Is IG Good for Crypto in 2026?

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

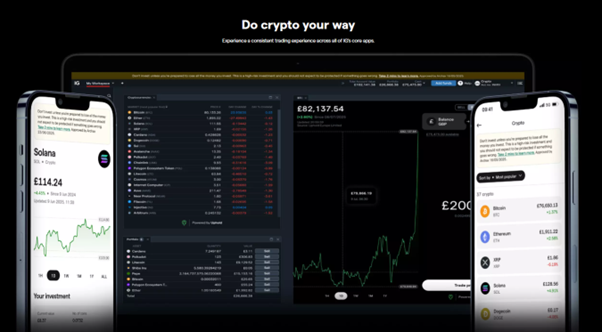

IG now lets UK users buy and hold actual crypto — not just CFDs. You get real coin ownership across 55+ coins, the ability to buy from just £1, and the familiar IG interface. Frankly, it’s a solid option if you already use IG for other trading, as you use cash from your existing accounts to fund your crypto purchases.

The crypto accounts hold FCA registration for anti-money laundering. IG handles custody through a secure third-party setup with cold storage. This adds credibility, though there’s a catch — more on protection limits below.

Quick Answer – Is IG any good for crypto?

Yes — if you want low fees, £1 entry, and simplicity. IG charges a flat 1.49% per trade with no hidden costs, beating the standard fees on Coinbase and Revolut. The catch? You can’t withdraw crypto to your own wallet, and there’s no FSCS protection. Best for buy-and-hold investors already using IG.

Featured Broker – IG Crypto

- Real Crypto Ownership – Buy and hold 55+ coins directly, rather than speculating via derivatives.

- Transparent Pricing – A flat 1.49% spread per trade with no hidden surprises.

- Unified Platform – Buy from just £1 using cash from your existing IG share dealing or CFD accounts.

- Robust Execution – Real-time data with secure institutional custody.

⚠️ Important: After IG approves your account, you must wait 24 hours before your first trade. You can't skip this — it's a regulatory requirement.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

What Is IG’s New Crypto Offering?

Spot crypto trading with actual coin ownership. IG launched this in 2025, giving UK retail clients direct ownership for the first time. Unlike CFDs or spread bets, you buy and own the real coins.

The FCA registers IG’s crypto service under Money Laundering Regulations. Your assets sit in secure custody. Here’s how the setup works:

- IG runs the platform, customer service, and trading interface

- A third party handles custody, execution, and fund transfers

- You hold “beneficial ownership” — real coins, held on your behalf

- You get IG’s trusted platform backed by institutional custody

Pros & Cons

- Low Fees: Just 1.49% all-in fee — beats Coinbase (4.87%), Revolut (2.49%), and eToro (1.75%)

- Low Entry: Buy crypto from just £1 (using existing account funds)

- Real Ownership: Own real crypto assets, not CFDs

- Trust: FCA registered with 50+ years of trading history (FTSE 250)

- Convenience: One platform for crypto,

- Custody Limits: No external wallet transfers (you cannot withdraw to Ledger/Trezor)

- No Yield: No staking rewards available

- Selection: 55+ coins (Updated) – still fewer than Coinbase (250+) or Kraken (350+)

-

What are the Fees?

-

What Cryptocurrencies are Available?

-

How Safe is the Broker?

-

Who Is It Best For?

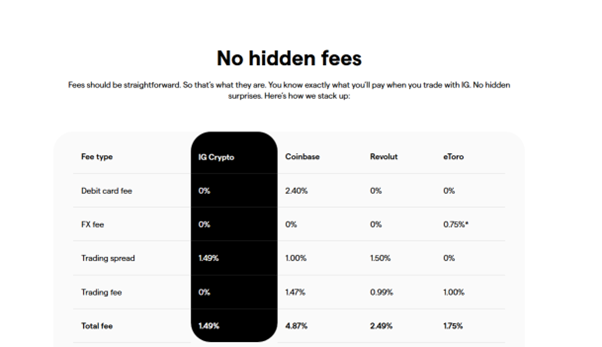

1.49% per trade — that’s the total cost. No commission, no hidden deposit fees, and no withdrawal fees. IG keeps it dead simple.

On a £1,000 Bitcoin purchase, you’d pay £14.90. Compare that to Coinbase at £48.70 or Revolut at £24.90 — IG saves you real money on every trade.

The minimum trade is just £1. Just note that you don’t fund the crypto wallet directly; you simply use cash from your main IG account (Share Dealing, Spread Bet, or CFD) to buy coins instantly.

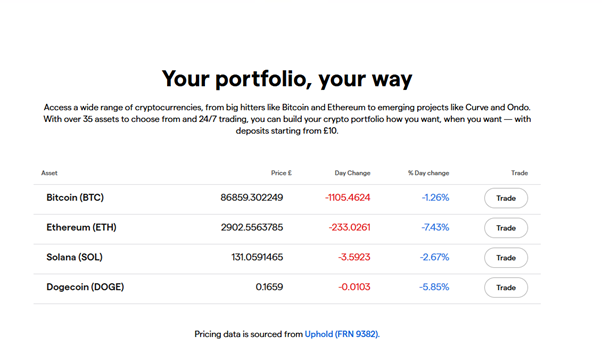

55+ cryptocurrencies covering the coins most UK investors actually want:

Majors: Bitcoin, Ethereum, Solana, XRP, Cardano, Litecoin

DeFi: Chainlink, Aave, Uniswap, Polkadot, Avalanche

Meme coins: Dogecoin, Shiba Inu, Pepe, Bonk, Floki

Stablecoins: USDT, USDC

Not as many as Binance or Kraken — but with the expanded list of 55+ coins, if you’re after mainstream crypto rather than obscure micro-caps, IG has you covered.

FCA registered with 50+ years in the game. IG Group is a FTSE 250 company — one of the most established names in UK trading.

Your crypto sits in cold storage through IG’s secure custody arrangement. Assets are segregated from IG’s company funds, and you get full two-factor authentication.

The catch? No FSCS protection. The standard £85,000 compensation scheme doesn’t cover crypto — but that’s true for every UK crypto platform, not just IG.

Existing IG users, buy-and-hold investors, and beginners wanting simple pricing from just £1. Not for traders needing wallet transfers, staking, or hundreds of altcoins. Cheap and trusted — but limited flexibility.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

How Do You Buy Crypto on IG? (Step-by-Step)

Yes, and it takes about 5 minutes to apply. Here’s the full process:

Step 1: Open a crypto account

- New to IG? Complete the online form, verify your ID, take a selfie

- Already with IG? Add a crypto account via My IG Dashboard

Step 2: Pass the quiz

IG asks a few questions to check you understand crypto risks. Takes 2-3 minutes. It’s a regulatory box-tick, not a hard exam.

Step 3: Wait 24 hours

Annoying but mandatory. The cooling-off period kicks in after approval. No way around it.

Step 4: Fund your account

| Method | Min | Max | Speed | Fee |

|---|---|---|---|---|

| Debit card | £1 | £15k (first 3 months) / £99k (after) | Instant | 0% |

| Credit card | £1 | £15k (first 3 months) / £99k (after) | Instant | 0% |

| Bank transfer* | £1 | £1000000 | Up to 2 hours | 0% |

*Bank transfers only work for clients who joined after 19 May 2025. Older accounts must use cards.

Step 5: Buy your crypto

Pick your coin, enter the GBP amount, check the 1.49% spread, and confirm. Simple as that.

⚠️ Heads up: Some banks block crypto buys. Chase, Starling, Clydesdale, and NewDay cards often decline. Try a different card if yours fails.

Which Cryptocurrencies Can You Buy on IG?

Over 55 coins — from Bitcoin and Ethereum down to meme coins like Pepe and Bonk. Not as many as Kraken (250+), but enough to build a solid portfolio. Here’s the breakdown:

Major Coins

Bitcoin, Ethereum, XRP, Litecoin, Solana, Cardano, Stellar

DeFi & Layer 1s

Chainlink, Polkadot, Avalanche, Cosmos, Arbitrum, NEAR, Aave, Curve, 1inch, Injective, Filecoin

Web3 & AI Tokens

Internet Computer, Fetch.ai, Render, AIOZ, Sui, Akash, Celestia, Immutable X, Ondo

Meme Coins

Dogecoin, Shiba Inu, Floki, Pepe, Bonk, dogwifhat

Stablecoins

Tether (USDT), USD Coin (USDC)

The range suits mainstream buyers. But if you’re hunting micro-caps or obscure altcoins, you’ll need Binance or Kraken instead.

Does IG Only Offer the Big Names Like BTC and ETH?

No. While Bitcoin and Ethereum are available for those seeking the most established digital assets, IG’s list also includes Solana, Cardano, and other well-known Layer 1s, catering to investors who want high-liquidity, widely-recognised coins.

What Emerging Projects Are Also Available?

IG includes DeFi-focused and newer tokens like Curve (CRV) and Ondo (ONDO), giving access to growth-focused projects. However, niche meme coins and very low-cap assets are absent, as the offering prioritises security and regulatory compatibility over speculative variety.

| Coin | Type | Notes |

|---|---|---|

| Bitcoin (BTC) | Major | Flagship coin |

| Ethereum (ETH) | Major | Smart contract leader |

| Solana (SOL) | Layer 1 | High-speed blockchain |

| Curve (CRV) | DeFi | Liquidity protocol |

| Ondo (ONDO) | DeFi | Yield-based token |

How Much Does It Cost to Trade Crypto on IG?

IG’s crypto fees are among the lowest for UK debit card purchases, charging only a 1.49% spread with no deposit, withdrawal, or FX fees. This makes it more competitive than Coinbase, Revolut, and eToro for direct crypto buying.

1.49% per trade — that’s it. No commission. No deposit fees. No withdrawal fees. One flat spread covers everything.

How Does IG Compare on Fees?

Here’s what you’d actually pay on a £1,000 Bitcoin purchase using a debit card:

| Platform | Trading Cost | Card Fee | Other Fees | Total Cost (£1k) |

|---|---|---|---|---|

| IG | 1.49% | 0% | None | £14.90 |

| Coinbase (Simple) | ~1.49% + spread | 2.40% | ~1% spread | ~£48.70 |

| Coinbase Advanced | 0.60%* | 0% (bank) | None | ~£6.00 |

| Revolut | 0.99% | 0% | 1.50% spread | ~£24.90 |

| eToro | 1.00% | 0% | 0.75% FX | ~£17.50 |

| Kraken (Instant) | 1.00% | Varies | ~0.5% spread | ~£15.00 |

| Kraken Pro | 0.40%* | 0% (bank) | None | ~£4.00 |

Taker fee for market orders. Maker fees (limit orders) are lower: Coinbase Advanced 0.40%, Kraken Pro 0.25%.

What’s the Catch with “Pro” Platforms?

Coinbase Advanced and Kraken Pro charge less — but they’re built for experienced traders. Here’s the trade-off:

| Factor | IG | Coinbase Advanced | Kraken Pro |

|---|---|---|---|

| Fee structure | Flat 1.49% | Tiered maker/taker | Tiered maker/taker |

| Lowest fee possible | 1.49% | 0.00% maker | 0.00% maker |

| Beginner-friendly? | ✅ Yes | ⚠️ Learning curve | ⚠️ Learning curve |

| Order types | Market only | Limit, stop, market | Limit, stop, market |

| Need to understand order books? | No | Yes | Yes |

Translation: If you just want to buy £500 of Bitcoin and hold it, IG’s 1.49% is fine. If you’re trading thousands per month and comfortable with limit orders, Kraken Pro at 0.25% saves serious money.

IG’s Fee Breakdown

No hidden costs. The 1.49% spread is baked into the buy/sell price — you’ll see the exact amount before confirming.

| Fee Type | Cost |

|---|---|

| Trading spread | 1.49% |

| Deposit (card) | 0% |

| Deposit (bank transfer) | 0% |

| Withdrawal (to bank) | 0% |

| Inactivity fee | £12/month after 24 months |

| Account fee | None |

Bank transfers only available to clients who joined after 19 May 2025.

Is 1.49% Actually Good Value?

Depends who you’re comparing against:

IG beats:

- Coinbase Simple (~4.87%) — by a mile

- Revolut (~2.49%) — comfortably

- eToro (~1.75%) — slightly

IG loses to:

- Kraken Pro (0.25-0.40%) — significantly cheaper

- Coinbase Advanced (0.40-0.60%) — notably cheaper

Bottom line: For casual investors who want zero complexity, IG’s 1.49% is fair. For active traders, the Pro platforms offer better value — but you’ll need to learn maker/taker fees and limit orders.

How Does IG Store Your Crypto Assets?

Cold storage holds most assets offline. IG’s custody partner keeps the bulk of crypto in secure vaults, away from hackers. A small hot wallet handles daily trading liquidity.

| Security Layer | What It Does |

|---|---|

| Cold storage | Keeps most coins offline in secure vaults |

| Hot wallet | Holds a small portion for quick trades |

| Encryption | Protects all transfers end-to-end |

| 2FA | Requires two-factor login for access |

| Segregation | Keeps your assets separate from IG's funds |

The catch: You don’t get private keys. You can’t move coins to your own wallet. IG holds them for you — you own them, but they stay on the platform. For some, that’s a dealbreaker.

Is IG Safe for Buying and Holding Crypto?

Safe from hackers? Yes — cold storage and encryption help. Safe from platform failure? Not really — there’s no FSCS protection. Let me explain both.

What Does “FCA Registered” Mean?

The FCA registers IG’s crypto under Money Laundering rules. That means AML compliance — not full investor protection. Big difference:

- FCA authorisation (IG’s CFDs) = full regulation, FSCS cover

- FCA registration (IG’s crypto) = AML only, no investor safety net

Do You Get FSCS Protection?

No. Crypto doesn’t qualify for the £120,000 FSCS scheme. If IG’s crypto service collapses, you won’t get government compensation. Same for all UK crypto platforms — not just IG.

What Protection Do You Actually Get?

No FSCS, but you still have:

- Cold storage (most assets offline)

- Fund segregation from IG’s company money

- AML checks and ID verification

- IG Group’s 50-year track record and FTSE 250 status

- Access to the Financial Ombudsman for complaints

Does IG Provide FSCS Protection for Crypto Balances?

No. Like most UK crypto services, IG’s balances aren’t covered by the Financial Services Compensation Scheme. If the provider fails, you won’t be entitled to government-backed reimbursement.

Can You Spread Bet on Crypto with IG?

Only if you’re a professional client. The FCA banned crypto derivatives for retail traders in January 2021. That includes spread betting and CFDs.

| Client Type | Spread Betting | CFDs | Spot Crypto |

|---|---|---|---|

| Retail | ❌ Banned | ❌ Banned | ✅ Yes |

| Professional | ✅ Yes | ✅ Yes | ✅ Yes |

How Do You Qualify as Professional?

Meet 2 of these 3 criteria:

- 40+ significant trades in the past year

- €500,000+ portfolio in financial instruments

- 1+ year working in finance with derivatives experience

Honestly, most people won’t qualify. And for long-term holding, spot crypto beats leveraged products anyway — you own the actual asset.

What Leverage Do Pros Get?

About 5.5:1 on Bitcoin and Ethereum (18% margin). Less than forex, but more than retail crypto CFDs had before the ban.

How Does IG Compare to Other UK Crypto Platforms?

IG stands out for low fees and FCA registration but lags behind Coinbase and eToro in coin variety and advanced features. It’s best for cost-conscious UK investors who value security over having hundreds of asset choices.

Is IG Better for Fees or for Asset Variety?

IG clearly wins on fees, charging just 1.49% total for a £1,000 debit card purchase versus Coinbase’s 4.87%. However, with only 35+ coins available, it falls short for those seeking wide diversification across niche or emerging cryptocurrencies.

Table – IG vs Competitors

| Platform | Typical Cost (£1k buy) | Best For |

|---|---|---|

| IG Crypto | 1.49% (£14.90) | Simplicity, existing IG users |

| Coinbase (Simple) | ~4.87% (£48.70) | Absolute beginners only |

| Coinbase Advanced | 0.60-1.20% (£6-12) | Active traders using limit orders |

| eToro | ~1.75% (£17.50) | Copy trading, social features |

| Kraken (Instant) | ~1.5% (£15) | Quick buys, staking |

| Kraken Pro | 0.25-0.40% (£2.50-4) | Experienced traders, lowest fees |

Final Verdict – Is IG Worth It for UK Crypto Buyers?

- No external transfers — coins stay on IG

- Fewer coins than dedicated exchanges

- No staking rewards

- No FSCS protection

- 24-hour wait before first trade

- £25k daily withdrawal cap

Bottom line: IG delivers for buy-and-hold investors who want mainstream crypto without complexity. For flexibility, altcoins, or DeFi access, look at Coinbase or Kraken instead.

FAQs IG Crypto

Can I withdraw crypto from IG to a personal wallet?

No. IG doesn’t allow external transfers. Your coins stay on the platform. To get money out, sell to GBP first, then withdraw cash.

Does FSCS cover my crypto?

No. Crypto doesn’t qualify for the £120,000 protection scheme. True for all UK platforms, not just IG.

How long to open an account?

About 5 minutes to apply. Most people verify same-day. But you must wait 24 hours after approval before trading.

Does IG offer staking?

No. No staking rewards available. Use Kraken or Coinbase if you want yield on your crypto.

Is there an inactivity fee?

IG charges £12/month after 24 months of no trading. This typically applies to CFD accounts — check IG’s terms for crypto specifics.

References

- IG UK Crypto: ig.com/uk/crypto

- IG Crypto Fees: ig.com/uk/crypto-fees

- IG Help Centre: ig.com/uk/help-and-support

- FCA Register: register.fca.org.uk