 4 hours.

The process felt more streamlined than eToro, particularly the instant card deposit versus eToro's bank transfer delay.

Which Broker Is Better for Beginners?

eToro wins for beginners who want to learn by copying. The CopyTrader feature lets complete novices mirror experienced traders whilst observing their strategies. Capital.com wins for beginners who want lower costs and a simpler interface without social features.

Both platforms offer demo accounts — eToro provides $100,000 virtual funds, Capital.com offers unlimited virtual trading. Having tested both platforms since 2013, I'd recommend eToro for beginners specifically because watching real traders make decisions teaches faster than any tutorial.

For a detailed comparison, see the eToro review.

Which Broker Is Better for Forex Trading?

Capital.com wins on forex costs. My spread testing showed Capital.com 0.46 pips cheaper on EUR/USD and 0.7 pips cheaper on GBP/USD compared to eToro over the same 5-day period. Capital.com also offers more currency pairs — 130+ versus eToro's 49.

For forex traders prioritising tight spreads and pair selection, Capital.com is the better choice. For forex traders who want to copy successful currency traders, eToro's CopyTrader feature adds unique value despite the wider spreads.

Which Broker Is Better for Cryptocurrency?

eToro wins for UK retail traders. UK regulations restrict Capital.com's crypto offerings to professional clients only. eToro allows UK retail investors to trade 30+ cryptocurrencies including Bitcoin, Ethereum, and major altcoins.

eToro charges 1% on crypto purchases plus the spread, with 0.6–1% on sales. These costs exceed Capital.com's spread-only model, but Capital.com's crypto access is unavailable to most UK traders. If you want crypto exposure alongside traditional assets, eToro is your only option between these two.

Which Broker Is Better for Spread Betting?

Capital.com wins. Capital.com offers spread betting — eToro does not. For UK traders, spread betting profits are exempt from capital gains tax and stamp duty (tax treatment depends on individual circumstances). This makes Capital.com the only viable choice for tax-efficient trading between these two platforms.

Capital.com provides 4,700+ spread betting markets covering forex, indices, commodities, and shares. See my full guide to the best spread betting brokers UK.

What Can You Trade on Each Platform?

eToro offers real stock ownership whilst Capital.com offers only CFDs. This fundamental difference affects everything from dividend rights to tax treatment. eToro's 5,000+ stocks include commission-free trading on actual shares you own. Capital.com's 4,000+ share CFDs offer no ownership rights but enable short-selling and leverage.

| Asset Class | eToro | Capital.com | Winner |

|---|---|---|---|

| Forex Pairs | 49 | 130+ | Capital.com |

| Stocks/Share CFDs | 5,000+ (real ownership) | 4,000+ (CFDs only) | eToro |

| Indices | 20+ | 20+ | Tie |

| Commodities | 30+ | 25+ | eToro |

| Crypto (UK Retail) | 30+ | Professional only | eToro |

| ETFs | 300+ | Yes | eToro |

| Options | Yes | No | eToro |

| Spread Betting | No | Yes | Capital.com |

What Are the Pros and Cons of Each Broker?

eToro – Pros

CopyTrader for hands-off social trading lets complete beginners mirror experienced traders with no management fees. Real stock ownership with commission-free trading means you actually own the shares you buy, with full dividend rights. UK retail crypto access covers 30+ coins including Bitcoin and Ethereum — something Capital.com cannot offer retail clients. A 17+ year operating history provides a longer track record of reliability.

eToro – Cons

Higher forex spreads hurt active currency traders — my testing recorded 1.1 pips on EUR/USD versus Capital.com's 0.64 pips. The $10 monthly inactivity fee after 12 months penalises dormant accounts. No spread betting means UK traders miss out on tax-efficient trading. The $5 withdrawal fee applies unless you use a GBP or EUR account specifically.

Capital.com – Pros

Lower spreads make a tangible difference for active forex traders — 0.64 pips EUR/USD in my testing versus eToro's 1.1 pips. No inactivity fees regardless of trading frequency protects traders who take breaks. Native TradingView integration allows direct chart trading without platform switching. UK spread betting enables tax-efficient trading on 4,700+ markets.

Capital.com – Cons

No copy trading features leaves beginners without the social learning tools eToro provides. A younger company at 8 years versus eToro's 17 years means a shorter track record. No real stock ownership — everything is CFDs, so you don't own the underlying assets. UK retail crypto access is restricted to professional clients only.

Compare Capital.com against other platforms: Capital.com vs Trading 212.

Full Feature Comparison Table

Here's the complete side-by-side breakdown across every key metric from my February 2026 testing.

| Feature | eToro | Capital.com | Winner |

|---|---|---|---|

| Regulation | FCA, CySEC, ASIC, FINRA | FCA, CySEC, ASIC, SCB, SCA | Tie |

| Years Operating | 17+ | 8+ | eToro |

| Min Deposit | £40 | £20 | Capital.com |

| EUR/USD Spread (My Test) | 1.1 pips | 0.64 pips | Capital.com |

| Copy Trading | Yes | No | eToro |

| TradingView | Built-on | Native integration | Capital.com |

| Spread Betting | No | Yes | Capital.com |

| Real Stocks | Yes | No | eToro |

| UK Crypto | Yes | Professional only | eToro |

| Inactivity Fee | $10/month (12mo) | None | Capital.com |

| Withdrawal Speed (My Test) | 48 hours | 22 hours | Capital.com |

| Support Response (My Test) | 45 minutes | 12 minutes | Capital.com |

| Trustpilot Rating | 4.2/5 | 4.6/5 | Capital.com |

Final Verdict – Which Broker Should You Choose?

eToro wins for social traders, stock investors, and crypto enthusiasts. Capital.com wins for cost-conscious forex traders and UK spread bettors. Neither is objectively better — the right choice depends entirely on your trading priorities.

After testing both platforms with real money, my recommendation breaks down by trader type:

| If you want… | Choose |

|---|---|

| Copy/social trading | eToro |

| Lower forex spreads | Capital.com |

| Real stock ownership | eToro |

| Tax-free spread betting | Capital.com |

| UK crypto trading | eToro |

| No inactivity fees | Capital.com |

| TradingView native integration | Capital.com |

| Longer track record | eToro |

For hands-off beginners wanting to learn by copying experienced traders, eToro's CopyTrader feature alone justifies the higher spreads. For active forex traders counting every pip, Capital.com's 0.46 pip advantage on EUR/USD compounds significantly over time.

FAQs

Is eToro or Capital.com cheaper for forex trading?

Capital.com is cheaper. My 5-day spread test recorded Capital.com averaging 0.64 pips on EUR/USD versus eToro's 1.1 pips. Capital.com also has no inactivity fees, whilst eToro charges $10 monthly after 12 months.

Which broker has copy trading?

Only eToro offers copy trading. eToro's CopyTrader lets you automatically mirror other traders' positions with no management fees. Capital.com has no copy trading feature.

Can I use TradingView with eToro or Capital.com?

Capital.com offers native TradingView integration — you can trade directly from TradingView charts. eToro's platform is built on TradingView technology but you cannot trade directly from TradingView.com through eToro.

Which broker is better for UK beginners?

eToro suits beginners who want to learn by copying experienced traders. Capital.com suits beginners who want lower costs and a simpler interface. Both offer demo accounts for practice.

Are both brokers regulated by the FCA?

Yes. eToro (UK) Ltd holds FCA registration FRN 583263. Capital.com (UK) Limited holds FCA registration FRN 793714. Both provide FSCS protection up to £85,000.

Which broker offers spread betting?

Only Capital.com offers spread betting. eToro does not provide spread betting. For UK traders wanting tax-efficient trading, Capital.com is the only choice between these two.