- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer: Which Broker Comes Out on Top?

eToro edges ahead for most UK traders in 2026. It offers broader market access, built-in copy trading, and cryptocurrency support — features Trading 212 lacks. While Trading 212 is ISA-friendly, eToro suits those wanting a more versatile and socially-driven trading experience.

How Do eToro and Trading 212 Compare?

Two of the UK’s most popular trading apps — but they’re built for different users. Here’s how eToro and Trading 212 stack up in 2026.

| Platform | Regulation | Min Deposit | ISA | Crypto Access | Demo Account |

|---|---|---|---|---|---|

| eToro | FCA | £50 | No (via Moneyfarm only) | Yes | Yes |

| Trading 212 | FCA | £1 | Yes | No | Yes |

Who Should Use eToro or Trading 212?

Your choice depends on whether you prioritise crypto access, trading tools, or tax-efficient investing. eToro is better for active traders and social investing. Trading 212 suits hands-off investors looking for low-cost, long-term ISA portfolios with limited assets.

When Is eToro the Better Choice?

Choose eToro if you value crypto trading, social investing, and the ability to copy experienced traders. It’s ideal for mobile-first traders and those learning through community insight. The platform also supports active trading with built-in risk controls and no commission on stocks.

When Is Trading 212 More Suitable?

Trading 212 is better suited for long-term investors focused on tax-free ISA gains. It offers simple, commission-free trading of stocks and ETFs* with minimal complexity. However, it lacks crypto, copy trading, and rich learning features found on more advanced platforms like eToro.

*Other fees may apply. See terms and fees.

What Account Types Do eToro and Trading 212 Offer?

Both brokers support basic investing and CFD accounts. eToro connects with Moneyfarm for ISA access but doesn’t offer direct ISA accounts. Trading 212 includes an in-platform ISA. Both provide demo accounts for risk-free practice.

Comparison Table – Account Types

| Account Type | eToro | Trading 212 |

|---|---|---|

| Standard/Invest | Yes | Yes |

| ISA | No (Moneyfarm only) | Yes |

| CFD | Yes | Yes |

| Demo | Yes | Yes |

My Takeaway: The biggest difference here is in the ISA offering. eToro provides ISAs through Moneyfarm, but it comes with management fees ranging from 0.25% to 0.75%. Meanwhile, Trading 212 offers a free ISA with no platform charges, making it a budget-friendly choice.

What Can You Trade on Each Platform?

While both brokers support stocks, ETFs, and forex, eToro provides a wider variety including crypto, indices, and commodities. Trading 212 lacks crypto and commodities, making eToro better for diversified and alternative asset trading.

Assets Available per Broker

| Asset | eToro | Trading 212 |

|---|---|---|

| Stocks & ETFs | Yes | Yes |

| Forex | Yes | Yes |

| Crypto | Yes | No |

| Commodities | Yes | No |

| Indices | Yes | Yes |

| ISAs | No | Yes |

How Do Their Fees Compare in 2026?

Both brokers offer 0% stock commission.* Trading 212 has lower FX conversion fees and no withdrawal or inactivity charges. eToro, however, includes a £5 withdrawal fee and monthly inactivity charge, making Trading 212 slightly cheaper for long-term inactive users.

*Other fees may apply. See terms and fees.

Fees Overview

| Fee Type | eToro | Trading 212 |

|---|---|---|

| Stock Commission | 0%* | 0%* |

| FX Conversion | 0.50% | 0.15% |

| Inactivity Fee | Yes (£10/mo) | No |

| Withdrawal Fee | £5 | £0 |

| Overnight CFD | Yes | Yes |

*Other fees may apply. See terms and fees.

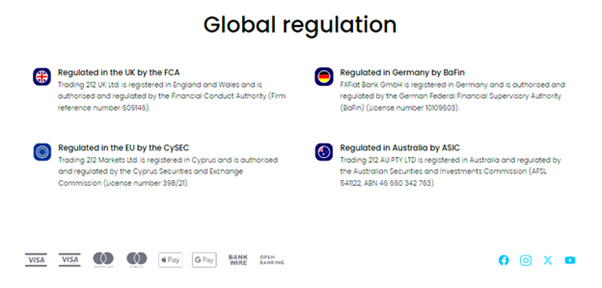

How Safe Are These Platforms?

Both eToro and Trading 212 are FCA-regulated and use Tier-1 custodians. They protect client funds up to £120,000 via the FSCS. Only Trading 212 offers direct ISA access, which adds a tax-efficient safety wrapper for eligible UK retail investors.

Regulation and Investor Protection Table

| Platform | Regulated By | ISA Eligible | FSCS Coverage |

|---|---|---|---|

| eToro | FCA | Indirect | Up to £85,000 |

| Trading 212 | FCA | Yes | Up to £85,000 |

Which Has the Better Trading Tools and UX?

eToro offers a visually rich, socially driven platform ideal for beginners and casual traders. Trading 212 provides faster execution and more robust charting, making it slightly more appealing for hands-on users who prioritise speed and simplicity over social features.

Feature-by-Feature Comparison

| Feature | eToro | Trading 212 |

|---|---|---|

| Mobile App | Yes | Yes |

| Advanced Charts | Basic | Intermediate |

| Social Feed | Yes | No |

| Watchlists | Yes | Yes |

| Price Alerts | Yes | Yes |

| Custom Indicators | No | Limited |

Education and Research Tools Compared

eToro offers social learning, market sentiment data, and built-in analysis tools. Trading 212 provides video tutorials and beginner guides, but lacks in-depth research. Overall, eToro better supports continuous learning, while Trading 212 focuses on simplicity for novice users.

Tool Comparison Table

| Tool | eToro | Trading 212 |

|---|---|---|

| Video Tutorials | Yes | Yes |

| Blog Content | Yes | Yes |

| Trading Sentiment | Yes | No |

| Demo Access | Yes | Yes |

| Market Analysis | Yes | Limited |

What's Changed in 2026?

The biggest shift is eToro’s expanded UK ISA offering. Through Moneyfarm, UK users can now access a DIY Stocks & Shares ISA (launched Feb 2025) with 1,000+ UK/US stocks, ETFs, bonds, and mutual funds — plus a Cash ISA (launched Nov 2025). Both are FSCS protected up to £1200,000.

Trading 212’s ISA remains fee-free with no platform charges, keeping it competitive for cost-conscious investors. eToro’s FX conversion fee stays at 0.50% vs Trading 212’s 0.15%. Both platforms remain FCA-regulated with FSCS protection. No major fee changes on either side — the choice still comes down to whether you want crypto and social features (eToro) or the cheapest ISA route (Trading 212).

Final Verdict – Which Platform Should You Pick?

Both platforms are solid, but they serve different purposes. eToro wins on crypto access, social trading, and now offers ISAs through its Moneyfarm partnership — including a DIY Stocks & Shares ISA and Cash ISA. Trading 212 remains the better pick for hands-off investors who want a free, straightforward Stocks & Shares ISA with no platform fees. If you want copy trading and crypto alongside stocks, go with eToro. If low-cost ISA investing is your priority, Trading 212 keeps things simple.

UK New Clients

UK New Clients

61% of retail CFD accounts lose money when trading CFD’s with this provider.

FAQs

Which platform is better for beginners?

Both platforms are beginner-friendly, but beginners often prefer Trading 212 due to its £1 minimum investment, free ISA, and straightforward interface. eToro, however, is excellent for those interested in social trading and cryptocurrency.

Can I trade cryptocurrency on Trading 212?

No, Trading 212 does not support cryptocurrency trading. If you want to trade crypto, eToro is the better option, as it offers over 100 different cryptocurrencies.

Does eToro charge withdrawal fees?

Yes, eToro charges a £4 withdrawal fee. In contrast, Trading 212 does not charge any withdrawal fees, making it a more cost-effective option for frequent withdrawals.

Which platform is safer?

Both platforms are FCA-regulated and offer FSCS protection of up to £85,000. They also have two-factor authentication and account segregation for added security.

Can I open an ISA on eToro or Trading 212?

Trading 212 offers a free ISA with no platform fees, while eToro provides ISAs through Moneyfarm, which charges management fees between 0.25% and 0.75%. If an ISA is a priority, Trading 212 is the better option.

References

- eToro Official Website – Stocks & beyond: Invest in 7000+ assets on eToro

- Financial Conduct Authority (FCA) – Financial Conduct Authority | FCA

- Statista – Statista – The Statistics Portal for Market Data, Market Research and …

- Trading 212 Official Website – Details on Trading 212’s commission-free model, ISAs, and account types.

- UK Cryptocurrency Regulation Report (Gov.uk) – Official UK government stance on cryptocurrency trading and taxation