- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer: Is Pepperstone Worth it?

Pepperstone Overview

A prominent player in the financial industry, offering innovative trading solutions to individuals and institutions worldwide. With its commitment to transparency, competitive pricing, and cutting-edge technology, Pepperstone has gained a reputation as a trusted broker.

- Minimum Deposit £0

- FCA regulated

- Use of TradingView

- Use of Meta Trader 4 + 5

- Acess to 25 major stock indices, 900+ shares CFDs, 62 forex, 17 commodities and 100+ ETF all in CFD form

72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Introduction

Pepperstone is a broker that has gained a strong reputation over the years for offering competitive trading conditions, powerful platforms, and robust regulation.

In this 2025 review, I’ll walk you through everything you need to know about Pepperstone — from how safe it is, to the fees you’ll encounter, the platforms you’ll be using, and what kind of trader it’s best suited for.

What Are the Pros and Cons of Pepperstone?

Like any broker, Pepperstone isn’t perfect. But after a lot of firsthand trading, I can say the pros far outweigh the cons — especially if you know what you’re looking for.

- Tight spreads: I consistently get some of the lowest spreads during major trading sessions, particularly on the Razor account.

- Strong regulation: It’s reassuring to know Pepperstone is regulated by multiple Tier-1 authorities like the FCA and ASIC.

- Fast execution: Orders get filled quickly and cleanly, which is critical for forex strategies like scalping or algo trading.

- Platform choice: I love being able to switch between MT4, MT5, cTrader, and even TradingView depending on the trading style I’m using that day.

- No proprietary platform: Some traders might miss having a slick, custom-built app, although the third-party platforms are excellent.

- Limited share CFD range: If you want access to thousands of individual stocks, a broker like IG or CMC might be a better fit.

- No built-in copy trading: While you can integrate with services like DupliTrade or Myfxbook AutoTrade, it’s not built into the platform natively.

Is Pepperstone a Safe and Trusted Broker?

It’s just not worth risking your money with a company that doesn’t have strong protections in place. That’s one of the main reasons I originally chose Pepperstone — their regulatory standing is genuinely impressive.

Which Authorities Regulate Pepperstone?

Pepperstone holds licences from several of the world’s most respected financial regulators. We’re talking about the FCA in the UK, ASIC in Australia, CySEC in Europe, and even the DFSA for the Middle East. Having accounts across multiple Tier-1 and Tier-2 jurisdictions indicates that they are serious about compliance and operating to the highest standards.

Here’s a quick look at their regulatory coverage:

| Regulatory Authority | Licence Number | Region Covered | Key Client Protections |

|---|---|---|---|

| FCA | 684312 | UK | Segregated funds, FSCS |

| ASIC | 414530 | Australia | Client funds protection |

| CySEC | 388/20 | Europe | Investor Compensation Fund |

| DFSA | F004356 | Middle East | Local client protections |

How Does Pepperstone Safeguard Client Funds?

With Pepperstone, all client funds are kept in segregated accounts, which means my money is separated from the company’s operating funds — a critical safeguard if anything were to go wrong.

They also provide negative balance protection under certain regulatory frameworks, so you can’t lose more than your deposit if the markets move quickly against you. On top of that, Pepperstone implements strong data security measures to keep your personal and financial information safe.

Overall, when it comes to safety, Pepperstone ticks every box that matters to me as an active trader.

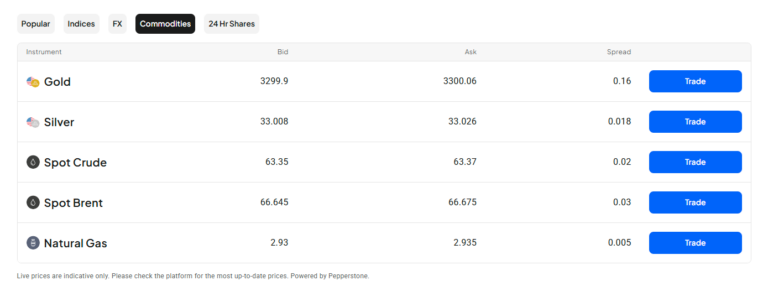

What Can You Trade with Pepperstone?

Pepperstone isn’t just a forex broker — even though forex is where they really shine. Through their platform, I’ve traded not only major currency pairs but also commodities like gold, silver and natural gases, global stock indices like the NASDAQ and FTSE 100, and even share CFDs from the US, Germany, and Australia.

They also offer a selection of ETFs and cryptocurrency CFDs (although access to crypto trading can vary depending on where you live due to regulation changes).

This diversity has been useful because it means I can shift my focus when forex markets are quiet — jumping into stock indices, trading commodities, or even crypto when opportunities pop up.

How Extensive Is Their Forex Offering?

If your primary passion is forex, then you’ll find Pepperstone is a fantastic forex broker. They offer over 60 currency pairs, covering all the majors, minors, and a good range of exotics too.

I like having access to exotics like USD/TRY or EUR/ZAR when volatility spikes, and Pepperstone’s pricing proves to be competitive across the board— especially during the London and New York sessions.

If you’re a trader who focuses on trading currencies but still enjoys the flexibility to explore other markets, Pepperstone is a very strong choice.

What Are Trading Conditions like with Pepperstone?

Pepperstone offers two main account types: Standard and Razor. I’ve used both, but nowadays, I almost exclusively trade with the Razor account due to its tight spreads.

- The Standard Account is commission-free, but the spreads are a little wider — still competitive, though. During peak sessions, I typically observed spreads of around 1.0 to 1.3 pips on EUR/USD.

- The Razor Account gives you raw interbank spreads starting from 0.0 pips, but you pay a small commission — $3.50 per side ($7 round trip) per 100,000 traded. Honestly, for active traders like me, it’s worth it.

| Account Type | Spread Type | Typical Spread (EUR/USD) | Commission | Best For |

|---|---|---|---|---|

| Standard | Spread only | 1.0 – 1.3 pips | None | Beginners, occasional traders |

| Razor | Raw + commission | 0.0 – 0.3 pips | $3.50 per side | Active traders, scalpers |

During major trading sessions like London/New York overlap, spreads on the Razor account have been incredibly sharp — I’ve often seen 0.1 pip or even true zero spreads on major pairs.

How Much Leverage Is Available?

Pepperstone’s leverage depends on where you’re based and what type of trader you are.

- Retail clients in the UK get up to 30:1 leverage, which aligns with local laws.

- Professional clients can access much higher leverage — up to 500:1 in some cases.

What Are Pepperstone’s Deposit and Withdrawal Policies?

One thing I’ve appreciated with Pepperstone is their approach to funding.

- No deposit or withdrawal fees

- Same-day processing for most funding methods, especially if you use major payment options like credit cards, bank transfer, or PayPal.

From my experience, my deposits have been credited instantly, and most of my withdrawals have been returned to my account within 24 hours.

Which Trading Platforms Can I Use at Pepperstone?

With Pepperstone, you can choose from MetaTrader 4, MetaTrader 5, cTrader, and even TradingView integration.

- MT4 is the classic — if you’ve traded forex before, you’ll be familiar with this one.

- MT5 is basically a newer, faster version with more charting options and the ability to trade more asset classes.

- cTrader is my personal favourite — it feels built for fast, professional execution, and it’s very clean to use if you’re a scalper.

- Plus, if you already use TradingView for your charting and analysis, you can now place trades directly through Pepperstone without leaving the TradingView platform.

How Do These Platforms Compare?

Execution speed across all platforms is excellent, but cTrader feels just a little snappier — which matters if you’re doing scalping or fast intraday trading .

Algorithmic trading is supported across MT4, MT5, and cTrader, and I’ve run custom EAs (expert advisors) without any issues. Mobile apps for all platforms are also available, and they’ve been reliable when I needed to manage trades on the go.

Overall, whatever your trading style — manual, automated, short-term, long-term — Pepperstone has a good trading platform that will fit.

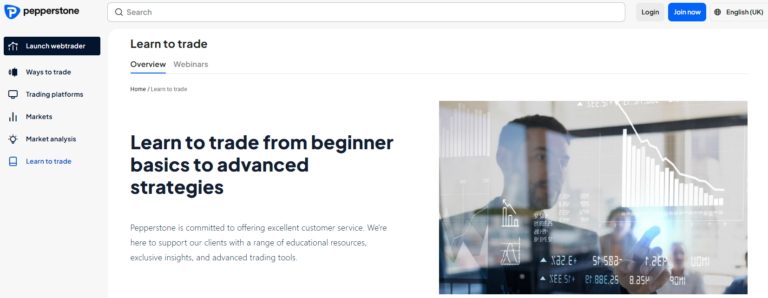

What Educational and Research Resources Does Pepperstone Offer?

Pepperstone’s education and research section is quite strong for a broker that primarily targets active traders.

They offer:

- Live webinars covering trading strategies and market updates.

- In-depth trading guides for everything from basic forex concepts to advanced risk management techniques.

- Beginner courses if you’re entirely new to trading.

What Trading Tools and Market Analysis Are Available?

When it comes to analysis tools, Pepperstone doesn’t cut corners. You get access to:

- Autochartist — which helps scan markets for trade setups automatically.

- An economic calendar — critical for staying on top of key news events.

- Trading Central tools — providing technical analysis insights straight into your platform.

All in all, Pepperstone’s combination of educational and research tools has definitely added value to my trading, especially when markets are moving quickly.

Is Pepperstone Good for Beginners?

If you’re brand new to trading, Pepperstone is a good choice because the platforms (especially MetaTrader 4 and cTrader) are intuitive once you get the hang of them. Plus, their customer support has been excellent every time I’ve reached out — quick, knowledgeable, and genuinely helpful.

Is Pepperstone Ideal for Experienced Traders?

If you’re already comfortable with trading or you’re looking to level up, Pepperstone is fantastic. Scalpers, algo traders, high-frequency traders — anyone who needs fast execution, tight spreads, and flexibility — will feel right at home here.

I’ve found Pepperstone’s Razor account to be perfect for fast, tactical trading, and the range of platforms provides all the tools I need without unnecessary clutter.

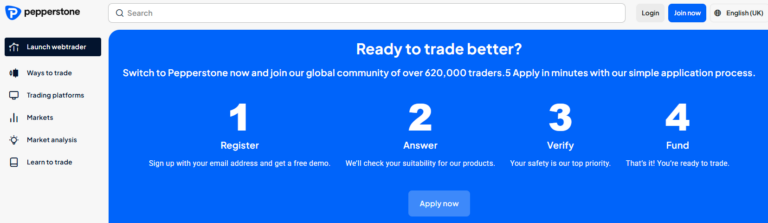

How to Open an Account with Pepperstone: Step-by-Step Guide

Step 1: Visit the Pepperstone Website

Head over to pepperstone.com and click the “Create Account” button in the top right corner.

Step 2: Fill Out the Registration Form

You’ll need to provide some basic details like your name, email address, country of residence, and preferred account type (individual, joint, or corporate).

Step 3: Verify Your Identity

As part of regulatory requirements, Pepperstone will ask you to upload proof of identity and proof of address.

Step 4: Choose Your Platform and Account Type

Next, select your trading platform (MT4, MT5, cTrader, or TradingView) and choose between a Standard or Razor account depending on your trading style.

Step 5: Fund Your Account

Once your account is approved, you can log in and make your first deposit.

Step 6: Start Trading

Download your chosen trading platform, log in with your new Pepperstone detials, and you’re ready to start trading

Final Thoughts

With its low-cost trading structure, wide platform support, and strong regulatory safeguards, Pepperstone delivers a highly competitive environment for active traders.

The Razor account, which features raw spreads, is particularly well suited to scalping and fast-paced trading strategies where execution speed and pricing precision matter most. Support for TradingView, MT4, MT5, and cTrader also gives traders the freedom to choose a platform that matches their preferred workflow.

For committed forex and CFD traders who value low fees, rapid execution, and platform flexibility, Pepperstone remains one of the strongest options available.

Seamless Trading Across Platforms

- Low Spreads and Fast Execution

- Multiple Account Types

- Advanced Trading Platforms

72% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

FAQs

Is Pepperstone a good broker for beginners?

Pepperstone is a great broker for beginners who are willing to learn. The platforms are user-friendly, and they offer plenty of educational resources.

What is the minimum deposit to open a Pepperstone account?

Pepperstone doesn’t have a strict minimum deposit. You can start with as little as $0, although I would recommend at least $200–$500 to trade more comfortably and cover margin requirements.

Does Pepperstone offer crypto trading?

Yes, Pepperstone offers cryptocurrency CFDs like Bitcoin, Ethereum, and Litecoin — but it depends on where you’re based.

Can I use TradingView to trade with Pepperstone?

Absolutely, Pepperstone integrates directly with TradingView, allowing you to chart and place trades within the TradingView platform.

Is Pepperstone good for scalping and high-frequency trading?

Definitely. I’ve found Pepperstone’s Razor account to be one of the best for scalping thanks to raw spreads, fast execution, and no dealing desk interference. If speed and tight pricing matter to you, they’re a very solid choice.

References

- Financial Conduct Authority (FCA) – Financial Conduct Authority | FCA

- Australian Securities and Investments Commission (ASIC) – ASIC: Australian Securities and Investments Commission

- Cyprus Securities and Exchange Commission (CySEC) – Cyprus Securities and Exchange Commission | Home

- Pepperstone Official Website – Pepperstone: Award-Winning Global …

- TradingView Official Website – TradingView — Track All Markets

- Autochartist Official Website – Autochartist: Best Charting & Market Data Software