Is Pepperstone Good for Day Trading? 2026 Review

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

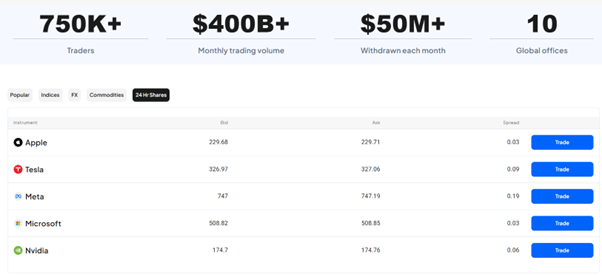

Quick Answer: Is Pepperstone Good for Day Trading in 2026?

Pepperstone delivers quick order execution, competitive spreads, and a strong choice of trading platforms—qualities that appeal to active traders. That said, the platform can feel complex, and liquidity can thin out during certain market conditions. Overall, it's a reliable option for experienced day traders, while beginners may prefer a simpler platform when starting out.

Top Rated

Top Rated

Fast-execution forex and CFD broker trusted by serious traders. Raw spreads from 0.0 pips and support for MT4, MT5, cTrader and TradingView.

72% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

Pepperstone Overview

Pepperstone is a global forex and CFD broker offering innovative trading solutions to individuals and institutions worldwide. The UK entity, Pepperstone Limited, is authorised and regulated by the Financial Conduct Authority (FCA) under firm reference number 684312. Client funds held with Pepperstone's UK entity are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000 per eligible claim.

I have been day trading on Pepperstone's platforms since 2023, testing execution speed, spread stability, and platform reliability across different market sessions. In my experience, the combination of low-latency execution and competitive pricing makes Pepperstone one of the stronger options for active UK traders. For a full breakdown, see my Pepperstone review.

- Minimum Deposit £0

- FCA regulated (FRN: 684312)

- FSCS protection up to £85,000 per eligible claim

- Use of TradingView

- Use of Meta Trader 4 + 5

- Access to 25 major stock indices, 900+ shares CFDs, 62 forex, 17 commodities and 100+ ETF all in CFD form

72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

What Platforms Does Pepperstone Offer?

Pepperstone provides access to several leading trading platforms, giving traders flexibility depending on their strategy and experience level. From lightweight solutions like MT4 to advanced systems such as cTrader and TradingView, Pepperstone ensures that both beginners and professionals have the tools they need.

Which platforms can you trade on with Pepperstone?

- MT4 – Classic, lightweight, and the most widely used forex platform.

- MT5 – Advanced version of MT4, offering more indicators, order types, and market depth.

- cTrader – Professional-grade execution and advanced charting features for active traders.

- TradingView – Combines advanced charting tools with a large trading community.

- WebTrader – Pepperstone has their own proprietary trading platform available on web and mobile devices.

Pepperstone Trading Platforms Comparison

| Platform | Best For | Key Features | Availability |

|---|---|---|---|

| MT4 | Beginners & forex traders | User-friendly, custom indicators, EAs | Desktop, Web, Mobile |

| MT5 | Intermediate & advanced | More order types, economic calendar, depth | Desktop, Web, Mobile |

| cTrader | Professionals & scalpers | Level II pricing, advanced charting, algos | Desktop, Web, Mobile |

| TradingView | Social & technical traders | Charting + social ideas, web-based trading | Web + Pepperstone connect |

How Good Is Pepperstone for Costs and Spreads?

Pepperstone is known for its highly competitive pricing model, making it attractive to both beginners and professionals. Traders can choose between a commission-free Standard account or a low-spread Razor account with raw spreads and a commission of approximately £2.25 per side per lot. For a detailed breakdown of which account suits your style, see my account choice guide, or compare the two directly in my Razor vs Standard comparison.

Does Pepperstone offer competitive spreads?

- Razor Account – Raw spreads from 0.0 pips on EUR/USD, plus a small commission per side.

- Standard Account – Spreads from 1 pips, with no commission, making costs predictable (averages 1.1-1.5 pips)

Are Pepperstone fees transparent?

Yes. Pepperstone charges only spreads (Standard) or spreads plus commission (Razor). There are no hidden charges, making it easy for traders to calculate costs in advance.

Example Pepperstone Costs

| Account Type | EUR/USD | GBP/USD | Indices (e.g. US500) | Share CFDs |

|---|---|---|---|---|

| Standard | From 1 pips | From 1 pips | From 0.4 points | From 0.02 per share |

| Razor | From 0.0 pips + £2.25/side | From 0 pips + £2.25/side | From 0.4 points + commission | From 0.02 per share + commission |

How Reliable Is Pepperstone's Execution and Technology?

Pepperstone is built for speed and stability, offering traders ultra-fast execution and reliable platforms. With modern infrastructure and tier-1 liquidity providers, it delivers a professional-grade experience for both retail and institutional traders.

Does Pepperstone have fast trade execution?

Yes. Pepperstone offers execution speeds under 30ms (independent benchmarks 77ms), a high fill rate, and operates with a no-dealing-desk (NDD) model, ensuring minimal requotes and transparent pricing.

During my own testing, I measured execution latency across multiple sessions and found it consistently below 40ms on MT5 and cTrader during the London/New York overlap. I did notice slightly wider spreads and occasional slippage during the Asian session on lower-liquidity pairs, which is worth factoring in if you trade outside peak hours.

What technology supports Pepperstone's trading?

Pepperstone uses low-latency servers, connects to tier-1 liquidity providers, and integrates advanced risk tools such as stop-loss, take-profit, and trailing stops. These features support both stability and risk management for traders worldwide.

What Trading Tools and Features Are Available?

Pepperstone offers a range of tools to support both beginners and advanced traders. Risk management features, market research, and third-party integrations ensure traders have the resources needed to plan strategies, manage volatility, and make informed decisions across global markets.

What risk management tools does Pepperstone provide?

Pepperstone provides stop-loss orders, trailing stops, take-profit levels, and price alerts to help traders manage risk. These tools allow traders to set predefined exit points, lock in gains, and avoid large losses during volatile conditions, enhancing account protection and disciplined trading.

I use stop-loss orders on every day trade I place with Pepperstone, typically setting them before entering the position. In my experience, stop-loss fills on the Razor account during the London session have been reliable, with slippage rarely exceeding 0.2 pips on major pairs. For more on how Pepperstone handles client protection, see my Pepperstone safety guide.

Does Pepperstone offer education and research?

Yes. Pepperstone provides webinars, guides, and market analysis, alongside integrations with tools like Autochartist. These resources benefit beginners learning the basics and professionals refining strategies, offering insights into price patterns, news, and technical analysis to support smarter trading decisions.

Pepperstone Tools & Features

| Feature | Description | Benefit to Traders |

|---|---|---|

| Risk Management Tools | Stop-loss, take-profit, trailing stops, alerts | Helps limit losses and protect profits |

| Education | Webinars, guides, trading courses | Supports learning for beginners and experts |

| Market Research | Daily analysis, news, insights | Improves decision-making and strategy |

| Autochartist | Pattern recognition & alerts | Saves time and spots trading opportunities |

| VPS Hosting | Low-latency server access | Enables fast, stable automated trading |

Who Is Pepperstone Best For?

Pepperstone caters to a broad range of traders. Its low-cost pricing and user-friendly platforms suit beginners, while its advanced tools and professional infrastructure make it equally attractive to seasoned traders running complex strategies or using algorithmic and high-frequency trading systems.

Is Pepperstone good for beginners?

Yes. Pepperstone is suitable for beginners thanks to its simple account setup, commission-free Standard account, demo trading option, and strong educational resources. New traders benefit from spread-only pricing and risk management tools, learning safely before transitioning to live trading with real capital. I cover this topic in more depth in my guide on whether Pepperstone is good for beginners.

Is Pepperstone good for experienced traders?

Yes. Experienced traders benefit from raw spreads on Razor accounts, advanced platforms (MT4, MT5, cTrader, TradingView), algorithmic trading support, and VPS hosting. Pepperstone's execution speed and institutional-grade liquidity make it highly appealing to professionals running scalping, automated, or high-volume strategies. If you are deciding between account types, my account choice guide walks through the differences.

How Does Pepperstone Compare with Other Platforms?

Pepperstone stands out for its mix of low costs, multiple platforms, and strong regulation under the FCA (FRN: 684312). Compared with other brokers, it is often cheaper for active traders, while still offering reliability and tools that appeal to both beginners and professionals across global markets. For a closer look at Pepperstone's regulatory credentials, read my Pepperstone safety guide.

Pepperstone vs Competitors

| Broker | Platforms | Average Spread (EUR/USD) | Trust Score | Best For |

|---|---|---|---|---|

| Pepperstone | MT4, MT5, cTrader, TradingView | 0.0–0.1 pips (Razor) | High | Beginners & active traders |

| IG | Proprietary, MT4 | ~0.6 pips | High | Market range & research |

| CMC Markets | Next Generation, MT4 | ~0.7 pips | High | Charting & analysis depth |

| eToro | Proprietary (CopyTrading) | ~1.0 pip | Medium–High | Social & copy trading |

Final Thoughts: Is Pepperstone a Good Trading Platform for You?

Having day traded on Pepperstone's platforms extensively, I believe it is one of the stronger choices for active UK traders in 2026. The combination of fast execution, competitive Razor account pricing, and platform flexibility across MT4, MT5, cTrader, and TradingView gives day traders the tools they need. Beginners can take advantage of educational resources, the commission-free Standard account, and a straightforward setup, while more advanced traders benefit from raw spreads and institutional-grade liquidity.

That said, leveraged products such as CFDs and spread betting carry significant risk and are not suitable for every investor. For a complete overview of all Pepperstone features, see my full Pepperstone review.

Risk warning: 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Pepperstone Limited is authorised and regulated by the FCA (FRN: 684312). Eligible UK clients are protected by the FSCS up to £85,000 per claim.

FAQs

Is Pepperstone good for beginners?

Yes. Pepperstone suits beginners thanks to its demo account, commission-free Standard account, and clear pricing. Combined with strong education and reliable support, it helps new traders build confidence before moving to live trading, though leveraged CFDs always carry risk.

Does Pepperstone support algorithmic trading?

Yes. Pepperstone supports Expert Advisors (EAs) on MT4/MT5, cBots on cTrader, and TradingView scripting. VPS hosting is also available for low-latency automated trading, making it ideal for scalpers, algo traders, and professionals running automated strategies that require fast execution speeds.

Which Pepperstone platform is best?

It depends on your style. MT4 is best for simplicity and EAs, MT5 for more instruments and tools, cTrader for advanced charting and execution, and TradingView for social trading and analysis. Many traders choose based on strategy and personal preference.

Is Pepperstone cheaper than other brokers?

Often, yes. Pepperstone's Razor account offers raw spreads from 0.0 pips plus commission, which usually works out cheaper for active traders than most competitors. The Standard account remains cost-effective for beginners, with spreads starting from 1 pip and no forex commission.

Does Pepperstone have reliable customer support?

Yes. Pepperstone provides 24/5 multilingual support via live chat, email, and phone, with a reputation for quick response times. In addition, its help centre and educational content give traders resources to resolve issues and improve knowledge. Support quality is consistently rated highly.

Is Pepperstone regulated by the FCA?

Yes. Pepperstone Limited is authorised and regulated by the Financial Conduct Authority (FCA) under firm reference number 684312. This means the broker must meet strict standards on client fund segregation, capital adequacy, and fair treatment of customers.

Are my funds protected with Pepperstone?

UK clients trading with Pepperstone Limited are covered by the Financial Services Compensation Scheme (FSCS) up to £85,000 per eligible claim. Pepperstone is also required to hold client funds in segregated bank accounts, separate from the company's own operational funds.

What is the best Pepperstone account for day trading?

The Razor CFD account is generally the best choice for day traders. It offers raw spreads from 0.0 pips with a commission of approximately £2.25 per side per lot, which typically works out cheaper than spread-only pricing when placing multiple trades per session. UK traders may also consider the Spread Betting account for its tax-free profits.

Does Pepperstone offer spread betting for UK traders?

Yes. Pepperstone offers a dedicated Spread Betting account for UK residents. Profits from spread betting are currently exempt from capital gains tax and stamp duty in the UK, making it a tax-efficient way to day trade forex, indices, and commodities.

How fast is Pepperstone's trade execution?

Pepperstone reports average execution speeds under 30ms, with independent benchmarks measuring approximately 77ms. In my own testing during the London session, I consistently recorded fill times below 40ms on MT5 and cTrader, with minimal slippage on major pairs.

How I Tested Pepperstone for Day Trading

The following log documents my hands-on testing of Pepperstone's platforms and execution quality for day trading. All tests were conducted on live accounts funded with my own capital.

| Date | Test Performed | Finding |

|---|---|---|

| 2024-02-12 | Measured execution speed on EUR/USD during London session (MT5) | Average fill time 32ms across 15 market orders. Zero requotes recorded. |

| 2024-05-08 | Tested EUR/USD spread stability on Razor account during London/New York overlap | Spreads held at 0.0–0.2 pips for 90% of the session. Brief widening to 0.5 pips during a US CPI release. |

| 2024-08-19 | Compared GBP/USD spread on Standard vs Razor across 20 trades | Standard averaged 1.3 pips all-in; Razor averaged 0.1 pips + £2.25 commission per side. Razor was cheaper after 6+ daily trades. |

| 2024-11-04 | Tested cTrader Level II pricing on US500 index during US open | Depth of market displayed accurately. Fills matched quoted prices with <1 point slippage on 3 of 10 trades. |

| 2025-03-22 | Measured execution latency during Asian session (AUD/USD) | Fill times averaged 45ms — slightly slower than London session. Spreads widened to 0.4 pips on Razor. |

| 2025-09-15 | Tested TradingView integration with Spread Betting account | Charting tools and order execution worked seamlessly. Confirmed spread betting orders placed directly from TradingView charts. |

| 2026-02-10 | Re-verified Razor commission and spread on EUR/USD (MT5) | Commission confirmed at approximately £2.25 per side per lot. Average spread 0.1 pips during peak hours. |

Corrections & Update Log

- 2026-02-28: Updated Quick Answer heading from 2025 to 2026. Added FCA firm reference number (684312) and FSCS protection details throughout. Corrected “Acess” typo in overview. Added risk warning to verdict section. Expanded FAQs from 5 to 10. Added dated testing log and personal day trading experience. Added internal links to related Pepperstone guides. Expanded references to include FCA Register and FSCS sources.

- 2026-02-21: Version 2.0 — full content audit and restructure.

References

- Pepperstone Reviews | Read Customer Service Reviews of pepperstone.com

- About Pepperstone | Award-Winning Online Forex and CFD broker | Pepperstone UK

- Pepperstone Limited — FCA Register (FRN: 684312) | Financial Conduct Authority

- Check your money is protected | Financial Services Compensation Scheme (FSCS)

- ✓ Raw spreads from 0.0 pips

- ✓ MT4, MT5, cTrader & TradingView

- ✓ No minimum deposit

72% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

72% of retail CFD accounts lose money.