- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection (£120,000 per person)

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Affiliate disclosure. Broker buttons and "Get Started" links are affiliate links. We may earn a commission if you open an account — at no extra cost to you. This never affects our ratings, rankings, or recommendations, which are based solely on our independent testing methodology.

Contact: info@theinvestorscentre.co.uk

Quick Verdict: Would We recommend Unbiased.co.uk?

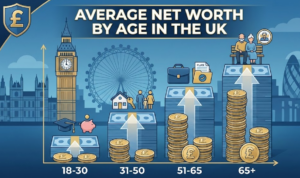

Unbiased stands out in 2026 as a straightforward, no-cost solution for connecting with vetted financial advisers. The platform delivers seamless access to independent professionals, making it a standout resource for individuals at any stage of their wealth-building journey. We’re happy to award it a full 5 stars for its ease of use and proven results.

What Is Unbiased?

Unbiased is a leading UK platform that connects individuals with financial advisers tailored to their specific needs. Established in 2009, Unbiased has built a reputation for being a reliable resource for finding expert financial advice.

The platform serves a wide range of users, from those looking for basic financial guidance to seasoned professionals needing specialised advice on complex financial matters.

A Brief Overview of Unbiased

Unbiased connects consumers with a wide network of over 27,000 financial advisers across the UK, addressing various needs such as investment advice, retirement planning, mortgage consultations, and business services. The platform features both independent and restricted advisers, offering a mix of whole-of-market options and specialized advice.

While independent advisers provide comprehensive market coverage, restricted advisers focus on specific products or providers. Unbiased ensures transparency by requiring restricted advisers to disclose their limitations and offering the flexibility for them to go beyond their usual recommendations when necessary, ensuring users receive the best possible advice tailored to their circumstances.

How Unbiased Works

Get Matched Now

Adviser Directory Search

What are the Pro's and Con's of Unbiased

- Wide Network of Financial Advisers: Unbiased connects users with over 27,000 advisers, ensuring a broad range of expertise.

- Free to Use: The platform is completely free for users, making it accessible to anyone seeking financial advice.

- Comprehensive Matching Service: The “Get Matched Now” feature quickly pairs you with a suitable adviser based on your specific needs.

- Lack of Detailed Fee Information: While the platform is free, the exact costs of adviser services aren’t disclosed upfront, which can lead to uncertainty.

- Variable Adviser Quality: Although Unbiased vets its advisers, the quality of service may still vary depending on the individual adviser, making it important to research before committing.

Financial Advisers on Unbiased

How Unbiased Ensures Quality Advice

What Does It Cost to Use Unbiased?

Free Services and Adviser Fees

Using the Cost of Advice Tool

Unbiased in Action: Our Experience

Step-by-Step Walkthrough of the Process

Upon accessing Unbiased, I opted for the “Get Matched Now” feature, which involved answering a series of questions about my financial situation and the type of advice I was seeking. The questions were clear and designed to gather essential information to match me with the right adviser.

After completing the questionnaire, Unbiased quickly processed my responses and provided me with a match. The adviser I was paired with was experienced in the area I needed help with, and the entire process from start to finish took less than 10 minutes, which was highly convenient.

Response Time and Adviser Matching

One of the standout aspects of my experience was the response time. After being matched with an adviser, I received an email notification within minutes, informing me that the adviser would contact me within 48 hours. In reality, the adviser reached out much sooner, demonstrating the platform’s efficiency.

The adviser was professional, knowledgeable, and well-matched to my needs, which highlighted the effectiveness of Unbiased’s matching algorithm. This quick and accurate matching process makes Unbiased a valuable tool for those seeking prompt and relevant financial advice.

Financial Products and Services Available Through Unbiased

Financial Planning and Investments

Mortgages and Insurance

Pensions, Retirement, and Long-Term Care

Business Services

Is Unbiased Trustworthy?

Key Benefits of Using Unbiased

Unbiased’s History and Reputation

What is our Final Verdict on Unbiased

Having taken a close look at Unbiased in 2026, it’s easy to see why the platform has earned the trust of millions over more than 15 years in the industry. Its intuitive design and rigorous vetting process create a seamless bridge between users and qualified financial advisers, positioning it as a top-tier option for anyone looking to take control of their financial future.

Who Should Use Unbiased?

Plan, Protect, and Build

- Free adviser matching

- Plan tax-efficient futures

- Expert mortgage & pension help

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

FAQs

How Does Unbiased Make Money?

Unbiased generates revenue by charging financial advisers a subscription fee, and a fee for a matched lead. This allows the platform to remain free for users.

Can I Trust the Advisers on Unbiased?

Yes, all advisers on Unbiased are vetted and must be fully regulated by the Financial Conduct Authority (FCA). This ensures that they meet high standards of professionalism and ethics.

What Is the Cost of Advice on Unbiased?

While using Unbiased is free, the cost of advice from financial advisers varies. Fees depend on the type of service provided and are typically discussed during an initial consultation, which is often free.

How to Begin Your Search

To begin your search, visit the Unbiased website or app, and use the “Get Matched Now” feature or browse the Adviser Directory to find an adviser suited to your needs.

References

Unbiased.co.uk – Find Independent Financial Advisers & Financial Advice

Trustpilot – Unbiased Reviews | Read Customer Service

VouchedFor – Find a Financial Adviser, Mortgage Adviser or Solicitor.

AdviserBook – AdviserBook – The Free Financial Adviser Directory.

Financial Conduct Authority (FCA) – Find a Financial Adviser – Financial Conduct Authority.