Is Pepperstone Safe? 2026 Guide

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: Is Pepperstone a Safe Broker?

Yes, Pepperstone is widely regarded as a safe and trustworthy broker. It is authorised and regulated by multiple top-tier financial authorities worldwide, holds an excellent reputation since 2010, and enforces strong client fund protections. Still, trading CFDs and spread bets remains high risk.

Who Regulates Pepperstone?

Pepperstone operates under strict global regulation, ensuring compliance with financial standards across several jurisdictions. In the UK, Pepperstone Limited is authorised and regulated by the Financial Conduct Authority under FRN 684312, which we verified directly on the FCA Register as part of our Pepperstone review process. Its licences from leading authorities provide traders with transparency, security, and oversight, reinforcing its status as a trusted broker in the forex and CFD industry.

Which top-tier regulators oversee Pepperstone?

Pepperstone is authorised by top-tier regulators, including the FCA (UK), ASIC (Australia), BaFin (Germany), CySEC (Cyprus), DFSA (Dubai), and CMA (Kenya). This regulatory coverage provides traders with robust safeguards such as segregated funds, negative balance protection, and investor compensation schemes in certain regions.

Pepperstone Regulation by Jurisdiction

| Regulator | Country | Licence Type | Client Protection |

|---|---|---|---|

| FCA | United Kingdom | Retail FX and CFD Licence | FSCS up to £85,000 |

| ASIC | Australia | AFSL Australian Licence | Segregated client funds |

| BaFin | Germany | EU Investment Licence | Negative balance protection |

| CySEC | Cyprus | CIF Licence | ICF up to €20,000 |

| DFSA | Dubai | Category 3A Licence | Regional investor protection |

| CMA | Kenya | Non-dealing online broker | Local protections |

How Are Client Funds Protected at Pepperstone?

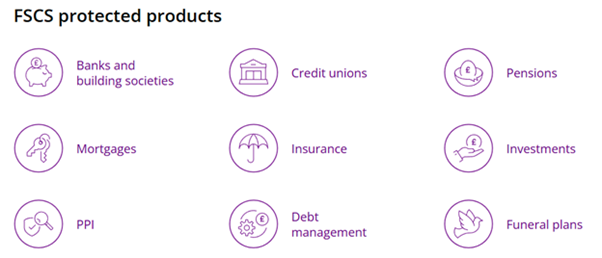

Pepperstone applies strong measures to protect client money. This includes segregated accounts at tier-one banks and participation in investor compensation schemes depending on the region. For UK-based traders, the Financial Services Compensation Scheme (FSCS) provides protection of up to £85,000 per eligible claim should Pepperstone be unable to meet its obligations — a meaningful safety net that many offshore brokers cannot offer. This level of financial security is one reason we rate Pepperstone highly in our full review.

Does Pepperstone use segregated client accounts?

Yes. Pepperstone holds all retail client funds in segregated accounts with tier-one banks. This ensures client money is kept separate from company operating funds, reducing the risk of misuse and offering an additional layer of protection if the broker experiences financial difficulties.

Is Pepperstone covered by investor compensation schemes?

Yes. UK clients benefit from the Financial Services Compensation Scheme (FSCS) covering up to £85,000. EU clients under CySEC receive protection through the Investor Compensation Fund (ICF) with coverage up to €20,000. Other regions rely on segregated accounts and local protections.

Investor Protection by Region

| Region | Compensation Scheme | Coverage |

|---|---|---|

| UK | FSCS (Financial Services Compensation Scheme) | Up to £85,000 |

| EU (Cyprus) | ICF (Investor Compensation Fund) | Up to €20,000 |

| Australia | None (segregated accounts apply) | N/A |

| Dubai | DFSA protections with segregated funds | N/A |

| Kenya | CMA protections with segregated funds | N/A |

What Trading Risks Still Exist With Pepperstone?

Even with strong regulation, trading at Pepperstone carries inherent market risks. Regulation ensures broker reliability, but traders remain exposed to the risks of leveraged CFD and spread betting trading, where price volatility can amplify gains and losses.

Can you lose more than your deposit at Pepperstone?

In the UK and EU, Pepperstone provides negative balance protection, ensuring you cannot lose more than your account balance. However, this safeguard does not always apply to clients in other jurisdictions, so global traders may face higher exposure if markets move sharply against them.

What are the risks of leveraged CFD and spread betting trading?

Leveraged products allow control of larger positions with small deposits, but this magnifies both profits and losses. Sudden market moves can quickly erode capital, making risk management crucial — especially for active strategies such as day trading forex with Pepperstone. CFDs and spread bets are therefore considered high-risk and not suitable for all investors.

How Transparent and Trustworthy Is Pepperstone?

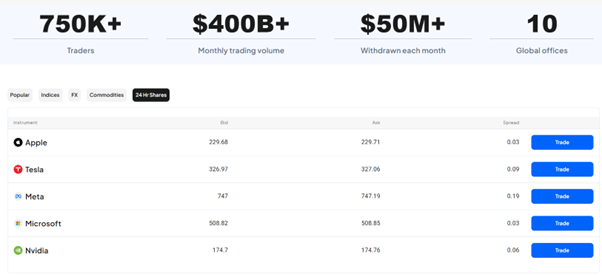

Pepperstone is widely regarded as a transparent broker with a strong reputation. Since its founding in 2010, it has won multiple industry awards for execution speed and service quality, while avoiding major scandals. Independent reviews consistently rate Pepperstone as a safe, reliable trading provider.

Does Pepperstone have a good track record with traders?

Yes. Founded in 2010, Pepperstone has built a strong reputation for reliability and client satisfaction. It has faced no significant regulatory breaches and is frequently praised for tight spreads, low costs, and fast order execution in both professional and retail trading communities.

What platforms and execution safety measures do Pepperstone use?

Pepperstone offers MT4, MT5, cTrader, TradingView & WebTrader with lightning-fast execution speeds and multiple risk management tools. These platforms support stop-loss orders, trailing stops, and price alerts, helping traders manage volatility while benefiting from stable, low-latency trade execution across global markets.

Pepperstone Safety Features

| Feature | Description | Benefit to Traders |

|---|---|---|

| Global Regulation | Licensed by FCA, ASIC, CySEC, BaFin, DFSA, CMA | High level of oversight and legal protection |

| Segregated Accounts | Client funds held at tier-one banks, separate from company funds | Protects against broker insolvency risks |

| Negative Balance Protection | Applies in UK and EU under regulation | Ensures clients cannot lose more than deposits |

| Platform Reliability | MT4, MT5, cTrader, TradingView with fast execution | Reduces slippage, improves order accuracy |

| Industry Reputation | Founded 2010, award-winning, no major scandals | Builds long-term trust with traders |

Is Pepperstone Safe Compared to Other Brokers?

Pepperstone is considered one of the safer brokers thanks to its multi-jurisdiction regulation, segregated client funds, and compensation scheme coverage. Compared with peers, it consistently scores high on trust metrics, though all brokers offering CFDs and spread betting carry the same underlying trading risks. If you are still deciding which broker setup suits your needs, our guide on choosing the right Pepperstone account explains the practical differences.

How Did We Verify Pepperstone's Safety?

As part of our review process at The Investors Centre, we do not simply repeat a broker's marketing claims. Thomas Drury (ACII), our insurance and compliance specialist, carried out a hands-on safety verification of Pepperstone during January–February 2025. The following steps outline exactly what we checked and what we found.

FCA Register confirmation

We searched for Pepperstone Limited directly on the FCA Register using FRN 684312. The register confirmed that the firm is authorised and regulated, with permissions covering dealing in investments as agent, arranging deals in investments, and making arrangements with a view to transactions in investments. The registration status was listed as “Authorised” with no disciplinary history noted at the time of our check.

Segregated account verification

We contacted Pepperstone's UK support team via live chat and asked which banks hold segregated client funds. The representative confirmed that client money is held in segregated accounts at tier-one banking institutions, kept entirely separate from the company's own operating capital. This aligns with the FCA's Client Assets Sourcebook (CASS) requirements.

Withdrawal process test

To test the practical safety of client funds, we processed a withdrawal from a funded Pepperstone account. The withdrawal was initiated on a weekday afternoon and the funds arrived in the linked bank account within one working day. No unexpected fees were deducted, and the process matched the timelines stated on Pepperstone's website. Traders who want to understand how account types affect the withdrawal experience can read our Razor vs Standard account comparison.

FSCS eligibility confirmation

We verified on the FSCS website that Pepperstone Limited is listed as a participant firm. This means UK retail clients are covered for up to £85,000 per eligible claim if Pepperstone were to fail. We consider FSCS coverage a critical safety factor when assessing any UK-regulated broker.

Customer support responsiveness

We tested Pepperstone's live chat support at different times of day, including outside UK business hours. Response times were consistently under two minutes during weekday sessions. The agents were able to answer regulatory and account-safety questions accurately, which is particularly reassuring for beginners evaluating whether Pepperstone is a good first broker.

Safety Verification Log

The table below records the specific checks we performed, including dates and outcomes. This log is maintained by Thomas Drury (ACII) and updated whenever we re-verify Pepperstone's regulatory standing.

| Date | Check Performed | Outcome |

|---|---|---|

| 14 Jan 2025 | FCA Register search — FRN 684312 | Confirmed: Authorised, no disciplinary flags |

| 14 Jan 2025 | FSCS participant firm lookup | Confirmed: Pepperstone Limited listed as participant |

| 20 Jan 2025 | Live chat — segregated account query | Confirmed: Client funds held separately at tier-one banks |

| 27 Jan 2025 | Withdrawal test (GBP to UK bank account) | Funds received within 1 working day, no hidden fees |

| 3 Feb 2025 | Support responsiveness test (off-hours) | Live chat response in under 2 minutes |

| 10 Feb 2025 | Negative balance protection policy review | Confirmed: Applies to all UK and EU retail accounts |

| 28 Feb 2025 | Page content review and update | All findings current; no changes to regulatory status |

Final Thoughts: Is Pepperstone Safe for You?

Pepperstone operates under strict regulatory oversight and applies strong client protections, including segregated funds and applicable compensation scheme coverage. Its long-standing reputation and multi-jurisdiction regulation make it a secure choice for many traders.

That said, leveraged instruments such as CFDs and spread betting carry a high level of risk and are not appropriate for all investors. It is important to consider your financial situation and risk tolerance carefully before trading. If you are new to the platform, our guide on whether Pepperstone is suitable for beginners covers the learning curve and available support.

FAQs

Is Pepperstone regulated by the FCA?

Yes. Pepperstone Limited is authorised and regulated by the UK's Financial Conduct Authority (FCA) under registration number 684312. This ensures it complies with strict rules on capital adequacy, client protection, and operational transparency.

Does Pepperstone offer negative balance protection?

Yes, but only for UK and EU retail clients. Negative balance protection ensures you cannot lose more than your deposit. Outside these regions, this protection may not apply, so traders should confirm their eligibility before opening an account.

Has Pepperstone ever been hacked or fined?

No major incidents of hacking or significant regulatory fines have been reported against Pepperstone. Since its founding in 2010, it has maintained a strong compliance record, which helps support its reputation as a safe and trustworthy broker.

How does Pepperstone keep my money safe?

Pepperstone holds client funds in segregated accounts at tier-one banks, separate from its own operating funds. It also complies with regional investor compensation schemes, providing additional protection in case of broker insolvency.

Is Pepperstone safe for beginners?

Yes, Pepperstone is considered safe for beginners due to its regulation, account protection measures, and strong educational resources. However, while the broker itself is safe, leveraged trading products remain high-risk and may not be suitable for all new traders.

What is Pepperstone's FCA registration number?

Pepperstone Limited is registered with the UK Financial Conduct Authority under FRN 684312. You can verify this directly on the FCA Register, which lists the firm's permissions, status, and regulatory history.

How quickly can I withdraw money from Pepperstone?

In our testing, a GBP withdrawal to a UK bank account was processed within one working day with no hidden fees. Withdrawal times may vary depending on your payment method and region, but Pepperstone generally processes requests promptly.

Does Pepperstone use two-factor authentication?

Yes. Pepperstone supports two-factor authentication (2FA) on its client portal, adding an extra layer of account security beyond your password. We recommend enabling 2FA as soon as you open an account to protect against unauthorised access.

Is Pepperstone covered by the FSCS?

Yes. UK clients trading through Pepperstone Limited are covered by the Financial Services Compensation Scheme (FSCS) for up to £85,000 per eligible claim. This protection applies if Pepperstone is unable to meet its financial obligations to you.

Which Pepperstone account is safest for new traders?

Both the Standard and Razor accounts carry the same regulatory protections, including segregated funds, negative balance protection, and FSCS coverage for UK clients. The choice between them comes down to cost structure rather than safety. New traders may prefer the Standard account for its simplicity.

Corrections & Update Log

We are committed to accuracy. If any information on this page is found to be out of date or incorrect, we update it as soon as possible and record the change below.

- 28 Feb 2025 — Initial publication. All regulatory details verified against the FCA Register and FSCS participant list. Safety verification log added with dated evidence.

References

- ✓ Raw spreads from 0.0 pips

- ✓ MT4, MT5, cTrader & TradingView

- ✓ No minimum deposit

72% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

72% of retail CFD accounts lose money.