How to Buy Dogecoin in the UK

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Updated 01/01/2025

Explore our curated list of reputable exchanges for buying DOGE in 2025, each rigorously tested with real funds. All brokers are accessible to traders in the United Kingdom.

To Buy Dogecoin in the UK, you'll need to:

To ensure its accuracy, this article was reviewed by Thomas Drury. Thomas is our seasoned finance and trading expert with Chartered status.

Featured Exchange

eToro

- Copy Trading

- User Friendly Platform

- Regulated & Trusted

- 30 Million+ Users

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

A Step-by-Step Detailed Guide on Buying Dogecoin

Choosing a Cryptocurrency Exchange:

- Research and select a cryptocurrency exchange that lists Dogecoin (DOGE) and is accessible in your region. Popular choices often include Binance, Coinbase, and Kraken.

- Review the exchange’s fee structure, security measures, and user reviews.

Creating an Account:

- Go to the chosen exchange’s website or app and sign up for a new account.

- Provide the required personal information, such as your name, email address, and proof of identification, to comply with Know Your Customer (KYC) regulations.

Securing Your Account:

- Enable two-factor authentication (2FA) for an added layer of security.

- Set up a strong password and store it securely.

Depositing Funds:

- Deposit fiat currency, like USD, EUR, or GBP, into your exchange account. This can typically be done via bank transfer, credit card, or debit card.

- Wait for the deposit to be processed. Processing times can vary depending on the method chosen.

Placing a Buy Order for Dogecoin:

- Navigate to the market section of the exchange where DOGE is listed.

- Choose a trading pair that matches your deposited currency, such as DOGE/USD or DOGE/GBP.

- Select the type of buy order: a ‘market order’ will purchase at the current market price, while a ‘limit order’ will execute at a specified price.

- Enter the amount of Dogecoin you want to buy.

Reviewing and Confirming the Purchase:

- Double-check the order details, including the amount of Dogecoin you’re buying and the total cost.

- Confirm the purchase and wait for the order to be filled.

Transferring Dogecoin to a Wallet:

- For security reasons, it’s recommended to transfer your Dogecoin from the exchange to a private wallet.

- Choose a wallet that supports Dogecoin, such as a hardware wallet for maximum security or a software wallet for convenience.

- Obtain your wallet’s receiving address.

Withdrawing to Your Wallet:

- Go back to the exchange and initiate a withdrawal to your Dogecoin wallet address.

- Enter the amount of DOGE to transfer and paste your wallet’s receiving address carefully.

- Confirm the withdrawal and wait for the blockchain confirmation.

Tracking Your Investment:

- Regularly monitor your Dogecoin investment by checking the price and news related to cryptocurrency markets.

- Consider setting up price alerts on your exchange or a cryptocurrency tracking app.

Selling or Using Dogecoin:

- If you decide to sell your Dogecoin, the process is similar to buying. You will navigate to the exchange, place a sell order, and withdraw the resulting funds to your bank.

- Alternatively, you can use Dogecoin for transactions where it is accepted, transferring DOGE directly from your wallet to the recipient’s address.

Where to Buy Dogecoin

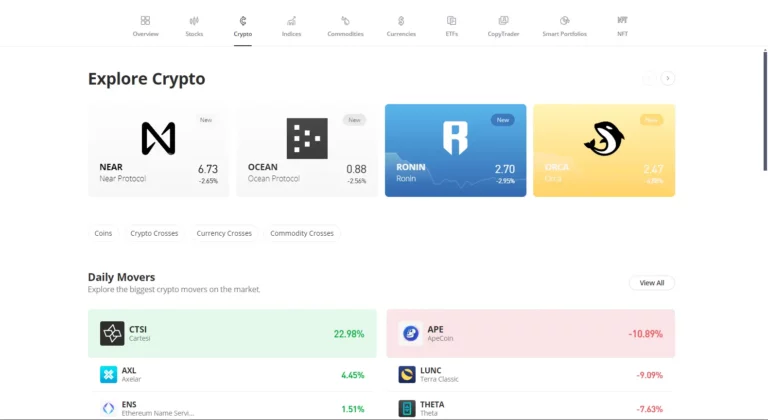

#1 eToro - Best in class for ease of use, simplicity and quick sign up

Pros & Cons

- User-friendly interface: Simple platform, especially suited for beginners.

- Social trading features: Allows users to copy trades from experienced investors with CopyTrader™.

- Multi-asset platform: Supports stocks, crypto, commodities, and forex in one place.

- Regulated and secure: Licensed in various jurisdictions, offering a layer of protection for users.

- Higher fees: Spread-based fees may be higher compared to some other platforms.

- Limited crypto variety: Supports around 100 cryptocurrencies, which is fewer than some dedicated crypto exchanges.

- Not ideal for advanced crypto traders: Lacks advanced order types and detailed analytics for active trading.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

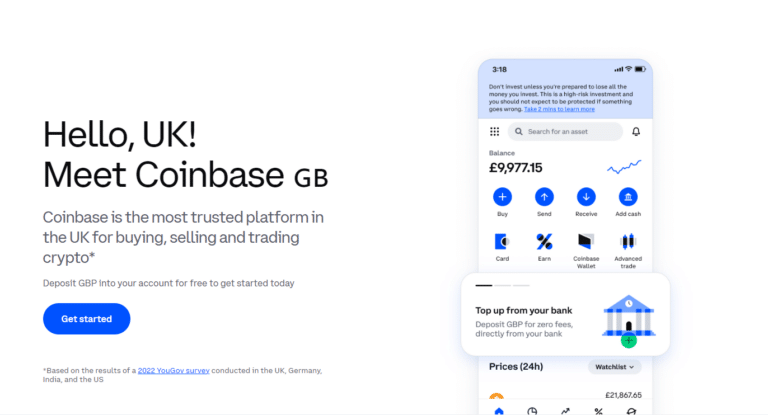

#2 Coinbase - The go-to platform for beginners

Pros & Cons

- Higher fees on standard Coinbase: The standard Coinbase platform has higher fees compared to Coinbase Advanced Trade.

- Limited to crypto assets: Unlike multi-asset platforms, Coinbase is exclusively focused on cryptocurrency.

- High transaction fees on small trades: Smaller transactions may incur relatively high fees if not using Advanced Trade.

- Strong security and regulatory compliance: Highly regulated and one of the most trusted crypto exchanges.

- Beginner-friendly: Coinbase offers a simple interface, making it easy for new users.

- Wide crypto selection: Supports hundreds of cryptocurrencies, including popular and emerging assets.

- Advanced Trade option: Provides advanced trading features like order books, lower fees, and various order types for active traders.

What are the Fees?

| Feature | Coinbase | Coinbase Pro |

|---|---|---|

| Instant Buy/Sell Fees | Around 1.49% (bank transfer); 3.99% (card) | Not applicable |

| Maker Fee (Up to $10,000 Volume) | N/A | 0.50% |

| Taker Fee (Up to $10,000 Volume) | N/A | 0.50% |

| Maker Fee (Over $50,000 Volume) | N/A | 0.25% |

| Taker Fee (Over $50,000 Volume) | N/A | 0.25% |

| Withdrawal Fees | Variable based on method | Not applicable |

| Spread Fees | Included in price | Not applicable |

What Cryptocurrencies are Available?

Coinbase offers a selection of over 240 cryptocurrencies, including popular options like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC). Coinbase Pro provides access to a wider range of assets and trading pairs, catering to both beginners and advanced traders.

How Safe is the Exchange?

Coinbase is a secure exchange, with two-factor authentication (2FA), encryption, and 98% of customer funds held in offline cold storage. Coinbase Pro provides the same high security standards, with the added benefit of insurance coverage for digital assets held in hot wallets.

For Coinbase comparisons consider visiting our pages Kraken vs Coinbase UK, Binance vs Coinbase or Best Coinbase Alternatives.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

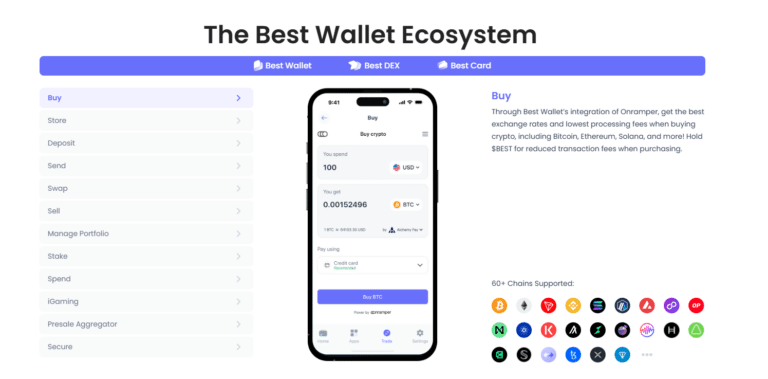

#3 Best Wallet - Hot Wallet, Spot Intergration

Pros & Cons

- Regulation Concerns: Best Wallet operates globally but is not regulated by major financial authorities in some regions. While it offers robust security, this may raise concerns for users in jurisdictions requiring licensed financial services.

- Limited Fiat Options: While Best Wallet excels in crypto transactions, fiat-to-crypto features may be limited in certain regions, requiring users to rely on third-party providers for fiat deposits.

- No Dedicated Customer Support Line: Best Wallet’s customer support is primarily via live chat or email, and response times may vary during high-traffic periods.

- Low Fees: Best Wallet offers highly competitive fees, with some transactions incurring no cost at all. This ensures users can maximize the value of their cryptocurrency without worrying about excessive charges.

- Wide Crypto Support: Best Wallet supports a diverse range of cryptocurrencies, including Bitcoin, Ethereum, Solana, and many more. This gives users the flexibility to manage a broad portfolio in one place.

- Advanced Features: Beyond basic wallet functionalities, Best Wallet includes features like staking, portfolio management, secure storage, and seamless token swapping. Perfect for both beginners and experienced users.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

What is Doge?

Dogecoin (DOGE) is a cryptocurrency that started as a joke based on the popular “Doge” meme featuring a Shiba Inu dog. Despite its whimsical origins,

Dogecoin has grown to become a prominent and widely used digital currency. It was created by Billy Markus and Jackson Palmer in December 2013 to be a more approachable and less serious alternative to Bitcoin.

Dogecoin’s creators envisioned it as a friendly, fun cryptocurrency that could reach a broader demographic than the typical Bitcoin audience.

The currency is decentralized and operates on blockchain technology, similar to Bitcoin and Ethereum, where all transactions are recorded on a public ledger.

How Does Dogecoin Work?

It utilizes a proof-of-work consensus mechanism, relying on miners to process transactions and secure the network.

One notable feature of Dogecoin is its low transaction fees and fast confirmation times, making it suitable for micro-transactions and online tipping.

Dogecoin has a passionate community that has used the currency for charitable acts and fundraising.

The coin’s mascot, the Shiba Inu, symbolizes the fun and friendly ethos of the Dogecoin community, which often rallies around causes and community support events.

The value of Dogecoin is not limited to investment value, but also heals and connects people. Imagine how fun it would be to have a physical Dogecoin! As Dogecoin has its own prototype, you can order custom enamel badges in the image of Doge, which would resemble a physical Dogecoin.

Despite its less serious beginnings, Dogecoin has a market cap in the billions of dollars and has garnered attention from investors and companies alike.

Is Dogecoin a Good Investment?

Determining whether Dogecoin is a good investment depends on various factors and the individual investor’s goals, risk tolerance, and investment strategy. Here are some considerations to keep in mind:

Volatility: Dogecoin has a history of volatile price swings. While this can create opportunities for significant returns, it also poses a substantial risk of loss. Potential investors should be prepared for the possibility of rapid changes in Dogecoin’s value.

Market Sentiment: Dogecoin often moves with the broader crypto market trends but can also be influenced by social media, celebrity endorsements, and the strong community sentiment surrounding it. This can both positively and negatively impact its investment potential.

Usage and Adoption: Dogecoin has gained acceptance for use in various transactions and as a tipping currency on social media platforms, which can contribute to its longevity and potential growth.

Inflationary Nature: Unlike Bitcoin, which has a cap on the number of coins that can be mined, Dogecoin has no maximum supply, with millions of new coins mined every year. This inflationary aspect could potentially dilute its value over time.

Speculative Investment: Many investors view Dogecoin as a speculative asset. Its price can be significantly affected by hype rather than underlying fundamentals, which can be risky for long-term investments.

Diversification: Some investors include Dogecoin in their portfolio for diversification, as it can sometimes exhibit different market dynamics compared to other cryptocurrencies and asset classes.

Investing in Dogecoin, like any cryptocurrency, should be done after thorough research and with the understanding that the market is highly unpredictable. It’s often advised to only invest money that you can afford to lose and consider seeking advice from financial advisors.

What are the Risks of Dogecoin?

Investing in Dogecoin, as with any cryptocurrency, involves several risks:

- Market Volatility: Dogecoin’s price is highly volatile, with sharp increases and decreases. This volatility can lead to significant financial loss for investors who are not prepared for such swings.

- Regulatory Risks: The regulatory environment for cryptocurrencies is still evolving. Changes in regulations can affect the value, legality, and stability of Dogecoin, impacting its adoption and potential as an investment.

- Security Risks: While blockchain technology is generally secure, cryptocurrency exchanges and wallets can be vulnerable to hacking and other cybersecurity threats. Investors must safeguard their digital assets against theft.

- Liquidity Risks: While Dogecoin is relatively popular, it may not have as much liquidity as Bitcoin or Ethereum. This can pose a risk if an investor wants to sell a large amount of DOGE quickly and may lead to selling at a lower price than desired.

- Inflationary Supply: Dogecoin has an unlimited supply, with millions of new coins minted regularly. This inflationary model can potentially reduce the value of each DOGE over time as the supply increases.

- Dependency on Social Media and Influencers: Dogecoin’s value can be significantly impacted by social media trends and endorsements by prominent figures, which can lead to unpredictable price movements based on speculative hype rather than market fundamentals.

- Lack of Backing by Assets or Cash Flow: Unlike traditional investments, Dogecoin does not represent a share in a company’s assets or cash flow. Its value is largely based on market perception and the willingness of others to buy and sell.

Potential investors should weigh these risks against their investment goals and risk tolerance before buying Dogecoin. Diversification, due diligence, and cautious investment strategies are crucial when dealing with speculative assets like cryptocurrencies.

FAQs

Dogecoin is a peer-to-peer cryptocurrency that was created as a lighthearted alternative to traditional cryptocurrencies like Bitcoin. It was initially started as a joke, but it has gained a large online community. Dogecoin has a quicker block generation time, a larger supply of coins, and a different hashing algorithm.

Yes, Dogecoin can be used for real-world transactions wherever it is accepted as a form of payment. Its community often uses it for tipping and donations due to its low transaction fees and fast confirmation times.

Dogecoin can be stored in a digital wallet. Options include software wallets (on a computer or smartphone) or more secure hardware wallets. It’s crucial to maintain strong security practices, like using two-factor authentication and backing up your wallet.

Top 5 Exchanges

1

eToro

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

2

Coinbase

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

3

Best Wallet

Link toWebsite

4

Uphold

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

5

OKX

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

References:

Featured Blogs

Our #1 Recommended Crypto Wallet & Exchange Platform in the UK

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.